Deliverable 5.4

Contents

- 1 Demand analysis model

- 1.1 Executive Summary

- 1.2 Introduction

- 1.3 Methods

- 1.3.1 Survey design

- 1.3.2 Constructs and Measures - Segmentation criteria

- 1.3.3 Sample

- 1.3.4 Data collection

- 1.3.5 Statistical Methods

- 1.3.5.1 Exploratory and Confirmatory Factor Analysis (EFA – CFA) for questionnairevalidation=

- 1.3.5.2 Latent Class Analysis (LCA) and multinomial logistic regression for segmentation and for matching consumer segmentations with products/firms

- 1.3.5.3 The formal models of LCA

- 1.3.5.4 Latent class with covariates (using multinomial logistic regression)

- 1.4 Models

- 1.5 Reports &Data

- 1.6 References & Readings

Demand analysis model

Executive Summary

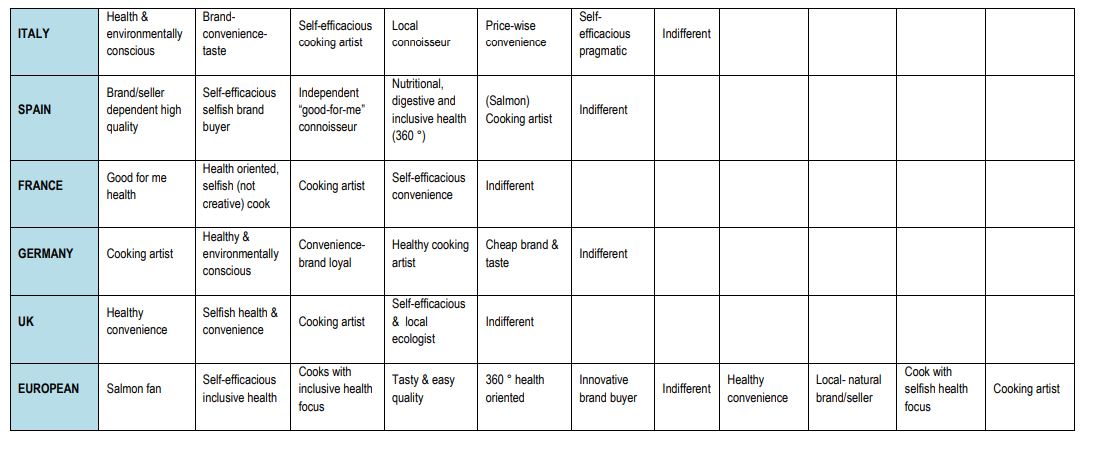

Some consumers expect clean and clear labels, transparency from manufacturers and highest safety while others value great taste, sensory appeal and premium quality. Others are relying on branded products and exhibit loyalty, again others may shop in non-traditional channels for food and purchase based on price. In order to address such consumer diversity and to succeed in a highly competitive marketplace, firms must understand differences in consumer preferences and behaviour in order to address them efficiently. New products (and existing ones) must be connected to consumers’ wants and expectations in order to be placed and marketed strategically and successfully. Many companies struggle with innovation and new product commercialization as is evident in failure rates of new food/drinks products as high as 70-80 %. The value that consumers give to the same product and the expectations they have with regard to it are different because they are influenced by many factors, e.g. socio-demographic, psychological characteristics of the person and their surroundings. Segmentation is an approach to better understand differences and commonalities in consumer behaviour as it helps to identify homogeneous subgroups of consumers and to efficiently address them. The concept of segmentation thus accounts for the idea that a business cannot serve the entire market(s) with a single set of marketing policies because there are disparities among consumers and disparities among countries. One size does not fit all – but one size may fit the same segment in more than one country. Surveying representative samples of consumers from Italy, Spain, France, Germany and the UK regarding their motivations and preferences for fish, the study also collected data on sociodemographic and consumption patterns garnering a total of 4000 usable questionnaires. Latent class analyses indicate clear and distinctive segment profiles for the single countries and for total Europe which give actionable insight for the firms’ new product development/marketing decisions. The study also identifies segments that cut across the different nations as well as groups of consumers that are idiosyncratic to just one or a few countries: the findings thus support the existence of similarities across the European fish market that would allow the fish industry to target the so-called ”pan-European segments” with an almost standardized marketing program. Examples of cross-national segments include ”cooking artists“, a group of ”indifferent“ fish consumers, and “ healthy & environmentally conscious” consumers. Of note, while the segment preferences, expected benefits and behaviour are similar, they may differ substantially in segment size and socio- demographic characteristics. The “knowledgeable local ecologist” is an example of a consumer type present only in the UK, and only in the UK/EU segmentation the combination of “healthy convenience” is uncovered. Convenience is coupled with price considerations, or taste in Italy, or brand loyalty in Germany, illustrating the many facets of consumer “convenience” - expectations. As is the case with convenience, the overly important theme of health (“it can’t be any higher” - Verbeke et al., 2008) is also appreciated in a multitude of different combinations. Overall, we construct from 7 (Italy) to 5 (UK) segments in each country and 11 EU-wide segments and indicate segment size and segment trend.

While already the segment profiles by themselves are highly informative, an additional dimension is obtained by matching the firm’s product(s) with the most attractive segment. The success analysis model is obtained through multinomial logistic regression, which provides the identification of the best fit between the segments identified in the various markets and/or Europe and the product attributes. The firm, in this case, receives clear guidance on which segment(s) to target. A comparison of product characteristics and the “ideal“ profile as indicated by the segment also gives valuable advice regarding whether and how to improve the product or marketing program.

Introduction

Consumers are too numerous, dispersed, and varied in their buying requirements to make it possible to serve all efficiently and in the same manner. At the same time, in today’s competitive landscape, companies follow more and more customized approaches to serve and satisfy the consumers which again drives their ever more differentiated wants. As a consequence, markets become “demassified”, dissolving more and more into “micromarkets”, characterized by different consumers purchasing different products in different distribution channels and attending to different communication channels. Segmentation aims at identifying such micro markets, i.e. groups of consumers that share the same expectations and behavioural patterns. The identification of the most attractive micromarkets, i.e. segment(s), for the company and its products therefore is imperative not only for successful commercialization but also for new product development.

Following a strategic approach to markets, the company distinguishes the major market segments based on the profiling of different consumer groups along their wants, consumption and purchasing behaviour; socio-demographic characteristics etc.; targets one or more of these segments; and develops products (and marketing programs) tailored to the profile and expectations of each selected segment.Tailoring starts with an understanding of the customers and providing them with the product and service they expect but, importantly, embraces also price, distribution and communication efforts to reach the target segment efficiently. The firm focus is on the buyers whom they have the greatest chance of satisfying. Having satisfied customers is at the basis for company success and the first step to repeat purchase and customer loyalty.

Evidence for new product development or new product commercialization success factors shows that the analyses of market segments, targeting, positioning and the alignment with the firms’ offer and resources are crucial to both new product development and new product commercialization (e.g. Montoya-Weiss & O’Driscoll, 2000; Florén et al., 2017). It follows that segmentation helps companies to navigate an increasingly competitive market, to understand their customers better, to develop offerings that satisfy specific wants, and to address diversity in an efficient manner.

The approach to developing a robust model to analyze the likelihood that new seafood product launches will be successful follows this perspective. We develop both country specific consumer segmentations in Italy, Germany, France, Spain and the UK, as well as an overarching European segmentation useful for companies that are innovating and developing new fish products or have fish products on offer and would like to improve their commercialization. The segmentations are based on latent class analyses of representative samples of consumers (800 in each of the five countries) who replied to an online survey in June-July 2017.

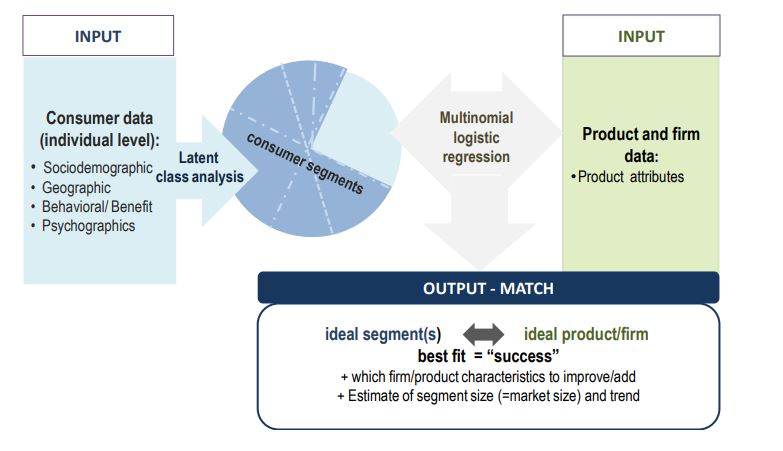

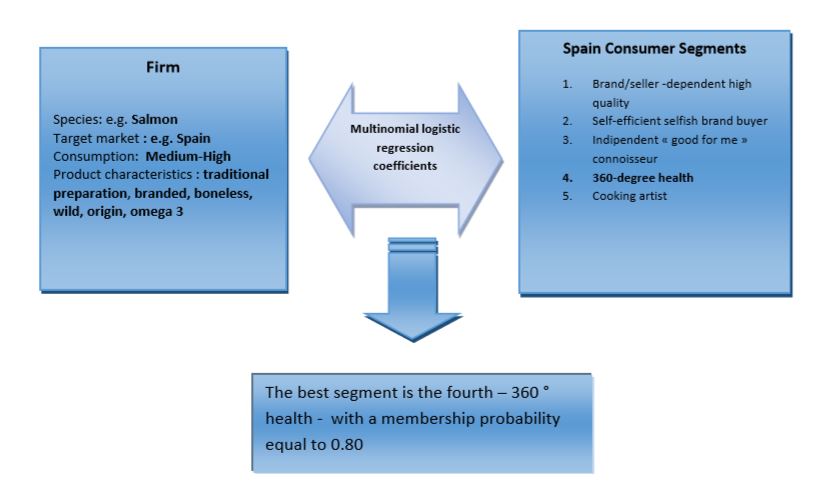

Although the segment profiles by themselves are informative, the methodology used contains an additional step in order to help the company select the most appropriate target(s). In this second stage, multinomial regression matches product (and firm) attributes with the most attractive consumer segment(s). A comparison of the segment, i.e. consumer profile, with the product attributes will further inform the company on how to improve the product and/or its marketing effort in order to tailor more closely to segment wants and characteristics and ultimately launch and commercialize successfully. Figure 1 gives an overview of the success analysis model.

Figure 1: The success analysis model at a glance

Methods

Survey design

Based on the objective of consumer segmentation, a questionnaire including socio-demographic, geographic, psychographic and benefits/behavioural dimensions of consumers and their behaviour was designed. It is built on previous literature (e.g. Ailawadi et al., 2001; Candel, 2001; Pieniak et al., 2007; Verbeke et al., 2007; Verbeke and Vackier, 2005), on studies on consumer behaviour regarding fish related products (EUMOFA, 2016; European Commission, 2016; ISMEA, 2014) and on qualitative insight gained through explorative in-depth interviews with fish consumers in each of the countries under study (performed in task 4.1.). Constant interaction with partners in all countries ensured equivalence and adaptation of the questionnaire in case culturally-specific measures were needed. The questionnaire was developed in English and cross-checked with a native English speaker from the partner in the United Kingdom, to ensure the right use of words and concepts from the local culture. Then, the questionnaire was translated to each of the languages of the remaining countries (Spanish, Italian, French and German) and back-translated. The translators and back-translators were bilingual in the target language and English.

The survey instrument was administered online. In order to keep the time to complete the questionnaire manageable, different flows along the questionnaire were developed so that only relevant questions and options were displayed. On average, the time needed to complete the questionnaire was around 11 minutes, in line with recommendations regarding length of online questionnaires.

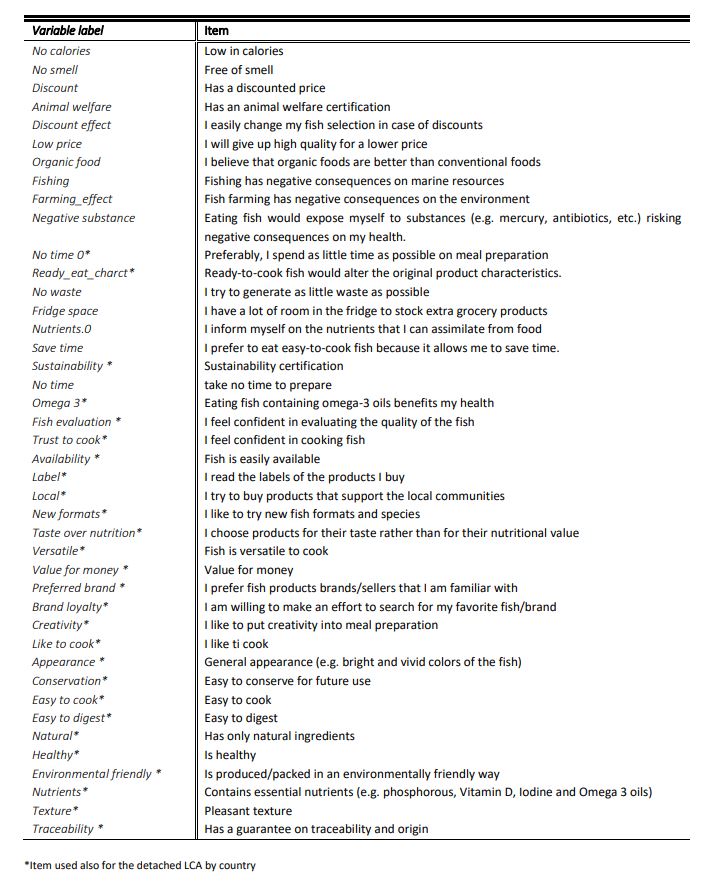

Constructs and Measures - Segmentation criteria

Market segments are large identifiable groups consisting of individuals that are characterized by homogenous buying attitudes, preferences, purchasing power, usage patterns etc. Any of these characteristics can be used to segment markets and to profile the consumers in the respective segments. We use combinations of sociodemographic, psychographic, benefit and behavioural criteria to build and profile segments. Demographic variables have obvious potential as segmentation criteria. The most commonly used variables include gender, age, income level, and educational achievement. Frequently, use is made of a battery of demographic variables when delineating market segments. Psychographic segmentation involves using "lifestyle" factors in the segmentation process. Appropriate criteria are usually of an inferred nature and concern consumer interests and perceptions of "way of living" in regard to work and leisure habits. Critical dimensions of lifestyle thus include activities, interests, and opinions. In the food context examples include interest in cooking, looking for new ways or recipes to cook etc. (e.g. Grunert et al., 1993). Behavioural variables pay attention to patterns of consumption (e.g. low-medium-high usage rates) or loyalty with respect to brand/products among others. Behaviourally defined segments may focus on a specific aspect of behaviour which is not broad enough to be defined as a "lifestyle". Benefit segmentation aims at proactively defining an (unfilled) need.

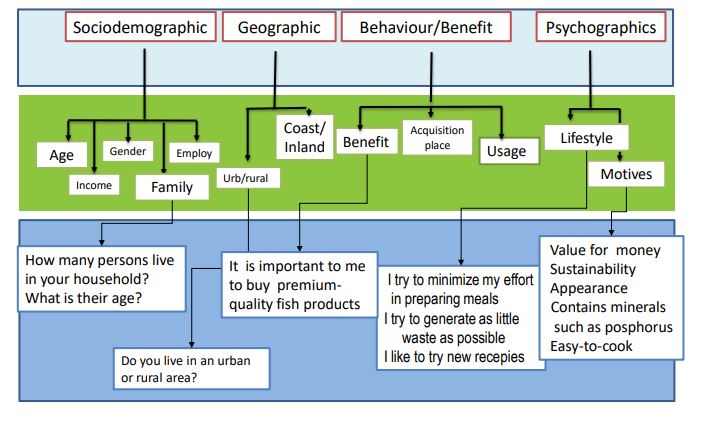

We apply a domain-specific segmentation base and integrate it with some general segmentation bases; this is pragmatic and relevant for identifying within-country segments but also in order to identify cross-country segments and related commonalities and differences. The major segmentation categories with respective variables (illustrative) are show in Figure 2 .

Figure 2: Profiling consumer segments along socio-demographic, geographic, behavioural/benefit- and psychographic criteriaIn general, operationalization followed extant literature and market studies (e.g. ISMEA 2014; EUMOFA 2017), the results from the explorative in-depth interviews, a pre-test (done in Italy with 91 respondents) and an iterative discussion with international researchers from the countries under study. Seven point Likert-scales were used throughout the questionnaire. All Likert-scale questions followed Friedman et al.’s(1993) recommendations on setting the negative statements on the left side to avoid the “left side bias” generated by the positive statement. We briefly describe the criteria and their measurement next (for more details please see the questionnaire in Appendix 1).

Consumer sociodemographic data

The sociodemographic variables we use include: age, gender, employment status, family composition, education and income. Age is measured as a continuous variable from 18 years onwards. Family size and structure are measured through two questions: first, respondents were asked to report the number of people living in their household (including themselves). Since the presence of children or elderly has been shown to be a major determinant of fish consumption and consumption patterns in earlier studies, respondents then were asked to indicate also the age of each family member and whether the member consumes fish.

Employment status is measured through a single selection question including the following categories: full-time, part-time, self-employed, homemaker, retired, student, unemployed, other. The education levels are based on ISCED (UNESCO, 2012) and are re-arranged in the following way: less than primary, primary and lower secondary education (ISCED levels 0-2); upper secondary (ISCED level 3); university or college below a degree (ISCED levels 4-5); bachelor (ISCED level 6); Postgraduate (ISCED levels 7-8). The income variable was introduced with options representing income levels from very low to very high. Country-specific ranges were set for each income level (using secondary data from e.g. Deutsches Statistisches Bundesamt, 2017; European Commission, 2016; Eurostat, 2017) and allowance was also made for the fact that the UK has its own currency.

Consumer geographic data

To account for potentially varying consumer profiles within each country, the geographical variables are measured through three questions. In the first one, respondents were asked to identify in which type of geographical area they live: urban (more than 50.001 inhabitants), intermediate (between 5.000 and 50.000 inhabitants), rural (less than 4.999 inhabitants). In the second one, respondents were asked to specify if they lived in an area with a coastline or not. In the third question, respondents reported their macro-geographical region of residence in their country according to the NUT3 classification (Eurostat, 2013).

Benefits and behavioural measures

The benefits and behavioural measures we include are consumer involvement in buying fish, places of acquisition, fish attributes important to the selection, fish- and overall food expenditure, situations for fish consumption, sources of information and past/expected future consumption behaviour. Consumer involvement was used for screening as we included only those people who were at least fairly involved in their household’s fish purchasing process.

Consumption frequency (i.e. usage rate) was based on Thong & Solgaard (2017) (never, few times a year, once a month, 2-3 times a month, 1-2 times a week, 3-4 times a week, almost every day) and included total fish consumption (i.e. fish consumption also in restaurants, canteens etc.), fish consumption by species (salmon, cod, seabass, seabream, herring, trout, pangasius) and by formats. Moreover, the usage rate was used for screening as only fish consumers were included in the survey.

The fish purchasing places and usage occasions were taken from the results of the explorative in-depth interviews and a continuous interaction with international researchers from the countries under study (e.g. at home, for a barbecue, at the restaurant, at the supermarket, online, at the fishmonger). We asked not only for the preferences of the attributes of the fish the consumers buy, but also for their importance to the purchase in order to account for the fact that consumers usually have to make a choice across attributes.

Food and fish products expenditure was measured through an open question in which the respondents were asked first to report their monthly expense on food related products and second, their expenses on fish products.

In order to understand the use of information sources, we asked respondents to report the frequency of consulting various information sources (e.g. family members, fish seller, supermarkets and in-store promotion, advertising, social media, medical advice, labels and information on the packaging of the product etc.).

Regarding past/future consumption, a new measure was developed based on the explorative in-depth interviews and on some previous qualitative studies (European Commission, 2016; ISMEA, 2014). We asked respondents to report changes (increase/decrease) in fish consumption over the past three years/expected for the next three years. If changes were reported, we also asked to indicate the reason for the change (e.g. income, available time for cooking, fish prices, health awareness, variety of choices). Importantly, this information was used to estimate the future segment trend, i.e. stable, increasing, or declining.

Psychographics

The psychographic dimension includes attitudes, preferences, consumption motives and lifestyle. Attitudes refer to the degree to which a person has a favourable or unfavourable evaluation towards a product or behaviour. Following literature, the measure of consumer attitudes included bipolar adjectives such as items regarding the source of the fish (wild/farmed), the price (expensive/cheap), formats (frozen/fresh) and production level (processed/unprocessed) and other bipolar pairs such as branded/unbranded, organic/not organic, natural/enhanced and EU origin/Outside EU origin.

Additionally, based on the exploratory in-depth interviews and the feedback of the international research team, the following adjectives were also added: local-origin/national-origin, familiar products or producers/new products or producers, traditional products/products for special dietary needs. Consumer motives as well as attitudes are extremely important in consumer research as they explain the reasons behind consumer behaviours. We included quality and sensory appeal motivation items, health motives as well as items related to price sensitivity and convenience motives and items related to ethical and environmental concerns.

Life style includes factual and procedural knowledge, based on subjective perceptions and experiences which encourage enduring dispositions to behave in certain ways. Life style might transcend individual products, but may be also specific to a product class (Grunert et al., 1993). In the present study, general and fish specific items were included, e.g. I like to try new recipes, I always inform myself on the nutrients I can assimilate from fish. We included convenience lifestyle items, ethical and environmental and health items together with novelty and innovativeness statements. Self-efficacy items (e.g. regarding the knowledge, evaluation and the preparation of fish) are present too.

Sample

The average apparent fish consumption per capita in the EU is the second highest in the world (at around 22 kg/capita/year), and some individual EU Member States are among the highest fish consuming countries in the world (EEA, 2016). The five selected nations under study had the highest household expenditure and volume in fishery and aquaculture products in 2015, representing in total the 72% of all consumer expenditures. Their importance is underlined also with the fact that they covered around 86 % of the total EU fresh fish consumption in volume and 85 % in value in 2015 (EUMOFA, 2016).

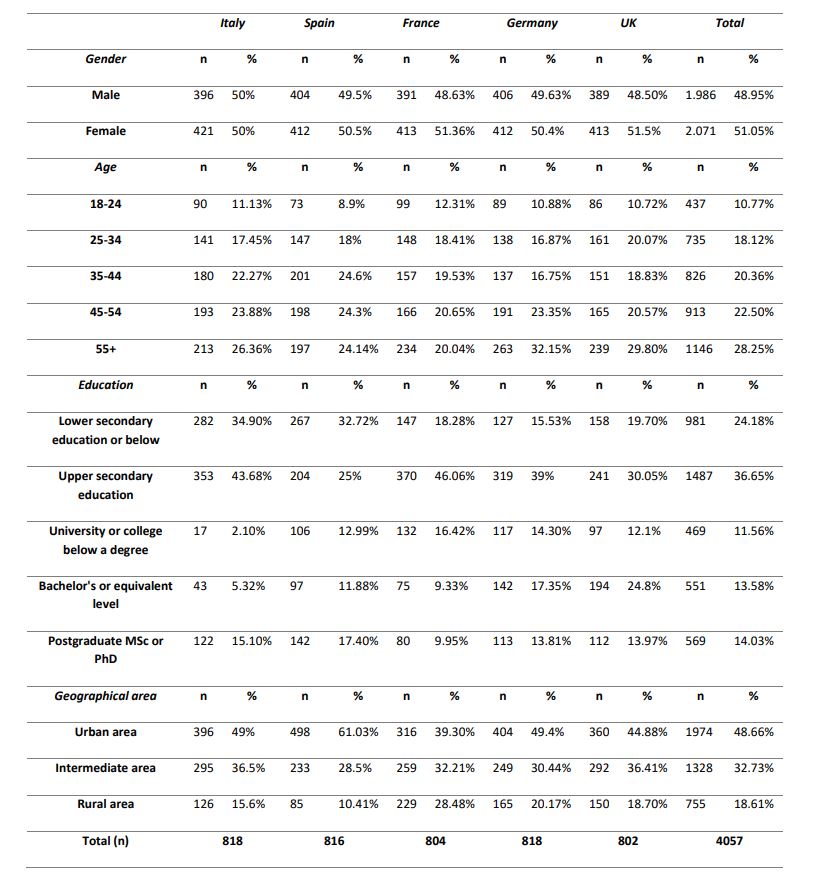

Within-country representativeness was ensured using a stratified random sample (Lohr, 2010), which is more likely to produce a representative sample (Reynolds et al., 2003). Each country was divided into different stratums for the sociodemographic variables described earlier, where the percentages of the sample assigned to each sociodemographic stratum were established based on the total distribution of the population of each country. The percentages for age, gender and geographical regions were obtained from Eurostat (2017) and were established based on the population between 18 to 74 years old in 2016. Age was divided into five stratums: 18-24 years old, 25-34 years old, 35-44 years old, 45-55 years old and >=55 years old. The geographical regions stratums were defined according to the NUT3 European classification of small regions (Eurostat, 2013). Representativeness of the education categories from the ISCED outlined earlier in the countries was established according to the OECD (2016, p. 43) as this source provided a more detailed classification than Eurostat (2017). The measures were based on the population between 18 to 64 years old.

Data collection

The target samples were 800 adults aged 18 and older from Italy, Germany, France, Spain and United Kingdom. The respondents had to be fish consumers (no restrictions on frequency) of at least one of the target species (salmon, cod, seabream, seabass, herring, trout, and pangasius) and be fairly or completely involved in the fish buying process in their households. The data was collected through an online survey developed on the Qualtrics platform. Before collecting survey data, a pilot test of the survey was performed with partners and with 91 Italian fish consumers. The feedback provided was used to improve the questionnaire. The final version of the questionnaire was launched in parallel in all five countries to ensure data collection equivalence (Hult et al., 2008). The data collection took a month, from June 23rd until July 24th, 2017.

Respondents were selected from a market research panel with qualifying demographic characteristics. They were sent an invitation to fill in with information on questionnaire length and the available incentives. Each sample stratum from the panel base was proportioned to the general population and then randomized before the survey was deployed. To exclude duplication and to ensure validity, every IP address was checked using a sophisticated digital fingerprint and deduplication technology (Qualtrics, 2014).

All data were collected through the online survey. Although online questionnaires present many advantages such as reduced cost, time and access to unique populations they also have some limitations such as the access to older and less educated consumer groups (Wright, 2006). For this reason, some of the stratums percentages originally defined for education and age had to be slightly modified, to reach the target of 800 respondents per country in a reasonable time frame. The changes were always done by increasing mainly the percentage of respondents in the closest categories from the one with the low quota response. On average, respondents took 11.4 minutes to complete the questionnaire.

In total, 4414 completed and usable questionnaires were collected, from which 4000 were representative for each country (800 responses per country) and sample stratum, according to the age, gender, education level and macro-geographical area. The main sample characteristics are reported in Table 1.

Table 1: Sample characteristicsStatistical Methods

Exploratory and Confirmatory Factor Analysis (EFA – CFA) for questionnairevalidation=

We followed the commonly used combination of exploratory factor analysis (EFA) and confirmatory factor analysis (CFA) to validate our questionnaire. Construct validity of the items of the questionnaire is investigated firstly with EFA to uncover the factor pattern underlying the questionnaire, and then CFA is used to validate the factor structure provided by EFA. We performed factor analysis i) overall and ii) within country (stratified analysis). Finally, we performed a multi-group confirmative factor analysis to assess the measurement invariance (i.e. configural, weak and strong invariance) (Meredith, 1993) between countries.

Factor analyses were performed using R (R Core Team, 2015) and the R-packages polycor (Fox, 2016), paran (Dinno, 2012), psych (Revelle, 2017) and lavaan (Rosseel, 2015).

All results confirm validity of our survey instrument: the EFA statistics, i.e. eigenvalue >1 and Horn’s parallel analysis, identified seven factors for Europe and each individual country. By CFA, only the items with high factor loadings were retained (83,3%) to maintain factor consistency. Overall, CFA fit indices were adequate for both European and for single country analyses. Indices of unidimensionality (AVE>0.2), reliability (omega>0.7) and general factor validity (rho>0.8) were satisfactory for each factor, and the item–factor correlations (>0.4) proved high-quality specific factor validity for all items. In addition, the indices were also satisfying in the CFAs stratified by country and in the multi-group analysis, by retaining the same items. Finally, concerning multi-group analysis, the testing of the measurement invariance showed a weak invariance, i.e. the factor loadings are equal across countries (results are available upon request).

Latent Class Analysis (LCA) and multinomial logistic regression for segmentation and for matching consumer segmentations with products/firms

Latent class analysis (LCA) can be viewed as a special case of model–based clustering for multivariate discrete data. It is assumed that each observation comes from one of a number of classes, groups or subpopulations, with its own probability distribution. The overall population thus follows a finite mixture model. When observed, data take the form of categorical responses as, for example, in consumer behaviour surveys, it is often of interest to identify and characterize clusters of similar individuals.

In the context of marketing research, one will typically interpret the latent number of mixture components as clusters or segments. In fact, LCA provides a powerful tool and the state-of-the-art technique to identify market segments. In line with our objective, latent class analysis has been suggested as a model-based tool for regular market segmentation (Wedel & Kamakura, 2000) and international market segmentation (Steenkamp & ter Hofstede, 2002).

In the following we describe the standard latent class model and its parameter estimation and we report the problem of model selection and goodness of fit criteria. Subsequently, we present the extension of the basic model which permits the inclusion of covariates to predict latent class membership. We discuss three-step approaches for LCA with covariates. Lastly, we present the empirical application.

The formal models of LCA

Let 𝑋 represent the latent variable and 𝑌𝑙 one of the L observed or manifest variables, where 1 ≤ 𝑙 ≤ 𝐿. Moreover, let C be the number of latent classes and 𝐷𝑙 the number of levels of 𝑌𝑙. A particular latent class is enumerated by the index x, x = 1, 2, ..., C, and a particular value of 𝑌𝑙 by 𝑦𝑙, 𝑦𝑙= 1, 2, ..., 𝐷𝑙.

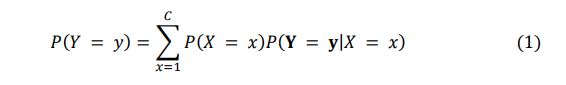

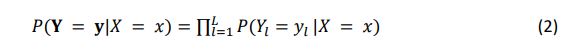

The vector notation Y and y is used to refer to a complete response pattern. The basic idea underlying any type of LC model is that the probability of obtaining response pattern y, 𝑃(𝐘 = 𝐲), is a weighted average of the C class-specific probabilities 𝑃(𝐘 = 𝐲|𝑋 = 𝑥); that is,

Here, 𝑃(𝑋 = 𝑥) denotes the proportion of persons belonging to LC 𝑥. In the classical LC model, this basic idea is combined with the assumption of local independence. The 𝐿 manifest variables are assumed to be mutually independent within each LC, which can be formulated as follows:

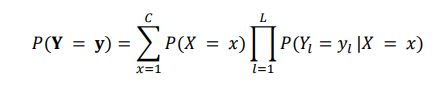

After estimating the conditional response probabilities 𝑃(𝑌𝑙 = 𝑦𝑙 |𝑋 = 𝑥), comparing these probabilities between classes shows how the classes differ from each other, which can be used to name the classes. Combining the two basic equations (1) and (2) yields the following model for 𝑃(𝐘 = 𝐲) marginal probability:

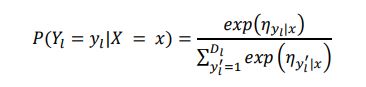

The model is formulated for nominal indicators 𝑌𝑙 and consequently a multinomial logit distribution is hypothesized for the conditional probability to obtain 𝑦𝑙 to l-th, given the affiliation to the latent class x, 𝑃(𝑌𝑙 = 𝑦𝑙 |𝑋 = 𝑥). The conditional probability is parameterized as follows

Where the linear term 𝜂𝑦𝑙 |𝑥 = 𝛽𝑦𝑙 + 𝛽𝑦𝑙𝑥, the parameter 𝛽𝑦𝑙 is the intercept and 𝛽𝑦𝑙𝑥 is the effect of the latent variable X on the indicator 𝑌𝑙.

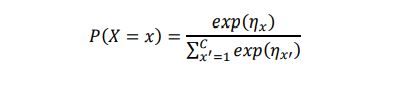

In the same way, the probability associated with the latent variable X has a nominal logit distribution:

Similarly to cluster analysis, one of the purposes of LC analysis might be to assign individuals to latent classes. The probability of belonging to LC x – often referred to as posterior membership probability – can be obtained by the Bayes rule,

The most common classification rule is modal assignment, which amounts to assigning each individual to the LC with the highest 𝑃(𝑋 = 𝑥|𝐘 = 𝐲).

The parameters of LC models are typically estimated by means of maximum likelihood (ML):

Where i is a particular pattern of response, I is the number of all potential patterns of response, (𝐼 =∏ 𝐷𝑙𝐿𝑙=1) and 𝑃(𝐘 = 𝐲𝑖). Among the most popular numerical methods for solving the Maximum Likelihood Estimation (MLE) problem is the Expectation-Maximization (EM) algorithm (Dempster et al., 1977). The EM algorithm treats the estimation of LC model parameters as an estimation problem similar to those for missing data (i.e. multiple imputation). More details about the model and the parameter estimation are provided in Lazarsfeld and Henry (1968), Goodman (1974); Haberman (1979), Clogg (1995), Agresti (2002) and Bartholomew, Knott and Moustaki (2011).

An advantage of LCA as compared with other clustering techniques is the variety of tools available for assessing model fit and for determining the appropriate number of latent classes. In some applications, the number of latent classes will be selected for primarily theoretical reasons. In other cases, however, the analysis may be of a more exploratory nature, with the objective being to locate the best fitting or most parsimonious model. The researcher may then begin by fitting a complete “independence” model with C = 1, and then iteratively increase the number of latent classes by one until a suitable fit has been achieved.

Parsimony criteria seek to strike a balance between over- and under-fitting the model to the data by penalizing the log-likelihood by a function of the number of parameters being estimated. The two most widely used parsimony measures are the Bayesian information criterion, or BIC (Schwartz 1978) and Akaike information criterion, or AIC (Akaike 1973). Preferred models are those that minimize values of the BIC and/or AIC.

BIC will usually be more appropriate for basic latent class models because of their relative simplicity (Lin and Dayton 1997; Forster 2000). Calculating Pearson’s χ2 goodness of fit and likelihood ratio chisquare (G2 ) statistics for the observed versus predicted cell counts is another method to help determine how well a particular model fits the data (Goodman 1970). The entropy of a model is also used as a model selection criterion, either by itself or together with other statistics.

Latent class with covariates (using multinomial logistic regression)

In most LC analysis applications, one not only wishes to build a measurement or classification model based on a set of responses, but also to relate the class membership to explanatory variables. In a more explanatory study, one may wish to build a predictive or structural model for class membership whereas in a more descriptive study the aim would be to simply profile the latent classes by investigating their association with external variables (Vermunt, 2010). The latent class regression model (LCRM) generalizes the basic latent class model by permitting the inclusion of covariates to predict individuals' latent class membership (Dayton and Macready, 1988; Hagenaars and McCutcheon, 2002).

In the LCA literature two ways for dealing with covariates have been proposed: a one-step and a threestep approach. The former involves simultaneous estimation of the LC (measurement) model of interest with a logistic regression (structural) model in which the latent classes are related to a set of covariates. An alternative estimation procedure that is sometimes used is called the “three-step" approach: estimate the basic latent class model, calculate the predicted posterior class membership probabilities and then use these values as the dependent variable(s) in a regression model with the desired covariates. Since the one-step presents certain disadvantages – for example, it limits the number of covariates that can be considered in the model (Vermunt, 2010) - we use the three-step approach in order to avoid such limitation. In a subsequent step, this allows us to predict the consumer segment and perform a matching between segmentation and firms’ characteristics, in order to detect the best segment for the firm. According to this, the causal relationship firm-to-consumer segment will be explained by multinomial logistic regression models where the consumer segment will be the dependent variable and the selected covariates (i.e. organic, wild, cheap etc.) will be the choice factors. Theoretical details and the generic equation of the multinomial logistic regression model are reported in Agresti (2002). LCA and multinomial regression were performed using poLCA (Linzer & Lewis, 2011) and nnet (Venables et al., 2002) R-packages (R Core Team, 2017), respectively.

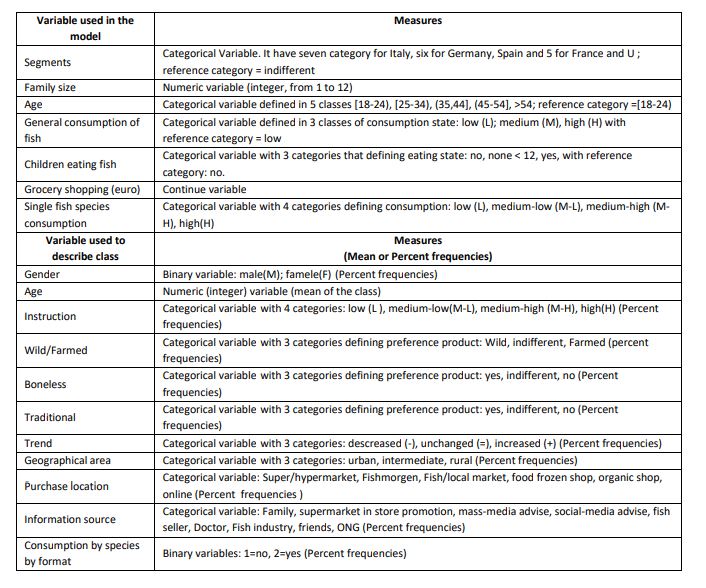

Models

Matching segments and products/firms via multinomial logistic regression

Multinomial regression was employed not only to integrate segment information (please see paragraph 3.2.), but is also employed in a subsequent step for the match of segment (demand) and product/firm (supply side). The company interested in an identification of the most attractive consumer segment for the firm’s offering, i.e. the match of segment profile and product characteristics, will select the variables which best describe the product, e.g. wild/farmed, species, branded/unbranded, claims used (Omega 3, new recipe, easy-to-cook etc.) and choose the target country (France, Italy, Germany, Spain, UK).

Once the company has selected the variables (X) – for our example in Figure 4 below – Spain (market), salmon (species), traditional preparation, branded, wild, origin, omega 3 (claims), the estimated coefficients of multinomial logistic regression will be employed:

where 𝑖 = 1,…,𝑘 − 1, k = number of classes discovered by LCA, r = reference class, X is the design matrix (with the independent variables) and i is the coefficients vector for the modality logit i Finally, we compute the membership probabilities 𝑝̂𝑖 = 𝑒𝑋𝛽 1+𝑒𝑋𝛽 (by coefficients) for each i class in order to obtain the results in terms of best class, i.e. the best membership probability, in other terms, the “best” segment. From the algorithm we obtain the association between product characteristics and the segment, according to the best fit (highest membership probability). Such a fit leads to success in this segment (i.e. market). Additionally, the model will indicate – based on firm and product characteristics - which product or marketing elements should be improved and/or added to increase the fit, and it will yield an estimate about segment (i.e. market) size and segment growth. Such information is essential because the fit is a necessary, but not sufficient, condition for sustainable product/firm success. Of course, the segment must be economically attractive and it must be accessible for the firm. The segments’ profiles provide also details on how to best access the segment, e.g. which communication and media to use, whether to innovate through packaging or through product features etc.

This step corresponds to targeting, i.e. the selection of the most attractive market segment(s) for the firm and informs about positioning, i.e. the overall marketing program to address the segment needs. Here follows an example on how the match is actually set (Figure 4). In this example case for Spain, the best fitting segment is the fourth: “360 degree health (nutritional digestive and inclusive health)” with probability membership equal to 0.80. This segment (360 degree-health) however is present also in EU.

Figure 4: Graphic results of the match between product firm and consumer segments

Conclusions

A LCA was conducted using a sample of 4000 representative responses collected from fish consumers involved in fish purchasing in five European countries, i.e. Italy, France, Spain, Germany and the UK. We identify distinct and meaningful segments for the single countries and an overarching European segmentation. Segment profiles include expected benefits, usage patterns, sociodemographic information etc. of the segments’ consumers.

Our findings show segments that cut across various countries (e.g. cooking artists, the group of indifferent consumers) but also groups that are idiosyncratic to one or a very few countries only (e.g. the local connoisseurs; the local ecologist in the UK; the convenience & health oriented cluster).

The segmentation profiles are valuable for new product development and commercialization activities in general as they provide firms with a better understanding of their primary markets as well as with a comparison with other markets and segments. Armed with insight on expected benefits and reasons for fish choice and actual consumption behaviour, firms get actionable input regarding the key decision of selection of country market(s) and/or consumer segment(s) and respective positioning and marketing programs. The model, however, goes a step further and proposes the “best” match (i.e. targeting) of segment with company offering (through multinomial regression). The match will further be developed in the decision support system (PrimeDSS) in WP6.

Using the results of the segmentation and the algorithm for matching consumer profiles with product/company attributes in five countries and in Europe, the DSS user will get clear advice on which segment(s) to target and indications of whether and how to improve the product or the marketing program (also internationally).

Finally, the present activity has been implemented in parallel with the survey in Task 4.6, with a number of common questions (the “bridge questions”) opening further avenues of development. The combination of the surveys bears potential to develop an even more powerful tool to be implemented in the PrimeDSS.

The results of the segmentation across the five surveyed countries and EU jointly with the algorithm for match as well as the possibility to combine the survey in Tasks 4.4 and 5.4, will be further investigated and eventually used as an input for the PrimeDSS development in WP6 of the project.

Reports &Data

Descriptive analysis

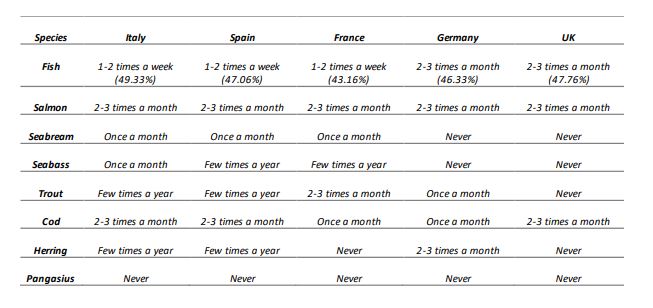

As shown in table 2, in our samples, fish is more frequently consumed in Italy, Spain and France (1-2 times a week) as a median value. The most consumed fish species across countries are salmon and cod. A significant consumption of herring is recorded only in Germany (2-3 times a month). Seabream and seabass are mostly consumed in Italy and Spain.

Among all nations, France has a higher median frequency of trout consumption (2-3 times a month). Pangasius has a median frequency of consumption that is completely irrelevant (median value corresponds to never ).

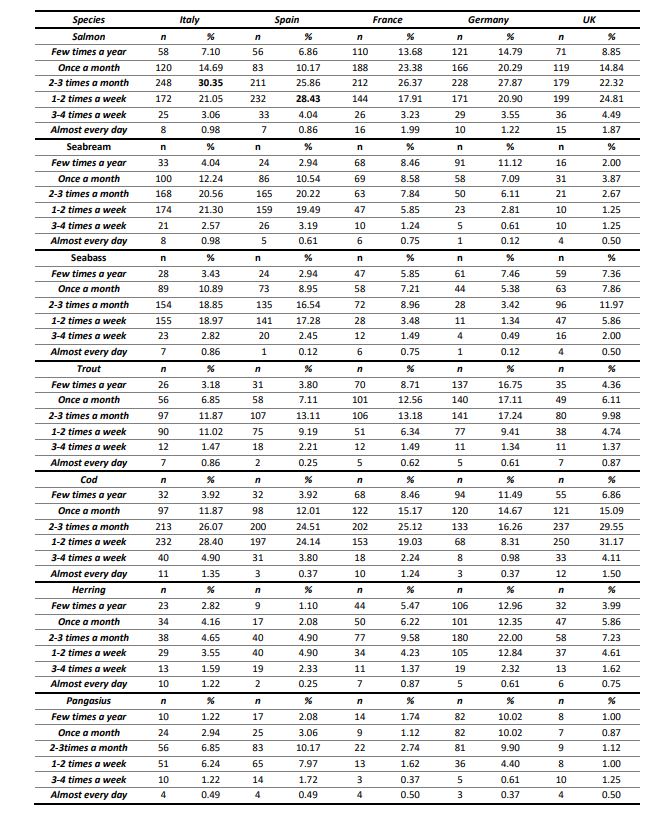

Table 2: Median values of fish consumptionIn Table 3 frequencies of consumption by species in the various countries are broken down further. Salmon is least frequently consumed in Spain and the UK where 28 % and 25 % of consumers report consuming salmon only 1-2 times a week. The corresponding frequency is 26-30 % in France, Italy and Germany.

Consumption of seabream is most frequent in Spain and Italy, where around 20 % of consumers have seabream at least 1-2 times a week. In the UK, only 4 % of consumers have seabream once a week or more often. A similar practice is to be observed for consumption of seabass; around 20 % of consumers in Italy and Spain have seabass at least 1-2 times a week, while the corresponding frequency in the other three countries is much lower, even as low as 1 % in Germany.

Consumption frequency of trout is comparable in all countries except Germany where percentages are slightly higher (17 %, 2-3 time a month). Cod is most popular in Italy and in the UK (1-2 times a week), in Spain the consumption of cod varies between 1-2 times a week and 2-3 times a month; in France and Germany cod is consumed less frequently (2-3 times a month) with the lowest – 16 % - consumption in Germany.

Herring is consumed mainly in Germany where 22 % indicate that they consume herring 2-3 times a month, and a further 13 % 1-2 times a week. France and the UK are similar in frequency but the percentage of those who consume herring is much lower. In Italy and Spain just a few consume herring. Pangasius, as compared to the other species, is the least consumed, as already evidenced by the 0 median shown above.

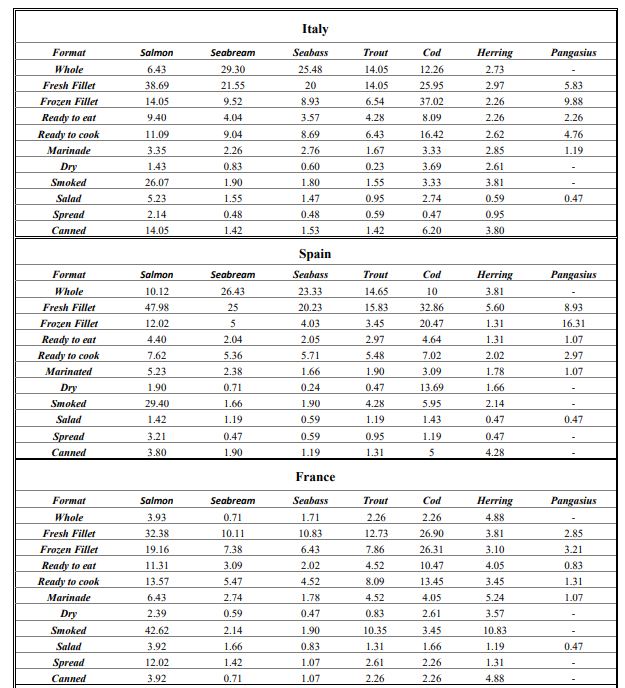

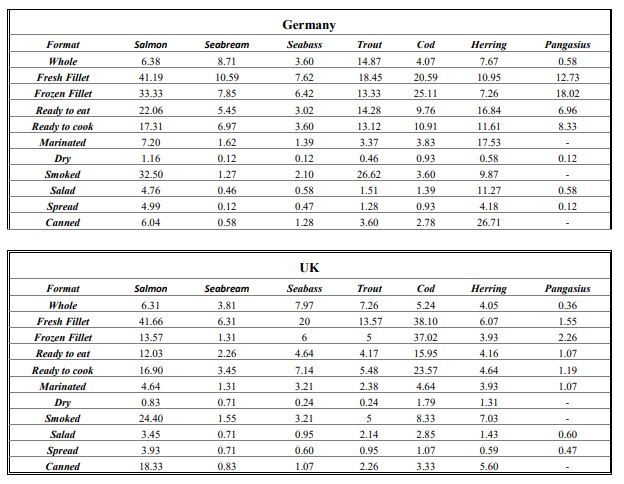

Table 3: Frequency of consumption for species in the various countriesIn Italy, the favorite formats of fish species consumption are: fresh fillet and smoked for salmon; whole fish for seabream, seabass and trout; frozen fillet for cod; and smoked and canned for herring.

In France the favourite format for seabream, seabass, trout and cod is fresh fillet whereas smoked is preferred for salmon and herring. In Germany the favourite formats are: fresh fillet for salmon, seabream and seabass; smoked for trout; frozen fillet for cod and canned for herring. In UK the favourite formats are: fresh fillet for salmon, seabream, seabass and trout; frozen and fresh fillet for cod and smoked for herring. Ready to eat/read-to-cook products are mainly consumed in Germany and UK (for further details on the choice of fish formats by species in the various countries please see Table 4).

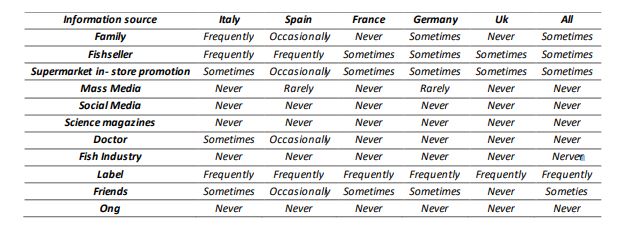

Table 4: Percentage of choice of fish formats by species by countryLooking into the main sources of information, in general, European consumers consult frequently labels, and sometimes fish-seller, supermarket and in-store promotions, family and friends. In all countries, labels are the most used source of information.

Italian consumers frequently consult the label, the fish-seller and the family, sometimes supermarket in-store promotion and medical and friends’ advice. The Spanish consumers consult frequently fishseller and label, occasionally supermarket in-store promotion and family, friends and doctor’s advice, and rarely mass media. French and British consumers differ somewhat from consumers in Italy and Spain, as they consult frequently label and sometimes supermarket in-store promotion, friends and fish-seller and thus make use of fewer sources of information. Germans additionally consult family, and, like Spanish consumers, they rarely attend to mass media. In none of the countries investigated, consumers use scientific magazines, social networks or industry and non-governmental organizations to learn about fish.

Table 5, below, shows the information behaviour in the single countries and in Europe.

Table 5: Maximum frequency for information sources by countryIn Appendix 2, more descriptives are presented, for example the place of purchase, and consumption situations by country (Table 11 and 12 respectively).

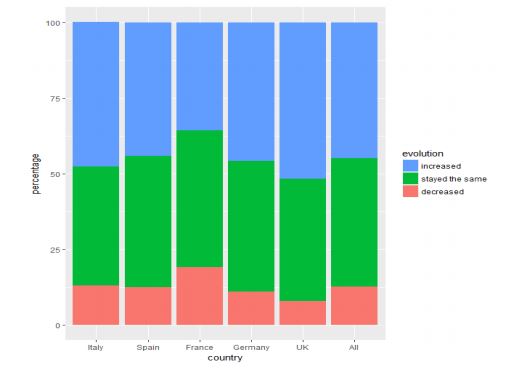

Overall, 42% of the respondents have maintained the same level fish consumption for the past 3 years, 13 % decreased fish consumption and 45 % increased fish consumption in the same period. The share of those who increased fish consumption is higher in the UK (52 %) and Italy (48 %), whilst the quota of those who decreased fish consumption is higher in France (19 %). Spain and Germany share the same trend of fish consumption over time (please see figure 3).

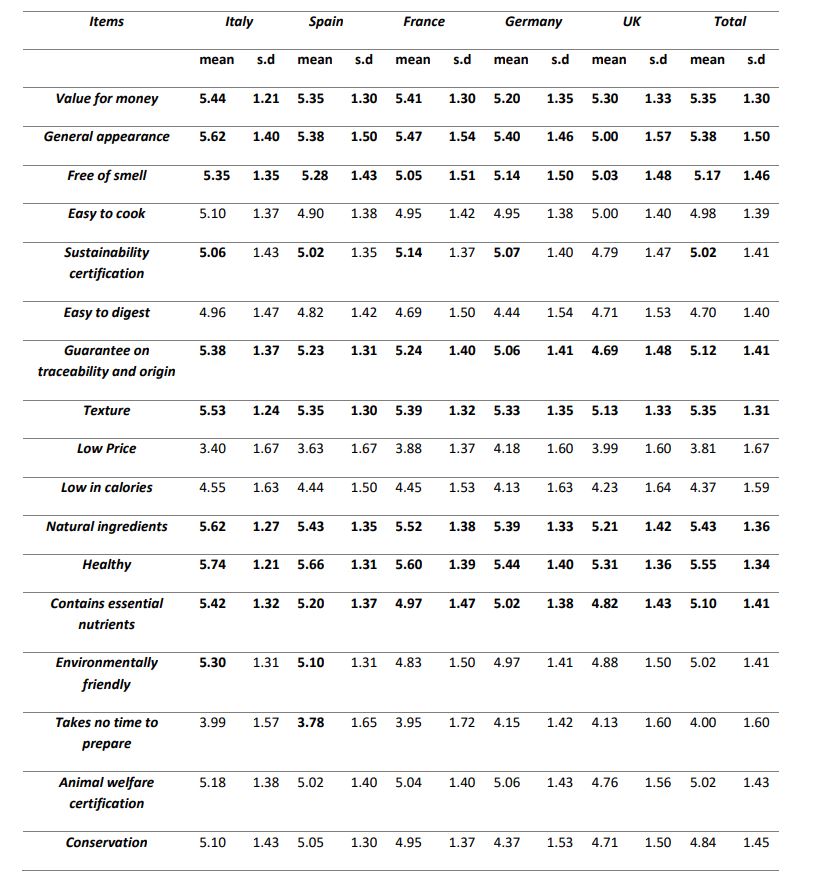

Figure 3: The evolution of fish consumption over the past three yearsTable 6 shows a series of different aspects important for fish selection as expressed by the respondents.

Table 6: Importance of different aspects in fish selection (1 = Not at all important; 7 = Extremely important)Regarding the importance of the characteristics ascribable to the fish, it can be noted that in all countries that the highest mean value of importance is associated with the items “value for money”, “general appearance”, “texture”, “origin and traceability” of the product, to the endowment of a “certification of sustainability” and to the “health-nutritional aspect”. Italy has the highest mean values for environmental, health-nutritional and sensory aspects.

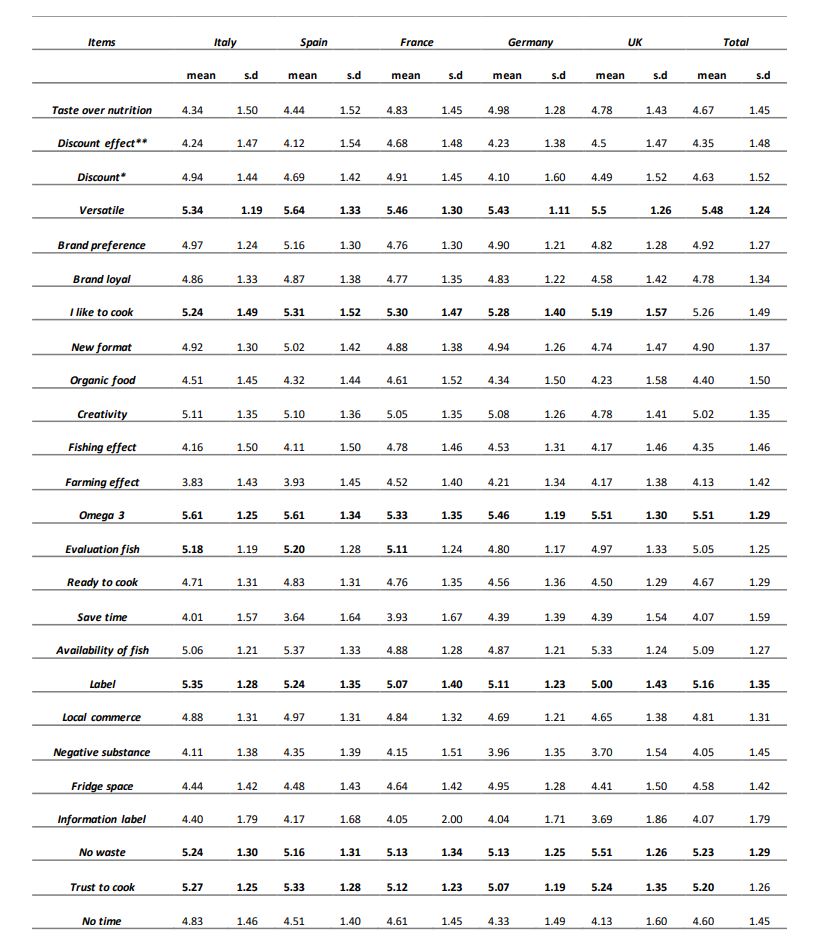

In general, consumers are more worried about the negative consequences of fishing on marine resources, than those of fish farming on the environment. The concern is higher in France and Germany. In general, respondents believe that fish consumption has more benefits than risks. The benefits are more appreciated in Spain and Italy. In general, consumers have confidence in their own ability to cook fish and evaluate the quality of the fish before buying it. Overall, consumers consider "save time" and -"ready to cook" characteristics unimportant as well as the low price and branded products (Table 7).

Table 7: Agreement with different statements in fish selection (1 = strongly disagree; 7 = strongly agree )- Has a discounted price; ** I easily change my fish selection in case of discounts; the first one wants to measure the

importance that the application of a reduced price has on the purchaser and the second wants to measure how much the consumer is susceptible to the effect of the discount.

LCA segments

Latent class analysis was performed on 42 items for the European consumer segmentation and 27 items for the single countries (please see Table 8 for the items). Using the information from EFA and CFA we have been able to obtain a first selection of items to be included in the latent class analysis (please see section 2.5.1.). A second selection of items was obtained on the basis of LCA: all those items that had a high probability on the neutral modalities of the Likert scale were eliminated (e.g. farming and fishing effect, save time item etc.) leading to a final selection of 27 items used in countryLCA. The items, as discussed above, reflect established benefit-behavioural, and psychographic segmentation criteria, useful to the identification and exploration of subgroups of consumers, i.e. segments. In Table 8 the items and respective variable labels are reported. The items used for single country analyses are marked with an asterisk. LCA were performed overall and stratified by country. In each country individuals were assigned to one of the latent classes based on their highest posterior probability of class membership derived from their response to the items.

In addition, for each country, the multinomial logistic regression model is applied to evaluate the associations between classes predicted by LCA and predictors (i.e. independent variables). In particular, the dependent variable (outcome) was the membership class predicted by LCA (i.e. segment), while the independent variables were: family size, general consumption of fish, children eating fish, age, grocery shopping (euro), single fish species consumption (i.e., salmon, seabream, seabass, cod, trout, herring) (see Table 9 for details). If our segment profiles are meaningful, that is explaining/able to predict actual consumption behaviour we should find a coherent pattern between preferences/benefits expected in the various segments and their consumption and sociodemographic combinations.

To gain degrees of freedom, the 7-point Likertscale for frequency of consumption of individual species was rearranged into four categories (≤low, medium-low, medium-high, high) while the one for the “general consumption” variable was collapsed into three (low, medium, high) categories. The age variable was divided into five classes (i.e. [18-24), (25-34], (35-44], (45-54], >54). To take into account the influence on consumption habits resulting from the presence of children (≤ 12 old years), a new categorical variable has been constructed using information on the presence of children eating fish “no” (children do not eat fish), “none” (no children in family) and “yes” (children eat fish). The class "low consumption”, “young”, “consumers and no children in the family" group was used as the reference category. As we will see in the following paragraph, the segment called “indifferent” is present in all countries. For reasons of easy and best comparison, this segment has been chosen as the reference category for the multinomial logistic regression.

Table 8: Items used in LCA models (single country – European segmentation)The coefficients of the model are interpretable as expected outcome variation in odds ratio (OR) terms (OR= exp (βj), from the reference category) per unit increase of the associated predictor, keeping fixed the others in the built-in model. Concerning the results, in all countries, family, children (<12 years) eating fish and grocery shopping variables were not statistically significant. The significance of the remaining variables varies by country and by nature of the variables, in particular the level of fish consumption by species and by age categories.

The results obtained from the multinomial logistic regression model (especially OR) and from the calculation of descriptive statistics (mean value and relative frequencies in each class) are used to characterize the consumer profile (market segment) in more detail (detailed results of the regression are available on request).

To obtain an improved description of the segments, we calculate frequency and mean of some sociodemographics (gender, family size, income, education), geography (presence of coastline and urbanization) and consumption (i.e. usage) variables (general fish consumption, format of fish etc.), preference for boneless, wild/farmed and traditional products. In case a variable was not statistically significant in the multinomial logistic regression model, mean and frequency were calculated in order to obtain all the information we needed to describe the segments.

Table 9: Variables names and measuresIn a pre-processing step, we decided to transform 7-point into 6-points Likert scales by collapsing the 5 and 6 modalities, in order to increase segment interpretability. Since the number of latent classes cannot be estimated as part of the LCA, we performed a LCA sensibility analysis by evaluating models from 1 to 14 classes and defining the number of classes based on statistical and substantive grounds. For the purpose of statistical model selection, we used the Bayesian information criterion (BIC) and we considered the relative improvement in model fit (based on the log likelihood-function). In addition, we evaluated the competing models in terms of usefulness and interpretability. Finally, we found the 11-class model in Europe to allow an adequate representation of the data and to permit good differentiation of the posterior probability classes (profiles or segments). Country analyses tend to yield fewer classes, e.g. in Italy we have identified a 7-class model, in Spain and Germany 6 class model, while in France and UK we have identified 5 class models.

Before we go into detailed country segment descriptions, a note on the interpretation of results is appropriate. For reasons of parsimony, in the following we will only report the main characteristics and patterns, as indicated by respondents, to support the construction of our segment profiles. The profiles are complemented with some key sociodemographics and linked to consumption patterns. For the full list of variables and detailed information (as well as probabilities of inclusion) please see Appendix 3, Tables 13-18. Of note, the segment profile is a combination of items which the respondents value highly and/or what they do not consider important. Members inside the segments share the same profile while their profiles are distinct across the segments (i.e. within- group homogeneity and statistically significant between-group heterogeneity). We turn now to a detailed description of single country- and the overarching European segmentation.

Italy

We identify 7 distinct consumer segments in Italy, as reported in Table 11 (for all details please see Appendix 3, Table 13).

Segment 1, the health & environmentally conscious consumer represents 13 % of the Italian consumers(trend: stable). Members of this segment are willing to pay (second highest expenditure for fish in Italy) for beneficial effects for both personal and environmental health. Predominantly women aged 50 + value items such as environmentally friendly, sustainability and natural ingredients, nutrients, easy-to digest characteristics highly. Appearance and traceability are also important to this segment, pointing to critical evaluation and check of quality/safety issues related to fish. They prefer wild fish, boneless and traditional recipes. Their favorite place of purchase is the supermarket/fish monger which are also their sources of information. The segment’s usage rate is medium-high. Of note, consumers here like all fish species (although they consume seabream and seabass most) and buy a broad range of formats. The women and their small families (3 persons) reside in bigger urban centers, with children who are grown up but still live at home.

The brand-convenience-taste consumers reflect only a small but growing portion of the Italian market (7 %). This group of young consumers with small families declares to have a preferred brand and to favor taste over nutritional aspects. Highly important to them are availability of the fish, new formats, labels and omega 3. The consumers here also value fish products that take little time to prepare while nutrients or sustainability claims are of no importance to them. Consistent with a brand buyer is also the fact that these consumers are not self-efficacious– they rely instead on the familiarity and security that comes with a preferred brand and label (another aspect of “convenience”). In line with this profile is the supermarket as the only place of purchase, which is also, together with advertisements, the segment’s main source of information. People in this group live predominantly in rural areas of the country. The favorite species are salmon (ready-to-eat/to cook, fresh fillet), seabream (fresh fillet) and cod (frozen fillet) with overall medium consumption and average expenditure.

The self-efficacious cooking artist, the third Italian cluster we describe, represents 14 % of Italian consumers (trend: growing). Here we find the self-efficacious (all items that point to knowledge and evaluation of fish score high) relatively young male who likes to cook, is creative in meal preparation and looks for versatility. Consistent with the passion for cooking, saving time in meal preparation is unimportant to him. He looks for healthy products (with traceability) but also for a reasonable pricequality ratio. He and his partner (or small family) live in coastal/rural areas as well as in urban centers. The favorite place of purchase is the supermarket or the fishmonger, the source of information is the label or the advice from the fishmonger. Chooses predominantly seabream, seabass and cod in a wide range of formats (except ready to eat). Fish expenditure is average, in line with the fact that those who have more knowledge of fish can find more alternatives among available products.

The local connoisseur represents the biggest segment in Italy (24%/growing). This is the group of consumers who know everything about fish (high values across self-efficacy items), use its versatility and experiment with new formats or recipes. Relatively young women here (with small family) strongly emphasize the health-nutritional aspect and underline easy digestion. This group of consumers also favours local origin. They pay attention to environment and sustainability issues and indicate the preference for a (local) brand or seller. Emphasizing value for money, they do not trade off quality for price (but would instead go for a cheaper species or stock the fish in order to be flexible). They prefer wild fish, are indifferent to bones, and are inclined to traditional preparation. Their consumption is medium-high (mainly seabream, seabass, less cod and salmon in a wide range of formats) with an expenditure that is the highest across all Italian segments. These consumers buy in the supermarket or at the fishmonger and do not indicate any sources of information.

Price-wise convenience consumers (14%/stable) represented in segment 5 are very price conscious, reflected also in their low expenditure on fish. People here are not knowledgeable about fish. They strongly underline health, easy-to-cook characteristics and texture. In line with this profile is their fish selection – they favor cod and salmon (fresh and frozen fillets but also canned, smoked, ready-tocook/ready-to eat). Both genders aged 54 + are represented here, mainly living with one grown up child in rural and urban areas. Preferably they buy in supermarkets which are, together with advertisements, also the source of information.

Segment 6 is a representation of self-efficacious pragmatic fish consumers, a large (23%) and growing segment with high fish expenditure. They value the health benefits of fish, look for conservation and versatility. Preferences here bring together the health of both, individuals and the environment, added is a strong emphasis on value for money. Although this segment is knowledgeable about fish and its preparation, the profile seems to reflect a pragmatic instance of “having to eat and cook fish” without related pleasure of doing so. In fact, this segment has only two favorite species, namely salmon and cod, which they consume frequently, predominantly as fresh/frozen fillets. Women aged 45 + with small families, medium-high education and income represent the sociodemographic profile of this segment best.

Finally, the group of indifferent consumers is the smallest group of consumers (6%/stable), represented by relatively young male with small family living in rural or intermediate areas of Italy. Their favorite place of purchase is the supermarket. They consult the label or ads for fish information. Species include seabream and salmon and their expenditure is among the lowest across the segments.

Spain

Latent class analysis identifies 6 segments in the Spanish market (for all details please see Appendix 3, Table 14).

Segment 1 represents brand/seller “dependent” high quality consumers who are not self-efficacious (23%/growing). The preferred “brand“ here is either the shop/seller or the brand itself. Consumers do not feel on the safe side regarding fish evaluation and preparation and thus rely on the trusted seller/brand of whom they learn. They give importance to inclusive health (individual and environment) and have a broad quality understanding for which they are ready to pay. This segment shows high fish consumption and the highest expenditure for fish. Consistent with the fact that they like to cook but do not indicate corresponding competence they go for a very limited range of species. They buy in supermarkets or at the fishmonger and listen to the advice of the fishmonger or seller. Women aged 46 + with small children (who eat fish) and low-medium education but relatively high income best represent this group of consumers. Favorite species are seabream (whole/fresh fillet) and cod (fresh/frozen fillet, dried).

Self-efficacious selfish brand buyer (23%/growing): also this group of consumers has a preferred brand/seller but it is, as compared to segment 1, self-efficacious. It is “egoistic” in terms of health orientation as only items which focus on individual health are important (while environmental attention is unimportant) to this segment. Men around 55 here take care of their family which lives in cities close to the coast. They are medium seabass and salmon consumers who spend relatively little on fish.

The independent “good for me” connoisseur (9%, growing) values taste and nutrition equally. Members of this segment love fish (sensory appeal) and they value its benefits for health. They crosscheck on labels and expect a guaranteed origin. In line with this, the segments favorite species is wild fresh seabass which is consumed in high quantities. Women aged 48, living with family in cities at the coast are willing to spend for their selected premium seabass which they preferably buy at the fishmonger or in the supermarket.

The consumers in the 4th and biggest (29 %, stable) segment in Spain are directed towards nutritionaldigestive and inclusive health (360 degree-health). Consistent with this emphasis is the importance given to origin and traceability. Value for money is crucial to this segment, and they value conservation. Their medium-high fish consumption is reflected also in a relatively high fish expenditure mainly spent on fresh seabream and salmon (fresh/smoked). Young women here take care of their families with young children.

(Salmon) Cooking artists (9%/stable), very young couples (24 +), like to cook and trust in their competence of fish (salmon) preparation, they are creative and experiment with new formats, and they emphasize versatility. None of the health related items is of importance. The young couples go mainly for wild salmon (medium –high consumption) in the supermarket. Salmon is the dominant species they buy in all formats. Consistent with the artist stance is also the (low) use of an exotic species such as herring. The main source of information is the seller.

The indifferent (7%/stable), with medium-low consumption of salmon and cod, spends little on fish. Typically consumers here are young male, small family size, low education level living in urban centers in the countryside.

France

In France, 5 distinctive segments are identified with LCA (for all details please see Appendix 3, Table 15).

The good for me health consumer represents 29 % of the French market (trend: stable) that expects mainly health benefits from fish consumption and looks for guarantees in terms of sustainability certifications and traceability. Predominantly consisting of male in their fifties, highly educated and with high income, this segment appreciates “easy-to-cook” products and emphasizes value for money. It is characterized by low-medium consumption and low expenditure for seabream (either fresh fillet or ready-to-eat). Shopping for two, predominantly in supermarkets, these men use the label or the seller for information.

The segment of the health oriented (selfish), (not creative) cook (23%/growing) is medium-high in fish consumption and the highest in expenditure. Women aged around 45 highly value the health benefits of fish, they like cooking and the variety and versatility that comes with many species and a wide range of formats (herring, cod and seabream) in traditional preparations. They purchase in the supermarket for a small family and take information from the label and the seller. The cooking artist represents around a quarter of fish consumers in France (trend: stable). This profile cuts across all ages, also the very young. They choose carefully, go for high quality for which they are ready to pay and they consult many information sources. Health is not on the agenda of this segment and they have no environmental concerns. They shop for seabream at the supermarket or at the fishmonger. The couple prefers fresh, but they are flexible and willing to try different formats and recipes.

Self-efficacious convenience consumer to whom, beyond inclusive health, convenience is central (31%/stable). They give importance to each and every aspect and thus represents very demanding consumers. This consumer critically checks the expected quality: reads labels and values certificates and guarantees. Medium consumption of varied fish species and broad range of formats (reflecting convenience), and second highest expenditure on fish. Relatively young women and men are representing the class, living in the countryside/intermediate cities in small families. The indifferent in France are the smallest group of consumers (7%/stable). The class is on a mediumlow level in fish consumption and the lowest expenditure for trout, salmon and cod. Prefer mainly in fresh and frozen formats. The segment is predominantly young singles or couple, living in the countryside in smaller cities.

In all segments salmon and trout is consumed. The species mentioned above distinguish the segments from this overall baseline consumption.

Germany

For the 6 segments constructed in Germany full details are depicted in Table 16, Appendix 3.

Among the 6 segments in Germany we identify the cooking artist (12%/stable) who is loyal to a brand/seller and gives importance to local origin. Consumers in this segment share the characteristics that cut across-countries for the cooking artist: they like to cook/are capable of preparing fish, value versatility, are creative and ready to try new formats. Taste here clearly dominates nutritional aspects (only Omega 3 is of importance). Consumers in this segment are not price sensitive, a fact reflected also in the highest fish expenditure across German segments. They prefer fresh fish, medium usage rate, mainly salmon but also the more “exotic” seabream (the only segment in Germany) and seabass. The class includes both genders, they are young, live with a small family with smaller kids in cities in the countryside.

Healthy & environmentally-conscious consumers make up a third of the German market (growing). To consumers in this segment, a healthy diet and a natural product and the texture are central. Health here is inclusive of the environment, consumers value sustainability certification and put emphasis on a guaranteed origin. They are not self-efficacious and thus trust their “seller/brand”, but also consult the label and ask for guarantees. The group is ready to pay for the value they ask for, i.e. a healthy & environmentally safe diet, which is reflected in high fish expenditure. The class includes both genders aged over 54 involved in decisions and patterns of fish consumption (salmon, trout and seabass; fresh and frozen); consistent with their health focus their consumption is medium high.

The convenience- brand loyal consumer (23%/growing), looks for value for money. Brands provide the benefits she asks for: nutrients, sustainability certification, traceability, label. Ready-to-eat is emphasized which together with fresh formats may satisfied her want for creativity. Predominantly relatively young female living in a two-person-household in cities in the countryside with lower fish expenditure and medium fish consumption represent this cluster best. The members of this segment shop in supermarkets where they get information in-store, from the seller or from the label. The fourth segment comprises healthy cooking artists who like variety. Being a premium segment in terms of expenditure, this profile unites the cooking artist with a focus on health. Versatility is important, but experimentation is also reflected in a broad range of species and formats. The sociodemographic profile of women over 54, with medium high education, in 2 person-households, is very much in line with this segment.

Cheap brand and taste consumer (16%/stable): People in this segment have learned the claims of their preferred brand (but they are not knowledgeable about fish), omega 3 and tasty, they are priceconscious and, overall, seem to go for an easy buy without much involvement or major decision criteria. Fish here offers the best compromise between health and taste. No importance is given to origin and traceability. Male in their forties (couple) spend little for medium-low consumption. The indifferent present around 7 % of the market, predominantly young and single. Medium consumption, relatively high expenditure and a broad range of species and formats. Of note, herring is consumed in all segments. The species mentioned above distinguish the segments from this overall baseline consumption.

UK

5 segments represent the British fish consumers best (for all details please see Appendix 3, Table 17). Healthy convenience consumers (22 %, growing) have their focus on “easy” to cook, to stock, to use (versatile). Health is also central, with a strong focus on digestion and environmental concern and the request for traceability. The segment is characterized by medium consumption and highest expenditure on fish across the segments. Women, aged above 50 with medium-high education and a 2-person household describe the segment best. Members of this segment appreciate wild fish; their favorite species are seabream, seabass – fresh fillets, ready-to-eat, whole fish.

Selfish health & convenience consumers, the biggest segment (43 % , growing) are typically younger couples with medium – low income but relatively high expenditure on fish. They are informed and are consulting many information sources, do not trade off quality for price and are indifferent to brands, origin and traceability. The focus is on health, but also easy to cook, versatility, and conservation are important. Consume salmon and seabass in medium quantity. This segment is similar to segment 1 in convenience but health is not inclusive and more focused on nutrients than on digestion and its information behaviour is more extensive.

Cooking artist (8 %/stable trend). Similar to her counterparts in the other countries, the British cooking artist likes to cook and to experiment with new formats. Taste is an important theme, while she is indifferent to health and environmental concerns; dietary issues are not important. British cooking artists are not really knowledgeable about fish. Women aged 44+ in small families with children eating fish do best describe the sociodemographic characteristics. Prefer wild, favorite species seabream and cod. Given the low income she really likes and spends (over proportionally) for fish. Self-efficacious & local ecologist (13 %/growing segment) are very young singles or 2-person households. They are knowledgeable and environmentally conscious. At the same time they give much importance to the local context. The segment members enjoy cooking and they trust in their meal preparation. Medium consumption of salmon, seabream, seabass, but with low expenditure. The segment of indifferent (14 %, growing) is composed of young male, single or in a household of two, and low to medium education. Prefer salmon and cod, ready to eat, ready to cook. Medium consumers, low expenditure.

In all segments cod is consumed. The species mentioned above distinguish the segments from this overall baseline consumption.

Europe

We construct 11 European segments which are briefly discussed here below (for all details please see Appendix 3, Table 18 ).

The salmon fan segment (9 %/growing), in line with the only species it consumes, values highest omega 3, availability, versatility and value for money. These consumers also clearly favor taste over nutritional aspects. Consumers here are women in their forties, living in households of two persons with medium – high salmon consumption of all formats and relatively high expenditure. In terms of relative composition, this segment is very prominent in the UK (29 %).

Segment two represents the self-efficacious inclusive health consumer, one of the largest EU segments (17 %, growing): knowledgeable people who appreciate the health-nutritional aspect of fish. Dietary considerations are not important (e.g. nr. of calories). Health includes the wellbeing of the environment. People emphasize value for money, expect traceability and certification but are indifferent with regard to organic products. Male and female consumers aged around 50, with medium expenditure and fish consumption; favorite species are salmon, seabream, cod with wide variety of formats. Germans make up 24 % of this segment.

Cooks with inclusive health focus (11%) characterize segment 3. They enjoy meal preparation (but are neither creative nor knowledgeable of fish) and emphasize omega 3 and “easy-to-digest” attributes. Their overall important theme is individual and environmental health, and, importantly, animal welfare, which is cross-checked with label and certifications. The segment is not price sensitive and is ready to pay for the expected value. Relatively young men here take care of small families who live in urban centers in the countryside. Low-medium consumption, but relatively high expenditure on fish. UK dominated with 27% of consumers in this segment (trend: stable).

Tasty and easy quality (8%). To this segment value for money is important as are “easy to cook” and quick preparation of meals. Availability and conservation is stressed, emphasizing the time/convenience posture of the segment. Taste and texture are valued more than health aspects. No environmental concerns and also self-efficacy criteria are low/indifferent. Young male (early thirties) with medium-high education take care of small families. They prefer wild over farmed and spend much for taste and easy quality - high expenditure for medium-high fish consumption. Segment is mainly populated by French, Spanish and Italians (trend: increasing).

Segment 5 is the 360 degree- health oriented segment (11%), which gives much importance to natural fish products. Also “easy to digest” and nutrients are of utmost importance, as is the absence of smell and a guaranteed origin. It is the only segment where people also have a concern regarding negative effects of farming. Consistent with this preference they favor wild fish. The segment is characterized by medium-high fish consumption with corresponding high expenditure. Women in their 50s in 2- people households with medium education represent best the demographic profile of the segment. Italians dominate this segment (trend: increasing ).

Segment 6, one of the smallest in EU (5 %), is characterizing the innovative brand buyer. Consumers here have a favorite brand to which they are also loyal. “Claim”-related items are important but not supported by corresponding factual knowledge. People here are also the only ones to underline new dietary preparations (e.g. gluten free products), they prefer products that take little time for preparation, and they emphasize conservation and versatility. Time, overall, is an important factor for this group. The known brand is a response to this: choosing the familiar brand saves time in terms of reflection/selection and it is a guarantee for satisfied expectations. Consumption of this segment is high with corresponding highest expenditure across all segments. British, Italian and French women around 45, with small families make up this segment (trend: increasing).

Indifferent: the majority of indifferent consumers is divided among UK (31 %) and France (27 %), followed by Spain and Germany (15 % and 14 %, respectively), with a stable trend. Only 12 % of the class is populated by Italian consumers. This segment is characterized by male and female aged 18- 40, with low education and medium-low consumption. Expenditure, not surprisingly, is the lowest. Healthy convenience (6 %). Segment 8 consumers look for easy to cook meals that take little time to prepare, appreciate conservation and general health/environmental benefits. Being demanding on all dimensions, they are ready to pay for the corresponding products. As confirmed by high fish expenditure, consumers do not trade off value for money. Here young dads with medium-high education take care of their bigger families’ health by balancing it with the need to have meals easily and quickly prepared (trend: stable). Only Italy is underrepresented (16 %) in this overall balanced segment.

This group – the local – natural brand/seller (5 %) - values “local” and natural highly. More than emphasizing the presence of positive nutrients and elements, consumers here emphasize the absence of ingredients and substances. They are self-efficacious, trust a certain – local – brand or seller to whom they are loyal. They also stress availability. Fish consumption is medium – low, expenditure is at the lower level across segments. The sociodemographic show relatively young men and women in households of three holding a medium education level. German consumers account for 27 % of this small segment (trend: stable).

In this segment we find the cook with selfish health focus (8%) who likes taste and nutrition. Broader health, dietary or environmental concerns are not considered important. Consistent with enjoying the preparation and consumption of fish, this segment’s expenditure is medium-high with corresponding high expenditure. Relatively young Spanish women in small households without children best describe the consumers of this segment (trend: increasing).

Cooking artists (17 %, stable) are creative, like to experiment with new formats, like to cook and are self-efficacious. No environmental and health concerns. Women in their fifties in small households (2- 3 members) with medium consumption and relatively low expenditure characterize this segment’s demographic profile. The majority of the class is made of Italians, while the minority comes from UK. Table 10 presents a summary of the segments identified in the single countries and in the “total” EU countries under study. As is clear from this table and the discussion above, some segments are crossnational or pan-European, while others are specific to a few/only one country.