|

|

| (11 intermediate revisions by one other user not shown) |

| Line 6: |

Line 6: |

| | ---- | | ---- |

| | | | |

| | + | |

| | | | |

| | == Introduction == | | == Introduction == |

| Line 11: |

Line 12: |

| | ---- | | ---- |

| | | | |

| − | In 2012, the food and drink manufacturing industry in the European Union was the largest manufacturing sector in terms of value of the output with 15% of the total manufacturing turnover. It also remains one of the largest in terms of employment and number of companies, the large majority of which are small and medium scale enterprises (SMEs) (ECSIP Consortium, 2016).

| + | Prime DSS has been designed to help fishing sector stakeholders to improve their competitiveness in the Fisheries and Aquaculture markets. One core component of identifying areas of competitive improvement involves the collection and dissemination of data revealed in success and failure stories. These stories include information collected on innovative product development and consumer behavior to understand which product attributes best fit customer preferences and therefore improve the possibility of a successful product launch. |

| | | | |

| − | Within the food and drink industry, the seafood processing sector had the smallest share of turnover in 2012. With 3570 companies, it occupied 0.01% of the total number of companies in the food sector (ECSIP Consortium, 2016). Nevertheless, the enterprises operating in the EU food and drink industry are a vital link in the supply chain, enabling wider economic activity and employment (Traill & Grunert, 1997).

| + | All fishing sector stakeholders are invited to share their stories about success and failure experiences when launching innovative products onto the market place. Over time, sector users will have access to a wealth of information that will provide invaluable insights into consumer behaviour and reactions to specific product attributes that will assist with launching successful products. The Success & Failure stories tool is a collections of the stories shared among stakeholders. |

| − |

| |

| − | In the context of globalisation and increased competition on domestic and foreign markets, innovation is seen as a key pathway to creating and sustaining competitive advantage at the firm level as well as stimulating wider economic growth (Porter, 1985, 1990). Indeed, one of the five targets of the Europe 2020 strategy is 3% of the GDP of the EU to be invested in R&D, a tool for innovation (EC, 2016). The food and drink industry, however, has been scored as a low-medium R&D intensity sectors, a group of sectors with R&D intensity between 1% and 2% of net sales, which comes at the background of companies in the automobile and electronics industries with R&D investment of more than 20% (Hernández et al., 2014). Nevertheless, as we will see below, this may not necessarily mean lack or a low level of innovation.

| |

| | | | |

| − | ===What is innovation?=== | + | == The tool == |

| | | | |

| − | Innovation is a ‘good, service or idea that is perceived by someone as new’(Grunert et al., 1997). According to the same authors, innovation may be related to invention but not all product innovations are based on inventions. New product could merely be an improved existing product. Schumpeter (1939) distinguishes between five types of innovation: introduction of new products; introduction of new methods of production; opening of new markets; development of new sources of supply for raw materials or other inputs and creation of new market structures in an industry. Similarly, The Oslo Manual on collecting and interpreting innovation data distinguishes between four innovation areas: product, process, marketing and organisation (OECD, 2005). In the context of the food industry, innovation can include new products, new types of packaging (including both the physical characteristics of packaging and the contents of information on it, new recipe (new flavours, new additives, conservation methods), range extension, re-launch, new marketing methods and implementation of a new or significantly improved logistical process (ECSIP Consortium, 2016).

| + | === Landing page === |

| | | | |

| − | The focus of this study is primarily on product innovation. However, the distinction between product and process innovation is not always clear-cut, since product and process innovation are often dependent on each other. Process innovation has been defined as “an investment into a company’s skills, resources and competences, which allows the company to introduce cost-saving changes in the production processes but also to introduce new technology which allows the production of a range of products quite different from the existing one” (Grunert et al., 1997). Modern market pressures have pushed food processing companies to move away from a focus of process improvement and cost reduction alone, which used to be the norm in the past, towards creating products that meet the consumer demands more successfully, where product innovation plays a key role (Fortuin & Omta, 2009). In the present-day food industry the introduction of new products is seen as an essential element of competition between companies (Grunert et al., 1997).

| + | [[File:Sfs home.png|home]] |

| | | | |

| − | ===Why look at innovation===

| + | In the landing page the user will be able to see the latest approved stories on the left, and also a list of stories uploaded by the user with their current status. The user can click the upload story button to open a modal where the story details can be entered and submitted for upload. Uploaded stories will then go through a review process by the DSS administrators and will either be approved or rejected by the administrators. |

| | | | |

| − | It is widely acknowledged that innovation is required for the growth of output and productivity. Schumpeter (1939) argues that economic development is driven by innovation through a process of replacement of old technologies with new, which he labels “creative destruction”. But innovation is also seen as a key to business success. A large study by the American Management Association, involving 1396 executives from large multinational companies showed that more than 90% of the participants believed innovation to be important or extremely important for the long-term success of the company and that this will still be the case in ten years’ time (AMA, 2006).

| + | The user can also use the search form to search for specific stories containing desired attributes and click the search button to see if any stories match their query. If no parameters are selected, all stories will be displayed. |

| | | | |

| − | However, unsuccessful innovation may be even more harmful than no innovation, given the high costs associated with it (Traill & Grunert, 1997). The commonly reported figures for new food product failure are between 70% and 90% (Stewart-Knox & Mitchell, 2003). However, as pointed out by Grunert et al. (1997) those figures may be overstated since the definition of success, usually measured by the period which a product has been on the market, is not standard, and indeed a product may be successful even though short lived, depending on its intended function. For example, a range of products can be introduced by a company to diffuse the success of a new product launch by a competitor, being consequently withdrawn but nevertheless strategically successful. Similarly, the definition of a new product varies among authors. It has been argued that if a new product is ‘one that is new to the consumer’ only 7-25% of food products launched can be considered truly novel (Rudolph, 1995).

| + | [[File:Sfs search.png|search]] |

| | | | |

| − | ===Aims and objectives===

| + | Both at the home page or at the search results, the user can click the ''read'' link on a story to read its full content. |

| | | | |

| − | In this report we mainly aim at addressing four research questions:

| + | [[File:Sfs read.png|read]] |

| | | | |

| − | Q1: How has the seafood innovation developed over time in general and for the selected species?

| + | |

| | | | |

| − | Q2: What drives product innovation at the company level?

| + | == References & readings == |

| − | | |

| − | Q3: What factors determine the focus of innovation?

| |

| − | | |

| − | Q4: What factors are responsible for success or failure in product innovation?

| |

| − | | |

| − | | |

| − | == Methods ==

| |

| − | | |

| − | ----

| |

| − | | |

| − | The present report was developed through a mixed research method – a combination of qualitative and quantitative analysis. The combination of data types can be highly synergistic. Quantitative evidence can indicate relationships which may not be salient to the researcher, while qualitative data are useful for understanding the rationale underlying the relationships showed in the quantitative data or suggested through theory (Eisenhardt 1989).

| |

| − | | |

| − | The report starts out with an analysis of The Global New Products Databased (GNPD) which is constructed by Mintel, a market intelligence agency, working across 34 countries. The main objective of GNPD is to provide data giving the depth of resources necessary to track trends in product innovation and retail success. Product innovation are tracked on shop and online across 62 of the world’s major economies; and around 33,000 new products a month are added into the database. Eighty fields of information ranging from companies information and flavour to packaging and positioning are noted. This database allows access to the products characteristics, the marketing positioning and the type of launches. However, it only concerns packed products. It provides detailed data on new products launched in the food, beverage, beauty and personal care, healthcare, household goods and pet care markets.

| |

| − | | |

| − | The innovation taken into account into the database can be from five different launch types: a totally new product, a new packaging, a new recipe, an extension of the range and a product relaunch. The product has to be claimed as “new” to be picked up. A new product corresponds to a new line or a new family of products for the brand, this kind of launch is brand depending. This also includes brand products that are launched in a new country where the product was not commercialized (Mintel International Group Ltd. 2012). A new packaging is based on the visual aspect of the product, it corresponds to product labelled as '''new look''', '''new size''' or '''new packaging''' (Mintel International Group Ltd. 2012). A new recipe concerns the new ingredients formulation of an existing product. An extension of the range depends of the brand line; it is assigned when an innovation is the horizontal extension of an existing line (Mintel International Group Ltd. 2012). Finally, a relaunch is assigned to an innovation when it is indicated on the product packaging or when a secondary information source informs consumers (trade show, website or press). It is also assigned when the product has been both reformulated and it has a new package (Mintel International Group Ltd. 2012). Thus, there are mainly product and marketing innovations valorised in this database, as major process or social innovations are not necessarily highlighted to shopper.

| |

| − | | |

| − | For this analysis on European Seafood market, we looked at food product containing seafood as major ingredients (seafood has to be in the five main ingredients to be selected for this analysis). The European market as delimited (and covered) by Mintel concerns 25 countries: Germany, Austria, Belgium, Croatia, Denmark, Spain, Finland, France, Greece, Hungary, Ireland, Italia, Norway, Netherland, Poland, Portugal, Czech Republic, Romania, United Kingdom, Russia, Slovakia, Sweden, Swiss, Turkey and Ukraine.

| |

| − | | |

| − | Secondly the report focus on a primarily qualitative analysis - an explorative multiple case study analysis where the unit of analysis is the firm, although special attention is also given to one of the main successful or unsuccessful company’s products. The research strategy of case studies was chosen because it focused on understanding the dynamics present within single settings, at numerous levels of analysis, and can be used to accomplish various aims, ranging from providing a description to generating theory (Eisenhardt, 1989).

| |

| − | | |

| − | The cases were identified from secondary data (e.g. newspapers, company sites, specialized literature, innovation awards, etc.). Then, a first stage selection based on careful cross-checks with databases such as Lexis Nexis4 and GNPD, resulted in 60 proposed cases (9 product failures and 51 successful products). From them, 17 were selected (4 failures and 13 successes) for in-depth studies, in order to provide a detailed view on the successful – or unsuccessful – industry practice /or learnings.

| |

| − | | |

| − | All the selected cases belong to the seafood industry and have at least one product based mainly on one of the following fish species: salmon, trout, seabream, seabass, cod, pangasius or hearing. Moreover, the final selection of the cases was done balancing the different types of innovations, claims, fish species, markets and successful/failed products, among the cases. The selected cases can be observed in the Table 1.

| |

| − | | |

| − | ''Table 1.Case studies general information''

| |

| − | {| class="wikitable" style="width: 100%;"

| |

| − | |-

| |

| − | !Case

| |

| − | !Innovation

| |

| − | !Major claim

| |

| − | !Fish species

| |

| − | !Markets

| |

| − | !Launching year

| |

| − | !Success/failure

| |

| − | |-

| |

| − | |A

| |

| − | | - New packing

| |

| − | -New recipe

| |

| − | | - Convenience

| |

| − | |Salmon, Seabass, Seabream

| |

| − | |UK

| |

| − | |2010

| |

| − | |Success

| |

| − | |-

| |

| − | |B

| |

| − | | - New recipe

| |

| − | | - Quality and tradition

| |

| − | |Herring

| |

| − | |France

| |

| − | |2012

| |

| − | |Failure

| |

| − | |-

| |

| − | |C

| |

| − | | - New product

| |

| − | -New recipe

| |

| − | - Extension range

| |

| − | | - Natural

| |

| − | - Health

| |

| − | |Salmon

| |

| − | |United States, Canada, European Union

| |

| − | |2014

| |

| − | |Success

| |

| − | |-

| |

| − | |D

| |

| − | | - New product

| |

| − | -New process

| |

| − | | - Quality and taste

| |

| − | |Salmon

| |

| − | |Italy

| |

| − | |2000

| |

| − | |Success

| |

| − | |-

| |

| − | |E

| |

| − | | - New product

| |

| − | - Extension range

| |

| − | | - Convenience

| |

| − | |Salmon, Cod

| |

| − | |United States

| |

| − | |2014-2015

| |

| − | |Success

| |

| − | |-

| |

| − | |F

| |

| − | | - New product

| |

| − | | - Natural

| |

| − | - Health

| |

| − | -Local

| |

| − | |Trout

| |

| − | |Italy

| |

| − | |1989

| |

| − | |Success

| |

| − | |-

| |

| − | |G

| |

| − | |-New product

| |

| − | -New recipe

| |

| − | | - Convenience

| |

| − | - Health

| |

| − | |Trout

| |

| − | |Italy

| |

| − | |2015

| |

| − | |Failure

| |

| − | |-

| |

| − | |H

| |

| − | | - New product

| |

| − | | - Convenience

| |

| − | - Natural

| |

| − | |Trout

| |

| − | |Italy, Switzerland

| |

| − | |n.d

| |

| − | |Success

| |

| − | |-

| |

| − | |I

| |

| − | | - New product

| |

| − | - New recipe

| |

| − | | - Convenience

| |

| − | - Health

| |

| − | |Seabass

| |

| − | |Italy

| |

| − | |2011

| |

| − | |Success

| |

| − | |-

| |

| − | |J

| |

| − | | - New product

| |

| − | -New recipe

| |

| − | | - Convenience

| |

| − | |Pangasius

| |

| − | |Europe, Asia and USA

| |

| − | |2005

| |

| − | |Success

| |

| − | |-

| |

| − | |K

| |

| − | | - New process

| |

| − | | - Quality

| |

| − | |Trout

| |

| − | |UK

| |

| − | |2008

| |

| − | |Success

| |

| − | |-

| |

| − | |L

| |

| − | | - New Product

| |

| − | | - Convenience

| |

| − | |Salmon

| |

| − | |Spain

| |

| − | |2013

| |

| − | |Success

| |

| − | |-

| |

| − | |M

| |

| − | | - New product

| |

| − | | - Convenience

| |

| − | |Salmon, cod, seabass, seabream

| |

| − | |Europe

| |

| − | |n.d

| |

| − | |Success

| |

| − | |-

| |

| − | |N

| |

| − | | - New Product

| |

| − | | - Convenience

| |

| − | |SeaBream

| |

| − | |Greece, Russia

| |

| − | |n.d

| |

| − | |Failure

| |

| − | |-

| |

| − | |O

| |

| − | | - New product

| |

| − | | - Natural

| |

| − | - Health

| |

| − | - Gourmet

| |

| − | |SeaBass

| |

| − | |Croatia, Italy, Germany

| |

| − | |2011

| |

| − | |Failure

| |

| − | |-

| |

| − | |P

| |

| − | | - New process

| |

| − | | - Quality

| |

| − | |Salmon

| |

| − | |Norway

| |

| − | |n.d

| |

| − | |Success

| |

| − | |-

| |

| − | |Q

| |

| − | | - New product

| |

| − | | - Quality

| |

| − | |Cod

| |

| − | |Germany

| |

| − | |n.d

| |

| − | |Success

| |

| − | |}

| |

| − | | |

| − | | |

| − | From the selected cases, 13 are product innovations, frequently related to new recipes (4 cases) or to an extension of product range (2 cases). There is also one case in which the new product development is related to a new process. Among the claims, the most common ones are convenience (9 products), health (5 products), high quality (5 products) or natural (4 products). Less common claims include taste or gourmet (2 products) and the ‘local’ claim (1 product). Regarding the fish species, 3 of the analyzed products are based on several fish species (salmon, cod, seabass and seabream). The rest of the products are focused on one particular specie: salmon (5 products), trout (4 products), seabass (2 products), seabream (1 product), cod (1 product) and pangasius (1 product).

| |

| − | | |

| − | Following the selection of the cases, multiple types of data compilation are used to develop the case studies: archives, interviews, questionnaires, and observations (Yin 1994). The case analysis was structure along a common framework derived from literature review on food/fish innovations. The major areas were developed in a semi-structured interview guideline, sent with instructions to all partners. The guide included information as aspects of company general information, market structure, innovative practices, innovation inside the firm, sources of innovation, success/failure perception, and more detailed information on the selected successful/fail product.

| |

| − | | |

| − | All firms were contacted by phone and additional information was sent via e-mail by local researchers. The semi-structured interviews were developed at the firms in their local language in order to enhance understanding. The interviews were carried by one or two local researchers, and when possible, these were recorded. The interviews were reinforced with additional secondary data collection and analysis. Then, based on the interview material and secondary data, a cross case analysis is performed with the objective of identifying commonalities and differences between the firms, operative markets, species, and successful/failure outcomes.

| |

| − | | |

| − | The analysis of the information is done through a cross-case analysis. All the results are presented based on the analysed case studies. Additionally, the report offers some comparisons of the qualitative and quantitative results. The general framework used for the analysis is divided into three main levels even though these clearly interrelate and interact:

| |

| − | 1. Innovative potential at the supra-company level - the wider environment 2. Company’s innovative potential 3. Influences on innovation success at the project level

| |

| − | When investigating at the innovative potential at the supra-company level – i.e. the wider environment we look for factors like market structure/characteristics, the firm’s perspective on consumer trends (needs/wants), value chain organization and regulation.

| |

| − | | |

| − | When looking at the innovative activity at the company level we looked for factors like company size, resource availability and experience. Further firm strategy and orientation, capabilities and relationships with other companies/institutions where investigated.

| |

| − | | |

| − | Finally, when it comes to each of the selected case products, the material was analysed based on factors such as; source of the innovation, innovation strategy, organisation of the NPD (individuals, relations, management involvement, etc), type of innovation (incremental, radical, ‘originality’), market and consumer knowledge, process of new product development and perception of success and effect on performance.

| |

| − | | |

| − | | |

| − | | |

| − | == Background: literature review ==

| |

| − | ----

| |

| − | | |

| − | The EU food industry is a dynamic arena affected by wider socio-economic processes. To remain competitive in the modern world, food manufacturers must develop capacity to innovate quickly and effectively as reliance on a stable range of traditional foods can no longer ensure business success (Grunert et al., 1997). The following discussion starts with an overview of the major trends in the industry, particularly as they relate to pressures on the industry to innovate. It then proceeds with a review of the factors deemed important for the success or failure of new food products.

| |

| − | | |

| − | ===Drivers of innovation – the bigger picture ===

| |

| − | | |

| − | Over the last several decades, significant changes in the patterns of food consumption have been observed in industrialised countries, with inevitable influence on the rate and direction of product innovation. The drivers for these changes will be examined from different perspectives, which however, are inherently related to and reinforcing each other.

| |

| − | | |

| − | ==== Economic factors====

| |

| − | | |

| − | Generally, growing disposable incomes in industrialised countries has translated into changes in the patterns of expenditure on food, such that an overall higher level of expenditure on food, through consumption of higher quality and more diversified foods rather than higher quantity, can be observed (Traill, 1997). When it comes to seafood, however, the development of consumer prices has played a similarly important role in determining consumption trends. Since price is often cited among the main barrier to consumption of fish and seafood (Birch, Lawley, & Hamblin, 2012; Liu, Bui, & Leach, 2013; Myrland, Trondsen, Johnston, & Lund, 2000; Trondsen, Scholderer, Lund, & Eggen, 2003; Verbeke & Vackier, 2005), a decrease in their prices relative to other sources of protein can act as a driver for consumption and overall expansion of the market. Indeed, good illustrations of this are shrimp, salmon, tilapia and pangasius, all of which are internationally traded commodities whose real prices have declined over time due to increased and more efficient production methods (Asche, Bjørndal, & Young, 2001). For example, shrimp and salmon have been leading the international farmed seafood market for almost three decades, with current real prices a third of what they were three decades ago (Asche, Roll, & Trollvik, 2009). However, relative prices of close substitutes remain still important for consumers. This is particularly true at times of economic recession, when clear declines in seafood consumption can be seen as consumers ‘trade down’ the food basket (Seafish, 2015).

| |

| − | | |

| − | | |

| − | ====Consumer concerns====

| |

| − | | |

| − | A wide array of non-economic factors is also at play in determining the trends in food consumption. Increasingly, these relate to ‘intangible’ aspects of the product, such as ethical and sustainable sourcing.

| |

| − | | |

| − | =====Diet and health=====

| |

| − | | |

| − | As the populations of many industrialized countries are becoming older, richer, more educated and more health conscious, the demand for food that promotes health and well-being is growing (FAO, 2008). Seafood has often been promoted as a having a variety of positive health properties. Because of that, seafood, and especially oily fish, can also be seen as a functional food (Gormley, 2006), a fast growing market with high opportunities for innovation (Khan, Grigor, Winger, & Win, 2013). However, risks of eating fish linked to contamination with carcinogens has also been communicated to the public (Sidhu, 2003). As a result there is a general confusion over the right choice of seafood (Oken et al., 2012), the individual choice whether to consume fish or not being eventually dependent on the type and accuracy of information consumers are exposed to (Burger & Gochfeld, 2009).

| |

| − | | |

| − | | |

| − | =====Environmental concerns=====

| |

| − | | |

| − | Consumers, as well as major distributors, are increasingly concerned about the sustainability and risk of depletion of marine stocks. While the range of fish and seafood products labelled as sustainably sourced is expanding and the demand for sustainable seafood products is rising (Roheim, 2009), there is a debate whether this is due to genuine consumer demand or due to influences by NGOs and branding strategies by retailers (Gutierrez & Thornton, 2014). Gulbrandsen (2006) and Bush et al (2013) for example argue that most markets for eco-labelled forestry and fisheries products have been created as a result of pressure by environmental groups on consumer-facing corporations, rather than resulting from consumer demand. In any case, consumers have as a result an increasing abundance and diversity of certified seafood product to choose from. Increasingly, consumer behaviour is shaped by the growing popularity of sustainable seafood guides, such as Monterey Bay Aquarium’s Seafood Watch and MCS Good fish (Roheim, 2009). However, the availability of too much information from different sources, with sometimes conflicting advice can lead to consumer confusion and even negatively impact consumption (Oken et al., 2012; Roheim, 2009). The issue whether demand is genuinely ‘consumer driven’ or resulting from a ‘retailer push’ would remain nevertheless important to the performance of new seafood products on this market.

| |

| − | | |

| − | =====Production methods and safety=====

| |

| − | | |

| − | Consumers have become increasingly concerned about the ways in which food is produced, with ranging attitudes towards the use of certain new food technologies (Grunert et al., 1997). More stringent demands for assurance concerning safety is yet another high-profile issue that has emerged in recent years and shaping consumption patterns. As a result a variety of safety certifications have been developed which have become requirements by supermarket chains. European retailers for example increasingly expect supplies to comply with quality standards such as BRC and IFS, as well as traceability (CBI, 2015).

| |

| − | | |

| − | ====Societal change====

| |

| − | | |

| − | Significant increase in the demand for convenience food can be attributed to increased participation of women in the work force (Traill, 1997). Due to factors such as time pressure, there is a strong rise in the demand for products that are ready to eat or require little preparation before serving (Brunner, van der Horst, & Siegrist, 2010). And while fish has been widely considered inconvenient because of the time and skills required for preparation (Olsen, Scholderer, Brunsø, & Verbeke, 2007), the current wide availability and expanding market for value added convenience seafood sets a new norm of how fish is consumed (Olsen, 2004). For example, the development of vacuum packed, pre-cooked mussels with sauce has been highly successful on the UK market, driven by the convenience, longer shelf life and versatility. In 2008 the ratio of Scottish produced mussels going to fresh counter market and to value added market were 70% to 30% respectively with a combined value of £6 million while in 2015 the ratio was 25% to 75% respectively with combined value of £15 million (Cameron, 2015). The trend in expanding value added seafood markets presents a vast opportunity for innovation in the field, with particular reference to younger generations.

| |

| − | | |

| − | Further, according to Olsen (2003) frequency of seafood consumption is positively correlated with chronological age, mediated by attitudes toward eating seafood, health involvement and perceived convenience. Markets where population is aging, and the number of one-person single households is growing, such as the UK and other European countries, present an opportunity for innovation tailored to this particular consumer group.

| |

| − | | |

| − | ====Availability of food products====

| |

| − | | |

| − | The increase in the global supply of seafood over the last few decades, combined with technological innovations, has facilitated the international orientation of the seafood industry. In particular, progress in storage and preservation and improved logistics leading to lower costs have allowed international trade to grow (Asche, Bellemare, Roheim, Smith, & Tveteras, 2015). An increased range of raw material available to processors has stimulated experimentation with new species and served as a basis for a wide variety of seafood product innovations. Notable examples are pangasius, tilapia and shrimp.

| |

| − | | |

| − | ====Food retailing====

| |

| − | | |

| − | Food retailing in Europe has become concentrated in the hands of leading multiple retailers with inevitable impact on innovation not only for processors but throughout the value chain (Murray & Fofana, 2002). One of the most powerful tools of retailers exerting control on the value chain is their ‘private label’ products (Bunte et al., 2011). It is generally accepted that private labels utilize markets created by branded products, by ‘imitating’ successful products. Private label products require little advertising as they rely on the image of the store, thus they are well placed to compete on price with the highly advertised branded products, pushing leading manufacturers to innovate even faster. At the same time, ‘private labels’ provide an opportunity for small and medium scale enterprises to supply the market while avoiding the prohibitive costs of developing a recognised brand (Traill, 1997).

| |

| − | | |

| − | ===Factors for success in innovation===

| |

| − | | |

| − | A considerable amount of insight on the key success and failure factors in new product performance has been published in the late twentieth century. This has led to the generation of a plethora of factors deemed critical for successful innovation, often cited with contradictory outcomes (Balachandra & Friar, 1997; Grunert et al., 1997). The discrepancies could partly be explained by the lack of methodological standardisation in the study designs and definition of key variables, but also by the contextual differences. The vast majority of these studies focus on high-tech industries such as electronics, biotechnology, or pharmaceutical (Fortuin, Batterink, & Omta, 2007). The number of foodrelated studies on innovation is considerably smaller, while regarding seafood it is negligible. While drawing from a wider industrial base, the following synthesis will review the factors with higher relevance to the food industry, wherever possible illustrating with examples from the seafood sector.

| |

| − | | |

| − | ====Enabling environment====

| |

| − | | |

| − | Porter (1990) argues that government policies play a key role in determining the competitiveness of enterprises as they directly influence the factors responsible for competitive advantage, with inevitable influences on innovation potential. Indeed, as pointed by Lindkvist & Sánchez (2008), prohibitive regulations have had a negative impact on the innovative activities and overall competitiveness of the Norwegian salt fish producers on the Spanish market. In particular, laws not allowing the processors to own fishing vessels have resulted in a fragmentation of the value chain and low level of control over the quality and timing of raw material supply. This has been further exacerbated by prohibitions on the use of chemicals other than ascorbic salts in the process of salting fish, leading to products of perceived inferior quality compared to the phosphate and antioxidant treated Icelandic products.

| |

| − | | |

| − | ====At the company level====

| |

| − | | |

| − | =====Interaction with other companies=====

| |

| − | | |

| − | Innovation capabilities at the company level can be influenced by the existence of clusters of companies producing interrelated products and having high level of coordination between their activities, thus exploiting a larger pool of skills and enhancing their innovative power. The same advantages can be exploited in a network of companies, not necessarily physically clustered together (Grunert et al., 1997).

| |

| − | | |

| − | In a similar fashion, vertical cooperation can bring advantages to the innovative activities of the firm in the form of generation of market intelligence by sharing of information between downstream and upstream members, increasing the firm’s portfolio of competences and improving cross-functional communication.

| |

| − | | |

| − | However, it has been argued that the inflexibility created by committing to a few partners may act as an impediment to market intelligence generation and competence expansion. Similarly, increased levels of bureaucracy, especially in connection with large retail chains with emphasis on price instead of differentiation, may inhibit upstream innovation. In such cases, the choice of co-operation partners becomes a crucial issue.

| |

| − | | |

| − | In addition to regulations, a lack of cooperation in innovation and market development, due to mistrust and protection of self-interests, between producers of salt cod in Norway has been cited as a central factor for the loss of market share to Icelandic producers on the Spanish market (Lindkvist, 2010).

| |

| − | | |

| − | The role a company plays in the supply chain can directly influence its innovative potential. Harmsen & Traill (1997) show that the seafood company ‘Royal Greenland’ increased considerably its innovation activities when it expanded its customer base from food service to retail. Similarly, Christensen et al. (2011) find that firms delivering directly to end users were more likely to be innovative than those delivering to the processing or wholesale links of the value chain.

| |

| − | | |

| − | =====Size of company =====

| |

| − | | |

| − | Size of the company has been a central variable in much of the literature on innovation activity at the company level. The neo-Schumpeterian view maintains that large companies are more innovative than small companies, largely because of better resource base; human and financial (Grunert et al., 1997). In fact, previous research has shown that small firms face the liability of smallness (Aldrich and Auster, 1986; Freeman et al., 1983), that refers to the limited access to financial resources and competitive human capital. Such constrains might generate a limited market power and a small customer base (Carson, 1985), as the firms are unknown to their potential customers (Gaddefors and Anderson, 2008). Thus, these companies must devote several resources to building an identity, but the process is lengthy and costly (Gruber, 2004).

| |

| − | | |

| − | An alternative view, argues that SMEs tend to be market makers while large companies tend to be imitators, if the potential market volume allows large scale production. It has also been argued that SMEs are more prone to innovate because of organisational and behavioural characteristics allowing them to react to market changes more quickly e.g. little bureaucracy, high commitment and motivation by managers, higher exposure to competition, lower innovation costs, higher R&D efficiency. Similarly, it has been hypothesised that radical innovation is more typical of small and medium scale companies because it does not fit with the pragmatic philosophy of larger companies which are looking for a systematic innovation process. Nevertheless, according to Grunert et al. (1997), there is no consensus in the literature regarding the influence of firm size on its innovativeness.

| |

| − | | |

| − | =====Orientation of the company =====

| |

| − | | |

| − | Innovative activity can be seen as pertaining to a particular innovation or to the company in general. When it comes to particular innovations, it has the dimension of how new it is to the market and how new it is from a technological point of view. Innovation at the company level can be broken down to innovation speed, innovation willingness, innovation capacity and innovation quality (Grunert et al., 1997).

| |

| − | | |

| − | Earle (1997) argues that successful innovation is reliant on innovation-oriented company and positively reactive environment. It is the company’s strategic decision whether to pursue an innovation course or not. A firm may take either reactive or proactive approach in innovation to either avoid losing market share to an innovative competitor or to gain strategic market position relative to its competitors.

| |

| − | | |

| − | Depending on their involvement with innovation activities companies can be divided into innovative (or prospectors); improvers, getting involved once the initial products have been already developed;

| |

| − | | |

| − | ‘me too’ companies, copying what others have already introduced on the market; and ‘die hard’ ignoring innovation altogether (Earle, 1997; Fortuin et al., 2007). The spectrum can be illustrated again by Icelandic companies producing salt cod for the Spanish market at one end and their Norwegian counterparts at the other (Larsen, 2014; Lindkvist, 2010).

| |

| − | | |

| − | Grunert et al. (1997) presents a further nuanced picture of innovation at the company level by providing two different perspectives: the first linking innovation with technological change, the driving force of economic growth, which is linked to, and can be measured by, R&D activities. As such the food industry could be classified as a low-tech industry due to the small R&D to sales ratios typically reported. In this view innovation could be regarded as a ‘technology push’.

| |

| − | | |

| − | On the other hand, from a marketing perspective, innovation can also be viewed as an activity required for fulfilling the unfilled needs and wants of potential customers using the skills, competences and resources of the company, often referred to as ‘market-orientation’ of the company, or ‘demand pull’. This view maintains that R&D activities do not guarantee innovative success alone, but only in interaction with the needs in the market (Gupta, Raj, & Wilemon, 1986).

| |

| − | | |

| − | As seen before, the food industry is generally considered as one with a low R&D expenditure. Indeed, Harmsen, Grunert, & Declerck (2000) in a series of case studies from the food industry showed that R&D is of minor importance in the innovation process, but innovative activities are nevertheless carried out. This was supported by findings by Avermaete et al. (2004) from a study on small-scale food manufacturers and by Christensen, Dahl, Eliasen, Nielsen, & Østergaard (2011) from a wider sectorial analysis. This has led Harmsen et al. (2000) to revise the framework proposed by Grunert et al. (1997) by focusing greater attention on ‘market orientation’ and ‘competencies’ and their interaction as explanatory factors for success. In their revised framework, orientation was seen as relating to ‘product’, ‘process’ and ‘market’, rather than simply markets. Competencies of the firm relate to the types of orientation but all three types, albeit to different degrees, were required for successful innovation. In-house capabilities of the work force were found to be strong determinants of innovation, particularly in small food firms (Avermaete et al., 2004). That is where the culture of the company and its vision are critical to successful innovation. It has been suggested than unconventional individuals rather than conventional science or engineering are central to innovation success. However, without entrepreneurial spirit and openness, new ideas by such individuals can be dismissed.

| |

| − | | |

| − | ====At the project level====

| |

| − | | |

| − | There is a great number of studies identifying performance factors and Ernst (2002) provides an extensive review of the topic. Here we focus on some of the most often cited groups of factors, particularly as they relate to the food industry and over which there seems to be some level of consensus.

| |

| − | | |

| − | Among others, the success and failure of new food products has been related to the process of new product development (Stewart-Knox & Mitchell, 2003). The process comprises five to eight steps spanning from idea generation to launch activities, going through screening, research, development and testing. The sequence in which those activities are undertaken has been linked to success in the past. For example (Cooper & Kleinschmidt, 1987) argue that companies which taking a stepwise approach were more successful. However, in later publications the same authors show that concurrent, overlapping, flexible approach has better potential than a simplistic stepwise model (Cooper & Kleinschmidt, 2007). The common ground is the requirement for repeated evaluation throughout the process.

| |

| − | | |

| − | Market and consumer knowledge and retailer involvement in the process of new food product development has also been highlighted as a factors critical for success (Kristensen, Ostergaard, & Juhl, 1998; Stewart-Knox & Mitchell, 2003). Similarly, the involvement (as well as its intensity and quality), of the final consumer during the process of product development has been claimed to have positive impact on the outcome of innovation (Gruner & Homburg, 2000). Hoban (1998) has shown that new product developers in the USA rely heavily on retailer customers for market information, and few draw on other sources of information, consequently the retailer involvement has become increasingly important but does not guarantee success. The importance of gathering of information from a variety of independent sources, including retailers, suppliers, research centres, consumers, prior to the development of new products has been emphasized as a unique to the food industry (Stewart-Knox & Mitchell, 2003). Similarly, in a number of publications Cooper emphasizes the importance of market research up-front of the initiation of the process of product development (G. R. Cooper & Cooper, 1994; R. G. Cooper, 1999; R. Cooper, 1996). However, McGinnis & Ackelsberg (1983) note that market analysis can limit the innovators to existing markets with small incremental innovations rather than direct them to undeveloped markets with major innovations. Therefore, a careful balance must be maintained between market analysis and thinking ‘out of the box’ (Balachandra & Friar, 1997). Furthermore, good market analysis is dependent on the quality of data, but as the same authors have pointed out, analysing customer needs may not yield accurate information as the needs may not be known by the customers themselves. In an earlier paper (Balachandra, 1984) suggests the need for an existence of a strong market, instead of a potential market, as the difficulties associated with consumer research can be thus avoided.

| |

| − | | |

| − | Most prospector organise the innovation processes, including new product development, in projects where different functional areas of the firm are represented in cross-functional teams co-operating throughout the process (Fortuin et al., 2007). As Robert G Cooper (1999) points out important decisions as to whether to initiate a project, terminate or redirect it are rarely based on a systematic analysis of the factors determining success or failure, but rather on the experience of the team.

| |

| − | | |

| − | Overall, factors linked to product development strategy, indicate the need for a purposeful and goaloriented approach to product development and balanced technological and market-related aspects, as well as a synergy with existing activities (Earle, 1997).

| |

| − | | |

| − | Although often pointed out as a critical factor for success in wider industrial innovation (Ernst, 2002), involvement of senior management throughout the process of food product development has not been consistently shown to be critical for success (Stewart-Knox & Mitchell, 2003), perhaps in part due to the variety of sizes of companies investigated in different studies and the different roles senior management play in them. In an UK study (Stewart-Knox, Parr, Bunting, & Mitchell, 2003), involvement of senior management seemed to be unrelated, while in Denmark (Kristensen et al., 1998) it was found to be a determinant for success.

| |

| − | | |

| − | Similarly, the rate of new product introduction has also been shown to drive success in opposing directions. Higher rate of introduction implies the growth stage of a product, therefore a higher chance of success, but at the same time greater intensity of competition – a negative factor for commercial success (Balachandra & Friar, 1997).

| |

| − | | |

| − | Generally, original products seem to be more successful than adapted products, because food products market can become quickly overcrowded, although that may be context specific (StewartKnox & Mitchell, 2003). And despite that the failure rate for truly new food products has been shown to be as low as only 25% (Hoban, 1998), only a small proportion of new food products are truly novel (Rudolph, 1995).This may be due to a fear of failure of a new product and taking the ‘safe’ approach of redeveloping old products, which however, only perpetuates the problem of high rate of product failure.

| |

| − | | |

| − | | |

| − | | |

| − | == Reports & Data ==

| |

| − | | |

| − | ----

| |

| − | | |

| − | | |

| − | | |

| − | == Tool Overview ==

| |

| − | | |

| − | ----

| |

| − | | |

| − | == References & Readings == | |

| − | | |

| − | ----

| |

Prime DSS has been designed to help fishing sector stakeholders to improve their competitiveness in the Fisheries and Aquaculture markets. One core component of identifying areas of competitive improvement involves the collection and dissemination of data revealed in success and failure stories. These stories include information collected on innovative product development and consumer behavior to understand which product attributes best fit customer preferences and therefore improve the possibility of a successful product launch.

All fishing sector stakeholders are invited to share their stories about success and failure experiences when launching innovative products onto the market place. Over time, sector users will have access to a wealth of information that will provide invaluable insights into consumer behaviour and reactions to specific product attributes that will assist with launching successful products. The Success & Failure stories tool is a collections of the stories shared among stakeholders.

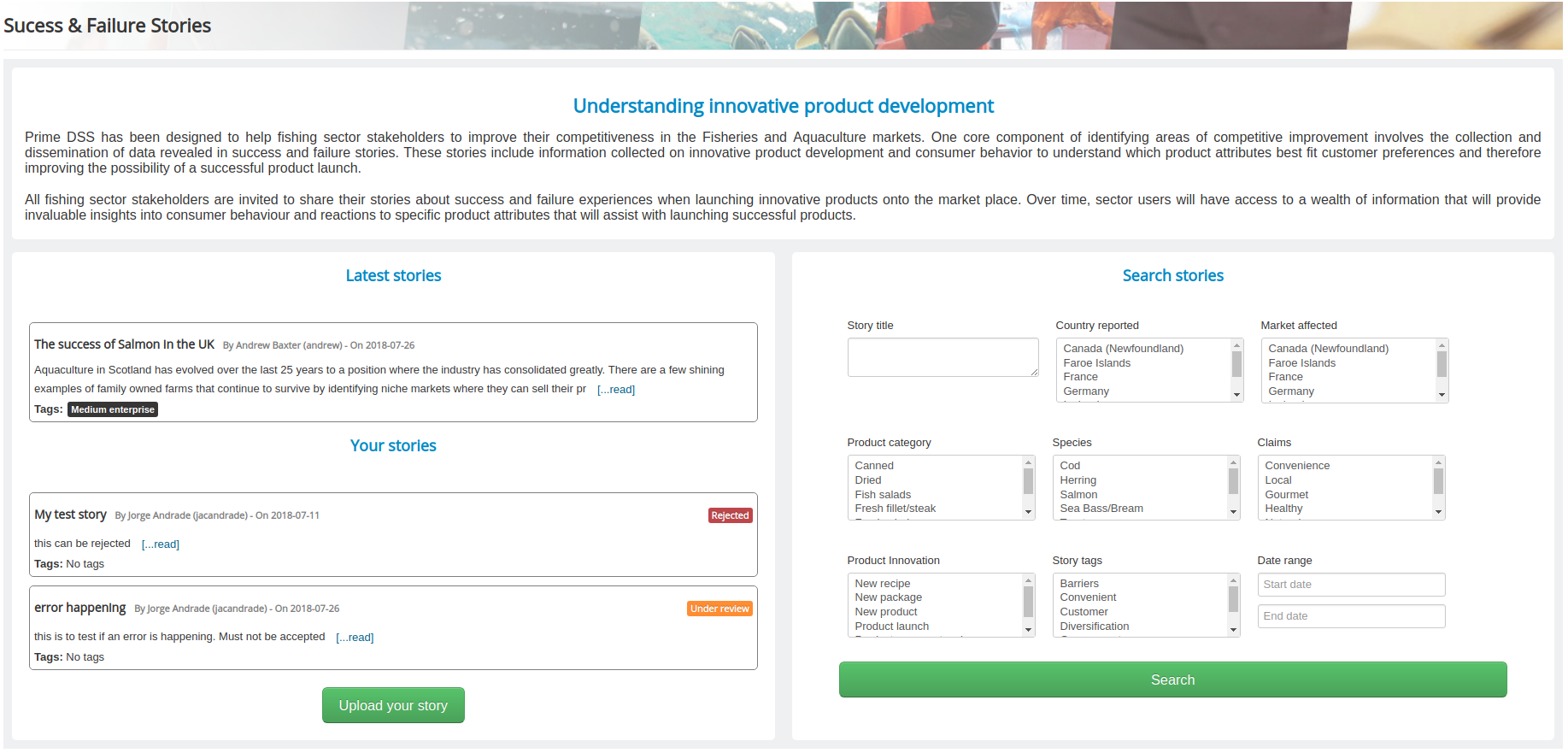

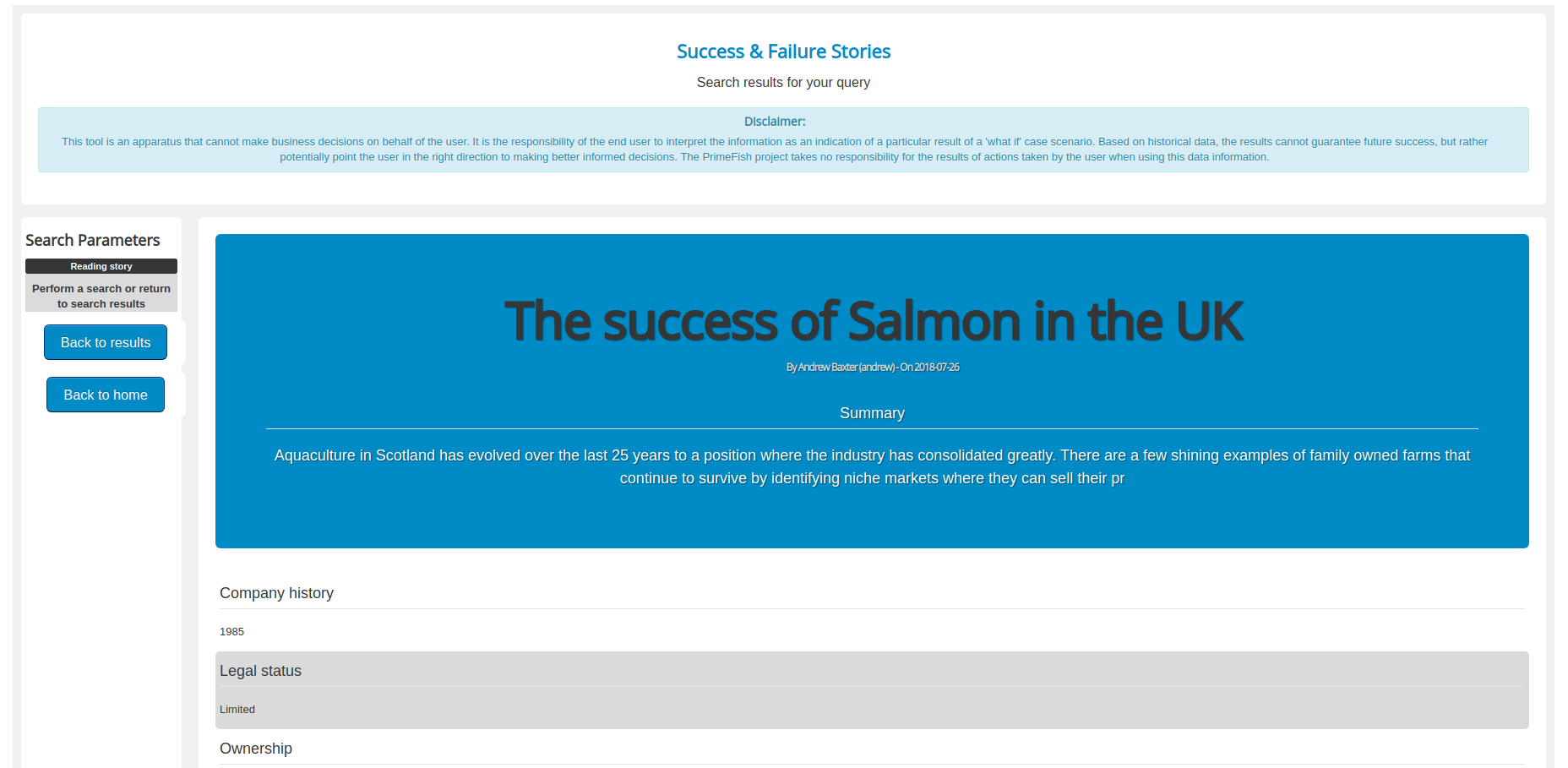

In the landing page the user will be able to see the latest approved stories on the left, and also a list of stories uploaded by the user with their current status. The user can click the upload story button to open a modal where the story details can be entered and submitted for upload. Uploaded stories will then go through a review process by the DSS administrators and will either be approved or rejected by the administrators.

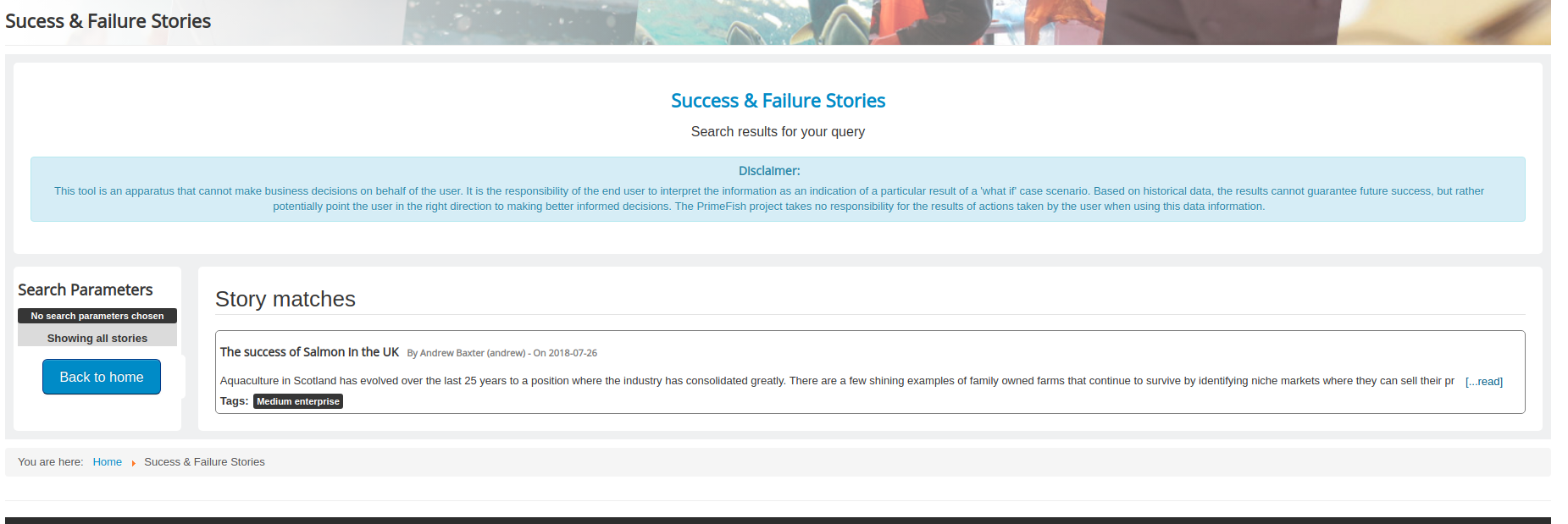

The user can also use the search form to search for specific stories containing desired attributes and click the search button to see if any stories match their query. If no parameters are selected, all stories will be displayed.