Difference between revisions of "Deliverable 3.4"

m (Minor formatting) |

m (Minor formatting) |

||

| (33 intermediate revisions by the same user not shown) | |||

| Line 41: | Line 41: | ||

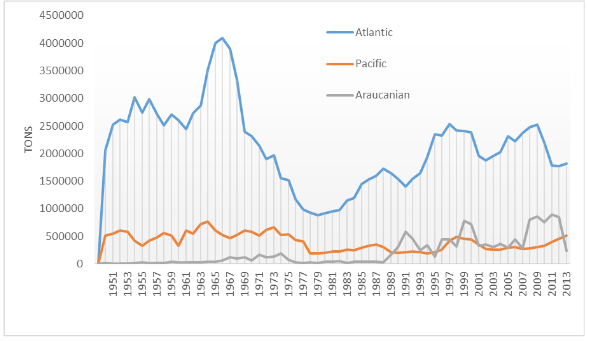

Cod importance has dwindled, but it is still of major importance to Iceland and Norway and growing importance in Newfoundland and therefore it is important to look at industry and market dynamics, opportunities and threats in the value chain of cod for these countries. | Cod importance has dwindled, but it is still of major importance to Iceland and Norway and growing importance in Newfoundland and therefore it is important to look at industry and market dynamics, opportunities and threats in the value chain of cod for these countries. | ||

| + | |||

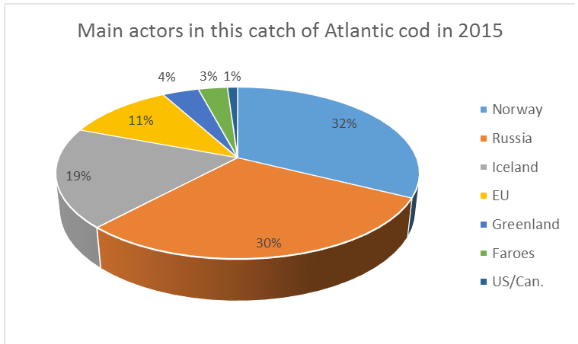

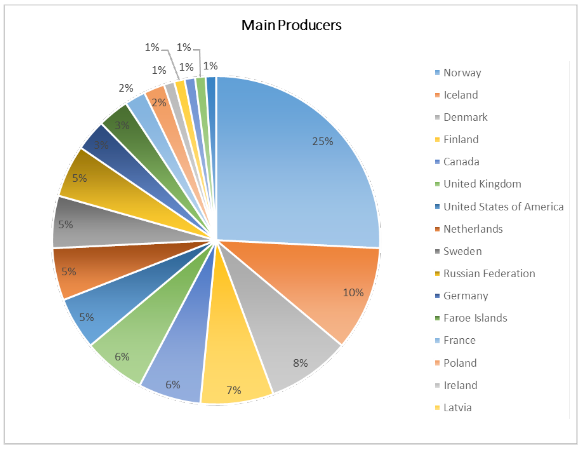

==== Main producers ==== | ==== Main producers ==== | ||

| Line 52: | Line 53: | ||

[[File:D34 fig 2.png|center|Figure 2]] ''Figure 2. Supply of Atlantic cod from the North Atlantic waters, by country, 1000 tonnes, 2000–2018. Source: FAO and (*) Groundfish Forum'' | [[File:D34 fig 2.png|center|Figure 2]] ''Figure 2. Supply of Atlantic cod from the North Atlantic waters, by country, 1000 tonnes, 2000–2018. Source: FAO and (*) Groundfish Forum'' | ||

| − | + | | |

| + | |||

| + | Figure 2 shows a relatively stable distribution of cod catches until the increase in the quotas for Northeast Atlantic cod about 2009, where Norway and Russia increased their share. Moreover, it shows that the catch of US/CAN fell until the end of this period, when it rose again, and that Greenland catches have increased over the period. As can been seen in Figure 2, The International Council for the Exploration of the Sea (ICES) has recommended a 20 percent cut in the Barents Sea cod quota for 2018. However, the Joint Russian Federation- Norwegian Fisheries Commission in October 2017 agreed on the 2018 quotas, which include a 13 percent cut in the Barents Sea cod quota to 775.000 tonnes (FAO). | ||

==== Main markets ==== | ==== Main markets ==== | ||

| Line 92: | Line 95: | ||

*Regional distribution safeguarded by fleet composition, and limited transferability between regions for some licenses/participation rights. | *Regional distribution safeguarded by fleet composition, and limited transferability between regions for some licenses/participation rights. | ||

*Quota year is the same as the almanac year. | *Quota year is the same as the almanac year. | ||

| + | |||

===== Iceland ===== | ===== Iceland ===== | ||

| Line 97: | Line 101: | ||

The ownership of quotas involves the right to catch the fish but does not entail ownership of the fish stock. Thus, it is claimed that the quota does not mean the ownership of the fish but rather the right to catch the fish. Since 2001 small boats has been allocated TAC (Total allowable catches) and all effort based system abolished until 2009 when coastal fisheries was introduced. As can be seen in figure the share of small boats of the TAC was 14.2% in 1992 and is 22.3% in 2016. It peaked in 2001 when it was 24.1% of the TAC in cod. Part of this increase can be explained with changes in classification of small boats as in 2013 when small boat definition went from 15 gross registered tonnes (GRT) to 30 GRT. | The ownership of quotas involves the right to catch the fish but does not entail ownership of the fish stock. Thus, it is claimed that the quota does not mean the ownership of the fish but rather the right to catch the fish. Since 2001 small boats has been allocated TAC (Total allowable catches) and all effort based system abolished until 2009 when coastal fisheries was introduced. As can be seen in figure the share of small boats of the TAC was 14.2% in 1992 and is 22.3% in 2016. It peaked in 2001 when it was 24.1% of the TAC in cod. Part of this increase can be explained with changes in classification of small boats as in 2013 when small boat definition went from 15 gross registered tonnes (GRT) to 30 GRT. | ||

| − | *The emphasis of the fisheries management system since 2001 has been to simplify the system and bring all into the quota | + | *The emphasis of the fisheries management system since 2001 has been to simplify the system and bring all into the quota system of ITQ and TAC system. Against this, open access fishing was introduced in 2009 when new system was introduced for small boat called costal fishing (isl. strandveiði). |

| − | + | *By the 1990 Act the fishing year was set from 1. September to 31. August in the following year but previously it had been based on the calendar year. This was an effort to channel fishing of the groundfish stocks away from the summer months, when quality suffers more quickly and many regular factory workers are on vacation. | |

| − | system of ITQ and TAC system. Against this, open access fishing was introduced in 2009 when new system was introduced for small boat called costal fishing (isl. strandveiði). | ||

| − | |||

| − | *By the 1990 Act the fishing year was set from 1. September to 31. August in the following year but previously | ||

| − | |||

| − | it had been based on the calendar year. This was an effort to channel fishing of the groundfish stocks away from the summer months, when quality suffers more quickly and many regular factory workers are on vacation. | ||

===== Newfoundland ===== | ===== Newfoundland ===== | ||

| Line 124: | Line 123: | ||

==== Entry barriers into the system: ==== | ==== Entry barriers into the system: ==== | ||

| + | |||

===== Norway ===== | ===== Norway ===== | ||

| Line 129: | Line 129: | ||

The activity demand in the Participation Act states that in order to own a fishing vessel one have to be an active fisher. | The activity demand in the Participation Act states that in order to own a fishing vessel one have to be an active fisher. | ||

| − | *Many exceptions have been granted. Firstly, on the same footing as active fishers are administrative fishing vessel | + | *Many exceptions have been granted. Firstly, on the same footing as active fishers are administrative fishing vessel owners – caretaking the daily operation of vessels from land. Also, as the filleting industry in the north of Norway was built up and prioritised as whole year employers, many filleting firms were granted cod trawl licenses, which today are held by two big processing concerns (Lerøy and Nergård) |

| − | |||

| − | owners – caretaking the daily operation of vessels from land. Also, as the filleting industry in the north of Norway was built up and prioritised as whole year employers, many filleting firms were granted cod trawl licenses, which today are held by two big processing concerns (Lerøy and Nergård) | ||

| − | |||

*To become a registered fisher, you have to live in Norway and work on a registered Norwegian fishing vessel | *To become a registered fisher, you have to live in Norway and work on a registered Norwegian fishing vessel | ||

*To get a vessel registered a as a fishing vessels, demands have to be met regarding size class and operating areas. | *To get a vessel registered a as a fishing vessels, demands have to be met regarding size class and operating areas. | ||

Like in other western society fisheries, the closure of the commons have increased the capital intensity, and labour is to a large degree substituted by capital intensive production equipment. Foreigners can buy vessels below 15 meters in Norway and control no more than 40 per cent for boats above 15 metres. Processing industry - no nationality limitations exists | Like in other western society fisheries, the closure of the commons have increased the capital intensity, and labour is to a large degree substituted by capital intensive production equipment. Foreigners can buy vessels below 15 meters in Norway and control no more than 40 per cent for boats above 15 metres. Processing industry - no nationality limitations exists | ||

| + | |||

===== Iceland ===== | ===== Iceland ===== | ||

| Line 148: | Line 146: | ||

*Open access | *Open access | ||

*Low profitability (returning loss for all years of operation) | *Low profitability (returning loss for all years of operation) | ||

| − | *Coastal fishing is limited to small boats with maximum two handlines per person and | + | *Coastal fishing is limited to small boats with maximum two handlines per person and maximum two person on the boat. The maximum 650 kg catch per day and fishing is limited to four days a week. |

| − | + | *There are also limits of TAC for each area for the small boats. | |

| − | maximum two person on the boat. The maximum 650 kg catch per day and fishing is limited to four days a week. | ||

| − | |||

| − | *There are also limits of TAC for each area for the small | ||

| − | |||

| − | boats. | ||

| | ||

| Line 196: | Line 189: | ||

==== Quota ownership and quota prices ==== | ==== Quota ownership and quota prices ==== | ||

| + | |||

===== Norway ===== | ===== Norway ===== | ||

| Line 201: | Line 195: | ||

There is in Norway a consolidation limit for cod for both conventional off-shore vessels (auto-liners) and cod trawlers, but not for coastal vessels. | There is in Norway a consolidation limit for cod for both conventional off-shore vessels (auto-liners) and cod trawlers, but not for coastal vessels. | ||

| − | *Firms owning conventional off-shore vessels cannot, directly or indirectly, own vessels that | + | *Firms owning conventional off-shore vessels cannot, directly or indirectly, own vessels that control more than 15 per cent of the group quota for any of the species included. |

| − | + | *For cod trawler, firms cannot control more vessels exceeding more than the number that controls 12 quota factors. With today’s quota ceiling (maximum four quota factors per vessel), it means 3 full structured vessels and about 13 per cent of the group quota for cod trawlers. | |

| − | control more than 15 per cent of the group quota for any of the species included. | + | *However, there are specific rules for ship owners that also own processing facilities, which is the reason that the two before mentioned cod trawler ship owners have more vessels than the limit of the Act. Quotas can be transferred among vessels in a vessel owning company, but only upon authorities’ approval. Also, other eases of transferability exist (renting quotas, ship wrecking, replacement permit – in awaiting of new vessel, and others) A quota flexibility between years is also possible, but within the cod fishery, this is only possible on group level – not for individual vessels. An overfishing of the vessel groups’ cod quota one year will be claimed against next year’s quota, and vice versa if the full quota is not taken. For the vessel groups with a limited number of vessels, this individual vessel quota flexibility between years will be effectuated over the turn of the year from 2017 to 2018. Coastal vessels will have to wait longer until this can be effectuated, since so many extraordinary schemes exists for these vessels Quotas within Norwegian fisheries are transferable, but there exists no central brokerage system where quota prices are noted. |

| − | |||

| − | *For cod trawler, firms cannot control more vessels exceeding more than the number that | ||

| − | |||

| − | controls 12 quota factors. With today’s quota ceiling (maximum four quota factors per vessel), it means 3 full structured vessels and about 13 per cent of the group quota for cod trawlers. | ||

| − | |||

| − | *However, there are specific rules for ship owners that also own | ||

| − | |||

| − | processing facilities, which is the reason that the two before mentioned cod trawler ship owners have more vessels than the limit of the Act. Quotas can be transferred among vessels in a vessel owning company, but only upon authorities’ approval. Also, other eases of transferability exist (renting quotas, ship wrecking, replacement permit – in awaiting of new vessel, and others) A quota flexibility between years is also possible, but within the cod fishery, this is only possible on group level – not for individual vessels. An overfishing of the vessel groups’ cod quota one year will be claimed against next year’s quota, and vice versa if the full quota is not taken. For the vessel groups with a limited number of vessels, this individual vessel quota flexibility between years will be effectuated over the turn of the year from 2017 to 2018. Coastal vessels will have to wait longer until this can be effectuated, since so many extraordinary schemes exists for these vessels Quotas within Norwegian fisheries are transferable, but there exists no central brokerage system where quota prices are noted. | ||

===== Iceland ===== | ===== Iceland ===== | ||

| Line 270: | Line 256: | ||

| | ||

| + | |||

===== Iceland ===== | ===== Iceland ===== | ||

| Line 291: | Line 278: | ||

'''Closures''' | '''Closures''' | ||

| − | *Marine Institute has licences to introduce closures fishing areas if for example share of small fish | + | *Marine Institute has licences to introduce closures fishing areas if for example share of small fish is too high according to landing or historical landing data Discard ban |

| − | |||

| − | is too high according to landing or historical landing data Discard ban | ||

| − | |||

*There are measurement’s in place to avoid discard | *There are measurement’s in place to avoid discard | ||

*Limited withdraw on unwanted catch form TAC | *Limited withdraw on unwanted catch form TAC | ||

| − | *Up to 5% of fish that is damage can be landed as VS fish special weighted and not withdraw from TAC | + | *Up to 5% of fish that is damage can be landed as VS fish special weighted and not withdraw from TAC |

===== Newfoundland ===== | ===== Newfoundland ===== | ||

| Line 318: | Line 302: | ||

=== Market approach === | === Market approach === | ||

| + | |||

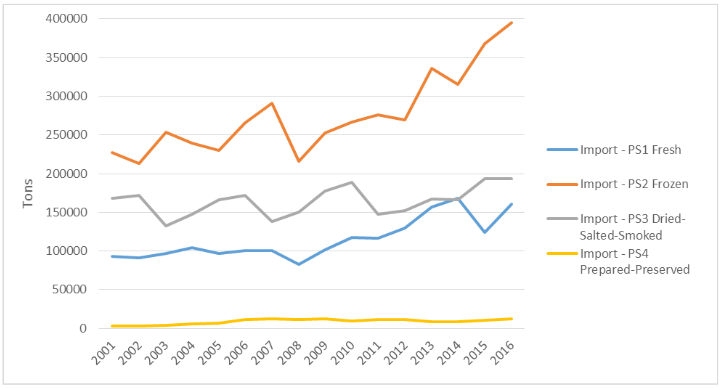

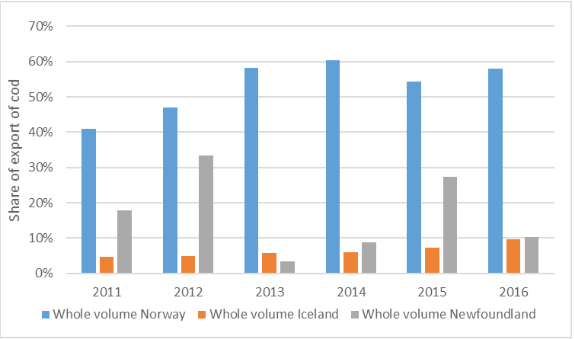

==== Differences in exports ==== | ==== Differences in exports ==== | ||

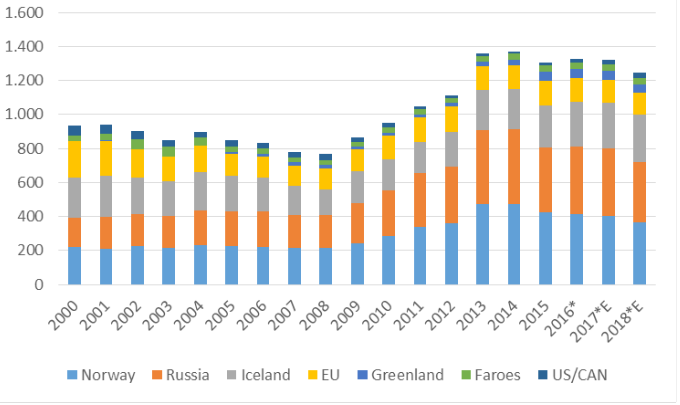

| Line 325: | Line 310: | ||

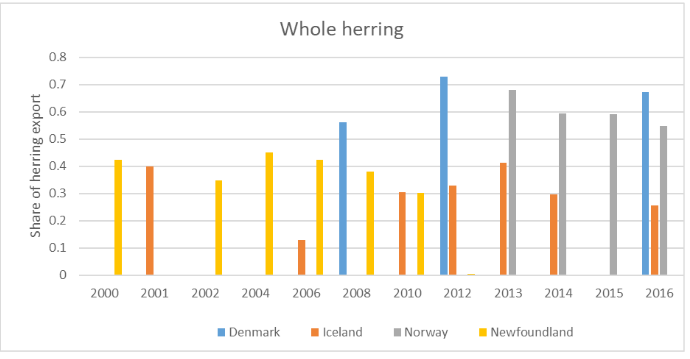

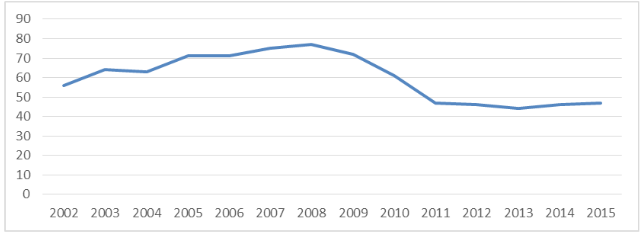

[[File:D34 fig 4.png|center|Figure 4]] ''Figure 4. Export of whole unprocessed fish from Norway and Iceland as share of total exports.'' | [[File:D34 fig 4.png|center|Figure 4]] ''Figure 4. Export of whole unprocessed fish from Norway and Iceland as share of total exports.'' | ||

| − | *Export of whole fish from Norway has rather been increasing in the recent | + | *Export of whole fish from Norway has rather been increasing in the recent years. Part of that could be the increase in catch in Norway or from around 215.000 thousand tons in 2008 to 422 thousand tons in 2015. This export is both frozen H/G (headed and gutted) and fresh. |

| − | + | *Norwegian have focused a lot the last year of marketing their H/G fresh fish as Skrei where they select the best fish for export under the brand name Skrei and receive premium for that export. | |

| − | years. Part of that could be the increase in catch in Norway or from around 215.000 thousand tons in 2008 to 422 thousand tons in 2015. This export is both frozen H/G (headed and gutted) and fresh. | + | *Export from Iceland has been increasing slightly and is mainly fresh with head on and is up to 9.7% in 2016 from 4.1% in 2011. |

| − | + | *Newfoundland export of whole fish fluctuates a lot between years; somewhat determined by the fluctuating TAC and weekly allocation/permissible catch rates. Another way to look at the processing stage of the value chain is to look at the share of fillets in the export from those countries. In figure 3, all fillets export is summarized. This takes into account whole fillets, fillets portions and fillets from different processing; fresh, frozen and dried. | |

| − | *Norwegian have focused a lot the last year of marketing their H/G fresh | ||

| − | |||

| − | fish as Skrei where they select the best fish for export under the brand name Skrei and receive premium for that export. | ||

| − | |||

| − | *Export from Iceland has been increasing slightly and is mainly fresh with | ||

| − | |||

| − | head on and is up to 9.7% in 2016 from 4.1% in 2011. | ||

| − | |||

| − | *Newfoundland export of whole fish fluctuates a lot between years; | ||

| − | |||

| − | somewhat determined by the fluctuating TAC and weekly allocation/permissible catch rates. Another way to look at the processing stage of the value chain is to look at the share of fillets in the export from those countries. In figure 3, all fillets export is summarized. This takes into account whole fillets, fillets portions and fillets from different processing; fresh, frozen and dried. | ||

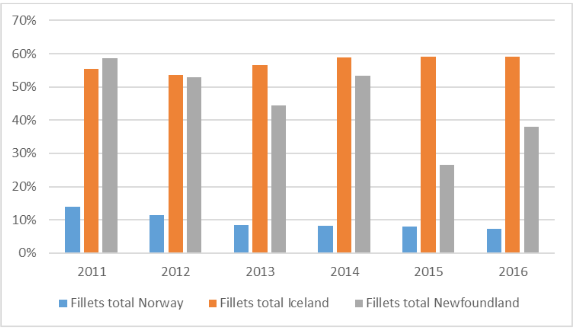

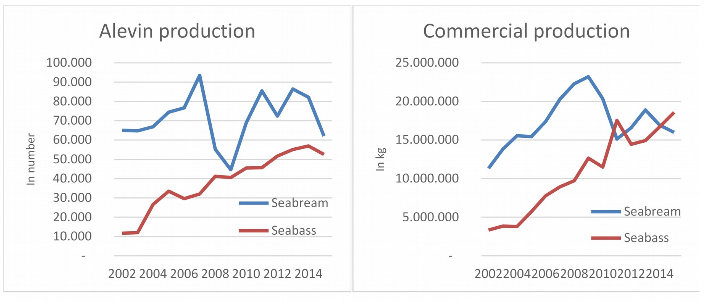

[[File:D34 fig 5.png|center|Figure 5]] ''Figure 5. Total share of volume of fillets in export from Norway, Iceland and Newfoundland.'' | [[File:D34 fig 5.png|center|Figure 5]] ''Figure 5. Total share of volume of fillets in export from Norway, Iceland and Newfoundland.'' | ||

| − | *Fillets production is very limited in Norway and accounts for less than 10% | + | *Fillets production is very limited in Norway and accounts for less than 10% of the export in 2016 and the share has been decreasing. The fillets production is mainly frozen in Norway. |

| − | + | *Iceland Fillet production is stable from around 55% to almost 60% of the total export. The 12.1 % of the export are fresh fillets or fillet parts, 21% is frozen and 10.3% are salted both frozen lightly salted and as salted fillets. | |

| − | of the export in 2016 and the share has been decreasing. The fillets production is mainly frozen in Norway. | ||

| − | |||

| − | *Iceland Fillet production is stable from around 55% to almost 60% of the | ||

| − | |||

| − | total export. The 12.1 % of the export are fresh fillets or fillet parts, 21% is frozen and 10.3% are salted both frozen lightly salted and as salted fillets. | ||

| − | |||

*Newfoundland export of fillets fluctuates between years. | *Newfoundland export of fillets fluctuates between years. | ||

| Line 359: | Line 327: | ||

| | ||

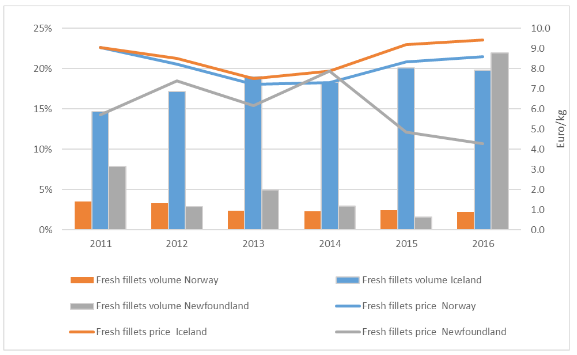

| − | *The volume of fresh fillets as a share of the total export in Norway has | + | *The volume of fresh fillets as a share of the total export in Norway has been decreasing in share although the real quantity has not been reduced as the share as quantity of landed cod has increased considerable in this period. It is interesting that the price per kg of exported fillets are lower than for Icelandic fillets, which could suggest more export of whole fillets instead of fillet portions (loin cut) export from Iceland or lower price in the market. |

| + | *The export of fresh fillets has been increasing it share in Iceland as well as price per kg which can mainly be traced to higher degree of portioning in Iceland today due to water jet cutting in the processing part of the value chain. | ||

| + | *The share of fresh fillets in Newfoundland was decreasing from 2011 when it was 10.1% to 2015 when it was 1.5%. Then in 2016 it was up to 22% of the total export. Price of the export is in most cases (except 2014) much lower than fresh fillets from Norway and Iceland. | ||

| − | + | [[File:D34 fig 7.png|center|Figure 7]] ''Figure 7. Share of export for frozen fillets by volume and average export price.'' | |

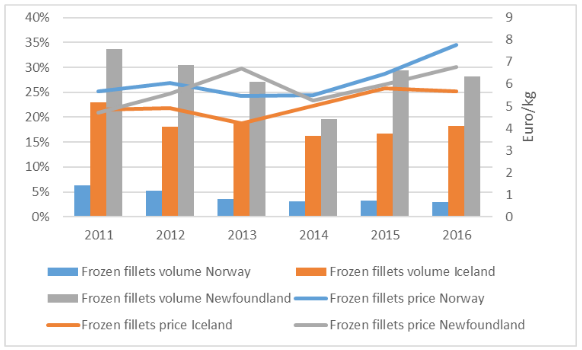

| − | *The export of fresh | + | *The share of the Norwegian frozen fillets export is decreasing or from around 6% in 2011 to 2.9% in 2016. What is interesting is that the Norwegian receive higher price per kg of fillet than Iceland. One reason for this could the focus of fresh fillet portions (loin cut) in Iceland leaving the tail and belly flap behind less valuable part of the fillet. |

| + | *Newfoundland have just under 30% of their export in frozen fillet and the price is in between Iceland and Norway except for 2013 when they receive the highest price of the three nations. The traditional markets of cod from all the three countries is the salted fish markets mainly in the Mediterranean countries. | ||

| − | + | [[File:D34 fig 8.png|center|Figure 8]] ''Figure 8. Total share of volume of salted fish in export from Norway, Iceland and Newfoundland'' | |

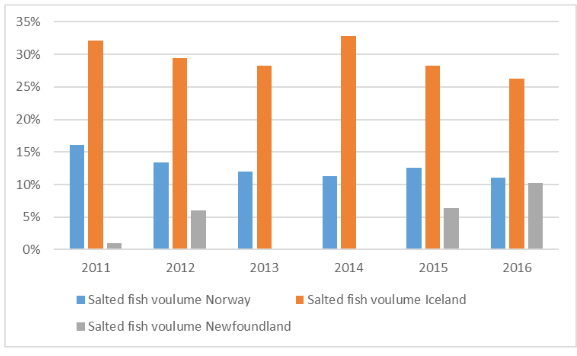

| − | *The share of | + | *Salt fish export form Iceland is divided between fillets and split fish. The share of export of split fish has been decreasing and the share of fillets increasing. |

| + | *The Norwegian export is mainly spited fish or clipfish dried salted that is counted as dried fish. | ||

| + | *The NL export consists of cod fillets dried and salted in brine (with/out smoking) and wet salted | ||

| − | + | The export of dried fish is also important for Norway and Iceland but not for the Newfoundland cod. The total share of salted and/or dried fish for NL has decreased over time. Between the years 2005-2010, NL salt fish exports ranged from 8-37% of total exports. This decreased from 2011-2016 where exports varied from 0% to 8.5% | |

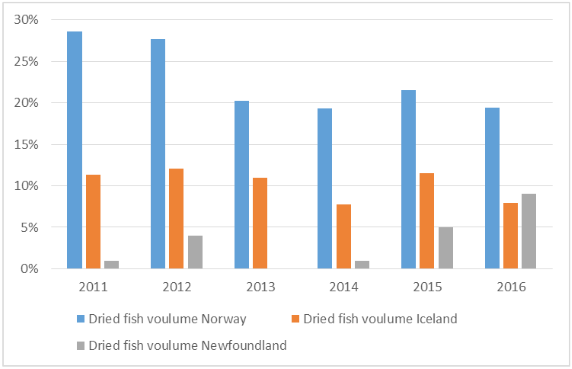

| − | [[File:D34 fig | + | [[File:D34 fig 9.png|center|Figure 9]] ''Figure 9. Total share of volume of dried fish in export from Norway and Iceland'' |

| − | *The | + | *The export of dried fish from Iceland is mostly dried head and frames. |

| − | + | *The Norwegian export is stock fish. The main markets is Italy, which Norwegian have overtaken almost completely. | |

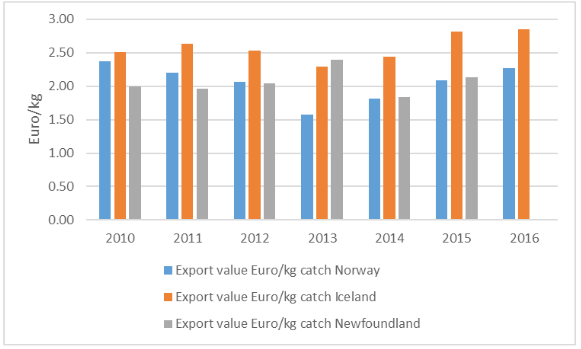

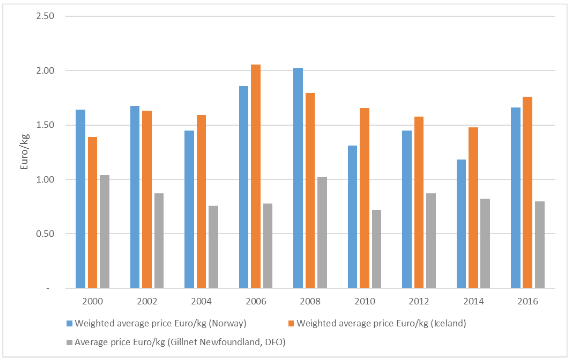

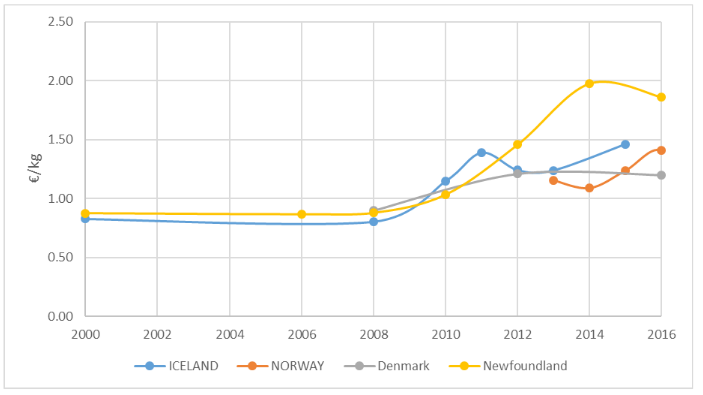

| − | + | To summarise the marketing and production part together, it is interesting to look at how much value each of the value chains are returning for per kilo of cod. From Figure 10 it can been seen that from 2010, Iceland has in most cases been returning highest value per kg of cod. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | To summarise the marketing and production part together, it is interesting to look at how much value each of the value chains are returning for per kilo of cod. From Figure 10 it can been seen that from 2010, Iceland has in most cases been returning highest value per kg of cod. | ||

[[File:D34 fig 10.png|center|Figure 10]] ''Figure 10 Total value of export per kg of cod landed'' | [[File:D34 fig 10.png|center|Figure 10]] ''Figure 10 Total value of export per kg of cod landed'' | ||

| − | *This method of calculating value creation does not take into account stock | + | *This method of calculating value creation does not take into account stock in the beginning of the year or at the end of the year. So that could affect the numbers especially in Newfoundland that focuses on frozen products. |

| − | |||

| − | in the beginning of the year or at the end of the year. So that could affect the numbers especially in Newfoundland that focuses on frozen products. | ||

==== Summary of main influencing factors regarding market approach ==== | ==== Summary of main influencing factors regarding market approach ==== | ||

| Line 454: | Line 397: | ||

=== Processing === | === Processing === | ||

| + | |||

==== Profitability and performance ==== | ==== Profitability and performance ==== | ||

| Line 467: | Line 411: | ||

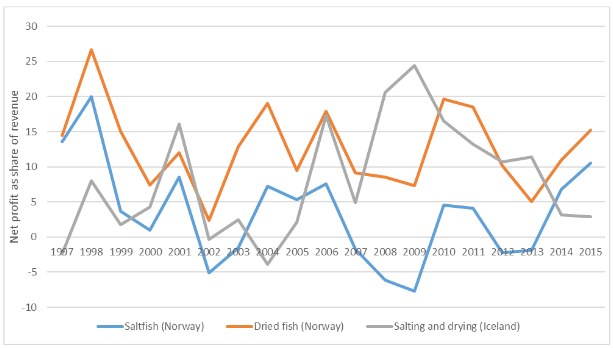

Main issues: | Main issues: | ||

| − | *The best profit in Norway is in dried stockfish and clipfish, that is dried | + | *The best profit in Norway is in dried stockfish and clipfish, that is dried salted fish. Salting and drying in Iceland is mainly salt fish. Light salted and even light salted and frozen. Profitability is much higher than in salted production in Norway, where production is mainly traditionally salted fish. |

| − | + | *Stockfish production in Norway is returning healthy EBIT for most year. The stockfish production is aimed for high end niche markets in Italy and lower value markets in Nigeria. | |

| − | salted fish. Salting and drying in Iceland is mainly salt fish. Light salted and even light salted and frozen. Profitability is much higher than in salted production in Norway, where production is mainly traditionally salted fish. | + | *Drying of whole fish is very limited, the main product of the drying sector in Iceland are heads and bone frames. |

| − | |||

| − | *Stockfish production in Norway is returning healthy EBIT for most year. The | ||

| − | |||

| − | stockfish production is aimed for high end niche markets in Italy and lower value markets in Nigeria. | ||

| − | |||

| − | *Drying of whole fish is very limited, the main product of the drying sector | ||

| − | |||

| − | in Iceland are heads and bone frames. | ||

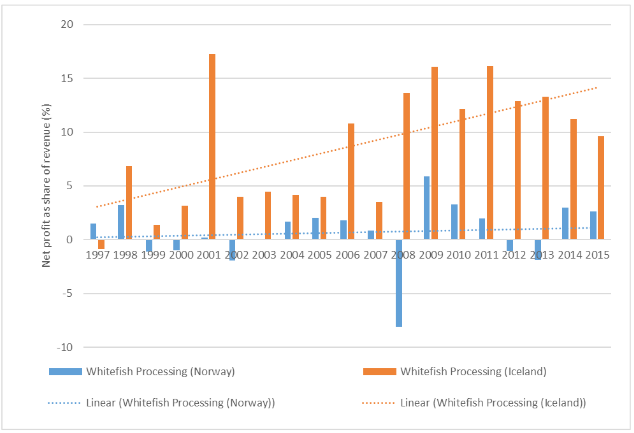

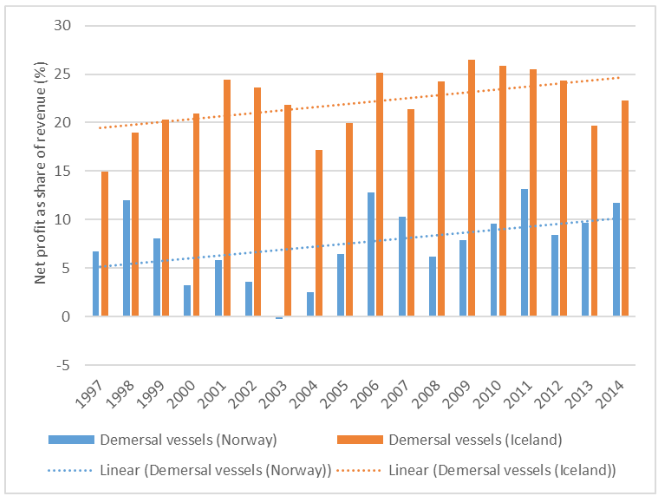

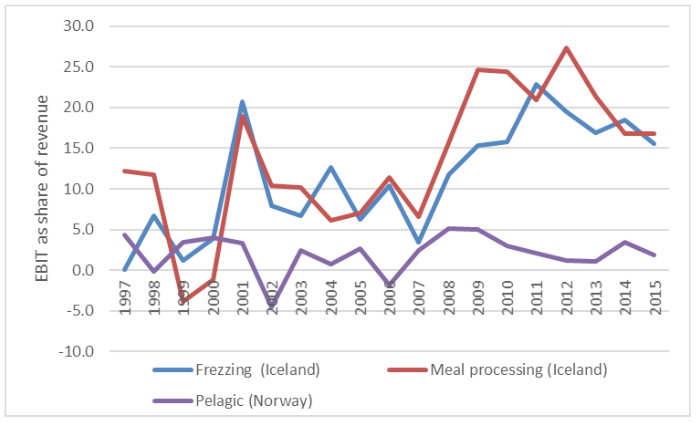

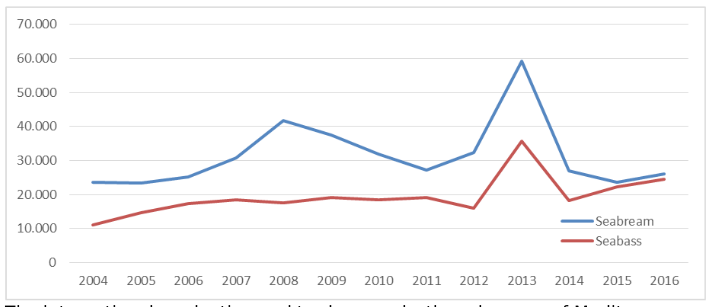

[[File:D34 fig 13.png|center|Figure 13]] ''Figure 13. Net profit as share of revenue in filleting processing in Norway and frozen production in Iceland 1997-2015'' | [[File:D34 fig 13.png|center|Figure 13]] ''Figure 13. Net profit as share of revenue in filleting processing in Norway and frozen production in Iceland 1997-2015'' | ||

| − | *Compering export and profitability on fillets production it is possible to | + | *Compering export and profitability on fillets production it is possible to compare the frozen production in Iceland with the filleting production in Norway. The frozen products from Iceland are mainly fillets or fillets portions. It is obvious that there is great difference in profitability although the profitability in Norway has been improving since 2008. One of the influencing factor on the performance of the processing industry is the flow of fish to the processing part. It is interesting to see the distribution of catches for Norway and Iceland as is done in Figure 14, were the flow is shown as monthly share of total catches for the year vs. export price of fresh fillets for these countries in 2014. |

| − | |||

| − | compare the frozen production in Iceland with the filleting production in Norway. The frozen products from Iceland are mainly fillets or fillets portions. It is obvious that there is great difference in profitability although the profitability in Norway has been improving since 2008. One of the influencing factor on the performance of the processing industry is the flow of fish to the processing part. It is interesting to see the distribution of catches for Norway and Iceland as is done in Figure 14, were the flow is shown as monthly share of total catches for the year vs. export price of fresh fillets for these countries in 2014. | ||

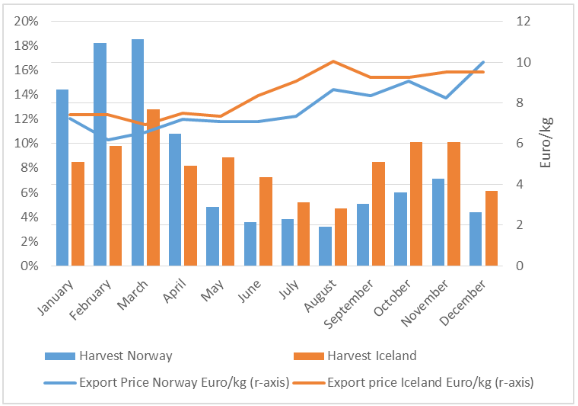

[[File:D34 fig 14.png|center|Figure 14]] ''Figure 14. Monthly catches of cod as share of total catches for 2014 and export price in Euro per kg for fresh fillets.'' | [[File:D34 fig 14.png|center|Figure 14]] ''Figure 14. Monthly catches of cod as share of total catches for 2014 and export price in Euro per kg for fresh fillets.'' | ||

| Line 489: | Line 423: | ||

| | ||

| − | *Norway has around 62.1% of the total catch landed in the first four months | + | *Norway has around 62.1% of the total catch landed in the first four months of the year while in Iceland the 39.2% of the total catch is caught during that period. |

| − | + | *During the first four months the price is lower than in the rest of the year and Iceland receives higher prices every month, except in December. | |

| − | of the year while in Iceland the 39.2% of the total catch is caught during that period. | ||

| − | |||

| − | *During the first four months the price is lower than in the rest of the year | ||

| − | |||

| − | and Iceland receives higher prices every month, except in December. | ||

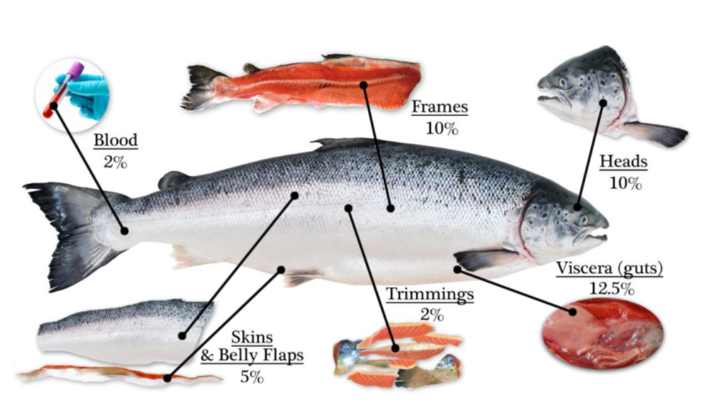

==== By-products ==== | ==== By-products ==== | ||

| Line 544: | Line 473: | ||

| Undetermined | | Undetermined | ||

|} | |} | ||

| + | |||

=== Price settling mechanism === | === Price settling mechanism === | ||

| Line 554: | Line 484: | ||

*Auction markets sells around 16% of the total landed cod, | *Auction markets sells around 16% of the total landed cod, | ||

| − | *The VICs are responsible for around 70% of the landed catch and process | + | *The VICs are responsible for around 70% of the landed catch and process most of the catches in own processing facilities. The price to the VIC ́s is connected to the auction price in Iceland. |

| + | *Contracts between individual boat owners and producers is responsible for 14% of the first sales. In Norway there are two main form of trade of fish from fisherman to producers: | ||

| + | *Fresh fish is traded upon direct agreements between seller and buyer, but with minimise price settling according to Act of the Fish Sales organizations (Fiskesalgslagsloven), which gives sales organizations owned by the fishers monopoly in the first hand trade of fish. In the case of cod, two of those organization are responsible for nearly 99 % of all cod landed by Norwegian fishers (in 2016). The sales organizations are responsible for setting minimum prices for fish which is in most cases the price in the transaction. | ||

| + | *Frozen fish is sold on auction or by own acquisition, where the vessel owner upon landing himself takes care the sale of fish. In general, frozen cod either goes to clipfish production or is exported unprocessed abroad, while fresh cod to a greater degree is processed where it is landed. In Newfoundland first hand price is negated before the start of the respective fishing season. | ||

| + | *This is done by The Fish, Food and Allied Workers Union (FFAW) and the processing companies convene as a price settling panel to negotiate the first gate prices paid to harvesters. | ||

| + | *The grade or quality of the product constitutes the price received with cod graded as either Grade A, B, C, or reject. The negotiated price is considered the minimum price and it is often augmented by the processing companies. | ||

| − | + | ==== Price according to fishing gear ==== | |

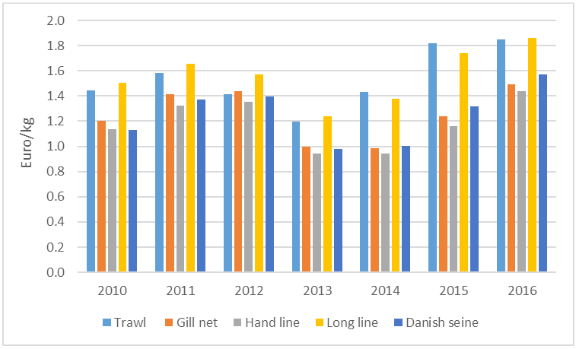

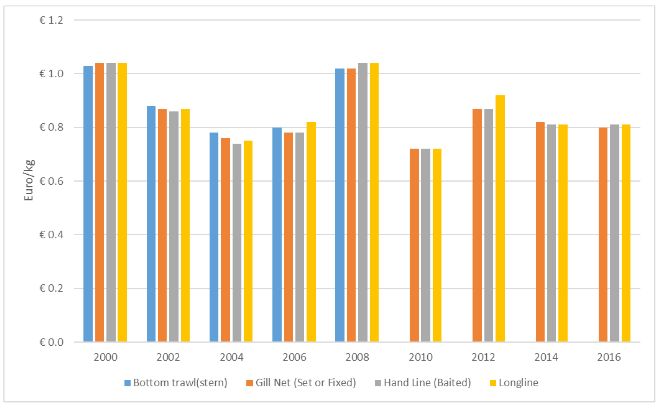

| − | + | It is important to understand if the price settling mechanism is rewarding fisherman for attribute that could affect the value creation in later stages in the value chain. These attributes are for example quality, timing, size of fish, fishing gear and temperature of the fish. It is impossible to evaluate all those factors, but it is possible to evaluate the ability of the price settling mechanism to pay different price according to fishing gear. | |

| − | + | [[File:D34 fig 16.png|center|Figure 16]] ''Figure 16. Norway, price according to fishing gear Euros/kg 2010 to 2016'' | |

| − | + | It is clear that the price is different in Norway after according to the fishing gear. | |

| − | + | *Longline and trawl receive the highest price but it is interesting that hand line usually gets the lowest price which is in contrast with the general believe that hook and line fish have the best quality. The price difference is quite high or up to 0.58 euro in 2015 between the highest and the lowest. Which means that the lowest price in 33% lower than the highest. | |

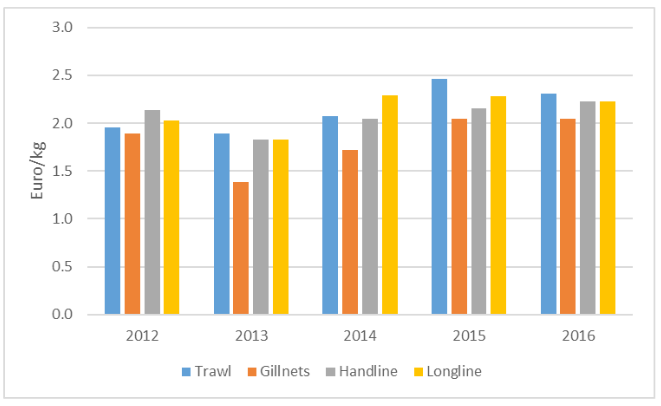

| − | + | [[File:D34 fig 17.png|center|Figure 17]] ''Figure 17. Iceland, price according to fishing gear Euros/kg 2012 to 2016'' | |

| − | + | Price varies according to fishing gear in Iceland. | |

| − | * | + | *The same trends can be detected as in Norway that the longline and trawl receive usually the highest price. Gillnets receive the lowest price but hand line receive the highest price in 2012, although the share of the total landed cod is rather low. |

| + | *The price difference between the highest and lowest price range between 0.25 to 0.51 euros per kilo and is biggest in 2013 when the difference is 27%. | ||

| + | *It is interesting to see the difference in price between hand line in Norway and Iceland that races questions about quality and the how active the price settling mechanism is in identifying and rewarding for quality. | ||

| − | + | [[File:D34 fig 18.png|center|Figure 18]] ''Figure 18 Newfoundland, price according to fishing gear Euros/kg 2000 to 2016'' | |

| − | + | In Newfoundland there is no difference according to fishing gear indicating there is no efficiency in the price settling mechanism to identify quality and pay incentives for that. There are recent examples were processing companies are engaged in collaborative relationships with harvesters and are paying higher premiums to those using fishing gear that produce a premium product. | |

| − | + | ==== Summary of main influencing factors on value chain dynamic ==== | |

| − | + | {| class="wikitable" style="width: 100%" | |

| − | + | |- | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | {| class="wikitable" style="width: 100% | ||

| − | |- | ||

! Factor | ! Factor | ||

! Iceland | ! Iceland | ||

| Line 675: | Line 578: | ||

=== Fishing === | === Fishing === | ||

| + | |||

==== Fishing gear ==== | ==== Fishing gear ==== | ||

| Line 684: | Line 588: | ||

*No active auction markets | *No active auction markets | ||

*Very limited price difference between fishing gear | *Very limited price difference between fishing gear | ||

| − | *Very limited marketing effect in the relationships between producers and | + | *Very limited marketing effect in the relationships between producers and fisherman’s. |

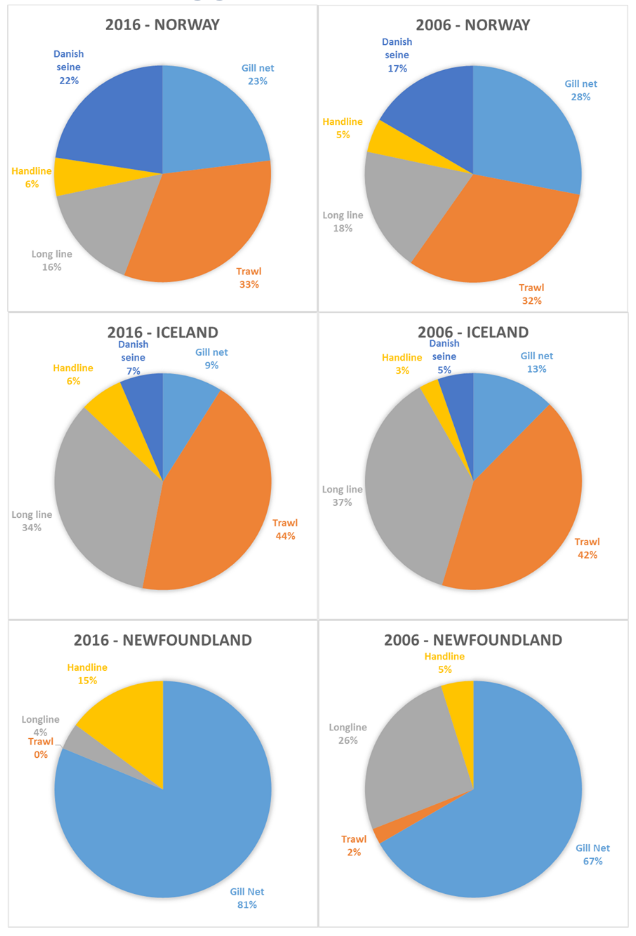

| − | + | *The use of gillnets and lack of markets connection suggest that most fisherman focus on minimising the cost of fishing and low cost strategy. Trawl is the most important fishing gear in Iceland with around 43% of the total catch in 2016. The main change in development of fishing gear is that the share of gillnets has steadily been decreasing from around 33% in 1982 to 13% in 2006 down to 8.8% in 2016. Longline has been increasing it share or from 11% in 1982 to 37% in 2006 and is around 33.5% in 2016. Use of hand line has increased mainly due to the introduction of coastal fishing in 2008. The share of hand line is around 6% and has double from 2006 when it was around 3% which is similar as in 1982. The reasons are: | |

| − | fisherman’s. | + | **The auction market in Iceland is active |

| − | + | **Price varies between fishing gear is creating incentives for better quality | |

| − | *The use of gillnets and lack of markets connection suggest that most | + | **The strategy is in most cases on quality and maximising the revenue |

| − | |||

| − | fisherman focus on minimising the cost of fishing and low cost strategy. Trawl is the most important fishing gear in Iceland with around 43% of the total catch in 2016. The main change in development of fishing gear is that the share of gillnets has steadily been decreasing from around 33% in 1982 to 13% in 2006 down to 8.8% in 2016. Longline has been increasing it share or from 11% in 1982 to 37% in 2006 and is around 33.5% in 2016. Use of hand line has increased mainly due to the introduction of coastal fishing in 2008. The share of hand line is around 6% and has double from 2006 when it was around 3% which is similar as in 1982. The reasons are: | ||

| − | |||

| − | *The auction market in Iceland is active | ||

| − | *Price varies between fishing gear is creating incentives for better quality | ||

| − | *The strategy is in most cases on quality and maximising the revenue | ||

In Norway, trawl is the most important fishing gear and accounts for 33% in 2016 which is increase of 1% since 2006. The use of gillnets has been going down from 2006 when the share was 28% to 23% in 2016. The biggest increase is in use of Danish seine has been increasing from 17% in 2006 to 22% in 2016. The reasons are: | In Norway, trawl is the most important fishing gear and accounts for 33% in 2016 which is increase of 1% since 2006. The use of gillnets has been going down from 2006 when the share was 28% to 23% in 2016. The biggest increase is in use of Danish seine has been increasing from 17% in 2006 to 22% in 2016. The reasons are: | ||

*Clear difference in price between fishing gear | *Clear difference in price between fishing gear | ||

| − | *Suggesting quality incentives in the relationship between producers | + | *Suggesting quality incentives in the relationship between producers and fisherman |

| + | *Seasonal fishing and use of gillnet and Danish seine suggest that the focus in fishing is mainly on minimizing cost of fishing | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==== Performance and profitability ==== | ==== Performance and profitability ==== | ||

| Line 713: | Line 607: | ||

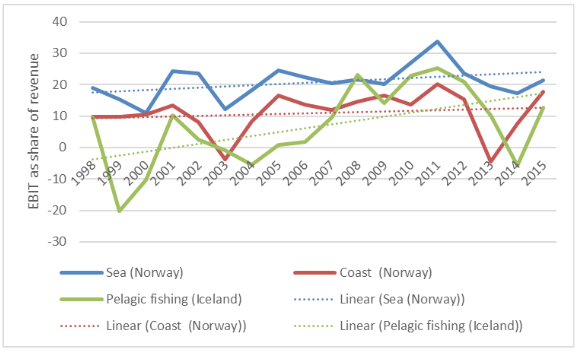

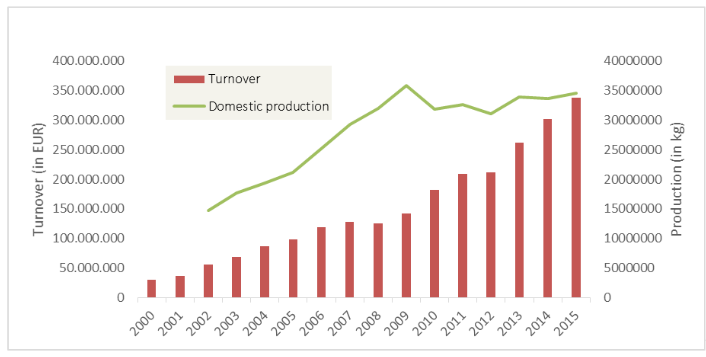

[[File:D34 fig 20.png|center|Figure 20]] ''Figure 20. Profitability for the demersal fishing sector, based on EBIT as share of revenue.'' | [[File:D34 fig 20.png|center|Figure 20]] ''Figure 20. Profitability for the demersal fishing sector, based on EBIT as share of revenue.'' | ||

| − | *The profitability in Norway and Iceland varies a lot but the profitability in | + | *The profitability in Norway and Iceland varies a lot but the profitability in Iceland is considerable higher than in Norway. The EBIT in Norwegian demersal fisheries has been rather low or in most cases below 10% with few exceptions. |

| − | + | *There is difference in the fleet groups as in Norway cod trawler are returning highest profitability in the last years and the coastal fleet or smaller vessels are less profitable. The same trend is in Iceland as small boat fleet is returning lower profitability than fresh fish trawler and bigger vessels. | |

| − | Iceland is considerable higher than in Norway. The EBIT in Norwegian demersal fisheries has been rather low or in most cases below 10% with few exceptions. | ||

| − | |||

| − | *There is difference in the fleet groups as in Norway cod trawler are | ||

| − | |||

| − | returning highest profitability in the last years and the coastal fleet or smaller vessels are less profitable. The same trend is in Iceland as small boat fleet is returning lower profitability than fresh fish trawler and bigger vessels. | ||

| | ||

| Line 842: | Line 731: | ||

==== Iceland ==== | ==== Iceland ==== | ||

| + | |||

===== Governmental form of the value chain ===== | ===== Governmental form of the value chain ===== | ||

| Line 856: | Line 746: | ||

'''Producers export links''' | '''Producers export links''' | ||

| − | *During the period before 1994 when the limited export licences were still | + | *During the period before 1994 when the limited export licences were still active the governmental structure of the value chain of cod from fishing to markets was Captive form as the sale organisation in key position in the value chain where producers had duty of handing inn all their product for selling thought the SMOs. |

| + | *The export part of the value chain has as changed a lot for the last 30 years. The bigger VIC have in many cases established their own marketing division or even their own marketing companies abroad depending on hierarchy form of governance. | ||

| + | *In most cases Icelandic companies are selling to middleman abroad as distributers or wholesalers, although some are selling directly to retail chain as in the fresh fish markets. In most cases companies have contract with buyers that that could be regarded as relational from of governance. | ||

| − | + | '''Dependency''' | |

| − | *The export part of the value chain | + | *The dependency in the value chain varies a lot depending degree of long term contracts in their business instead of ad hoc sale. In interview with mangers in the Icelandic fish industry it is clear that more and more of the TAC is sold before it is caught. This indicates long term relationship and relational governance form in the export part of the value chain term relationship |

| − | + | '''Power structure/balance''' | |

| − | * | + | *It is in the nature of quota system that the quota holder has the power in the value chain. Hence it is in the hands of the quota holders when where and how the fish is caught and then for others to try to make the most out of the raw material that is brought onshore. Due to high degree of VICs (70%) in the value chain in Iceland, the negative effects of this power is not real. Auction markets are as well important for power balance as they send markets signal to the independent fisherman about quality, fishing gear and even timing. The power balance between links in the value chain are in good balance in the Icelandic value chain |

| − | + | ===== Drive force in the value chain ===== | |

| − | + | The drive force in the value chain have changed a lot the last 30 years from having: | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | The drive force in the value chain have changed a lot the last 30 years from having: | ||

*harvesting/production driven value chain to becoming more and more marketing driven value chain. The main reasons for this changes can be trace to: | *harvesting/production driven value chain to becoming more and more marketing driven value chain. The main reasons for this changes can be trace to: | ||

| Line 896: | Line 774: | ||

==== Norway ==== | ==== Norway ==== | ||

| + | |||

===== Governmental Form ===== | ===== Governmental Form ===== | ||

| − | *In modern times (after WWII), up until the new seafood export legislation | + | *In modern times (after WWII), up until the new seafood export legislation in the 1990s, all branches in the cod sector was subject to the trade conditions dictated by the sectoral export commissions. These commissions was leading actors in the centralised export, where they lead negotiations and entered into common agreements for most all important seafood products. They were, like in Iceland at that time, a captive lead firm that explicitly coordinated the export, and by that had great influence on the business environment. |

| − | + | *After the new Export Act in 1992, these export commissions were dissolved, and new liberal rules granted practically anyone paying an export fee could to start export of seafood. With this many processors above a certain side (or even just processors that have found it opportunistic) have started their own export. There are of course cooperation between exporters, processors and both, where some quantities/products/species are sold by standalone exporters, while some have caretaker in-house, but in general the structure and governance form in the marketing sector is atomistic. Some large exporters exists within some products, and also some major processing firms dominate the export of other products, but in general a market to modular form of this trade is the usual. This is our impression of the chain as a whole, and we cannot see a big development towards one governmental form or the other throughout the latest 10 to 20 years. | |

| − | in the | + | *The power between purchasers and suppliers is balanced in the way that terms of trade is governed by the price, even though relations play a role together with trust and esteem/reputation. |

| − | |||

| − | *After the new Export Act in 1992, these export commissions were | ||

| − | |||

| − | dissolved, and new liberal rules granted practically anyone paying an export fee could to start export of seafood. With this many processors above a certain side (or even just processors that have found it opportunistic) have started their own export. There are of course cooperation between exporters, processors and both, where some quantities/products/species are sold by standalone exporters, while some have caretaker in-house, but in general the structure and governance form in the marketing sector is atomistic. Some large exporters exists within some products, and also some major processing firms dominate the export of other products, but in general a market to modular form of this trade is the usual. This is our impression of the chain as a whole, and we cannot see a big development towards one governmental form or the other throughout the latest 10 to 20 years. | ||

| − | |||

| − | *The power between purchasers and suppliers is balanced in the way that | ||

| − | |||

| − | terms of trade is governed by the price, even though relations play a role together with trust and esteem/reputation. | ||

'''Power balance/structure''' | '''Power balance/structure''' | ||

| − | *The consolidation in the fleet might have had an effect on the power | + | *The consolidation in the fleet might have had an effect on the power balance, and some would maintain that the fishing industry have increased their power on expense of the processing industry. |

| − | + | *Others again, would maintain that the processing industry, by ways of consolidation in this link of the chain, have ascertained increased power over the fishing/selling side of the transaction. | |

| − | balance, and some would maintain that the fishing industry have increased their power on expense of the processing industry. | + | *However, the heterogeneity of the fishing sector makes it impossible to conclude unanimously on this matter. In some areas for some vessel groups consolidation might have increased the fishing side’s power towards the processing sector, whereas in other areas the opposite might be the case. The power balance might also depend on the aggregated demand and supply situation, and as such depend on the cod quota available for the industry. |

| − | |||

| − | *Others again, would maintain that the processing industry, by ways of | ||

| − | |||

| − | consolidation in this link of the chain, have ascertained increased power over the fishing/selling side of the transaction. | ||

| − | |||

| − | *However, the heterogeneity of the fishing sector makes it impossible to | ||

| − | |||

===== Drive force in the value chain ===== | ===== Drive force in the value chain ===== | ||

| − | *The development of the Norwegian seafood industry has over time | + | *The development of the Norwegian seafood industry has over time followed a trend of liberalization, where the emphasis has changed from protection and subsidies (pre-1990’ies) to international competitiveness and environmental and economic sustainability. It is not easy to set a clear division in time where this policy change occurs, but over time the emphasis has gone in that direction. |

| + | *From early 1970’ies as a process where resources and resource allocations becomes the main theme in the fisheries policy, while negotiations on subsidies and its distributions becomes secondary. | ||

| + | *In the mid-1990’ies, Norway has left a period with free conduct on the ocean and regulated market behaviour, to one with regulated conduct on sea and free competition in the market. Earlier (pre-1990’ies), the seafood export was organised in trade unions, dependent on product (dried fish, salt fish, fresh fish, frozen fish and clipfish) whereas a deregulation of the seafood export act in early 1990’ies open up for anyone – satisfying a set of objective criteria, to export seafood. | ||

| + | *In the first hand market, the abolishment of subsidies involved that the price wedge between supply and demand was removed, enabling price movements in the market to be directly transferred to fishers. | ||

| + | *Sales organisations’ right to set minimum prices still meant a share of market power on behalf of fishers, but also here the development towards a dynamic minimum price – dependent on objective and observable factors on the market place – have reduced the shielding of fishermen from market signals. | ||

| + | *The reduction of both fishing vessels and purchasers along the coast, has consolidated and professionalised the industry on both sides of the transaction in the first hand market.9.3 | ||

| − | + | ==== Newfoundland ==== | |

| − | |||

| − | + | ===== Governmental Form ===== | |

| − | *In the | + | *In Newfoundland it is possible to separate the fishing industry into two sectors. First is the offshore sector that is vertical integrated in fishing, processing and marketing and then inshore fleet, which is based up on individual boat owners where vertical integration is banned. |

| + | *Today TAC in cod is only allocated to the inshore sector (TAC will need to exceed 115.000 thousand tons before it is reallocated to the offshore sector). | ||

| + | *The links between boat owner and producers is based on negotiated price between FFAW (The Fish, Food and Allied Workers Union) and associations of producers. There are no auction markets and more or less the negotiated price is used in the transaction. | ||

| + | *The relationship is in some way captive due to lack of active markets in the relationship but in some cases it could be regarded relational where boat owner and producers have some contract about landing of cod and other spices. | ||

| + | *Stakeholders seems to play more active role in governing the value chain and its structure than in other countries as allocation of quota and limits on transferability seems to depend on the stakeholders as FFAW. | ||

| − | + | '''Power balance/structure''' | |

| − | * | + | *Due to the structure of the fisheries management system that is individual vessel do not have TAC (have to follow the weekly limits of catch) and very limited possibility of transferring fishing licenses (stacking up) the power in the value chain lies in the hands of the stakeholders that decides on the system. |

| + | *The stakeholders are the policymakers that is the politicians and the parliament that decide on the system. Secondly it is the FFAW that plays big role in influencing the system and deciding of how it is conducted. | ||

| + | *FFAW and negotiated agreements are having significant influence on the free markets; the agreements preventing markets relationship and market influence in the value chain. | ||

| − | |||

| − | + | ===== Drive force in the value chain ===== | |

| − | + | *Due to low quota in Newfoundland and more important species as lobster and crab, cod have been looked up as filling and not major species in fishing. With foreseeable increase in quota this can become problematic. | |

| + | *The fishing of cod in gillnet during August points out that the drive force is minimising the cost of fishing rather than anything else. | ||

| + | *Longer season and strict rules about transferring quota (stacking up) points out that the fishing is looked at as a social aspect rather than building up economic sustainable business. The influence of stakeholders seams to affect the economical sustainability of the industry. | ||

| − | |||

| − | + | ==== Summary of main influencing factors regarding concentration ==== | |

| − | + | *The structure and the governance of the value chain, Vertical integration is creating more value per kg of raw material and returning higher profit | |

| + | **The profitability is higher than in other system | ||

| + | **The market responsive is better | ||

| + | **The flow and stability is better | ||

| + | *In value chain where vertical integration is banned or limited the strategy of fishing is more or less to minimise the cost of fishing. | ||

| + | **Seasonal fishing | ||

| + | **Use of gillnets is common | ||

| + | *The auction markets in Iceland has created new source of dynamic in the value chain that is specialisation in production | ||

| + | **Companies selling of species and sizes that do not fit their production mix | ||

| + | *Iceland has freedom on decide on its structure that is vertical integration or not | ||

| + | *Norway has limits on vertical integration in the coastal fishing | ||

| + | *Newfoundland ban vertical integration in inshore fleet. | ||

| + | *Source of competitiveness of the value chains | ||

| − | == | + | {| class="wikitable" style="width: 100%" |

| − | + | |- | |

| − | + | ! Factor | |

| − | + | ! Iceland | |

| − | + | ! Norway | |

| + | ! Newfoundland | ||

| + | |- | ||

| + | | Structure of the industry | ||

| + | | Vertical integrations Hierarchy Market through auction markets | ||

| + | | Limits to vertical integrations Individual boat owner and producers | ||

| + | | Ban on vertical integration’s in the inshore fleet. Offshore fleet has no cod quota | ||

| + | |- | ||

| + | | Vertical integrations | ||

| + | | High | ||

| + | | Low | ||

| + | | Low/none in inshore fleet | ||

| + | |- | ||

| + | | Flow of raw material | ||

| + | | Stable controlled by the processing marketing needs | ||

| + | | Seasonal controlled by the catch and seasons | ||

| + | | Seasonal controlled by catch limits and fisherman’s effort | ||

| + | |- | ||

| + | | Governance | ||

| + | | Mainly through hierarchy of VICs or use of auction markets | ||

| + | Market relationship, based on auction markets | ||

| − | + | | The role of minimum price affect the dynamic in the value chain | |

| + | | Significant stakeholder involvement such as FFAW | ||

| + | |- | ||

| + | | Coordination | ||

| + | | High in the VICs and based on buyers need in some sense. | ||

| + | In the auction markets coordination is limited | ||

| − | + | | Low in coastal fleet In the offshore fleet it could be high due to | |

| + | vertical integration | ||

| − | + | | Very low in inshore fleet; some in the offshore sector and cooperatives | |

| + | |- | ||

| + | | Dependency | ||

| + | | High in the hierarchy low in the market based | ||

| + | | High in the hierarchy low in the market based | ||

| + | | Low but minimum processing requirements can create dependency | ||

| + | between fishing and production | ||

| − | + | |- | |

| + | | Power structure/balance | ||

| + | | Twofold Hierarchy with high dependency by sectors and power balance Markets based on | ||

| + | power of quota holders. Low dependency | ||

| − | + | | Twofold Hierarchy with high dependency by sectors and power balance Markets based on | |

| + | power of quota holders. Lowdependency | ||

| − | the | + | | Unbalanced power lies in the hands of stakeholders mainly FFAW |

| + | |- | ||

| + | | Drive force | ||

| + | | Buyer driven value chain based on coordination of fishing and production through | ||

| + | VICs and auction markets | ||

| − | + | | Harvesting (product) driven value chain. Based on minimising cost strategy of fisherman’s | |

| + | | Harvesting (product) driven value chain, Stakeholders driven (FFAW) Based on minimising cost | ||

| + | strategy of fisherman | ||

| − | + | |- | |

| + | | Lead firm | ||

| + | | VICs | ||

| + | | Owner of the off shore fleet. | ||

| + | | None/FFAW on behalf of small boat owners | ||

| + | |- | ||

| + | | Specialisation | ||

| + | | Rather high ITQ in in fishing Auction markets for processing, spices, sizes etc. | ||

| + | | Rather low or limited | ||

| + | | Very low seasonal industry | ||

| + | |} | ||

| − | + | === Strategic Positioning Briefing === | |

| − | + | ==== Norway ==== | |

| − | + | Norway’s main advantage within the cod sector is the proximity to a productive Barents Sea and a cod stock in good shape. A disadvantage market wise is the seasonality in landings, following the spawning and feeding pattern of the cod. This is also a cost effective advantage, since great volumes can be caught close to the coast as the cod find its way to the spawning grounds of Lofoten. Within the fishing industry, structuring combined with large quotas (at a reasonable first hand price) has increased the profitability in the last decade. | |

| − | + | For the processing industry, the high Norwegian labour cost is a disadvantage. Moreover, sectors emphasising a continuous production throughout the year to meet pull market demands, meet great barriers in the seasonal supply of cod. Conventional production (saltfish, clipfish and stockfish) are used to and have adapted to these supply variabilities. Clipfish is also the sector that to the greatest degree have adapted to the relatively new raw material source of frozen cod, which have insulated them from the seasonal supply. The interest from investors stemming from aquaculture can revive the supply chain by ways of competence, financial muscles and the utilization of already established markets, logistics and marketing channels. | |

| − | + | {| class="wikitable" style="width: 100%;" | |

| − | + | |- | |

| − | + | ! | |

| − | + | ! Description | |

| − | + | ! Share cod quota | |

| − | + | ! Access barriers | |

| − | = | + | ! Opportunities and upgrade possibilities |

| − | + | ! Threats | |

| − | + | ! Value chain relationship | |

| − | + | ! Dynamic in the value chain | |

| − | + | |- | |

| + | ! scope="row" | Open vessel group | ||

| + | | 2000 vessels <11m, max. vessel quota 15-24t (length dep.) guaranteed 11-18t | ||

| + | | 6.8 % | ||

| + | | Low | ||

| + | | Pressure due to high uptake and stop. Opportunities in other fisheries than cod, and quota purchase. | ||

| + | | Lower cod quotas. Regional differences in availability and landing opportunities. | ||

| + | New safety regulations will increase capital demands. | ||

| − | + | | Direct agreement with buyers, little influence on price. | |

| + | | Open fishery with entry under profitable circumstances | ||

| + | |- | ||

| + | ! scope="row" | Coastal vessels under 11m | ||

| + | | 1200 vessels, with vessel quota of 25- 50t | ||

| + | | 14.1 % | ||

| + | | Relatively low. Higher quota prices up to 350kEUR | ||

| + | | Differentiation through quality, opportunities in other fisheries (king crab, haddock) and co-fishing | ||

| + | | Uncertainty regarding future fisheries management system, (structuring and vessel length | ||

| + | limits). Structural development in landing sites. | ||

| − | + | | Direct agreements with buyers. Often close ties with local purchaser. | |

| + | | Maximize first hand value, often with low cost focus (seasonality). | ||

| + | |- | ||

| + | ! scope="row" | Coastal vessels, 11m and above | ||

| + | | 560 vessels, with | ||

| + | structuring, vessel quotas of 50-166t | ||

| − | + | | 37.1 % | |

| + | | High - capital intensive, due quota price | ||

| + | | Better handling. Sale contracts with producers. Many generalists with rights in pelagic sector also. | ||

| + | | Uncertainty regarding fisheries management system, potential introduction of resource rent tax, affecting profitability. | ||

| + | | Direct agreements, high mobility and in greater (volume) demand. | ||

| + | | Maximize first hand value, low cost focus (seasonality). On board freezing incr. | ||

| + | |- | ||

| + | ! scope="row" | Off shore vessels (auto-line and trawl) | ||

| + | | 26 conventional vessels (autoline), vessel quota >274t 36 cod trawlers, vessel quota >1,096t | ||

| + | | 8 % | ||

| + | 30.8 % | ||

| − | + | | Very high | |

| + | | On board processing potential exploited by few. High quality on hook catch, with price | ||

| + | premium. Tendencies towards own sale. Structuring potential exploited. | ||

| − | + | | Currency and quota fluctuations. Uncertainty regarding future management options and resource rent tax. | |

| + | | Auction sale of frozen fish, tendency towards contracts and own takeover of catch | ||

| + | | Maximize value from catch. Full capacity utilisation with later years’ quotas. | ||

| + | |- | ||

| + | ! scope="row" | White fish processing firms | ||

| + | | Companies with processing facilities, some with vessel ownership, some | ||

| + | with export licence. Great heterogeneity. | ||

| − | + | | 0 | |

| + | | Low to medium, dependent of capital intensity of production. | ||

| + | | Choice of product mix. Increasingly capital intensive processing have led to big fresh fish export under high | ||

| + | quotas and seasonality. Falling quotas can counter this dev. | ||

| − | + | | Favourable but unstable currency fluctuations. Seasonality in supply. Much fish surpass traditional supply | |

| + | channels, to an increasing degree. Thawing have reduced comp. power of fresh. High Norw. salary level. | ||

| − | + | | Tough competition up- and downstream the value chain, but close ties and trust | |

| − | + | | Small margins and low profitability on average. Liquidity challenges in production of conventional prod. | |

| − | + | |- | |

| − | + | ! scope="row" | Export and marketing companies | |

| − | + | | Many exporters of varying size, markets and product portfolio. | |

| + | In-house, stand alone and preferred traders. | ||

| − | of | + | | 0 |

| + | | Low | ||

| + | | Small degree of own brands in international seafood trade, especially with raw material and semi-finished products. | ||

| + | Supported by the generic marketing of seafood from the Norw. Seafood council. | ||

| − | + | | Currency fluctuation. Lack of branding. Seasonal landings complicates continuous supply of fresh fish. | |

| − | + | | Demanding retail chains and spot markets. Price signals most important but also relational customer ties. | |

| − | + | | Monitor markets needs and preferences and share market signals to producers. Multiple and regional | |

| − | + | sourcing eases supply continuity | |

| − | + | |} | |

| − | + | ==== Iceland ==== | |

| − | |||

| − | production | + | In general the main strength of the Icelandic system is the distribution of catches around the whole year, strengthen by the start of the quota year on 1. September each year. The industry is putting more emphasis on production of fresh fish instead of frozen or salted product with huge investment in new fresh fish trawlers. The processing companies have also been investing in new equipment, especially regarding water cutting and super-chilling. With super- chilling and good control of temperature in containers, more emphasis has been put in transportation on sea rather than by plane. This is related to cost but also to carbon footprint. There is also more emphasis on markets in N-Amerika and the industry in closely monitoring developments in Asia. VICs are extremely strong as they control more than 2/3 of the cod quota and therefore limited amount is going through the auction markets. |

| − | + | {| class="wikitable" style="width: 100%;" | |

| − | + | |- | |

| − | + | ! | |

| − | + | ! Description | |

| − | + | ! Share cod quota | |

| − | + | ! Access barriers | |

| − | + | ! Opportunities and upgrade possibilities | |

| − | + | ! Threats | |

| − | {| class="wikitable" style="width: 100%;" | + | ! Value chain relationship |

| + | ! Dynamic in the value chain | ||

|- | |- | ||

| − | ! | + | ! scope="row" | Independent small boat owners in costal fisheries |

| − | + | | <30 tons, number of fishing days limitation. | |

| − | + | | 3.2% | |

| − | |||

| − | | | ||

| − | | | ||

| − | | | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| Low | | Low | ||

| − | | | + | | Better handling, buy quota. |

| + | | Unstable currency, uncertainty of number of fishing days resulting in poor profitability. | ||

| + | | Almost all goes through auction markets. | ||

| + | | Lack of dynamic | ||

|- | |- | ||

| − | | | + | ! scope="row" | Independent small boat owners with quota |

| − | | | + | | <30 tons, TAC |

| − | + | | 19.4% | |

| − | | | + | | High - capital intensive quota price |

| − | |- | + | | Can participate in costal fisheries without using their TAC. Better handling. Sale contracts with producers. |

| − | | | + | | Unstable currency, Uncertainty regarding fisheries management system, uncertainty regarding resource rent that |

| − | | | + | could affect profitability. |

| − | |||

| − | | | + | | Auction market around 70%. Rest sold by contract relationships. |

| − | | | + | | Maximize first sale price. |

|- | |- | ||

| − | | | + | ! scope="row" | Independent big boat owners |

| − | | High in | + | | >30 tons with TAC |

| − | + | | 7.6% | |

| + | | High - capital intensive quota price | ||

| + | | Better handling. Sale contracts with producers. | ||

| + | | Unstable currency, Uncertainty regarding fisheries management system, uncertainty | ||

| + | regarding resource rent that could affect profitability. Reduction in number of independent big boat owners. | ||

| − | | | + | | Mixture of auction market and contract relationship. |

| − | + | | Maximize first sale price. | |

| − | |||

| − | | | ||

|- | |- | ||

| − | | | + | ! scope="row" | Individual producer |

| − | | | + | | Supplies fish by contracts and from auction markets. Medium and small size producers with often low |

| − | + | degree of automatization, mainly focusing on fresh niece markets. | |

| − | |||

| − | |||

| + | | 0 | ||

| + | | Medium - depends on markets needs and level of automatization required. | ||

| + | | Market relationships, product mix, long time source and sales contracts | ||

| + | | Unstable currency, Access to supply do to quota system and high degree of VICs. Lack of branding | ||

| + | | Sourcing form auction market and by contracts with boat owners and other producers. | ||

| + | | Maximize value from bycatches and serving niece markets | ||

|- | |- | ||

| − | | | + | ! scope="row" | Vertical integrated company in fishing, production and marketing (VICs) |

| − | | | + | | Companies with own boats, processing facilities and marketing office. High degree of atomisation in |

| − | + | processing and fishing. Producing fresh, frozen and salted products. | |

| − | | | + | | 70.8% |

| − | + | | Very high - quota price, capital intensive fishing and production. | |

| + | | Branding, product mix, market relationships, usage of by-products, increase quota share up to limit. | ||

| + | | Unstable currency, Uncertainty regarding fisheries management system, uncertainty regarding resource rent that | ||

| + | could affect profitability. Reduction in number of independent big boat owners. Refresh fish. Lack of branding. | ||

| − | | | + | | Internal sourcing and auction market when there is shortage of own catches. |

| + | | Coordination of fishing and processing according to market needs, current sales and quota limitations. | ||

|- | |- | ||

| − | | | + | ! scope="row" | Export and marketing companies with no own production |

| − | | | + | | One big sales company and number of small companies selling fish products from VICs and smaller producers |

| − | + | by long term contracts and adhoc trade. Sourcing fish from Iceland and other countries. | |

| − | | | + | | 0 |

| − | | | + | | Low - depends of market and supply relationships |

| − | + | | Branding, market relationship, long time contracts | |

| + | | Unstable currency, Lack of branding, unstable supply. | ||

| + | | Mixture contract relationship ad hoc trade | ||

| + | | Monitor markets needs and preferences and share market signals to | ||

| + | producers. Risk reduction through network of suppliers. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|} | |} | ||

| − | + | | |

| − | ==== | + | ==== Newfoundland and Labrador ==== |

| − | + | In general, the main strengths of the Newfoundland and Labrador system is the proximity of the resource to the landing sites and the proximity to the North American markets. The industry is putting more emphasis on the quality of the product and efforts are being made to expand into the fresh fillet markets. Labour costs when compared to European costs are cheaper however the industry is currently very labour dependent as most of processing sector is still manually driven with limited automation. The export market to the US continues to remain strong as the market has shifted to higher value product forms. The resource (harvestable biomass) has remained stable and is expected to grow over the coming years. In recent years, government has been providing financial support for technology enhancement initiatives within the harvesting and processing sectors. | |

| − | + | From an economic or value chain perspective the NL cod fishery (and Canadian fisheries in general) is a social resource where market conditions have limited consideration in terms of the structure or management of the industry. Compared to the European market the challenges for the NL market are based on economies of scale as the NL biomass or landed volume is a fraction of that produced by Iceland, Norway and Russia. Some of the challenges with the fishery include the number of vessels and harvesters competing for the limited resource. The current industry structure limits the transferability of quota between vessels thus impacting the self-rationalization within the industry. The current fishery has a seasonality that is not linked to market demand or prices. The fishery does however have the potential to extend its current season so that it operates longer throughout the year and efforts are being made to move in this direction. Strict regulation on enterprise combining and owner operator fleet separation has influenced vertical integration within the industry. The lack of exit barriers has resulted in licenses being sold at extremely high value which is negatively impacting new entrants into the industry as the costs are prohibitive. Demographics are challenging both the harvesting and processing sectors as the average age of participants is >50 years+ and recruitment of people <30 years has been declining. To combat pending labour losses, the fishery (harvesting/processing) will have to move towards more automated systems. For the limited harvestable resource, the number of landing ports (>400) and potentially processing facilities adds a level of complexity to the logistics component of the value chain. Many processing facilities have aging and outdated equipment based on current markets. | |

{| class="wikitable" style="width: 100%;" | {| class="wikitable" style="width: 100%;" | ||

| Line 1,130: | Line 1,112: | ||

! Dynamic in the value chain | ! Dynamic in the value chain | ||

|- | |- | ||

| − | ! scope="row" | | + | ! scope="row" | Independent small boat owners in inshore/coastal fisheries |

| − | | | + | | <65 feet (or 19.8 metre), fishery can be based on a weekly allocation or quota based (e.g. certain NAFO |

| − | | | + | regions such as 3Ps); number of fishing days/season determined by union and government |

| − | | | + | |

| − | | | + | | 75+% |

| − | | | + | | High cost for vessels and licences; no new licence being issued must buy existing licences |

| − | + | | Can improve on board handling/holding technology; can buy additional licences (2:1 or 3:1). | |

| + | | Weekly catch allocation is variable and overall stock/quota is uncertain; Negotiated price; | ||

| + | fishing season not necessarily linked to market | ||

| − | | | + | | Most goes to independent processing companies; portion of catch is processed and sold directly (micro- |

| − | + | vertical integration model) | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | | Maximize first sale price | |

| − | | Maximize first | ||

|- | |- | ||

| − | ! scope="row" | | + | ! scope="row" | Independent boat owners (inshore/mid-shore range) |

| − | | | + | | 65 feet (19.8 m) – 90 feet (27.4m); fishery can be based on a weekly allocation or |

| − | + | quota based (e.g. certain NAFO regions such as 3Ps); number of fishing days/season determined by union and government | |

| + | |||

| + | | 20+% | ||

| + | | High cost for vessels and licences; no new licence being issued must buy existing licences | ||

| + | | Can improve on board handling/holding technology; can buy additional licences (2:1 or 3:1). | ||

| + | | Weekly catch allocation is variable and overall stock/quota is uncertain; Negotiated price; | ||

| + | fishing season not necessarily linked to market | ||

| − | | | + | | Most goes to independent processing companies |

| − | + | | Maximize first sale price. | |

| − | |||

| − | |||

| − | |||

| − | | Maximize first | ||

|- | |- | ||

| − | ! scope="row" | | + | ! scope="row" | Vertical integrated company in fishing, production and marketing (VICs) |

| − | | | + | | Companies with own boats, processing facilities and marketing office. Medium degree of automation |

| − | | | + | processing and fishing. Producing a variety of products frozen, portions, block, fresh |

| − | + | ||

| + | | ~1% | ||

| + | | Very high - quota price, capital intensive fishing and production. | ||

| + | | Improved technology in processing facilities and vessels; building relationships with | ||

| + | smaller vessels for secure product | ||

| − | | | + | | Unstable currency, Uncertainty regarding access to quota; regulations preventing growth of |

| − | + | vertically integrated sector | |

| − | |||

| − | | | + | | Internal sourcing |

| − | | | + | | Coordination of fishing and processing according to market needs, current sales and quota limitations. |

| − | |||

|- | |- | ||

| − | ! scope="row" | | + | ! scope="row" | Export and marketing companies with no own production |

| − | | | + | | One big sales company and number of small companies selling fish products from VICs and smaller producers |

| − | + | by long term contracts and adhoc trade. Sourcing fish from Iceland and other countries. | |

| − | + | ||

| 0 | | 0 | ||

| − | | Low | + | | Low - depends of market and supply relationships |

| − | | | + | | Branding, market relationship, long time contracts |

| − | + | | Unstable currency, Lack of branding, unstable supply. | |

| + | | Variable, based on relationships and access to resources | ||

| + | | Variable, constrained by the seasonality and availability of product; Monitor markets needs and | ||

| + | preferences and share market signals to producers | ||

| + | |||

| + | |} | ||

| − | + | | |

| − | |||

| − | + | ==== Summary of Strategic Positioning ==== | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | It is very interesting to see the huge difference in structure and functionality of the value chains between Norway, Iceland and Newfoundland. Previous studies have argued that the superior harvesting and marketing strategies of the Icelandic industry may be rooted in factor conditions that are difficult to duplicate and a rigid institutional framework in Norway and partly the social resource structure of the Newfoundland industry, where market conditions have very limited consideration in terms of the structure or management of the industry. Both in Norway and Newfoundland, this structure or rigid framework is hampering the industry to organise the value chain, to be more market competitive by methods like vertical integration. | |

| − | |||

| − | |||

| − | |||

| − | + | The vertically integrated companies in Iceland where the processor owns its own fishing vessels. Unlike the push supply chain system followed by the Norwegian and partly the Newfoundland companies where they must process the fish that they receive, the Icelandic processors places orders to its fishing vessels based on the customer orders and quota status, thus following a pull supply chain system. The Icelandic processors are able to sends orders to the vessels for how much fish of each main spices is wanted, where to catch and to land so they have the desired size and quality of raw material needed for fulfilling customer orders. This structural difference is also affecting the product mix that the countries are going for. Iceland is therefore placing more and more emphasis on fresh fillets and pieces, while the other countries are going for more traditional products, like salted, dried and frozen products. Due to the vertical integration in Iceland, the production plans are developed based on customer orders and then a plan is made for fishing, while in Norway and Newfoundland, the production plans is usually developed after receiving the fish at the processing plant as the information about volumes of specifies caught and quality is not available beforehand. | |

| − | |||

| − | |||

| − | |||

| − | + | However, the socioeconomic effects of VICs in Iceland and aforementioned consolidation where not addressed in this report. | |

| − | + | | |

| − | + | == Atlantic Herring == | |

| − | + | === Executive summary === | |

| − | + | ||