Difference between revisions of "Deliverable 3.1"

Jacandrade (talk | contribs) |

Jacandrade (talk | contribs) |

||

| Line 10: | Line 10: | ||

---- | ---- | ||

| − | This report describes the main material flow in the supply chain (input-output structure) for the six commodity species (or species groups) that are the focus of PrimeFish; four farmed and two capture: (i) Atlantic Salmon, (ii) Rainbow Trout, (iii) European Sea bass (Dicentrarchus labrax) and gilthead sea bream (Sparus aurata) (iv) Pangasius catfish (Pangasius hypophthalmus) (v) Atlantic Cod (Gadus morhua) (vi) Atlantic Herring (Clupea herrengus). The latter two species are selected as examples of demersal and pelagic fisheries. Sea bass and sea bass are treated as a single group as almost perfect substitutes, sharing very similar production and post-harvest value-chain characteristics. The report is a synthesis of 17 individual value-chain reports. The report is based on publicly available data, and for each species covers (a) farmed production or landings (b) imports (c) processing (d) export (e) consumption. | + | This report describes the main material flow in the supply chain (input-output structure) for the six |

| + | commodity species (or species groups) that are the focus of PrimeFish; four farmed and two capture: | ||

| + | (i) Atlantic Salmon, (ii) Rainbow Trout, (iii) European Sea bass (Dicentrarchus labrax) and gilthead sea | ||

| + | bream (Sparus aurata) (iv) Pangasius catfish (Pangasius hypophthalmus) (v) Atlantic Cod (Gadus | ||

| + | morhua) (vi) Atlantic Herring (Clupea herrengus). The latter two species are selected as examples of | ||

| + | demersal and pelagic fisheries. Sea bass and sea bass are treated as a single group as almost perfect | ||

| + | substitutes, sharing very similar production and post-harvest value-chain characteristics. The report | ||

| + | is a synthesis of 17 individual value-chain reports. The report is based on publicly available data, and | ||

| + | for each species covers (a) farmed production or landings (b) imports (c) processing (d) export (e) | ||

| + | consumption. | ||

=== Atlantic cod === | === Atlantic cod === | ||

| − | Iceland and Norway are two of the world’s largest suppliers of cod, having access to abundant cod stocks in Norwegian and Icelandic waters. The catches have been growing over the last few years in in both Iceland and Norway. On the other hand, the UK has a small contribution to global catches even though quotas are slightly increasing. Since the collapse of the Canadian stocks of cod in early ‘90’s Canada has lost its global presence and its current landings represent a minor share of the global production of cod. There are indications that cod stocks in Canada may be recovering. In all countries there is a trend to consolidation in the industry towards fewer and larger vessels and companies. The bulk of the cod landings in Norway, Iceland and the UK are delivered by relatively large vessels in contrast Canada where boat of less than 10m in length still predominate. In Iceland there has been a shift from use of gillnets to trawl and long line. This can be explained to some extent by the better quality of product resulting from the latter methods of fishing. Consistent with this change, over recent years Iceland has specialised in production and export of fresh fillets with high quality assurance. | + | Iceland and Norway are two of the world’s largest suppliers of cod, having access to abundant cod |

| + | stocks in Norwegian and Icelandic waters. The catches have been growing over the last few years in | ||

| + | in both Iceland and Norway. On the other hand, the UK has a small contribution to global catches | ||

| + | even though quotas are slightly increasing. Since the collapse of the Canadian stocks of cod in early | ||

| + | ‘90’s Canada has lost its global presence and its current landings represent a minor share of the | ||

| + | global production of cod. There are indications that cod stocks in Canada may be recovering. | ||

| + | In all countries there is a trend to consolidation in the industry towards fewer and larger vessels and | ||

| + | companies. The bulk of the cod landings in Norway, Iceland and the UK are delivered by relatively | ||

| + | large vessels in contrast Canada where boat of less than 10m in length still predominate. | ||

| + | In Iceland there has been a shift from use of gillnets to trawl and long line. This can be explained to | ||

| + | some extent by the better quality of product resulting from the latter methods of fishing. Consistent | ||

| + | with this change, over recent years Iceland has specialised in production and export of fresh fillets | ||

| + | with high quality assurance. | ||

| − | A large and increasing proportion of the Norwegian catch is landed frozen, while in Iceland the number of freeze trawlers have declined with a concomitant shift towards fresh landings and processing on land. The UK fleet lands its catches of cod whole fresh or gutted and a significant proportion of landings originate from third-country vessels. Canadian catches of cod are landed exclusively as fresh fish, destined primarily for primary processing and local retailing. Compared to Norway, Iceland benefits from lower variability in landings throughout the year which is an advantage when it comes to supplying multiple retail chains requiring continuity and predictability of supply. | + | A large and increasing proportion of the Norwegian catch is landed frozen, while in Iceland the |

| + | number of freeze trawlers have declined with a concomitant shift towards fresh landings and | ||

| + | processing on land. The UK fleet lands its catches of cod whole fresh or gutted and a significant | ||

| + | proportion of landings originate from third-country vessels. Canadian catches of cod are landed | ||

| + | exclusively as fresh fish, destined primarily for primary processing and local retailing. | ||

| + | Compared to Norway, Iceland benefits from lower variability in landings throughout the year which | ||

| + | is an advantage when it comes to supplying multiple retail chains requiring continuity and | ||

| + | predictability of supply. | ||

| − | With the exception of some foreign vessel landings in Norway, there is negligible import of cod to Iceland or Norway associated with their successful management of well-endowed fisheries. The UK on the other hand is a major market and importer of cod products, particularly frozen fillets which represent the highest share of imports. The main exporting countries to the UK are Iceland, China and Norway. Due to limited domestic supply, Atlantic cod is also imported into Canada for further processing and re-export and to supplement domestic markets though imports have declined over the last decade. | + | With the exception of some foreign vessel landings in Norway, there is negligible import of cod to |

| + | Iceland or Norway associated with their successful management of well-endowed fisheries. | ||

| + | The UK on the other hand is a major market and importer of cod products, particularly frozen fillets | ||

| + | which represent the highest share of imports. The main exporting countries to the UK are Iceland, | ||

| + | China and Norway. Due to limited domestic supply, Atlantic cod is also imported into Canada for | ||

| + | further processing and re-export and to supplement domestic markets though imports have declined | ||

| + | over the last decade. | ||

| − | Cod processing in Norway, Iceland and the UK has undergone significant consolidation resulting in fewer but larger companies. In Iceland the consolidation process has been accompanied by increased investment and modernisation resulting in increased productivity, product quality and profitability. | + | Cod processing in Norway, Iceland and the UK has undergone significant consolidation resulting in |

| + | fewer but larger companies. In Iceland the consolidation process has been accompanied by | ||

| + | increased investment and modernisation resulting in increased productivity, product quality and | ||

| + | profitability. | ||

| − | In Iceland cod is predominantly processed into fresh fillets for export and the share of salted and dried products has declined over time. In Norway, by contrast a significant proportion of cod is still processed into dried and/or salted fish as well as frozen whole. The majority of UK companies processing cod specialise in secondary processing, primarily of imported frozen fillets into value added products. The Canadian processing sector consists of mainly small-scale primary processing companies, reliant partly on imports and partly on domestic landings. | + | In Iceland cod is predominantly processed into fresh fillets for export and the share of salted and |

| + | dried products has declined over time. In Norway, by contrast a significant proportion of cod is still | ||

| + | processed into dried and/or salted fish as well as frozen whole. The majority of UK companies | ||

| + | processing cod specialise in secondary processing, primarily of imported frozen fillets into value | ||

| + | added products. The Canadian processing sector consists of mainly small-scale primary processing | ||

| + | companies, reliant partly on imports and partly on domestic landings. | ||

| − | The vast majority of the cod landed and processed in Iceland and Norway is exported. The main export markets for cod from Iceland are within the EU. Similarly, large proportion of the Norwegian exports target EU countries. In Norway the share of unprocessed whole gutted cod has increased in the last few years, particularly to China and Lithuania, where the fish undergoes further processing. Norway is also a main supplier of salted and dried fish to Portugal, which represents the largest market for these products. Exports from the UK are minor compared to Iceland and Norway and target mainly other EU member states. Canadian exports are also small and declining with the US and UK the major destinations. | + | The vast majority of the cod landed and processed in Iceland and Norway is exported. The main |

| + | export markets for cod from Iceland are within the EU. Similarly, large proportion of the Norwegian | ||

| + | exports target EU countries. In Norway the share of unprocessed whole gutted cod has increased in | ||

| + | the last few years, particularly to China and Lithuania, where the fish undergoes further processing. | ||

| + | Norway is also a main supplier of salted and dried fish to Portugal, which represents the largest | ||

| + | market for these products. Exports from the UK are minor compared to Iceland and Norway and | ||

| + | target mainly other EU member states. Canadian exports are also small and declining with the US | ||

| + | and UK the major destinations. | ||

| − | Detailed publicly available data on retail and consumption is most readily accessible in the UK, where cod is one of the three most consumed species, along with salmon and tuna. The majority of cod sales in the UK are in the retail sector as fresh or frozen products. A large proportion of cod is also sold through food service outlets including traditional ‘fish and chip’ shops. In Iceland cod for the domestic market is mainly retailed through fishmongers and Horeca. | + | Detailed publicly available data on retail and consumption is most readily accessible in the UK, where |

| + | cod is one of the three most consumed species, along with salmon and tuna. The majority of cod | ||

| + | sales in the UK are in the retail sector as fresh or frozen products. A large proportion of cod is also | ||

| + | sold through food service outlets including traditional ‘fish and chip’ shops. In Iceland cod for the | ||

| + | domestic market is mainly retailed through fishmongers and Horeca. | ||

| − | === Atlantic herring === | + | ===Atlantic herring=== |

| − | In all study countries catches of herring declined over the last decade reflected in lower quotas. Herring is currently targeted by the largest vessels in the national fleets of the countries examined here (>40m length). A trend of consolidation of vessel and quota ownership for pelagic species occurred across all main producer countries. This trend is likely driven by economies of scale which fishing for pelagic species benefits from together with the relatively low market prices commanded by pelagic species. Purse seine was the main gear type used in Norway, Denmark and the UK, while Iceland relied mostly on trawling gears. | + | In all study countries catches of herring declined over the last decade reflected in lower quotas. |

| + | Herring is currently targeted by the largest vessels in the national fleets of the countries examined | ||

| + | here (>40m length). A trend of consolidation of vessel and quota ownership for pelagic species | ||

| + | occurred across all main producer countries. This trend is likely driven by economies of scale which | ||

| + | fishing for pelagic species benefits from together with the relatively low market prices commanded | ||

| + | by pelagic species. Purse seine was the main gear type used in Norway, Denmark and the UK, while | ||

| + | Iceland relied mostly on trawling gears. | ||

| − | The great majority of landings across countries was destined for human consumption and this share has been growing over time. In all countries most herring was processed by a few large companies, often vertically integrated; also owning multi-species pelagic fishing vessels. Thus the level of concentration in processing has been mirrored in the capture sector. Denmark and Germany undertook most of the secondary processing, while main producer countries (Iceland and Norway) exported unprocessed or minimally processed herring products. The share of value added herring products from Iceland has declined in favour of low value added, filets and frozen fish, the production of which benefits from economies of scale. | + | The great majority of landings across countries was destined for human consumption and this share |

| + | has been growing over time. In all countries most herring was processed by a few large companies, | ||

| + | often vertically integrated; also owning multi-species pelagic fishing vessels. Thus the level of | ||

| + | concentration in processing has been mirrored in the capture sector. Denmark and Germany | ||

| + | undertook most of the secondary processing, while main producer countries (Iceland and Norway) | ||

| + | exported unprocessed or minimally processed herring products. The share of value added herring | ||

| + | products from Iceland has declined in favour of low value added, filets and frozen fish, the | ||

| + | production of which benefits from economies of scale. | ||

| − | Germany and Denmark with large consumer markets and processing capacity import substantial amounts of herring. Imports to Norway and the UK were mostly low value fresh fish landed in those countries by foreign vessels. A small quantity of value-added herring imports in Iceland is directed to the domestic consumption market. | + | Germany and Denmark with large consumer markets and processing capacity import substantial |

| + | amounts of herring. Imports to Norway and the UK were mostly low value fresh fish landed in those | ||

| + | countries by foreign vessels. A small quantity of value-added herring imports in Iceland is directed to | ||

| + | the domestic consumption market. | ||

| − | Almost the entire landings of herring in Iceland and Norway were destined for export. The main markets have historically been Eastern Europe and Russia. However, these markets have recently become less important due to political reasons. Denmark supplies Central and Northern European countries while the UK supplies Western Europe and African countries. | + | Almost the entire landings of herring in Iceland and Norway were destined for export. The main |

| + | markets have historically been Eastern Europe and Russia. However, these markets have recently | ||

| + | become less important due to political reasons. Denmark supplies Central and Northern European | ||

| + | countries while the UK supplies Western Europe and African countries. | ||

| − | === Atlantic salmon === | + | ===Atlantic salmon=== |

| − | Salmon production around the world has steadily matured into an industry dominated by vertically and horizontally integrated multinational companies. Among the three countries examined here, the Faroese salmon industry is by far the most consolidated followed by Scotland and Norway. | + | Salmon production around the world has steadily matured into an industry dominated by vertically |

| + | and horizontally integrated multinational companies. Among the three countries examined here, the | ||

| + | Faroese salmon industry is by far the most consolidated followed by Scotland and Norway. | ||

| − | Consolidation has been accompanied increased investment and consequent improvements in productivity and competitiveness. Mergers and acquisitions have played a central role in sector consolidation as increasingly stringent environmental regulations have limited ‘organic’ expansion in more sheltered inshore sites European and other countries. | + | Consolidation has been accompanied increased investment and consequent improvements in |

| + | productivity and competitiveness. Mergers and acquisitions have played a central role in sector | ||

| + | consolidation as increasingly stringent environmental regulations have limited ‘organic’ expansion in | ||

| + | more sheltered inshore sites European and other countries. | ||

| − | Environmental conditions in the Faroes, notably water temperature are more stable throughout the year than in Norway or Scotland. Norwegian and Scottish production has stabilised following 3 decades of rapid growth, while in the Faroes, growth continues. In all three countries 'Boom and bust cycles', linked to overproduction and falling prices appear to have moderated with industry consolidation. | + | Environmental conditions in the Faroes, notably water temperature are more stable throughout the |

| + | year than in Norway or Scotland. Norwegian and Scottish production has stabilised following 3 | ||

| + | decades of rapid growth, while in the Faroes, growth continues. In all three countries 'Boom and | ||

| + | bust cycles', linked to overproduction and falling prices appear to have moderated with industry | ||

| + | consolidation. | ||

| − | Most processing is limited to gutting, freezing and filleting in the Faroes and Norway due to export tariffs for value-added products linked to the countries membership of the EAA but not the EU. A large share of UK production is processed into value-added goods where a large domestic market exists, salmon being the top retail seafood. The UK also imports significant amounts of salmon from Non-EU countries especially the Faroes and Norway which is mainly farmed for export. | + | Most processing is limited to gutting, freezing and filleting in the Faroes and Norway due to export |

| + | tariffs for value-added products linked to the countries membership of the EAA but not the EU. A | ||

| + | large share of UK production is processed into value-added goods where a large domestic market | ||

| + | exists, salmon being the top retail seafood. The UK also imports significant amounts of salmon from | ||

| + | Non-EU countries especially the Faroes and Norway which is mainly farmed for export. | ||

| − | Although the UK has seen significant export growth, most export production originates from non-EU countries. Faroese exports have recorded strong growth in the German, UK, USA, Chinese and particularly Russian market (the Faroes were excluded from the ban on imports from western countries introduced in 2014). Norway has achieved strong growth in exports to the EU, which also accounts for the vast majority of its exports. The Faroes specialise in production of ‘above-average’ sized salmon commanding a better price than typical Norwegian and Scottish salmon. However, Scotland achieves a premium for its ‘Label Rouge’ certified premium quality salmon (around 8% of production) further enhanced by ‘Scottish’ origin branding. | + | Although the UK has seen significant export growth, most export production originates from non-EU |

| + | countries. Faroese exports have recorded strong growth in the German, UK, USA, Chinese and | ||

| + | particularly Russian market (the Faroes were excluded from the ban on imports from western | ||

| + | countries introduced in 2014). Norway has achieved strong growth in exports to the EU, which also | ||

| + | accounts for the vast majority of its exports. The Faroes specialise in production of ‘above-average’ | ||

| + | sized salmon commanding a better price than typical Norwegian and Scottish salmon. However, | ||

| + | Scotland achieves a premium for its ‘Label Rouge’ certified premium quality salmon (around 8% of | ||

| + | production) further enhanced by ‘Scottish’ origin branding. | ||

| − | === Rainbow trout === | + | ===Rainbow trout=== |

| − | Production of rainbow trout in Spain and the UK has declined in the period 2000-2014 to reach similar volumes of around 15,000 t in both countries. UK production is predominantly of table-size trout. Only the largest company is progressively transitioning to marine cage farming. Production in Spain is also mainly of table-size trout. Denmark and Italy both exhibit relatively stable production trends, though Denmark has increased the share of production originating from modern recirculation systems (RAS). Around one quarter of Danish output also originates from marine cages where fish are grown to a larger size. Turkey farms more trout than the other four study countries combined and only here has output increased substantively over the last decade, though growth has also flattened here over the last few years. Most output comes from land-based pond and raceway systems where fish are grown to around 300g. Larger export-orientated companies are attempting to farm larger sizes in order to avoid tariffs on import of table size trout into the EU. The number of companies involved in trout production in all EU countries has been decreasing. This is part of an overall European-wide trend for consolidation in aquaculture. In the UK less than 10 companies account for more than half of the domestic trout production, while the Danish sector has shown an increased output per farm due to growing productivity and increased capacity. In Turkey trout aquaculture is still composed of a large number of small owner-operated companies, however with increasing presence of integrated export-oriented companies. | + | Production of rainbow trout in Spain and the UK has declined in the period 2000-2014 to reach |

| + | similar volumes of around 15,000 t in both countries. UK production is predominantly of table-size | ||

| + | trout. Only the largest company is progressively transitioning to marine cage farming. Production in | ||

| + | Spain is also mainly of table-size trout. Denmark and Italy both exhibit relatively stable production | ||

| + | trends, though Denmark has increased the share of production originating from modern | ||

| + | recirculation systems (RAS). Around one quarter of Danish output also originates from marine cages | ||

| + | where fish are grown to a larger size. Turkey farms more trout than the other four study countries | ||

| + | combined and only here has output increased substantively over the last decade, though growth has | ||

| + | also flattened here over the last few years. Most output comes from land-based pond and raceway | ||

| + | systems where fish are grown to around 300g. Larger export-orientated companies are attempting | ||

| + | to farm larger sizes in order to avoid tariffs on import of table size trout into the EU. | ||

| + | The number of companies involved in trout production in all EU countries has been decreasing. This | ||

| + | is part of an overall European-wide trend for consolidation in aquaculture. In the UK less than 10 | ||

| + | companies account for more than half of the domestic trout production, while the Danish sector has | ||

| + | shown an increased output per farm due to growing productivity and increased capacity. In Turkey | ||

| + | trout aquaculture is still composed of a large number of small owner-operated companies, however | ||

| + | with increasing presence of integrated export-oriented companies. | ||

| − | Limited data on trout processing indicates that in the Spain and the UK trout undergoes small amounts of processing, being marketed mostly as a fresh whole fish on the domestic market. Larger size trout from the UK however is processed into a variety of value-added products. Denmark shows the highest level of value-addition where smoked trout products occupy the largest share of trout processing and export. In Italy, where the market has traditionally been for whole fresh fish, value- added trout products increasingly gain prominence on the domestic market but exports continue to be composed of whole fresh fish or fresh fillets. Turkey has focused on a combination of lower value frozen whole fish and higher value smoked trout. Limited international trade with trout was recorded in the UK in the period 2000-2014. Slightly higher but more stable levels of export were present in Spain. Of all countries, Denmark recorded the highest level of exports in terms of value, around half of which represented by smoked trout products. | + | Limited data on trout processing indicates that in the Spain and the UK trout undergoes small |

| + | amounts of processing, being marketed mostly as a fresh whole fish on the domestic market. Larger | ||

| + | size trout from the UK however is processed into a variety of value-added products. Denmark shows | ||

| + | the highest level of value-addition where smoked trout products occupy the largest share of trout | ||

| + | processing and export. In Italy, where the market has traditionally been for whole fresh fish, value- | ||

| + | added trout products increasingly gain prominence on the domestic market but exports continue to | ||

| + | be composed of whole fresh fish or fresh fillets. Turkey has focused on a combination of lower value | ||

| + | frozen whole fish and higher value smoked trout. Limited international trade with trout was | ||

| + | recorded in the UK in the period 2000-2014. Slightly higher but more stable levels of export were | ||

| + | present in Spain. Of all countries, Denmark recorded the highest level of exports in terms of value, | ||

| + | around half of which represented by smoked trout products. | ||

| − | Exports from Italy and Denmark are mainly to the EU whilst Spanish exports fresh trout are more limited to neighbouring countries. Turkey mainly exports whole frozen and smoked trout with Germany being as its largest market where it competes directly with significant amounts of smoked trout produced and exported from Denmark. | + | Exports from Italy and Denmark are mainly to the EU whilst Spanish exports fresh trout are more |

| + | limited to neighbouring countries. Turkey mainly exports whole frozen and smoked trout with | ||

| + | Germany being as its largest market where it competes directly with significant amounts of smoked | ||

| + | trout produced and exported from Denmark. | ||

| − | === Sea bass and sea bream === | + | ===Sea bass and sea bream=== |

| − | Sea bass and sea bream form a significant proportion of EU aquaculture output. Production and market demand is concentrated around the Mediterranean. Greece is the world’s largest producer of sea bream and second largest in sea bass after Turkey. However its production has stabilised and even slightly declined over recent years, likely due to market saturation. The same can be said about the Italian sector. The only growth in production was for sea bass in Spain. Spain grows fish to a larger size than Greece and achieves a better price on the international market. | + | Sea bass and sea bream form a significant proportion of EU aquaculture output. Production and |

| + | market demand is concentrated around the Mediterranean. Greece is the world’s largest producer | ||

| + | of sea bream and second largest in sea bass after Turkey. However its production has stabilised and | ||

| + | even slightly declined over recent years, likely due to market saturation. The same can be said about | ||

| + | the Italian sector. The only growth in production was for sea bass in Spain. Spain grows fish to a | ||

| + | larger size than Greece and achieves a better price on the international market. | ||

| − | Value chains for these species are less vertically integrated ‘upstream’ because of technical requirements in the reproduction and on-growing stages, resulting in the formation of specialised firms dealing with brood stock and juvenile production. However, the exact number of establishments in each link of the value chain for sea bass and sea bream could not be confirmed. | + | Value chains for these species are less vertically integrated ‘upstream’ because of technical |

| + | requirements in the reproduction and on-growing stages, resulting in the formation of specialised | ||

| + | firms dealing with brood stock and juvenile production. However, the exact number of | ||

| + | establishments in each link of the value chain for sea bass and sea bream could not be confirmed. | ||

| − | In Mediterranean markets sea bass and sea bream are mostly sold whole fresh with only limited processing, mainly filleting. This lack of specialisation means value chains are shorter than for other aquaculture species such as salmon. Thus there is little differentiation on product attributes apart from size, and there is a higher tendency for price swings due to overproduction. The largest share of production reaches consumers through modern retail supermarkets and hypermarkets purchasing directly from farms. | + | In Mediterranean markets sea bass and sea bream are mostly sold whole fresh with only limited |

| + | processing, mainly filleting. This lack of specialisation means value chains are shorter than for other | ||

| + | aquaculture species such as salmon. Thus there is little differentiation on product attributes apart | ||

| + | from size, and there is a higher tendency for price swings due to overproduction. The largest share | ||

| + | of production reaches consumers through modern retail supermarkets and hypermarkets purchasing | ||

| + | directly from farms. | ||

| − | Consumption of sea bream and sea bass produced in the EU is also largely confined to the EU. Italy, which produces relatively little sea bass and sea bream is the main market for Greek exports. Spain has closed its trade gap for sea bass in recent years steadily growing its production for domestic consumption and export. | + | Consumption of sea bream and sea bass produced in the EU is also largely confined to the EU. Italy, |

| + | which produces relatively little sea bass and sea bream is the main market for Greek exports. Spain | ||

| + | has closed its trade gap for sea bass in recent years steadily growing its production for domestic | ||

| + | consumption and export. | ||

| − | === Pangasius === | + | ===Pangasius=== |

| − | Commercial output of Vietnamese Pangasius catfish increased from 22,500 MT to more than 1 million MT between 1998 and 2007 whilst export values rose from $19.7 million to $0.98 billion. Total Vietnamese Pangasius production in 2008 (all of which originated from just nine Mekong Delta provinces) was estimated at 1.2 million MT, with an export value of approximately $1.45 billon. Although most farms are still smaller than 1ha, consolidation of the pangasius sector over the last decade has resulted in increasing domination by large-scale producers with concomitant shedding of small-scale producers. The remaining smaller operations are likely to contract-farm for lager vertically integrated farms. Most of the large-scale commercial farms are owned and operated by export companies while most of the small-scale are operated by individual households. International markets continue to pressure pangasius farmers to move towards more sustainable production practices. More than half of all production now originates from larger farms certified against third- party audit environmental and social standards (e.g. ASC, GLOBALgap, GAA). | + | Commercial output of Vietnamese Pangasius catfish increased from 22,500 MT to more than 1 |

| + | million MT between 1998 and 2007 whilst export values rose from $19.7 million to $0.98 billion. | ||

| + | Total Vietnamese Pangasius production in 2008 (all of which originated from just nine Mekong Delta | ||

| + | provinces) was estimated at 1.2 million MT, with an export value of approximately $1.45 billon. | ||

| + | Although most farms are still smaller than 1ha, consolidation of the pangasius sector over the last | ||

| + | decade has resulted in increasing domination by large-scale producers with concomitant shedding of | ||

| + | small-scale producers. The remaining smaller operations are likely to contract-farm for lager | ||

| + | vertically integrated farms. Most of the large-scale commercial farms are owned and operated by | ||

| + | export companies while most of the small-scale are operated by individual households. International | ||

| + | markets continue to pressure pangasius farmers to move towards more sustainable production | ||

| + | practices. More than half of all production now originates from larger farms certified against third- | ||

| + | party audit environmental and social standards (e.g. ASC, GLOBALgap, GAA). | ||

| − | There are currently more than 140 processing establishments certified to export to the EU, whilst in 2010 there were 291 pangasius exporters two-thirds of which had exports volumes of less than 1,000. The remaining larger exporters contribute almost 75% of the total export volume. The EU and USA are the most important markets for pangasius. Nearly all pangasius is exported as IQF and block-frozen fillets; less than 1% of export volume are value-added products. Controversially some EU supermarkets are known to retail de-frosted frozen as fresh fillets! The value of pangasius exports to the EU have decreased since 2008, possibly as a result of stronger competitiveness in the European whitefish market during the past few years, whilst negative perceptions of the product among certain buyers and consumers also present a challenge to the sector. | + | There are currently more than 140 processing establishments certified to export to the EU, whilst in |

| + | 2010 there were 291 pangasius exporters two-thirds of which had exports volumes of less than | ||

| + | 1,000. The remaining larger exporters contribute almost 75% of the total export volume. | ||

| + | The EU and USA are the most important markets for pangasius. Nearly all pangasius is exported as | ||

| + | IQF and block-frozen fillets; less than 1% of export volume are value-added products. Controversially | ||

| + | some EU supermarkets are known to retail de-frosted frozen as fresh fillets! | ||

| + | The value of pangasius exports to the EU have decreased since 2008, possibly as a result of stronger | ||

| + | competitiveness in the European whitefish market during the past few years, whilst negative | ||

| + | perceptions of the product among certain buyers and consumers also present a challenge to the | ||

| + | sector. | ||

| − | |||

== Introduction == | == Introduction == | ||

| Line 80: | Line 236: | ||

---- | ---- | ||

| − | This report constitutes Deliverable 3.1 ‘Description of value chains & input-output structure’ of the EU Horizon 2020 funded ‘Primefish’ Project (2015-2019; [ | + | This report constitutes Deliverable 3.1 ‘Description of value chains & input-output structure’ of the |

| + | EU Horizon 2020 funded ‘Primefish’ Project (2015-2019; [www.primefish.eu] ) assessing | ||

| + | competitiveness of European fisheries and aquaculture in global markets. Task 3.1 (Box 1) lead by | ||

| + | the University of Stirling, is conceived as the first of four inter-linked elements of a competitiveness | ||

| + | assessment based on the Global Value Chain Analysis Framework (see T3.4 Deliverable Protocol). | ||

| + | The other linked WP3 tasks are T3.1 value chain descriptions, T3.2 value chain governance, T3.3 | ||

| + | market based governance, T3.4 Industry dynamics, opportunities and threats and WP4 T4.1 product | ||

| + | innovation case studies. | ||

| − | Task 3.1: Description of value chains for species/country systems (see Table 1) from point-of-production to sale covering channel intermediaries to major European consumer markets (supply, processing distribution). Assessment of market dynamics i.e. form dominance of processing, wholesale and retail outlets, concentration and capitalization of the industry at various nodes. The input-output structures assessed for specified value-chains. | + | Task 3.1: Description of value chains for species/country systems (see |

| + | Table 1) from point-of-production to sale covering channel intermediaries to major European | ||

| + | consumer markets (supply, processing distribution). Assessment of market dynamics i.e. form | ||

| + | dominance of processing, wholesale and retail outlets, concentration and capitalization of the | ||

| + | industry at various nodes. The input-output structures assessed for specified value-chains. | ||

The report is a synthesis of 17 individual value-chain reports, | The report is a synthesis of 17 individual value-chain reports, | ||

''Table 1. Species-country value chain case studies and responsible institution'' | ''Table 1. Species-country value chain case studies and responsible institution'' | ||

| − | |||

{| class="wikitable" style="width: 100%;" | {| class="wikitable" style="width: 100%;" | ||

|- | |- | ||

| − | ! SN | + | !SN |

| − | ! Species | + | !Species |

| − | ! Country | + | !Country |

| − | ! Institution | + | !Institution |

| − | ! SN | + | !SN |

| − | ! Species | + | !Species |

| − | ! Country | + | !Country |

| − | ! Institution | + | !Institution |

|- | |- | ||

| − | | 1 | + | |1 |

| rowspan="3" | Salmon | | rowspan="3" | Salmon | ||

| − | | Norway | + | |Norway |

| − | | Kontali | + | |Kontali |

| − | | 10 | + | |10 |

| rowspan="4" | Cod | | rowspan="4" | Cod | ||

| − | | Canada | + | |Canada |

| − | | Memorial | + | |Memorial |

|- | |- | ||

| − | | 2 | + | |2 |

| − | | UK | + | |UK |

| − | | UoS | + | |UoS |

| − | | 11 | + | |11 |

| − | | UK | + | |UK |

| − | | UoS | + | |UoS |

|- | |- | ||

| − | | 3 | + | |3 |

| − | | Faroes | + | |Faroes |

| − | | Syntesa | + | |Syntesa |

| − | | 12 | + | |12 |

| − | | Norway | + | |Norway |

| − | | Nofima | + | |Nofima |

|- | |- | ||

| − | | 4 | + | |4 |

| rowspan="3" | Trout | | rowspan="3" | Trout | ||

| − | | Denmark | + | |Denmark |

| − | | Alborg | + | |Alborg |

| − | | 13 | + | |13 |

| − | | Iceland | + | |Iceland |

| − | | U. Iceland | + | |U. Iceland |

|- | |- | ||

| − | | 5 | + | |5 |

| − | | Italy | + | |Italy |

| − | | Parma | + | |Parma |

| − | | 14 | + | |14 |

| − | | rowspan="5" | Herring | + | | rowspan="5"| Herring |

| − | | Iceland | + | |Iceland |

| − | | MATIS/ U.Ice | + | |MATIS/ U.Ice |

|- | |- | ||

| − | | 6 | + | |6 |

| − | | Turkey | + | |Turkey |

| − | | Kontali | + | |Kontali |

| − | | 15 | + | |15 |

| − | | Norway | + | |Norway |

| − | | Nofima | + | |Nofima |

|- | |- | ||

| − | | 7 | + | |7 |

| rowspan="2" | Sea bass/bream | | rowspan="2" | Sea bass/bream | ||

| − | | Spain | + | |Spain |

| − | | CETMAR | + | |CETMAR |

| − | | 16 | + | |16 |

| − | | Germany | + | |Germany |

| − | | TTZ | + | |TTZ |

| + | |- | ||

| + | |8 | ||

| + | |Greece | ||

| + | |Kontali | ||

| + | |17 | ||

| + | |Denmark | ||

| + | |Alborg | ||

| + | |- | ||

| + | |9 | ||

| + | |Pangasius | ||

| + | |Viet Nam | ||

| + | |Nha Trang | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |} | ||

| + | |||

| + | |||

| + | All reports are based on publicly available data, including European catch/production as well | ||

| + | as import and export to and from the EU. The original source reports are available on the PrimeFish | ||

| + | website ( [http://www.primefish.eu/content/supply-chain-relations-and-regulation] ). | ||

| + | |||

| + | This report separately describes the main material flow in the supply chain (input-output structure) | ||

| + | for the six commodity species (or species groups) that are the focus of PrimeFish; four farmed and | ||

| + | two capture: (i) Atlantic Salmon, (ii) Rainbow Trout, (iii) European Sea bass (Dicentrarchus labrax) | ||

| + | and gilthead sea bream (Sparus aurata) (iv) Pangasius catfish (Pangasius hypophthalmus) (v) | ||

| + | Atllantic Cod (Gadus morhua) (vi) Atlantic Herring (Clupea herrengus). The latter two species are | ||

| + | selected as examples of demersal and pelagic fisheries. Sea bass and sea bass are treated as a single | ||

| + | group as almost perfect substitutes, sharing very similar production and post-harvest value-chain | ||

| + | characteristics. | ||

| + | |||

| + | The value chain mapping for each species covers catch and harvesting as well as value-addition | ||

| + | through the various stages of processing, distribution, retail and food-service, where data was | ||

| + | available. Results for each species (group) are synthesised across the following value-chain headings: | ||

| + | (a) farmed production or landings (b) imports (c) processing (d) export (e) consumption. Each | ||

| + | species-section then concludes with a summary of the main VC attributes with findings contrasted | ||

| + | between countries. | ||

| + | |||

| + | Results will form the sample frame/design for the subsequent micro level mapping of different | ||

| + | product categories of the chosen species for key market segments (niche and commodity, local, | ||

| + | European/international). | ||

| + | |||

| + | |||

| + | ==Atlantic cod== | ||

| + | |||

| + | ===Introduction=== | ||

| + | |||

| + | Four countries with particular relevance to Atlantic cod supply in Europe – Norway, Iceland, the UK | ||

| + | and Canada – will be analysed in the sections below. While Norway and Iceland are major global | ||

| + | suppliers of cod (see Table 2), the UK is a main consumer country in the EU, where significant level of | ||

| + | value addition also occurs. | ||

| + | |||

| + | ''Table 2. Top 10 producers in 2014 (quantity). Source: FAOSTAT 2016'' | ||

| + | {| class="wikitable" style="width: 100%" | ||

| + | |- | ||

| + | ! colspan="2" | Top 10 producers | ||

| + | ! Quantity (t) | ||

| + | ! Share of global production (%) | ||

| + | |- | ||

| + | |1 | ||

| + | |Norway | ||

| + | |473.6 | ||

| + | |34.5 | ||

| + | |- | ||

| + | |2 | ||

| + | |Russian Federation | ||

| + | |438.0 | ||

| + | |31.9 | ||

| + | |- | ||

| + | |3 | ||

| + | |Iceland | ||

| + | |237.8 | ||

| + | |17.3 | ||

| + | |- | ||

| + | |4 | ||

| + | |Faroe Islands | ||

| + | |36.4 | ||

| + | |2.7 | ||

|- | |- | ||

| − | | | + | |5 |

| − | | | + | |United Kingdom |

| − | | | + | |30.6 |

| − | | | + | |2.2 |

| − | |||

| − | |||

|- | |- | ||

| − | | 9 | + | |6 |

| − | | | + | |Greenland |

| − | | | + | |30.5 |

| − | | | + | |2.2 |

| − | | | + | |- |

| − | | | + | |7 |

| − | | | + | |Denmark |

| + | |22.3 | ||

| + | |1.6 | ||

| + | |- | ||

| + | |8 | ||

| + | |Spain | ||

| + | |18.7 | ||

| + | |1.4 | ||

| + | |- | ||

| + | |9 | ||

| + | |Poland | ||

| + | |18.3 | ||

| + | |1.3 | ||

| + | |- | ||

| + | |10 | ||

| + | |Germany | ||

| + | |15.2 | ||

| + | |1.1 | ||

| + | |- | ||

| + | |11 | ||

| + | |Canada | ||

| + | |13.0 | ||

| + | |0.9 | ||

| + | |- | ||

| + | | | ||

| + | |EU28 | ||

| + | |140.3 | ||

| + | |10.2 | ||

| + | |- | ||

| + | | | ||

| + | |World | ||

| + | |1373.5 | ||

| + | |100.0 | ||

|} | |} | ||

| − | + | In general, the EU is a small producer of cod, reliant on imports from main producer countries. As | |

| + | Table 3 reveals, the combined share of the EU20 in harvesting of cod only amounted to 10.2% in | ||

| + | 2014, while Norway and Iceland together produced more than half of the world production. | ||

| + | Currently, the influence of Canada on the EU market is very limited due to the small volume of cod | ||

| + | harvest. However, there is indication that the cod stocks may be exploitable again in the near future | ||

| + | which may mean that Canada could become a more significant supplier of cod to the EU in the | ||

| + | future. | ||

| + | |||

| + | ''Table 3. Production in PF countries (000 t). Source: FAOSTAT 2016'' | ||

| − | + | {| class="wikitable" style="width: 100%" | |

| + | ! | ||

| + | !2000 | ||

| + | !2001 | ||

| + | !2002 | ||

| + | !2003 | ||

| + | !2004 | ||

| + | !2005 | ||

| + | !2006 | ||

| + | !2007 | ||

| + | !2008 | ||

| + | !2009 | ||

| + | !2010 | ||

| + | !2011 | ||

| + | !2012 | ||

| + | !2013 | ||

| + | !2014 | ||

| + | !Change 2000 - 2014 | ||

| + | |- | ||

| + | ! scope="row" |World | ||

| + | |940 | ||

| + | |945 | ||

| + | |903 | ||

| + | |849 | ||

| + | |899 | ||

| + | |850 | ||

| + | |834 | ||

| + | |784 | ||

| + | |771 | ||

| + | |868 | ||

| + | |952 | ||

| + | |1052 | ||

| + | |1114 | ||

| + | |1359 | ||

| + | |1373 | ||

| + | |433 | ||

| + | |- | ||

| + | ! scope="row" |EU28 | ||

| + | |214 | ||

| + | |204 | ||

| + | |163 | ||

| + | |141 | ||

| + | |151 | ||

| + | |125 | ||

| + | |125 | ||

| + | |117 | ||

| + | |119 | ||

| + | |127 | ||

| + | |140 | ||

| + | |142 | ||

| + | |150 | ||

| + | |142 | ||

| + | |140 | ||

| + | |-74 | ||

| + | |- | ||

| + | ! scope="row" |Norway | ||

| + | |219 | ||

| + | |209 | ||

| + | |228 | ||

| + | |217 | ||

| + | |231 | ||

| + | |226 | ||

| + | |221 | ||

| + | |218 | ||

| + | |215 | ||

| + | |244 | ||

| + | |283 | ||

| + | |340 | ||

| + | |358 | ||

| + | |471 | ||

| + | |474 | ||

| + | |254 | ||

| + | |- | ||

| + | ! scope="row" |Iceland | ||

| + | |238 | ||

| + | |240 | ||

| + | |213 | ||

| + | |206 | ||

| + | |227 | ||

| + | |212 | ||

| + | |199 | ||

| + | |174 | ||

| + | |151 | ||

| + | |189 | ||

| + | |179 | ||

| + | |182 | ||

| + | |205 | ||

| + | |236 | ||

| + | |238 | ||

| + | |-1 | ||

| + | |- | ||

| + | ! scope="row" |UK | ||

| + | |42 | ||

| + | |33 | ||

| + | |32 | ||

| + | |22 | ||

| + | |21 | ||

| + | |20 | ||

| + | |21 | ||

| + | |19 | ||

| + | |19 | ||

| + | |23 | ||

| + | |26 | ||

| + | |23 | ||

| + | |26 | ||

| + | |29 | ||

| + | |31 | ||

| + | |-11 | ||

| + | |- | ||

| + | ! scope="row" |Canada | ||

| + | |46 | ||

| + | |40 | ||

| + | |35 | ||

| + | |23 | ||

| + | |25 | ||

| + | |26 | ||

| + | |27 | ||

| + | |27 | ||

| + | |27 | ||

| + | |20 | ||

| + | |17 | ||

| + | |13 | ||

| + | |11 | ||

| + | |11 | ||

| + | |13 | ||

| + | |-33 | ||

| + | |- | ||

| + | |} | ||

| − | + | ==Landings/supply== | |

| − | + | ===Iceland=== | |

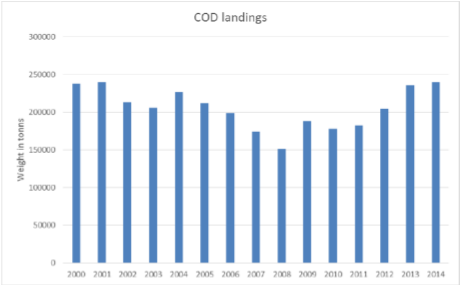

| − | + | Supply of materials is mainly landings from Icelandic boats fished within the Icelandic exclusive | |

| + | fisheries zone. There have been some fluctuations in cod catches for the period 2000-2014, but the | ||

| + | stock is quite strong now and catches in Icelandic waters have been over 200 thousand tonnes in | ||

| + | recent years. In 2014, cod landings totalled 237,455 t, 6.7% from the Barents Sea and 93.3% from | ||

| + | Icelandic waters, (see Figure 1). | ||

| − | + | [[File:d31_fig_1.png|center|Figure 1]] | |

| + | ''Figure 1. Cod landings in Iceland, LWE. Source: Statistics Iceland'' | ||

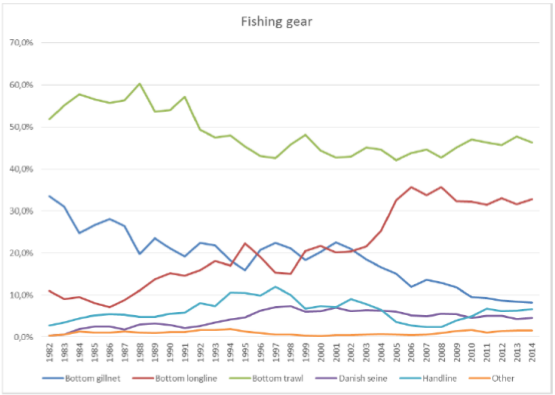

| − | + | In 2014, the majority of cod was landed by Icelandic owned trawlers (45%), long-liners (33%), gill- | |

| + | netters (8%) operating in Icelandic Exclusive fisheries zone and small proportion from the Barents | ||

| + | Sea. The proportion of cod landed by long line and gillnet has increased and declined to 33% and 8% | ||

| + | respectively from having equal shares of about 20% in 2000, Figure 2. This is due to an increase in | ||

| + | the demand for line caught fish as well as fresh fillets, which are of better quality when the fish is | ||

| + | line caught and command a higher market price. | ||

| − | + | [[File:d31_fig_2.png|center|Figure 2]] | |

| + | ''Figure 2. The total catch of cod by Icelandic boats by major fishing gear since 1982. Source: Statistics Iceland'' | ||

| + | |||

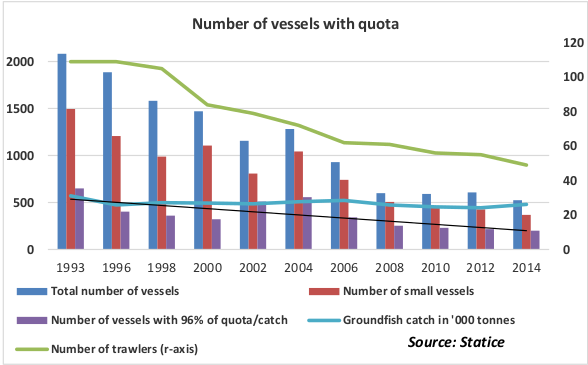

| + | The number of freeze trawlers has declined from 35 in 2000 to 15 in 2014, because of better | ||

| + | economic viability for fresh products, processed on land, high labour cost for freeze trawlers, higher | ||

| + | levy for freeze trawlers compared to fresh fish trawlers. | ||

| + | Figure 3 present the development in the Icelandic fleet from 1993 to 2014. Between early 1990s | ||

| + | and 2014 the number of all vessels has fallen by 60% - the number of trawler by half and medium | ||

| + | sized vessel by three quarters. | ||

| + | |||

| + | [[File:d31_fig_3.png|center|Figure 3]] | ||

| + | ''Figure 3. Development in the Icelandic fleet'' | ||

| + | |||

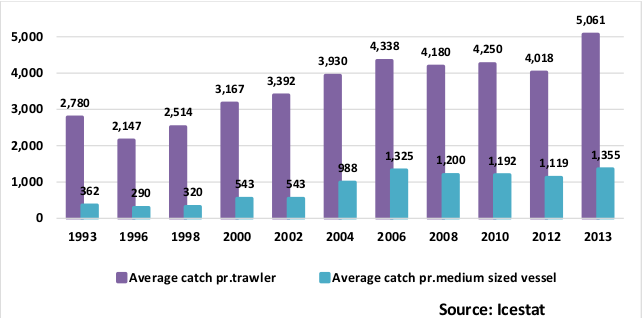

| + | From the introduction of the quota system the profitability of the sector has increased. The trend | ||

| + | has been that the companies are getting bigger and fewer. The 50 biggest companies in this sector | ||

| + | have around 87% of the total quota while ten the biggest have around half the quota. At the | ||

| + | beginning of the fishing year 2016/2017, which runs from September 1 st to August 31 st , the biggest | ||

| + | companies were HB Grandi with 10.9% of the combined catch share in all species, Samherji Iceland | ||

| + | with 6.2% and Thorbjorn with 5.1%. | ||

| + | |||

| + | In the same time as the number of vessel have declined the average catch per vessel have increased | ||

| + | as can been seen from Figure 4. Average catch per trawler have more than double from early 1990 | ||

| + | to 2013. In the category of medium size vessel, the average catch was nearly three times larger in | ||

| + | 2013 than in the 90s. | ||

| + | |||

| + | [[File:d31_fig_4.png|center|Figure 4]] | ||

| + | ''Figure 4. Average catch per vessel (tonnes)'' | ||

| + | |||

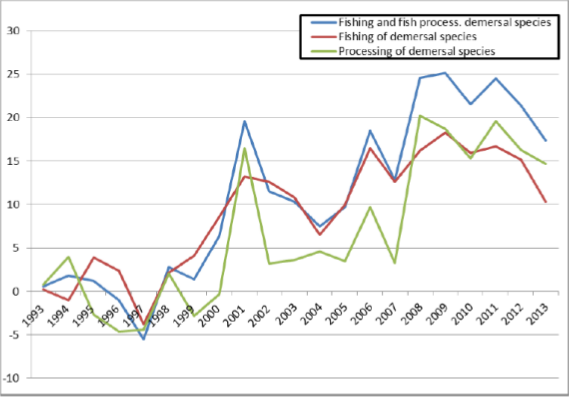

| + | Figure 5 shows the profitability of the consolidated industry, on average net profit of the industry | ||

| + | has been 6.1% of total revenues. Only in 1997 and 1999 did the industry lose money, 1.4% in 1997 | ||

| + | and 1.3% in 1999. The figure indicates as well, that the profitability of the industry has been | ||

| + | improving in recent years. Every year since 2001 the profit of the fishing industry as a whole has | ||

| + | been above 5% of revenues, but between 1993 and 2000 the profitability of the industry was never | ||

| + | above 5%. The best years were 2001, when the profit of the industry was 18.1% of revenues, and | ||

| + | 2006, when the profit was 16.9%. The reasons for the increased profitability of the industry are | ||

| + | mainly twofold, increased productivity and higher prices. | ||

| + | |||

| + | [[File:d31_fig_5.png|center|Figure 5]] | ||

| + | ''Figure 5. Net profit in fishing and fish processing, 1993-2013. Matis'' | ||

| + | |||

| + | ===Norway=== | ||

| + | |||

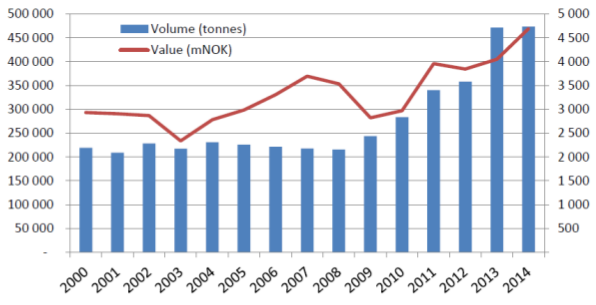

| + | Cod is the most important species in Norwegian commercial fisheries, with about 1/3-of total catch | ||

| + | value. The fleet fishing for cod is also the most numerous, with about 3 500 vessels. The Norwegian | ||

| + | catch of cod has been steadily increasing since 2008 and reached about 470,000 t in 2014, due to | ||

| + | favourable resource situation and TACs reaching all time high levels, Figure 6. Of this 98% of was | ||

| + | caught in the Barents Sea (ICES I) and the Norwegian Sea (ICES IIa) and within the waters of | ||

| + | Spitzbergen and bear Island (ICES IIb) and 78% of which from within the Norwegian EEZ. | ||

| + | |||

| + | [[File:d31_fig_6.png|center|Figure 6]] | ||

| + | ''Figure 6. Norwegian catch of cod (tonnes) and corresponding ex-vessel value (mNOK, in nominal prices), 2000-2014. Source: Norwegian Directorate of Fisheries and Statistics Norway'' | ||

| + | |||

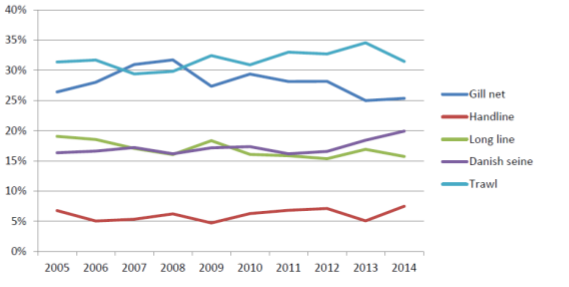

| + | Even though most demersal vessel catch cod as their main species (except for off shore conventional | ||

| + | vessels) most of them are involved in multispecies fisheries most often including saithe and haddock | ||

| + | as well. For many trawlers also shrimp is targeted. The most common gears used in this fishery in | ||

| + | 2014 is trawl (30 %), gill net (25 %), Danish seine (20 %), long line (16 %) and hand line (7 %), with | ||

| + | relatively stable development in the shares latter ten years, despite the mentioned doubling of the | ||

| + | catch from 2005-2014, Figure 7. | ||

| + | |||

| + | [[File:d31_fig_7.png|center|Figure 7]] | ||

| + | ''Figure 7. Gear use development in Norwegian cod catches, 2005-2014. Source: Norwegian Directorate of fisheries.'' | ||

| + | |||

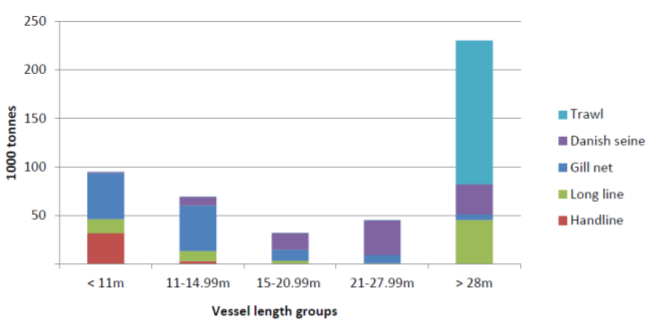

| + | The distribution of gears in fleet segments of different length – in which the division between off- | ||

| + | shore and coastal vessels traditionally have been 28 meters. Gill nets are the most employed gear | ||

| + | among smaller vessels (<15m) while trawl and long line (auto) dominate among the largest (off- | ||

| + | shore) vessels (>28m). Danish seine is the main gear among the larger coastal vessels (15-28m), | ||

| + | Figure 8. | ||

| + | |||

| + | [[File:d31_fig_8.png|center|Figure 8]] | ||

| + | ''Figure 8. Norwegian cod catch in 2014 by vessel length and gear use. Source: Norwegian Directorate of fisheries'' | ||

| + | |||

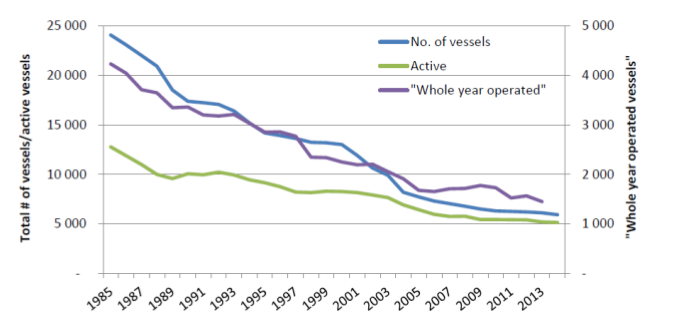

| + | The Norwegian fishing fleet has undergone vast changes in size the later 100 years, a development | ||

| + | pacing speed in recent years as resources have become more scarce, technology more effective and | ||

| + | – therefore – authorities have been forced to phase in regulations to secure it’s sustainability. Since | ||

| + | 1985 the fishing fleet (number of registered fishing vessels) is reduced by more than 3/4, and since | ||

| + | the start of the millennium by more than the half (- 54 %), Figure 9. While the quantities of cod | ||

| + | landed by the Norwegian fleet have been increasing, the fishing fleet has contracted during the last | ||

| + | 15 years, indicating increased productivity. | ||

| + | |||

| + | [[File:d31_fig_9.png|center|Figure 9]] | ||

| + | ''Figure 9. The Norwegian fishing fleet, 1985 – 2014; number of registered fishing vessels, active fishing vessels and whole year operated vessel. Source: Directorate of Fisheries, Norway'' | ||

| + | |||

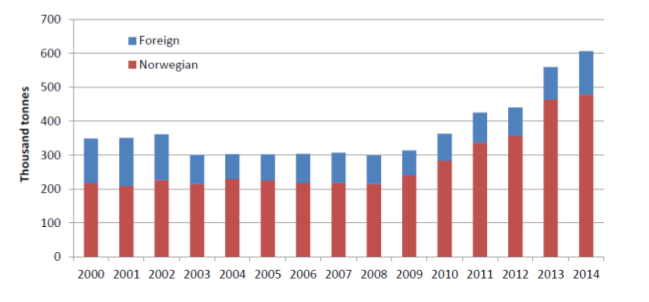

| + | The Norwegian first hand market does not only include cod landed by Norwegian vessel. The figure | ||

| + | below displays the Norwegian cod landings in the period 2000–2014, together with the cod landings | ||

| + | in Norway from foreign vessels, Figure 10. | ||

| + | |||

| + | [[File:d31_fig_10.png|center|Figure 10]] | ||

| + | ''Figure 10. Cod landings in Norway (LWE) from Norwegian and foreign vessels – 2000-2014. Source: Directorate of Fisheries, Norway'' | ||

| + | |||

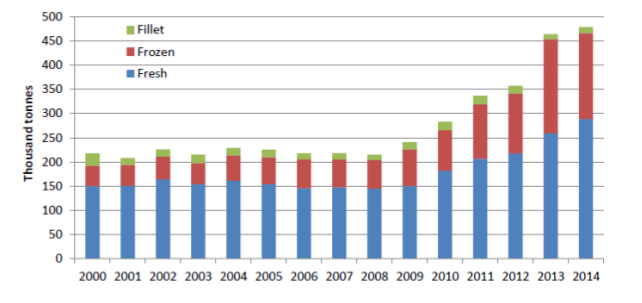

| + | The cod landings from Norwegian vessels in the period 2000–2014 are displayed with respect to the | ||

| + | state of the raw material; fresh or frozen or on-board processed (i.e. cod fillets). This has of course | ||

| + | great significance for which value chains the raw material can enter (and which processing facilities | ||

| + | can utilise the cod), Figure 11. Until 2009, with stable quotas, the share of landings landed frozen | ||

| + | was stable at about 27–33 per cent (fillets included) of the total. In later years (after 2008) the share | ||

| + | of frozen landings has increased considerably. While total landings increased with 120% in the | ||

| + | period 2008–2014, frozen landings increased by 200 per cent, fillets increased by 15 per cent while | ||

| + | the volume of fresh cod landings were doubled. | ||

| + | |||

| + | [[File:d31_fig_11.png|center|Figure 11]] | ||

| + | ''Figure 11. Norwegian cod landings – fresh, frozen and fillets – 2000-2014, LWE. Source: Directorate of Fisheries.'' | ||

| + | |||

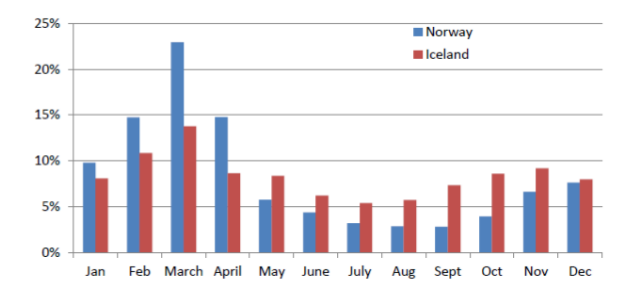

| + | One striking characteristic with Norwegian cod landings is the seasonality of landings, especially | ||

| + | when comparing with Iceland, Figure 12 . Large quantities of the cod are caught during the first | ||

| + | months of the year. In general, this is explained by the spawning migration of the cod, where it | ||

| + | migrates from the Barents Sea to the Lofoten islands. In addition the fleet composition and quota | ||

| + | distribution, where large quantities are reserved for the coastal vessels, vouches for this result. | ||

| + | Below, the monthly catch shares of cod are illustrated for the period 2000–2014, and highlighted | ||

| + | against the same in Iceland. With a value chain that demand a high degree of continuity in supply, | ||

| + | too big seasonality in supply will represent a great obstacle for the chain. It can be argued that the | ||

| + | global trade of fish today, led by multinational retail chains, is characterised by the need for | ||

| + | continuous supply. | ||

| + | |||

| + | [[File:d31_fig_12.png|center|Figure 12]] | ||

| + | ''Figure 12. Seasonality in landings – monthly catches as share of total – Norway and Iceland, weighted average. Source: Directorate of Fisheries and Statistics Iceland'' | ||

| + | |||

| + | ===Canada=== | ||

| + | |||

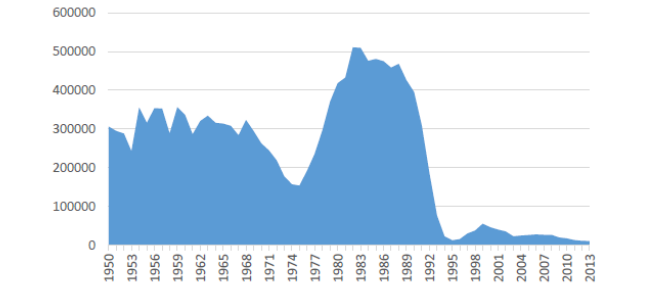

| + | Historically, the Canadian cod fishery has played a major role in the global supply of white fish. | ||

| + | Landings peaked at 810,000 t in 1968, 80% of which by harvested by foreign vessels. Landings of cod | ||

| + | in Canada by the Canadian fleet have historically been above 300,000 t /year. However, due to | ||

| + | overfishing the fishery collapsed in early 1990s and moratorium was announced on the commercial | ||

| + | northern cod fishery. Since then landings have been below 50,000 t/ year, Figure 13. Canadian | ||

| + | landings of cod in 2012 were 12,263 t or 1.1% of the global landings of cod for the same year. | ||

| + | |||

| + | [[File:d31_fig_13.png|center|Figure 13]] | ||

| + | ''Figure 13. Atlantic cod landings in Canada, tonnes LWE. Source: FAO 2014'' | ||

| + | |||

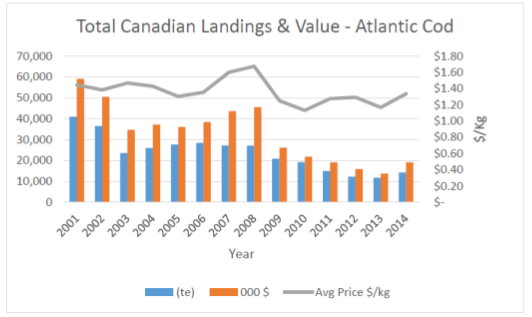

| + | Between 2001 and 2014 total landings and value have decreased from 40,913 t (€41 million) to | ||

| + | 14,261 t (€12 million). Despite that the average price has remained relatively stable at about | ||

| + | €0.90/kg over the same period, Figure 14. | ||

| + | |||

| + | [[File:d31_fig_14.png|center|Figure 14]] | ||

| + | ''Figure 14. Total landings and value (in Canadian $) of Atlantic cod in Canada (DFO 2015)'' | ||

| + | |||

| + | About 70% of Atlantic cod currently harvested in Canada is captured in Newfoundland and Labrador. | ||

| + | In 2015, 71% (6,493 t) of the total cod harvest was landed by boats of length <35’ (10 m), underlining | ||

| + | the current small-scale nature of the fishery (Table 4). | ||

| + | |||

| + | ''Table 4. Newfoundland Atlantic cod landings by vessel length. Source: Fisheries and Oceans Canada.'' | ||

| + | {| class="wikitable" style="width: 100%" | ||

| + | |- | ||

| + | ! Vessel length | ||

| + | ! Landed RW Cod (Kg) | ||

| + | ! % Landed by Vessel type (Length) | ||

| + | ! # of Vessels | ||

| + | ! Kg/Vessel | ||

| + | |- | ||

| + | | < 35' | ||

| + | | 6,493,372 | ||

| + | | 71% | ||

| + | | 2,212 | ||

| + | | 2,936 | ||

| + | |- | ||

| + | | 35-44' | ||

| + | | 1,877,298 | ||

| + | | 20% | ||

| + | | 300 | ||

| + | | 6,258 | ||

| + | |- | ||

| + | | 45-54' | ||

| + | | 427,566 | ||

| + | | 5% | ||

| + | | 38 | ||

| + | | 11,252 | ||

| + | |- | ||

| + | | 55-64' | ||

| + | | 394,399 | ||

| + | | 4% | ||

| + | | 50 | ||

| + | | 7,888 | ||

| + | |- | ||

| + | ! scope="row" | Total | ||

| + | | 9,192,635 | ||

| + | | 100% | ||

| + | | 2600 | ||

| + | | 3,536 | ||

| + | |} | ||

| − | |||

== Conclusion == | == Conclusion == | ||

| Line 191: | Line 785: | ||

---- | ---- | ||

| − | |||

== Bibliography == | == Bibliography == | ||

| Line 197: | Line 790: | ||

---- | ---- | ||

| − | |||

| − | == Appendix 1 == | + | == Appendix 1== |

---- | ---- | ||

Revision as of 19:29, 13 March 2018

Contents

Deliverable D3.1 - Report on description of value chains and input-output structure

Summary

This report describes the main material flow in the supply chain (input-output structure) for the six commodity species (or species groups) that are the focus of PrimeFish; four farmed and two capture: (i) Atlantic Salmon, (ii) Rainbow Trout, (iii) European Sea bass (Dicentrarchus labrax) and gilthead sea bream (Sparus aurata) (iv) Pangasius catfish (Pangasius hypophthalmus) (v) Atlantic Cod (Gadus morhua) (vi) Atlantic Herring (Clupea herrengus). The latter two species are selected as examples of demersal and pelagic fisheries. Sea bass and sea bass are treated as a single group as almost perfect substitutes, sharing very similar production and post-harvest value-chain characteristics. The report is a synthesis of 17 individual value-chain reports. The report is based on publicly available data, and for each species covers (a) farmed production or landings (b) imports (c) processing (d) export (e) consumption.

Atlantic cod

Iceland and Norway are two of the world’s largest suppliers of cod, having access to abundant cod stocks in Norwegian and Icelandic waters. The catches have been growing over the last few years in in both Iceland and Norway. On the other hand, the UK has a small contribution to global catches even though quotas are slightly increasing. Since the collapse of the Canadian stocks of cod in early ‘90’s Canada has lost its global presence and its current landings represent a minor share of the global production of cod. There are indications that cod stocks in Canada may be recovering. In all countries there is a trend to consolidation in the industry towards fewer and larger vessels and companies. The bulk of the cod landings in Norway, Iceland and the UK are delivered by relatively large vessels in contrast Canada where boat of less than 10m in length still predominate. In Iceland there has been a shift from use of gillnets to trawl and long line. This can be explained to some extent by the better quality of product resulting from the latter methods of fishing. Consistent with this change, over recent years Iceland has specialised in production and export of fresh fillets with high quality assurance.

A large and increasing proportion of the Norwegian catch is landed frozen, while in Iceland the number of freeze trawlers have declined with a concomitant shift towards fresh landings and processing on land. The UK fleet lands its catches of cod whole fresh or gutted and a significant proportion of landings originate from third-country vessels. Canadian catches of cod are landed exclusively as fresh fish, destined primarily for primary processing and local retailing. Compared to Norway, Iceland benefits from lower variability in landings throughout the year which is an advantage when it comes to supplying multiple retail chains requiring continuity and predictability of supply.

With the exception of some foreign vessel landings in Norway, there is negligible import of cod to Iceland or Norway associated with their successful management of well-endowed fisheries. The UK on the other hand is a major market and importer of cod products, particularly frozen fillets which represent the highest share of imports. The main exporting countries to the UK are Iceland, China and Norway. Due to limited domestic supply, Atlantic cod is also imported into Canada for further processing and re-export and to supplement domestic markets though imports have declined over the last decade.

Cod processing in Norway, Iceland and the UK has undergone significant consolidation resulting in fewer but larger companies. In Iceland the consolidation process has been accompanied by increased investment and modernisation resulting in increased productivity, product quality and profitability.

In Iceland cod is predominantly processed into fresh fillets for export and the share of salted and dried products has declined over time. In Norway, by contrast a significant proportion of cod is still processed into dried and/or salted fish as well as frozen whole. The majority of UK companies processing cod specialise in secondary processing, primarily of imported frozen fillets into value added products. The Canadian processing sector consists of mainly small-scale primary processing companies, reliant partly on imports and partly on domestic landings.

The vast majority of the cod landed and processed in Iceland and Norway is exported. The main export markets for cod from Iceland are within the EU. Similarly, large proportion of the Norwegian exports target EU countries. In Norway the share of unprocessed whole gutted cod has increased in the last few years, particularly to China and Lithuania, where the fish undergoes further processing. Norway is also a main supplier of salted and dried fish to Portugal, which represents the largest market for these products. Exports from the UK are minor compared to Iceland and Norway and target mainly other EU member states. Canadian exports are also small and declining with the US and UK the major destinations.

Detailed publicly available data on retail and consumption is most readily accessible in the UK, where cod is one of the three most consumed species, along with salmon and tuna. The majority of cod sales in the UK are in the retail sector as fresh or frozen products. A large proportion of cod is also sold through food service outlets including traditional ‘fish and chip’ shops. In Iceland cod for the domestic market is mainly retailed through fishmongers and Horeca.

Atlantic herring

In all study countries catches of herring declined over the last decade reflected in lower quotas. Herring is currently targeted by the largest vessels in the national fleets of the countries examined here (>40m length). A trend of consolidation of vessel and quota ownership for pelagic species occurred across all main producer countries. This trend is likely driven by economies of scale which fishing for pelagic species benefits from together with the relatively low market prices commanded by pelagic species. Purse seine was the main gear type used in Norway, Denmark and the UK, while Iceland relied mostly on trawling gears.

The great majority of landings across countries was destined for human consumption and this share has been growing over time. In all countries most herring was processed by a few large companies, often vertically integrated; also owning multi-species pelagic fishing vessels. Thus the level of concentration in processing has been mirrored in the capture sector. Denmark and Germany undertook most of the secondary processing, while main producer countries (Iceland and Norway) exported unprocessed or minimally processed herring products. The share of value added herring products from Iceland has declined in favour of low value added, filets and frozen fish, the production of which benefits from economies of scale.

Germany and Denmark with large consumer markets and processing capacity import substantial amounts of herring. Imports to Norway and the UK were mostly low value fresh fish landed in those countries by foreign vessels. A small quantity of value-added herring imports in Iceland is directed to the domestic consumption market.

Almost the entire landings of herring in Iceland and Norway were destined for export. The main markets have historically been Eastern Europe and Russia. However, these markets have recently become less important due to political reasons. Denmark supplies Central and Northern European countries while the UK supplies Western Europe and African countries.

Atlantic salmon

Salmon production around the world has steadily matured into an industry dominated by vertically and horizontally integrated multinational companies. Among the three countries examined here, the Faroese salmon industry is by far the most consolidated followed by Scotland and Norway.

Consolidation has been accompanied increased investment and consequent improvements in productivity and competitiveness. Mergers and acquisitions have played a central role in sector consolidation as increasingly stringent environmental regulations have limited ‘organic’ expansion in more sheltered inshore sites European and other countries.

Environmental conditions in the Faroes, notably water temperature are more stable throughout the year than in Norway or Scotland. Norwegian and Scottish production has stabilised following 3 decades of rapid growth, while in the Faroes, growth continues. In all three countries 'Boom and bust cycles', linked to overproduction and falling prices appear to have moderated with industry consolidation.

Most processing is limited to gutting, freezing and filleting in the Faroes and Norway due to export tariffs for value-added products linked to the countries membership of the EAA but not the EU. A large share of UK production is processed into value-added goods where a large domestic market exists, salmon being the top retail seafood. The UK also imports significant amounts of salmon from Non-EU countries especially the Faroes and Norway which is mainly farmed for export.

Although the UK has seen significant export growth, most export production originates from non-EU countries. Faroese exports have recorded strong growth in the German, UK, USA, Chinese and particularly Russian market (the Faroes were excluded from the ban on imports from western countries introduced in 2014). Norway has achieved strong growth in exports to the EU, which also accounts for the vast majority of its exports. The Faroes specialise in production of ‘above-average’ sized salmon commanding a better price than typical Norwegian and Scottish salmon. However, Scotland achieves a premium for its ‘Label Rouge’ certified premium quality salmon (around 8% of production) further enhanced by ‘Scottish’ origin branding.

Rainbow trout

Production of rainbow trout in Spain and the UK has declined in the period 2000-2014 to reach similar volumes of around 15,000 t in both countries. UK production is predominantly of table-size trout. Only the largest company is progressively transitioning to marine cage farming. Production in Spain is also mainly of table-size trout. Denmark and Italy both exhibit relatively stable production trends, though Denmark has increased the share of production originating from modern recirculation systems (RAS). Around one quarter of Danish output also originates from marine cages where fish are grown to a larger size. Turkey farms more trout than the other four study countries combined and only here has output increased substantively over the last decade, though growth has also flattened here over the last few years. Most output comes from land-based pond and raceway systems where fish are grown to around 300g. Larger export-orientated companies are attempting to farm larger sizes in order to avoid tariffs on import of table size trout into the EU. The number of companies involved in trout production in all EU countries has been decreasing. This is part of an overall European-wide trend for consolidation in aquaculture. In the UK less than 10 companies account for more than half of the domestic trout production, while the Danish sector has shown an increased output per farm due to growing productivity and increased capacity. In Turkey trout aquaculture is still composed of a large number of small owner-operated companies, however with increasing presence of integrated export-oriented companies.

Limited data on trout processing indicates that in the Spain and the UK trout undergoes small amounts of processing, being marketed mostly as a fresh whole fish on the domestic market. Larger size trout from the UK however is processed into a variety of value-added products. Denmark shows the highest level of value-addition where smoked trout products occupy the largest share of trout processing and export. In Italy, where the market has traditionally been for whole fresh fish, value- added trout products increasingly gain prominence on the domestic market but exports continue to be composed of whole fresh fish or fresh fillets. Turkey has focused on a combination of lower value frozen whole fish and higher value smoked trout. Limited international trade with trout was recorded in the UK in the period 2000-2014. Slightly higher but more stable levels of export were present in Spain. Of all countries, Denmark recorded the highest level of exports in terms of value, around half of which represented by smoked trout products.

Exports from Italy and Denmark are mainly to the EU whilst Spanish exports fresh trout are more limited to neighbouring countries. Turkey mainly exports whole frozen and smoked trout with Germany being as its largest market where it competes directly with significant amounts of smoked trout produced and exported from Denmark.

Sea bass and sea bream

Sea bass and sea bream form a significant proportion of EU aquaculture output. Production and market demand is concentrated around the Mediterranean. Greece is the world’s largest producer of sea bream and second largest in sea bass after Turkey. However its production has stabilised and even slightly declined over recent years, likely due to market saturation. The same can be said about the Italian sector. The only growth in production was for sea bass in Spain. Spain grows fish to a larger size than Greece and achieves a better price on the international market.

Value chains for these species are less vertically integrated ‘upstream’ because of technical requirements in the reproduction and on-growing stages, resulting in the formation of specialised firms dealing with brood stock and juvenile production. However, the exact number of establishments in each link of the value chain for sea bass and sea bream could not be confirmed.

In Mediterranean markets sea bass and sea bream are mostly sold whole fresh with only limited processing, mainly filleting. This lack of specialisation means value chains are shorter than for other aquaculture species such as salmon. Thus there is little differentiation on product attributes apart from size, and there is a higher tendency for price swings due to overproduction. The largest share of production reaches consumers through modern retail supermarkets and hypermarkets purchasing directly from farms.

Consumption of sea bream and sea bass produced in the EU is also largely confined to the EU. Italy, which produces relatively little sea bass and sea bream is the main market for Greek exports. Spain has closed its trade gap for sea bass in recent years steadily growing its production for domestic consumption and export.

Pangasius