Difference between revisions of "Deliverable 3.1"

Jacandrade (talk | contribs) |

Jacandrade (talk | contribs) |

||

| Line 398: | Line 398: | ||

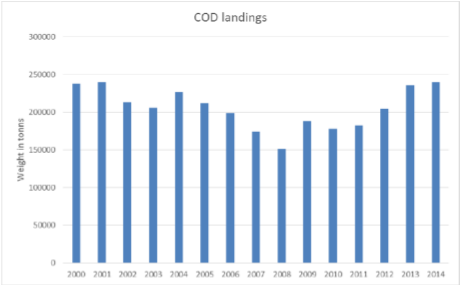

Supply of materials is mainly landings from Icelandic boats fished within the Icelandic exclusive fisheries zone. There have been some fluctuations in cod catches for the period 2000-2014, but the stock is quite strong now and catches in Icelandic waters have been over 200 thousand tonnes in recent years. In 2014, cod landings totalled 237,455 t, 6.7% from the Barents Sea and 93.3% from Icelandic waters, (see Figure 1). | Supply of materials is mainly landings from Icelandic boats fished within the Icelandic exclusive fisheries zone. There have been some fluctuations in cod catches for the period 2000-2014, but the stock is quite strong now and catches in Icelandic waters have been over 200 thousand tonnes in recent years. In 2014, cod landings totalled 237,455 t, 6.7% from the Barents Sea and 93.3% from Icelandic waters, (see Figure 1). | ||

| − | [[File: | + | [[File:D31 fig 1.png|center|Figure 1]] ''Figure 1. Cod landings in Iceland, LWE. Source: Statistics Iceland'' |

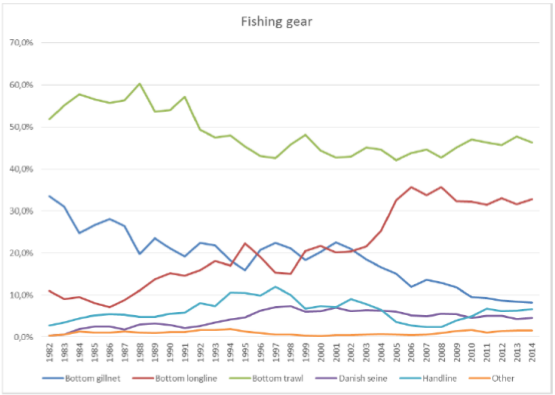

In 2014, the majority of cod was landed by Icelandic owned trawlers (45%), long-liners (33%), gill- netters (8%) operating in Icelandic Exclusive fisheries zone and small proportion from the Barents Sea. The proportion of cod landed by long line and gillnet has increased and declined to 33% and 8% respectively from having equal shares of about 20% in 2000, Figure 2. This is due to an increase in the demand for line caught fish as well as fresh fillets, which are of better quality when the fish is line caught and command a higher market price. | In 2014, the majority of cod was landed by Icelandic owned trawlers (45%), long-liners (33%), gill- netters (8%) operating in Icelandic Exclusive fisheries zone and small proportion from the Barents Sea. The proportion of cod landed by long line and gillnet has increased and declined to 33% and 8% respectively from having equal shares of about 20% in 2000, Figure 2. This is due to an increase in the demand for line caught fish as well as fresh fillets, which are of better quality when the fish is line caught and command a higher market price. | ||

| − | [[File: | + | [[File:D31 fig 2.png|center|Figure 2]] ''Figure 2. The total catch of cod by Icelandic boats by major fishing gear since 1982. Source: Statistics Iceland'' |

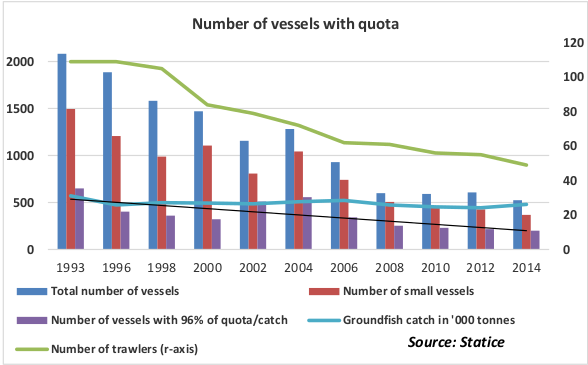

The number of freeze trawlers has declined from 35 in 2000 to 15 in 2014, because of better economic viability for fresh products, processed on land, high labour cost for freeze trawlers, higher levy for freeze trawlers compared to fresh fish trawlers. Figure 3 present the development in the Icelandic fleet from 1993 to 2014. Between early 1990s and 2014 the number of all vessels has fallen by 60% - the number of trawler by half and medium sized vessel by three quarters. | The number of freeze trawlers has declined from 35 in 2000 to 15 in 2014, because of better economic viability for fresh products, processed on land, high labour cost for freeze trawlers, higher levy for freeze trawlers compared to fresh fish trawlers. Figure 3 present the development in the Icelandic fleet from 1993 to 2014. Between early 1990s and 2014 the number of all vessels has fallen by 60% - the number of trawler by half and medium sized vessel by three quarters. | ||

| − | [[File: | + | [[File:D31 fig 3.png|center|Figure 3]] ''Figure 3. Development in the Icelandic fleet'' |

From the introduction of the quota system the profitability of the sector has increased. The trend has been that the companies are getting bigger and fewer. The 50 biggest companies in this sector have around 87% of the total quota while ten the biggest have around half the quota. At the beginning of the fishing year 2016/2017, which runs from September 1 st to August 31 st , the biggest companies were HB Grandi with 10.9% of the combined catch share in all species, Samherji Iceland with 6.2% and Thorbjorn with 5.1%. | From the introduction of the quota system the profitability of the sector has increased. The trend has been that the companies are getting bigger and fewer. The 50 biggest companies in this sector have around 87% of the total quota while ten the biggest have around half the quota. At the beginning of the fishing year 2016/2017, which runs from September 1 st to August 31 st , the biggest companies were HB Grandi with 10.9% of the combined catch share in all species, Samherji Iceland with 6.2% and Thorbjorn with 5.1%. | ||

| Line 412: | Line 412: | ||

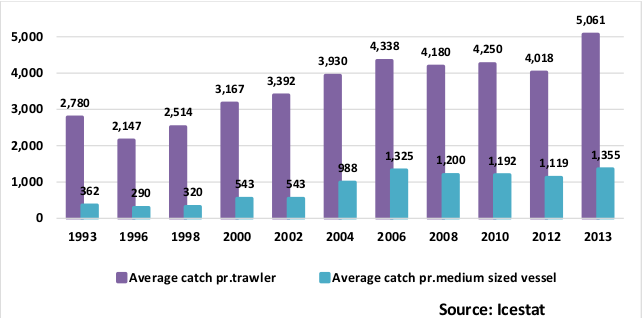

In the same time as the number of vessel have declined the average catch per vessel have increased as can been seen from Figure 4. Average catch per trawler have more than double from early 1990 to 2013. In the category of medium size vessel, the average catch was nearly three times larger in 2013 than in the 90s. | In the same time as the number of vessel have declined the average catch per vessel have increased as can been seen from Figure 4. Average catch per trawler have more than double from early 1990 to 2013. In the category of medium size vessel, the average catch was nearly three times larger in 2013 than in the 90s. | ||

| − | [[File: | + | [[File:D31 fig 4.png|center|Figure 4]] ''Figure 4. Average catch per vessel (tonnes)'' |

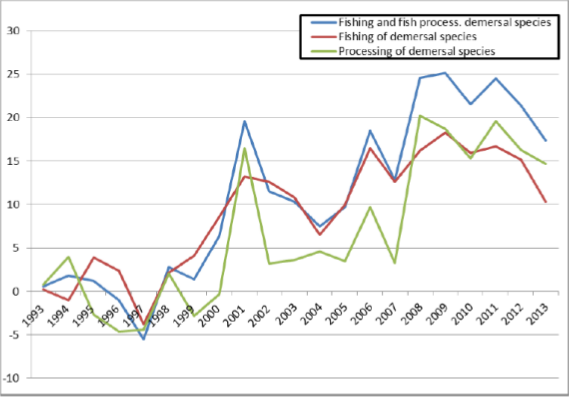

Figure 5 shows the profitability of the consolidated industry, on average net profit of the industry has been 6.1% of total revenues. Only in 1997 and 1999 did the industry lose money, 1.4% in 1997 and 1.3% in 1999. The figure indicates as well, that the profitability of the industry has been improving in recent years. Every year since 2001 the profit of the fishing industry as a whole has been above 5% of revenues, but between 1993 and 2000 the profitability of the industry was never above 5%. The best years were 2001, when the profit of the industry was 18.1% of revenues, and 2006, when the profit was 16.9%. The reasons for the increased profitability of the industry are mainly twofold, increased productivity and higher prices. | Figure 5 shows the profitability of the consolidated industry, on average net profit of the industry has been 6.1% of total revenues. Only in 1997 and 1999 did the industry lose money, 1.4% in 1997 and 1.3% in 1999. The figure indicates as well, that the profitability of the industry has been improving in recent years. Every year since 2001 the profit of the fishing industry as a whole has been above 5% of revenues, but between 1993 and 2000 the profitability of the industry was never above 5%. The best years were 2001, when the profit of the industry was 18.1% of revenues, and 2006, when the profit was 16.9%. The reasons for the increased profitability of the industry are mainly twofold, increased productivity and higher prices. | ||

| − | [[File: | + | [[File:D31 fig 5.png|center|Figure 5]] ''Figure 5. Net profit in fishing and fish processing, 1993-2013. Matis'' |

==== Norway ==== | ==== Norway ==== | ||

| Line 422: | Line 422: | ||

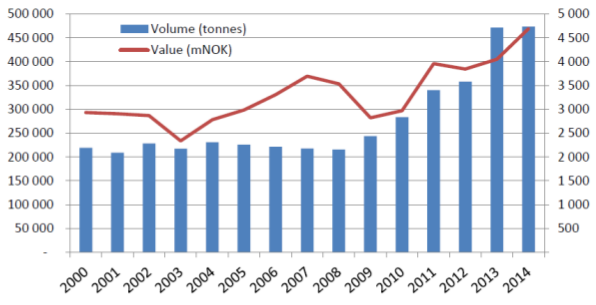

Cod is the most important species in Norwegian commercial fisheries, with about 1/3-of total catch value. The fleet fishing for cod is also the most numerous, with about 3 500 vessels. The Norwegian catch of cod has been steadily increasing since 2008 and reached about 470,000 t in 2014, due to favourable resource situation and TACs reaching all time high levels, Figure 6. Of this 98% of was caught in the Barents Sea (ICES I) and the Norwegian Sea (ICES IIa) and within the waters of Spitzbergen and bear Island (ICES IIb) and 78% of which from within the Norwegian EEZ. | Cod is the most important species in Norwegian commercial fisheries, with about 1/3-of total catch value. The fleet fishing for cod is also the most numerous, with about 3 500 vessels. The Norwegian catch of cod has been steadily increasing since 2008 and reached about 470,000 t in 2014, due to favourable resource situation and TACs reaching all time high levels, Figure 6. Of this 98% of was caught in the Barents Sea (ICES I) and the Norwegian Sea (ICES IIa) and within the waters of Spitzbergen and bear Island (ICES IIb) and 78% of which from within the Norwegian EEZ. | ||

| − | [[File: | + | [[File:D31 fig 6.png|center|Figure 6]] ''Figure 6. Norwegian catch of cod (tonnes) and corresponding ex-vessel value (mNOK, in nominal prices), 2000-2014. Source: Norwegian Directorate of Fisheries and Statistics Norway'' |

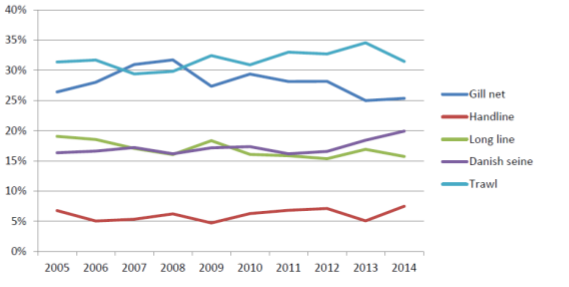

Even though most demersal vessel catch cod as their main species (except for off shore conventional vessels) most of them are involved in multispecies fisheries most often including saithe and haddock as well. For many trawlers also shrimp is targeted. The most common gears used in this fishery in 2014 is trawl (30 %), gill net (25 %), Danish seine (20 %), long line (16 %) and hand line (7 %), with relatively stable development in the shares latter ten years, despite the mentioned doubling of the catch from 2005-2014, Figure 7. | Even though most demersal vessel catch cod as their main species (except for off shore conventional vessels) most of them are involved in multispecies fisheries most often including saithe and haddock as well. For many trawlers also shrimp is targeted. The most common gears used in this fishery in 2014 is trawl (30 %), gill net (25 %), Danish seine (20 %), long line (16 %) and hand line (7 %), with relatively stable development in the shares latter ten years, despite the mentioned doubling of the catch from 2005-2014, Figure 7. | ||

| − | [[File: | + | [[File:D31 fig 7.png|center|Figure 7]] ''Figure 7. Gear use development in Norwegian cod catches, 2005-2014. Source: Norwegian Directorate of fisheries.'' |

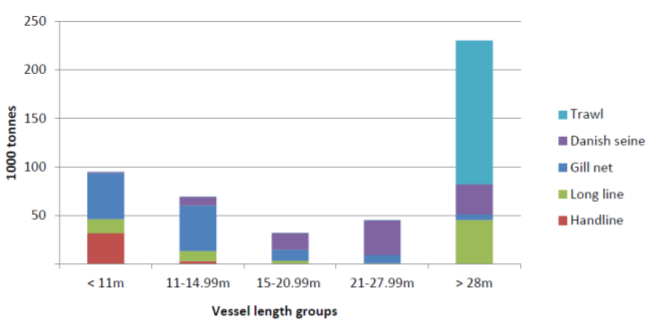

The distribution of gears in fleet segments of different length – in which the division between off- shore and coastal vessels traditionally have been 28 meters. Gill nets are the most employed gear among smaller vessels (<15m) while trawl and long line (auto) dominate among the largest (off- shore) vessels (>28m). Danish seine is the main gear among the larger coastal vessels (15-28m), Figure 8. | The distribution of gears in fleet segments of different length – in which the division between off- shore and coastal vessels traditionally have been 28 meters. Gill nets are the most employed gear among smaller vessels (<15m) while trawl and long line (auto) dominate among the largest (off- shore) vessels (>28m). Danish seine is the main gear among the larger coastal vessels (15-28m), Figure 8. | ||

| − | [[File: | + | [[File:D31 fig 8.png|center|Figure 8]] ''Figure 8. Norwegian cod catch in 2014 by vessel length and gear use. Source: Norwegian Directorate of fisheries'' |

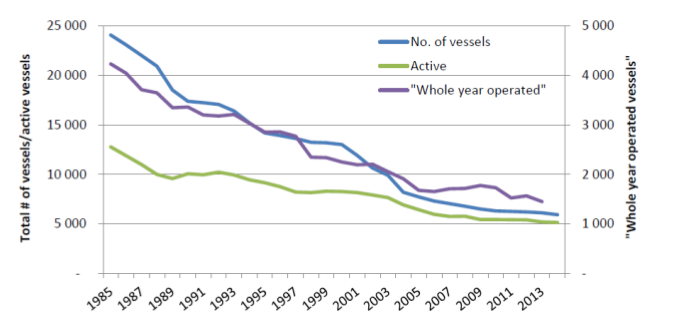

The Norwegian fishing fleet has undergone vast changes in size the later 100 years, a development pacing speed in recent years as resources have become more scarce, technology more effective and – therefore – authorities have been forced to phase in regulations to secure it’s sustainability. Since 1985 the fishing fleet (number of registered fishing vessels) is reduced by more than 3/4, and since the start of the millennium by more than the half (- 54 %), Figure 9. While the quantities of cod landed by the Norwegian fleet have been increasing, the fishing fleet has contracted during the last 15 years, indicating increased productivity. | The Norwegian fishing fleet has undergone vast changes in size the later 100 years, a development pacing speed in recent years as resources have become more scarce, technology more effective and – therefore – authorities have been forced to phase in regulations to secure it’s sustainability. Since 1985 the fishing fleet (number of registered fishing vessels) is reduced by more than 3/4, and since the start of the millennium by more than the half (- 54 %), Figure 9. While the quantities of cod landed by the Norwegian fleet have been increasing, the fishing fleet has contracted during the last 15 years, indicating increased productivity. | ||

| − | [[File: | + | [[File:D31 fig 9.png|center|Figure 9]] ''Figure 9. The Norwegian fishing fleet, 1985 – 2014; number of registered fishing vessels, active fishing vessels and whole year operated vessel. Source: Directorate of Fisheries, Norway'' |

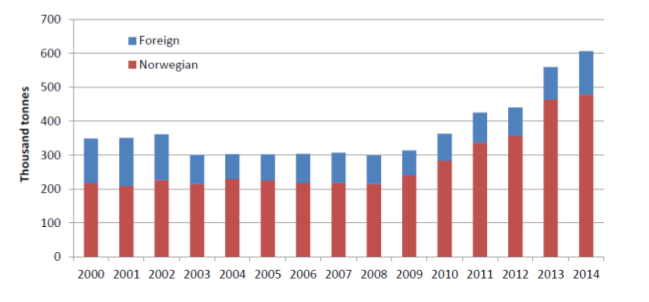

The Norwegian first hand market does not only include cod landed by Norwegian vessel. The figure below displays the Norwegian cod landings in the period 2000–2014, together with the cod landings in Norway from foreign vessels, Figure 10. | The Norwegian first hand market does not only include cod landed by Norwegian vessel. The figure below displays the Norwegian cod landings in the period 2000–2014, together with the cod landings in Norway from foreign vessels, Figure 10. | ||

| − | [[File: | + | [[File:D31 fig 10.png|center|Figure 10]] ''Figure 10. Cod landings in Norway (LWE) from Norwegian and foreign vessels – 2000-2014. Source: Directorate of Fisheries, Norway'' |

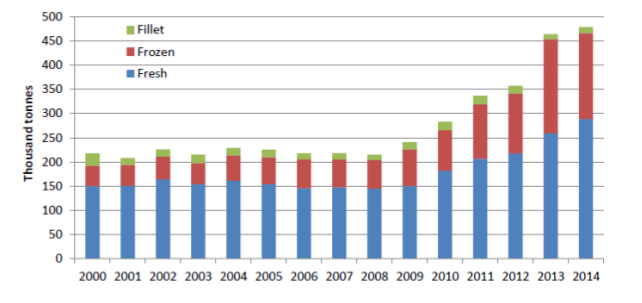

The cod landings from Norwegian vessels in the period 2000–2014 are displayed with respect to the state of the raw material; fresh or frozen or on-board processed (i.e. cod fillets). This has of course great significance for which value chains the raw material can enter (and which processing facilities can utilise the cod), Figure 11. Until 2009, with stable quotas, the share of landings landed frozen was stable at about 27–33 per cent (fillets included) of the total. In later years (after 2008) the share of frozen landings has increased considerably. While total landings increased with 120% in the period 2008–2014, frozen landings increased by 200 per cent, fillets increased by 15 per cent while the volume of fresh cod landings were doubled. | The cod landings from Norwegian vessels in the period 2000–2014 are displayed with respect to the state of the raw material; fresh or frozen or on-board processed (i.e. cod fillets). This has of course great significance for which value chains the raw material can enter (and which processing facilities can utilise the cod), Figure 11. Until 2009, with stable quotas, the share of landings landed frozen was stable at about 27–33 per cent (fillets included) of the total. In later years (after 2008) the share of frozen landings has increased considerably. While total landings increased with 120% in the period 2008–2014, frozen landings increased by 200 per cent, fillets increased by 15 per cent while the volume of fresh cod landings were doubled. | ||

| − | [[File: | + | [[File:D31 fig 11.png|center|Figure 11]] ''Figure 11. Norwegian cod landings – fresh, frozen and fillets – 2000-2014, LWE. Source: Directorate of Fisheries.'' |

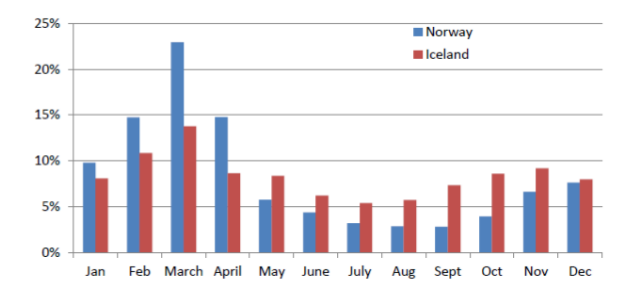

One striking characteristic with Norwegian cod landings is the seasonality of landings, especially when comparing with Iceland, Figure 12 . Large quantities of the cod are caught during the first months of the year. In general, this is explained by the spawning migration of the cod, where it migrates from the Barents Sea to the Lofoten islands. In addition the fleet composition and quota distribution, where large quantities are reserved for the coastal vessels, vouches for this result. Below, the monthly catch shares of cod are illustrated for the period 2000–2014, and highlighted against the same in Iceland. With a value chain that demand a high degree of continuity in supply, too big seasonality in supply will represent a great obstacle for the chain. It can be argued that the global trade of fish today, led by multinational retail chains, is characterised by the need for continuous supply. | One striking characteristic with Norwegian cod landings is the seasonality of landings, especially when comparing with Iceland, Figure 12 . Large quantities of the cod are caught during the first months of the year. In general, this is explained by the spawning migration of the cod, where it migrates from the Barents Sea to the Lofoten islands. In addition the fleet composition and quota distribution, where large quantities are reserved for the coastal vessels, vouches for this result. Below, the monthly catch shares of cod are illustrated for the period 2000–2014, and highlighted against the same in Iceland. With a value chain that demand a high degree of continuity in supply, too big seasonality in supply will represent a great obstacle for the chain. It can be argued that the global trade of fish today, led by multinational retail chains, is characterised by the need for continuous supply. | ||

| − | [[File: | + | [[File:D31 fig 12.png|center|Figure 12]] ''Figure 12. Seasonality in landings – monthly catches as share of total – Norway and Iceland, weighted average. Source: Directorate of Fisheries and Statistics Iceland'' |

==== Canada ==== | ==== Canada ==== | ||

| Line 452: | Line 452: | ||

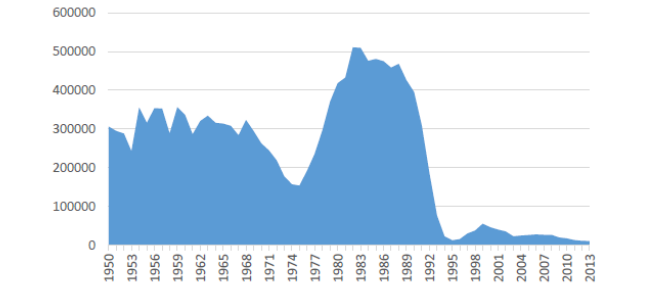

Historically, the Canadian cod fishery has played a major role in the global supply of white fish. Landings peaked at 810,000 t in 1968, 80% of which by harvested by foreign vessels. Landings of cod in Canada by the Canadian fleet have historically been above 300,000 t /year. However, due to overfishing the fishery collapsed in early 1990s and moratorium was announced on the commercial northern cod fishery. Since then landings have been below 50,000 t/ year, Figure 13. Canadian landings of cod in 2012 were 12,263 t or 1.1% of the global landings of cod for the same year. | Historically, the Canadian cod fishery has played a major role in the global supply of white fish. Landings peaked at 810,000 t in 1968, 80% of which by harvested by foreign vessels. Landings of cod in Canada by the Canadian fleet have historically been above 300,000 t /year. However, due to overfishing the fishery collapsed in early 1990s and moratorium was announced on the commercial northern cod fishery. Since then landings have been below 50,000 t/ year, Figure 13. Canadian landings of cod in 2012 were 12,263 t or 1.1% of the global landings of cod for the same year. | ||

| − | [[File: | + | [[File:D31 fig 13.png|center|Figure 13]] ''Figure 13. Atlantic cod landings in Canada, tonnes LWE. Source: FAO 2014'' |

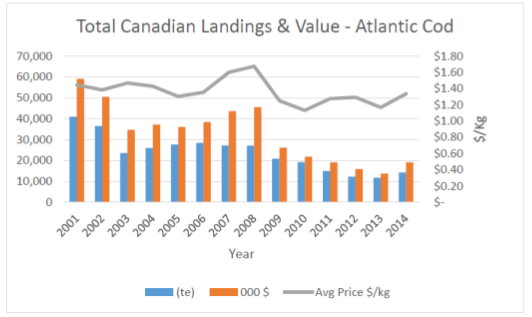

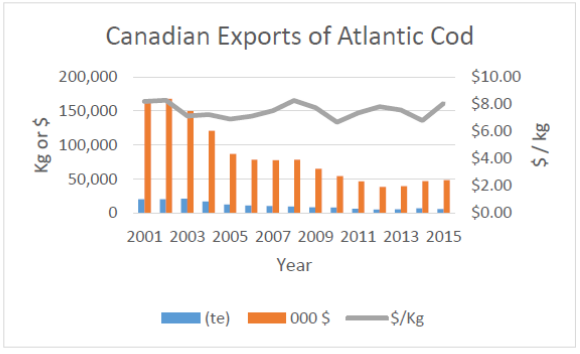

Between 2001 and 2014 total landings and value have decreased from 40,913 t (€41 million) to 14,261 t (€12 million). Despite that the average price has remained relatively stable at about €0.90/kg over the same period, Figure 14. | Between 2001 and 2014 total landings and value have decreased from 40,913 t (€41 million) to 14,261 t (€12 million). Despite that the average price has remained relatively stable at about €0.90/kg over the same period, Figure 14. | ||

| − | [[File: | + | [[File:D31 fig 14.png|center|Figure 14]] ''Figure 14. Total landings and value (in Canadian $) of Atlantic cod in Canada (DFO 2015)'' |

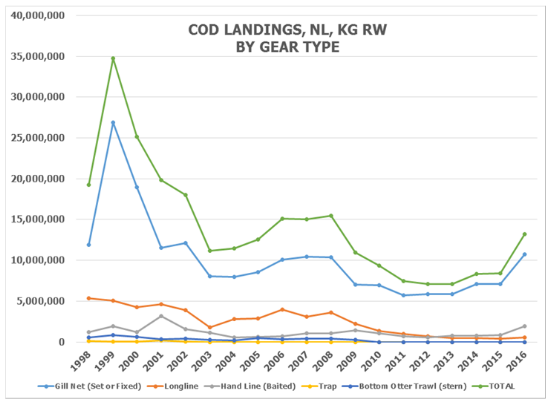

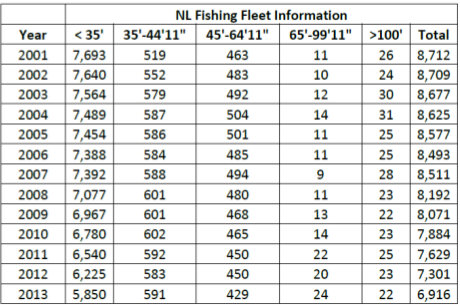

About 70% of Atlantic cod currently harvested in Canada is captured in Newfoundland and Labrador. In 2015, 71% (6,493 t) of the total cod harvest was landed by boats of length <35’ (10 m), underlining the current small-scale nature of the fishery (Table 4). | About 70% of Atlantic cod currently harvested in Canada is captured in Newfoundland and Labrador. In 2015, 71% (6,493 t) of the total cod harvest was landed by boats of length <35’ (10 m), underlining the current small-scale nature of the fishery (Table 4). | ||

| Line 503: | Line 503: | ||

Correspondingly, the vast majority of fish were caught using gillnet, followed by hand line and longline, Figure 15. | Correspondingly, the vast majority of fish were caught using gillnet, followed by hand line and longline, Figure 15. | ||

| − | [[File: | + | [[File:D31 fig 15.png|center|Figure 15]] ''Figure 15. Atlantic cod landings in Newfoundland by gear type. Source: MemU'' |

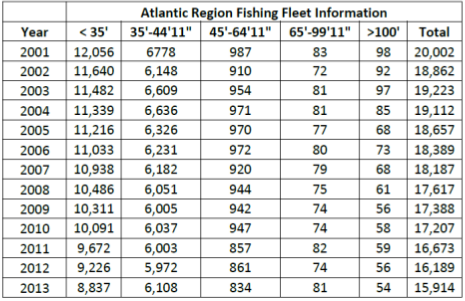

Canadian catches of cod are landed primarily as fresh fish by the inshore/nearshore fleet destined primarily for primary processing, local retailing and export. However, there is a small by-catch of cod harvested by the offshore fleet which is landed frozen. There is an indication that the cod stock may be recovering, and a significant investment in the fishing fleet may be required in order to be able to exploit it. Employment in the harvesting sector in NL has declined by about 60% in the period 2001-2014 and reached 3,100 full-time equivalent jobs in 2014, complicated by aging workforce. Canada’s fishing fleet is divided into two regions, Atlantic and Pacific representing the east and west coasts of the country, respectively. The fleet is further categorized by overall vessel length. Since 2001, the national fleet has decreased by 21% (4,909 vessels) from 23,361 vessels (2001) to 18,452 vessels (2013). The majority of the fleet reduction has occurred in the Atlantic fishing fleet, Table 5, which decreased by 4088 vessels (83% of the national decrease) with Newfoundland and Labrador (Table 6), accounting for 37% (1796 vessels) of the total decrease in the national fleet size. The reduction in the fleet size has mainly occurred in the <35’ and 45’64’11” fleet segments. The fleet is predominantly composed of vessels <35’ vessels (9854 in 2013) followed by vessels in the 35’-44’11” (7119 in 2013) category, which together make-up 92% of the national fleet. | Canadian catches of cod are landed primarily as fresh fish by the inshore/nearshore fleet destined primarily for primary processing, local retailing and export. However, there is a small by-catch of cod harvested by the offshore fleet which is landed frozen. There is an indication that the cod stock may be recovering, and a significant investment in the fishing fleet may be required in order to be able to exploit it. Employment in the harvesting sector in NL has declined by about 60% in the period 2001-2014 and reached 3,100 full-time equivalent jobs in 2014, complicated by aging workforce. Canada’s fishing fleet is divided into two regions, Atlantic and Pacific representing the east and west coasts of the country, respectively. The fleet is further categorized by overall vessel length. Since 2001, the national fleet has decreased by 21% (4,909 vessels) from 23,361 vessels (2001) to 18,452 vessels (2013). The majority of the fleet reduction has occurred in the Atlantic fishing fleet, Table 5, which decreased by 4088 vessels (83% of the national decrease) with Newfoundland and Labrador (Table 6), accounting for 37% (1796 vessels) of the total decrease in the national fleet size. The reduction in the fleet size has mainly occurred in the <35’ and 45’64’11” fleet segments. The fleet is predominantly composed of vessels <35’ vessels (9854 in 2013) followed by vessels in the 35’-44’11” (7119 in 2013) category, which together make-up 92% of the national fleet. | ||

| − | ''Table 5. Atlantic region Fishing Fleet Information. Source: Fisheries and Oceans Canada, Regional Offices, Licensing Units'' [[File: | + | ''Table 5. Atlantic region Fishing Fleet Information. Source: Fisheries and Oceans Canada, Regional Offices, Licensing Units'' [[File:D31 tab 5.png|center|Table 5]] |

| − | ''Table 6. Newfoundland and Labrador Fishing fleet Information. Source: Fisheries and Oceans Canada, Regional Offices, Licensing Units'' [[File: | + | ''Table 6. Newfoundland and Labrador Fishing fleet Information. Source: Fisheries and Oceans Canada, Regional Offices, Licensing Units'' [[File:D31 tab 6.png|center|Table 6]] |

==== UK ==== | ==== UK ==== | ||

| Line 515: | Line 515: | ||

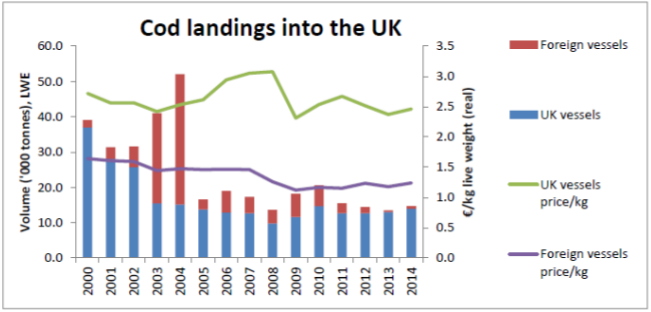

The majority of cod landed into the UK by British vessels was captured in the North Sea (ICES area IV). The total landings of cod into the UK amounted to 14,700 tonnes LWE, of which foreign vessels landed 700 tonnes (considered import). For comparison, in 2000 the total quantity of cod landed in the UK was 39,100 tonnes LWE, Figure 16. The decline in landings of demersal fish has a number of causes, including reductions in fleet size, declining fish stocks and restricted fishing opportunities. EU and UK regulation has limited demersal fishing activity in recent decades, through decommissioning of fishing vessels, reductions in quotas and fishing effort limits and other provisions of stock management plans. The cod quota for UK vessels was 28,988 tonnes for 2014 with UK vessels landing 14,900 tonnes of cod abroad (which is roughly equivalent to the landings in the UK) with a value of €25 million. The largest amounts of demersal fish (incl cod) landed abroad by the UK fleet were into the Netherlands and Norway (17 and 10 thousand tonnes respectively). | The majority of cod landed into the UK by British vessels was captured in the North Sea (ICES area IV). The total landings of cod into the UK amounted to 14,700 tonnes LWE, of which foreign vessels landed 700 tonnes (considered import). For comparison, in 2000 the total quantity of cod landed in the UK was 39,100 tonnes LWE, Figure 16. The decline in landings of demersal fish has a number of causes, including reductions in fleet size, declining fish stocks and restricted fishing opportunities. EU and UK regulation has limited demersal fishing activity in recent decades, through decommissioning of fishing vessels, reductions in quotas and fishing effort limits and other provisions of stock management plans. The cod quota for UK vessels was 28,988 tonnes for 2014 with UK vessels landing 14,900 tonnes of cod abroad (which is roughly equivalent to the landings in the UK) with a value of €25 million. The largest amounts of demersal fish (incl cod) landed abroad by the UK fleet were into the Netherlands and Norway (17 and 10 thousand tonnes respectively). | ||

| − | [[File: | + | [[File:D31 fig 16.png|center|Figure 16]] ''Figure 16. Cod landings into the UK by UK and foreign vessels and prices achieved. Source: DEFRA'' |

The average price of cod landed by UK vessels was €2.47/kg whereas foreign vessels achieved an average price of €2.12/kg. France tops the list of foreign vessels landing into the UK, with 17 thousand tonnes of demersal fish. A large majority of demersal fish landed by UK vessels in 2014 were caught using demersal trawls and seines. Price differentials are also observed between different gears of the same class. This variation in prices partly reflects the different species caught by different gears. There can also be a premium attached to the method by which the fish are captured.' | The average price of cod landed by UK vessels was €2.47/kg whereas foreign vessels achieved an average price of €2.12/kg. France tops the list of foreign vessels landing into the UK, with 17 thousand tonnes of demersal fish. A large majority of demersal fish landed by UK vessels in 2014 were caught using demersal trawls and seines. Price differentials are also observed between different gears of the same class. This variation in prices partly reflects the different species caught by different gears. There can also be a premium attached to the method by which the fish are captured.' | ||

| Line 525: | Line 525: | ||

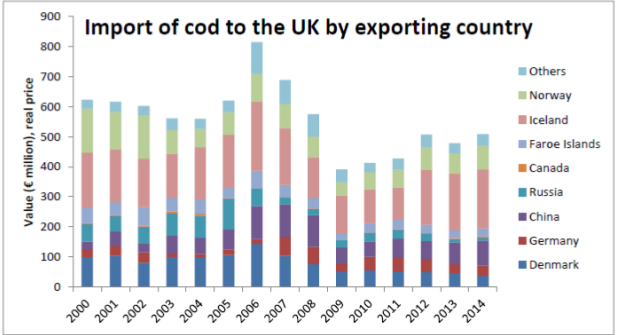

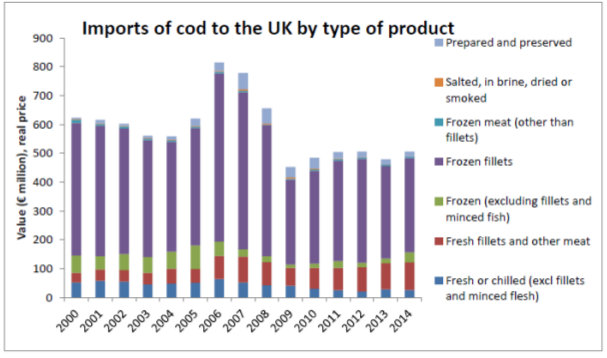

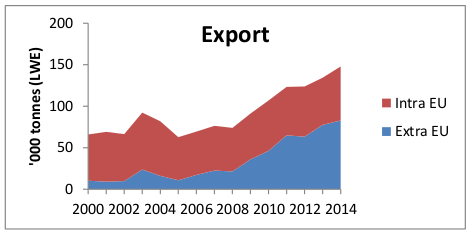

The UK is a net importer of cod. For the period 2000 -2014, UK imports of cod ranged between about 100,000 and 140,000 tonnes product weight per year, with a total value of between €400 and €800 million. In 2014 the imports of cod to the UK was 116,300 tonnes product weight (16% of all fish imports by volume) equivalent to around 295,000 tonnes live weight. In 2014, arrivals from EU member states comprised 20% of the total cod import by volume. Of those, Germany and Denmark accounted for about 70%. For the period 2000-2014 the share of those two countries has ranged between 54% and 86%. In 2014, of the non-EU exporter countries Iceland alone accounted for more than a quarter of all cod imports by volume and value in 2014. Other major countries were China and Norway, Figure 17. In 2014, 78% and 73% of the volume and value of imported cod products into the UK were frozen products, Figure 18. Of those, 64% and 65% of the volume and value respectively of total cod imports were frozen fillets. Frozen fillets have remained the top cod import product by volume for the period 2000- 2014. In 2014 the average price of imported frozen fillets was €4.38/kg, similar to 2000. Fresh fillets achieved the highest average price of €8.39/kg. | The UK is a net importer of cod. For the period 2000 -2014, UK imports of cod ranged between about 100,000 and 140,000 tonnes product weight per year, with a total value of between €400 and €800 million. In 2014 the imports of cod to the UK was 116,300 tonnes product weight (16% of all fish imports by volume) equivalent to around 295,000 tonnes live weight. In 2014, arrivals from EU member states comprised 20% of the total cod import by volume. Of those, Germany and Denmark accounted for about 70%. For the period 2000-2014 the share of those two countries has ranged between 54% and 86%. In 2014, of the non-EU exporter countries Iceland alone accounted for more than a quarter of all cod imports by volume and value in 2014. Other major countries were China and Norway, Figure 17. In 2014, 78% and 73% of the volume and value of imported cod products into the UK were frozen products, Figure 18. Of those, 64% and 65% of the volume and value respectively of total cod imports were frozen fillets. Frozen fillets have remained the top cod import product by volume for the period 2000- 2014. In 2014 the average price of imported frozen fillets was €4.38/kg, similar to 2000. Fresh fillets achieved the highest average price of €8.39/kg. | ||

| − | [[File: | + | [[File:D31 fig 17.png|center|Figure 17]] Figure 17. Value of cod Imported to the UK by exporting country 2000-2014. Source; HM Revenue & Customs |

| − | [[File: | + | [[File:D31 fig 18.png|center|Figure 18]] Figure 18. Value of cod imported to the UK by type of product: 2000-2014. Source: HM revenue and Customs |

==== Canada ==== | ==== Canada ==== | ||

| Line 533: | Line 533: | ||

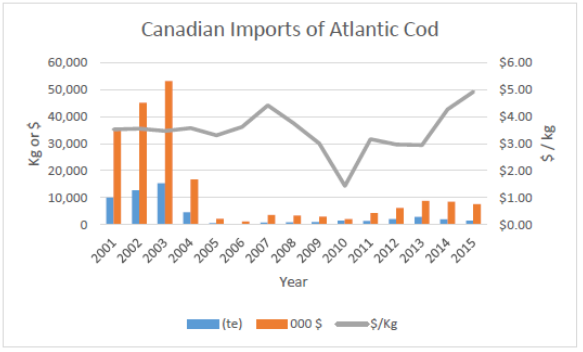

Due to limited domestic supply, Atlantic cod is also imported into Canada for further processing (and re-export) and to supplement domestic markets. Imports of Atlantic Canada decreased from over 15,000 tons valued at $53 million CDN (€33 million) in 2003 to 1,989 tons worth $8.5 million CDN (€5.6 million) in 2014 (Statistics Canada, International Trade Division, 2015), Figure 19. The import price has fluctuated from as low as $1.44/Kg (€1.02/Kg) in 2010 up to $4.92/Kg (€3.49/Kg) in 2015. | Due to limited domestic supply, Atlantic cod is also imported into Canada for further processing (and re-export) and to supplement domestic markets. Imports of Atlantic Canada decreased from over 15,000 tons valued at $53 million CDN (€33 million) in 2003 to 1,989 tons worth $8.5 million CDN (€5.6 million) in 2014 (Statistics Canada, International Trade Division, 2015), Figure 19. The import price has fluctuated from as low as $1.44/Kg (€1.02/Kg) in 2010 up to $4.92/Kg (€3.49/Kg) in 2015. | ||

| − | [[File: | + | [[File:D31 fig 19.png|center|Figure 19]] ''Figure 19. Canadian imports of Atlantic cod. Source: Statistics Canada, International Trade Division'' |

=== Processing === | === Processing === | ||

| Line 545: | Line 545: | ||

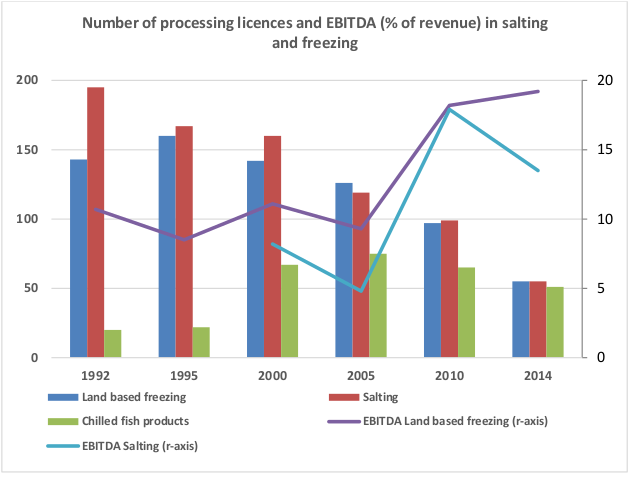

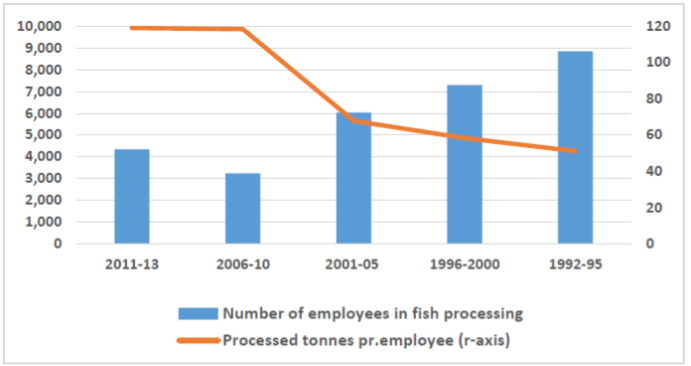

The workforce employed in fish processing declined by 60% from mid-1990s to latter half of 2000s. However, employment has started to rise again in recent years, driven by increasing share of processing of fresh fish products and increasing volume of pelagic species being processed, Figure 21. | The workforce employed in fish processing declined by 60% from mid-1990s to latter half of 2000s. However, employment has started to rise again in recent years, driven by increasing share of processing of fresh fish products and increasing volume of pelagic species being processed, Figure 21. | ||

| − | [[File: | + | [[File:D31 fig 20.png|center|Figure 20]] Figure 20. Number of processing companies in Iceland. Source: Statistics Iceland and Mast |

| − | [[File: | + | [[File:D31 fig 21.png|center|Figure 21]] Figure 21. Number of employees in processing and productivity 1992- 2013. |

Traditionally nearly all demersal wet fish was allocated to freezing, salting or iced whole for export. This changed with the emergence of freezing trawlers in the 1980s. Since mid-1990s, around one- third of wet ground fish has been frozen at sea but land based freezing fell from 45% in 1990 to about 35% on average in 2010-13. These changes in processing of demersal fish in Iceland occur in the allocation to salting that was increased temporally to 25% in 1996-2000 but has fallen to 16%- 20% in the recent years. Another significant change since mid-1990s has been the rapid increase in allocation to chilled products to near one-fifth in 2014 up from a very low level in the 1990s. | Traditionally nearly all demersal wet fish was allocated to freezing, salting or iced whole for export. This changed with the emergence of freezing trawlers in the 1980s. Since mid-1990s, around one- third of wet ground fish has been frozen at sea but land based freezing fell from 45% in 1990 to about 35% on average in 2010-13. These changes in processing of demersal fish in Iceland occur in the allocation to salting that was increased temporally to 25% in 1996-2000 but has fallen to 16%- 20% in the recent years. Another significant change since mid-1990s has been the rapid increase in allocation to chilled products to near one-fifth in 2014 up from a very low level in the 1990s. | ||

| Line 559: | Line 559: | ||

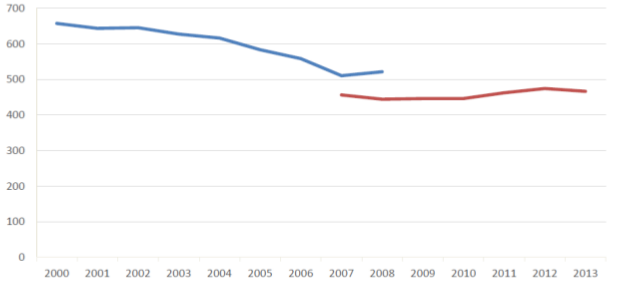

From Figure 22 we see that the total number of establishments have been reduced by nearly 200 in the period, from about 660 establishments in 2000. The largest reductions came prior to 2007 (holding the break in the time series outside) while in later years there has been a small increase in number of fish processors. The reduction in number of establishments in the whole period is 29 %. | From Figure 22 we see that the total number of establishments have been reduced by nearly 200 in the period, from about 660 establishments in 2000. The largest reductions came prior to 2007 (holding the break in the time series outside) while in later years there has been a small increase in number of fish processors. The reduction in number of establishments in the whole period is 29 %. | ||

| − | [[File: | + | [[File:D31 fig 22.png|center|Figure 22]] ''Figure 22. Number of establishments “Processing and preserving of fish and fish products” (blue line) and enterprises in “Processing and preserving of fish, crustaceans and mollusc” (red line) in the period 2000-2013. Source: Statistics Norway'' |

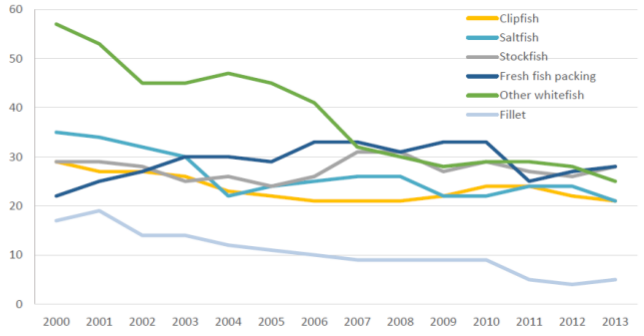

In Figure 23 the number of firms within the different branches of the whitefish processing industry is depicted over the 2000–2015 period. We only include the six traditionally largest branches, constituting the lion’s share of the industry. By doing so we leave out multi sectorial companies (also caretaking other fish than whitefish), companies who is hired to produce for others, landing stations (packing and transporting fish to other purchasers) and minced seafood production. | In Figure 23 the number of firms within the different branches of the whitefish processing industry is depicted over the 2000–2015 period. We only include the six traditionally largest branches, constituting the lion’s share of the industry. By doing so we leave out multi sectorial companies (also caretaking other fish than whitefish), companies who is hired to produce for others, landing stations (packing and transporting fish to other purchasers) and minced seafood production. | ||

| − | [[File: | + | [[File:D31 fig 23.png|center|Figure 23]] ''Figure 23. Development in the number of companies within different whitefish sectors, 2000-2015'' |

Notably, all sectors/branches have undergone reductions in number of companies. The reduction in single branches need not be due to closure or bankruptcy among companies, but can also stem from a change in the companies’ product mix, redefining them into another branch. However, the overall reduction in companies – from 213 in 2000 to 142 in 2013 – indicates fewer and larger companies, especially by the increase in the cod quota. | Notably, all sectors/branches have undergone reductions in number of companies. The reduction in single branches need not be due to closure or bankruptcy among companies, but can also stem from a change in the companies’ product mix, redefining them into another branch. However, the overall reduction in companies – from 213 in 2000 to 142 in 2013 – indicates fewer and larger companies, especially by the increase in the cod quota. | ||

| Line 571: | Line 571: | ||

Saltfish producers seems to operate under more fierce completion, not safeguarded from the severities in the first hand market. This branch has experienced lower profitability over time and also greater downsizing of the company population. The only branch of companies that have increased in numbers throughout this period are the fresh fish packers. In 2000, there were 22 companies, increasing to roughly 33 in 2006–2010, before falling back to 28 in 2013. The latter increase can be due to the ‘extreme’ increase in the cod quota, while the period with the most companies can possibly be explained by the quota stability. | Saltfish producers seems to operate under more fierce completion, not safeguarded from the severities in the first hand market. This branch has experienced lower profitability over time and also greater downsizing of the company population. The only branch of companies that have increased in numbers throughout this period are the fresh fish packers. In 2000, there were 22 companies, increasing to roughly 33 in 2006–2010, before falling back to 28 in 2013. The latter increase can be due to the ‘extreme’ increase in the cod quota, while the period with the most companies can possibly be explained by the quota stability. | ||

| − | One persisting disadvantage for the Norwegian fish processing industry in Norway in the last 20 years, relative to competitor countries, is the extra-Norwegian labour cost level. The hourly wage in the Norwegian industry is at a level that is 6 times higher than in Poland, 61 % above UK and 37 % above France. With capital costs at a historical low level, automatization has become a necessity and a possibility. One efficiency increasing innovation, which has taken place in this industry in later years, is the establishing of dedicated gutting and grading lines for fresh fish landings from the coastal fleet. This has led to a great relief in the workload for the fishers, who no longer need to gut the fish – neither on board nor on land. | + | One persisting disadvantage for the Norwegian fish processing industry in Norway in the last 20 years, relative to competitor countries, is the extra-Norwegian labour cost level. The hourly wage in the Norwegian industry is at a level that is 6 times higher than in Poland, 61 % above UK and 37 % above France. With capital costs at a historical low level, automatization has become a necessity and a possibility. One efficiency increasing innovation, which has taken place in this industry in later years, is the establishing of dedicated gutting and grading lines for fresh fish landings from the coastal fleet. This has led to a great relief in the workload for the fishers, who no longer need to gut the fish – neither on board nor on land. |

==== Canada ==== | ==== Canada ==== | ||

| Line 577: | Line 577: | ||

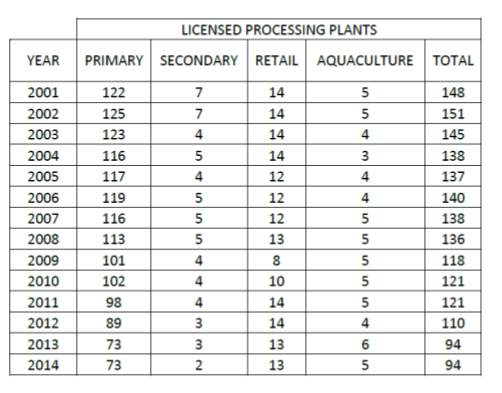

The processing capacity in NL has been decreasing, from 148 in 2001 to 94 in 2014 (Table 7). Error! Reference source not found.Most plants are multi-species and have dedicated processing lines per species. The majority of the processing capacity is in the primary processing sector, accounting for about 80% of the total production in NL. Secondary processing contributes only 2% of the total processing capacity in the province. In order to ensure that fish landings benefit not only harvesters but also processors, a minimum processing requirement has been applied by regulation to all fish intended for sale outside the province. For ground fish (including cod), the minimum requirement is that it must be filleted or split and salted. | The processing capacity in NL has been decreasing, from 148 in 2001 to 94 in 2014 (Table 7). Error! Reference source not found.Most plants are multi-species and have dedicated processing lines per species. The majority of the processing capacity is in the primary processing sector, accounting for about 80% of the total production in NL. Secondary processing contributes only 2% of the total processing capacity in the province. In order to ensure that fish landings benefit not only harvesters but also processors, a minimum processing requirement has been applied by regulation to all fish intended for sale outside the province. For ground fish (including cod), the minimum requirement is that it must be filleted or split and salted. | ||

| − | ''Table 7. Licensed processing plants in NL. Source: Fisheries and Oceans Canada'' [[File: | + | ''Table 7. Licensed processing plants in NL. Source: Fisheries and Oceans Canada'' [[File:D31 tab 7.png|center|Table 7]] |

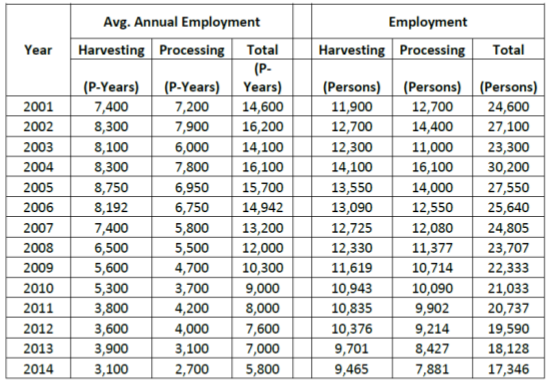

Equivalently, the employment in the processing sector has declined by about 60% in the period 2001-2014, reaching 2,700 full-time equivalent jobs in 2014, Table 8. | Equivalently, the employment in the processing sector has declined by about 60% in the period 2001-2014, reaching 2,700 full-time equivalent jobs in 2014, Table 8. | ||

| − | ''Table 8. NL fishing industry employment. Source: Department of fisheries and Aquaculture.'' [[File: | + | ''Table 8. NL fishing industry employment. Source: Department of fisheries and Aquaculture.'' [[File:D31 tab 8.png|center|Table 8]] |

==== UK ==== | ==== UK ==== | ||

| Line 605: | Line 605: | ||

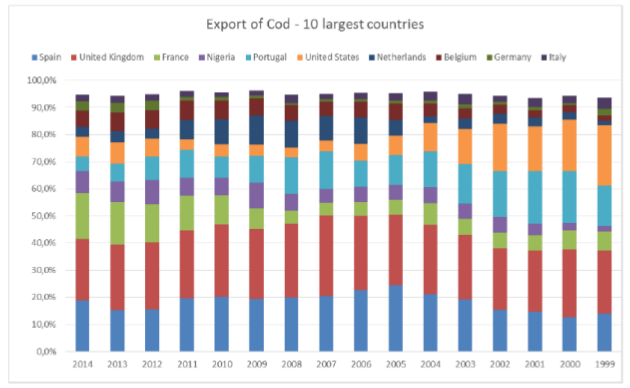

The ten largest countries for cod products accounts for over 93% of the total export value for cod from Iceland. The most important export countries for cod product before 1999 were US markets for frozen products, Figure 24. After the EEA agreement in 1994 the importance of EU markets has increased. As can been seen the most important country for cod export is UK with around 22.3% of the total values. Nigerian markets have been increasingly important for cod by-products such as dried heads and bones, but that market is now struggling because of low oil prices and unstable infrastructure. Britain is getting less important, whereas Belgium has been a growing market. The French market is dominating the export of fresh cod loins. | The ten largest countries for cod products accounts for over 93% of the total export value for cod from Iceland. The most important export countries for cod product before 1999 were US markets for frozen products, Figure 24. After the EEA agreement in 1994 the importance of EU markets has increased. As can been seen the most important country for cod export is UK with around 22.3% of the total values. Nigerian markets have been increasingly important for cod by-products such as dried heads and bones, but that market is now struggling because of low oil prices and unstable infrastructure. Britain is getting less important, whereas Belgium has been a growing market. The French market is dominating the export of fresh cod loins. | ||

| − | [[File: | + | [[File:D31 fig 24.png|center|Figure 24]] ''Figure 24. Export value of cod from Iceland by 10 major countries. Source: Statistics Iceland'' |

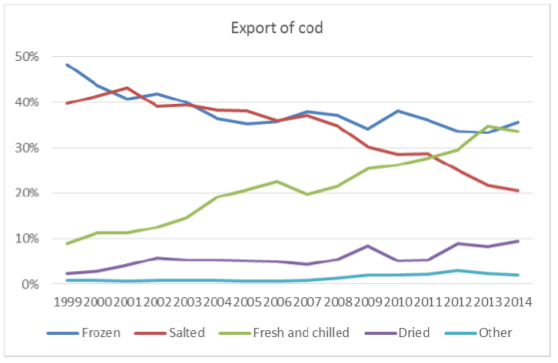

As can be seen from Figure 25 the export of cod products has changed a lot since 1999 when frozen products accounted for 48.3% of the total value of cod products. In 2014, frozen products is down to 35.6%. In the same time fresh and chilled products has gone from 9% in 1999 to 33.6% in 2014. In 1999 the export was mainly whole fish while in 2014 it is more or less loin cuts and fillets. The share of salt fish export decreased from 39.7% in 2014 to 20.6% in 2014. | As can be seen from Figure 25 the export of cod products has changed a lot since 1999 when frozen products accounted for 48.3% of the total value of cod products. In 2014, frozen products is down to 35.6%. In the same time fresh and chilled products has gone from 9% in 1999 to 33.6% in 2014. In 1999 the export was mainly whole fish while in 2014 it is more or less loin cuts and fillets. The share of salt fish export decreased from 39.7% in 2014 to 20.6% in 2014. | ||

| − | [[File: | + | [[File:D31 fig 25.png|center|Figure 25]] ''Figure 25. Export of cod according to production methods, % of value.'' |

The increase of dried cod is interesting as it share has increased form 2.3% in 1999 to 8.4% in 2014. This increase can be traced to increase in production of dried cod head and bones or what is often counted as by-products. | The increase of dried cod is interesting as it share has increased form 2.3% in 1999 to 8.4% in 2014. This increase can be traced to increase in production of dried cod head and bones or what is often counted as by-products. | ||

| Line 615: | Line 615: | ||

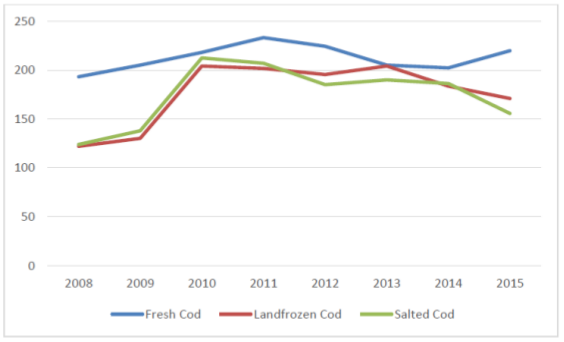

In Figure 26 the price development for the main cod production is demonstrated as index were the price of 2005 is equal to 100. Figure for fresh Cod are not available for 2006 and 2007 so they are not shown here. As can been seen the price index start to rice in 2009 and rice fast until 2010 for salted and frozen products. The trend from 2010 has been slow decrease in price but the fresh cod is starting to go up in 2014. | In Figure 26 the price development for the main cod production is demonstrated as index were the price of 2005 is equal to 100. Figure for fresh Cod are not available for 2006 and 2007 so they are not shown here. As can been seen the price index start to rice in 2009 and rice fast until 2010 for salted and frozen products. The trend from 2010 has been slow decrease in price but the fresh cod is starting to go up in 2014. | ||

| − | [[File: | + | [[File:D31 fig 26.png|center|Figure 26]] ''Figure 26. Price index of cod products, 2008 to 2015. Reference 4 quarter 2005 =100'' |

==== Norway ==== | ==== Norway ==== | ||

| Line 621: | Line 621: | ||

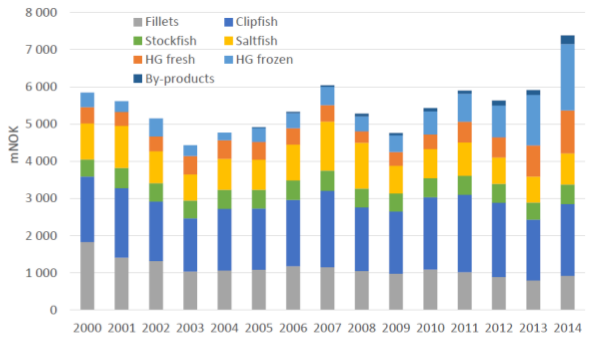

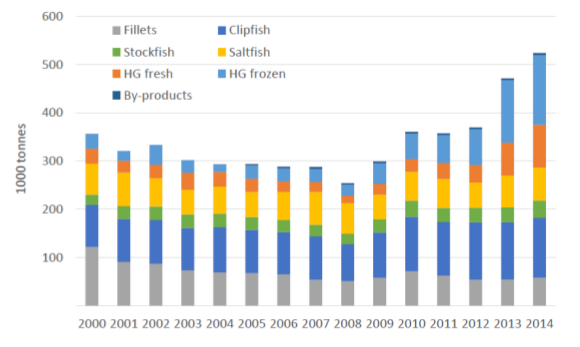

Figure 27 shows how Norwegian cod exports have been relatively stable in the period 2000 to 2013 – between 4.3 and 6 bNOK – while peaking in 2014 with 7.4 bNOK. In the “saltfish” product group saltfish fillets are included, constituting about 6 per cent of the total export value in the period (showing a negative trend). The product category “fillets” include both fresh and frozen fillets. The export value from frozen fillets is reduced by 2/3 in the period, while fresh fillets is 10 times as big in 2014 as in 2000. Hence the fresh share of fillets have increased from 2% to 40%. | Figure 27 shows how Norwegian cod exports have been relatively stable in the period 2000 to 2013 – between 4.3 and 6 bNOK – while peaking in 2014 with 7.4 bNOK. In the “saltfish” product group saltfish fillets are included, constituting about 6 per cent of the total export value in the period (showing a negative trend). The product category “fillets” include both fresh and frozen fillets. The export value from frozen fillets is reduced by 2/3 in the period, while fresh fillets is 10 times as big in 2014 as in 2000. Hence the fresh share of fillets have increased from 2% to 40%. | ||

| − | [[File: | + | [[File:D31 fig 27.png|center|Figure 27]] ''Figure 27. Export value of different cod product categories, 2000-2012. Source: Statistics Norway'' |

| − | [[File: | + | [[File:D31 fig 28.png|center|Figure 28]] ''Figure 28. Norwegian exports of cod products, LWE, 2000-2014. Source: Statistics Norway'' |

Figure 28 shows exports volume of cod. The reduction between 2000 and 2008 can be explained by Norway receives landings from foreign vessels. In 2014 foreign vessels landed 126 000 tonnes cod in Norway (Russian vessels responsible for 3⁄4). Second, warehousing of frozen fish can imply differences between exports and quotas each year. Third, a growing domestic market (relative to export) can explain some differences. Forth, and perhaps the most important factor, the crude conversion factors from product to live weight, can be too coarse for the different products, and technological improvements during the period can have rendered these factors misrepresentative. The most striking feature in the composition of the Norwegian export trade of cod is the increase in export of unprocessed goods. A more than doubled cod quota from 2008–2013 has led to a fivefold increase in the export headed and gutted (HG) cod. | Figure 28 shows exports volume of cod. The reduction between 2000 and 2008 can be explained by Norway receives landings from foreign vessels. In 2014 foreign vessels landed 126 000 tonnes cod in Norway (Russian vessels responsible for 3⁄4). Second, warehousing of frozen fish can imply differences between exports and quotas each year. Third, a growing domestic market (relative to export) can explain some differences. Forth, and perhaps the most important factor, the crude conversion factors from product to live weight, can be too coarse for the different products, and technological improvements during the period can have rendered these factors misrepresentative. The most striking feature in the composition of the Norwegian export trade of cod is the increase in export of unprocessed goods. A more than doubled cod quota from 2008–2013 has led to a fivefold increase in the export headed and gutted (HG) cod. | ||

| Line 629: | Line 629: | ||

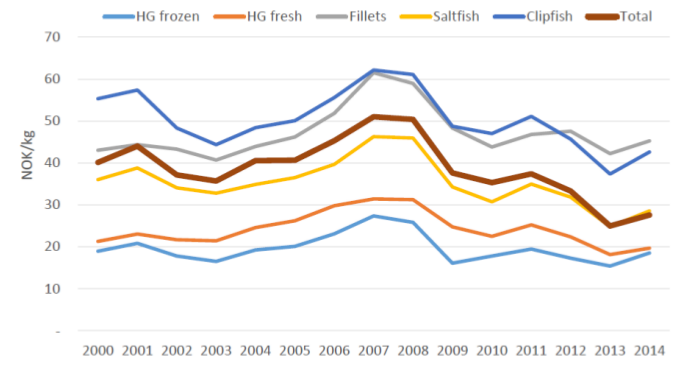

For traditional product categories from cod (clipfish, salt fish, dried fish and fillets) the export volume increase has been more modest, in the range of 15–65 %. Prices have fallen with about 1/3. Below we will look more into detail on the development of the different product categories within the cod export. Before doing that we present in Figure 29 the development in export product prices on the different cod export products. Price variations are to some extent easily observable during 2000–2014. The broad brown line represents the average price of all cod export, including stockfish and by-products, and reveals not only the price changes in exports but to some degree also the composition of the total export. | For traditional product categories from cod (clipfish, salt fish, dried fish and fillets) the export volume increase has been more modest, in the range of 15–65 %. Prices have fallen with about 1/3. Below we will look more into detail on the development of the different product categories within the cod export. Before doing that we present in Figure 29 the development in export product prices on the different cod export products. Price variations are to some extent easily observable during 2000–2014. The broad brown line represents the average price of all cod export, including stockfish and by-products, and reveals not only the price changes in exports but to some degree also the composition of the total export. | ||

| − | [[File: | + | [[File:D31 fig 29.png|center|Figure 29]] ''Figure 29. Export prices for main categories of Norwegian cod products (stockfish excl), 2000-2014. Statistics Norway'' |

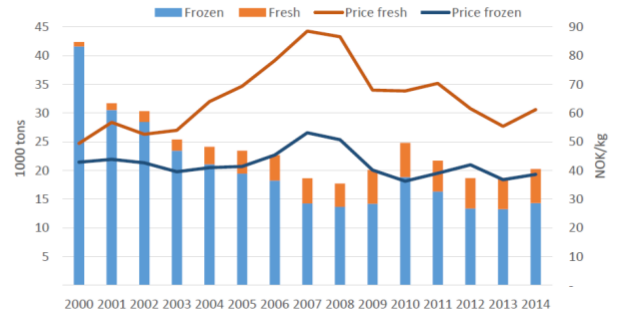

The general development shown in Figure 28 is relatively stable prices from 2000 to 2005, then an increase until 2008, before a decrease – with the financial crisis and increased quotas – until 2013, and an increase again until 2014 (which has prolonged Medio 2015). The graph above only draws the coarse picture regarding export prices. More details will be treated below when for each product. In 2014, the export of cod fillets was constituted of roughly 30% fresh fillet, 30% block frozen fillets and 40% of other frozen fillets. The price differences are great between the products. Block frozen fillets received NOK 29 per kg, other frozen fillets NOK 46 per kg, while the export price of fresh fillets where NOK 62 per kg (more than the double of the block frozen), Figure 30. The largest market for frozen fillets are Great Britain with about 45 per cent, before France (20 %). Most fresh fillets export goes to Denmark (76 %), while 10 % goes to France and 5 % to Sweden and UK, respectively. In the graph below, the only distinction is made between frozen and fresh fillets, showing volumes and prices in the period 2000–2014. | The general development shown in Figure 28 is relatively stable prices from 2000 to 2005, then an increase until 2008, before a decrease – with the financial crisis and increased quotas – until 2013, and an increase again until 2014 (which has prolonged Medio 2015). The graph above only draws the coarse picture regarding export prices. More details will be treated below when for each product. In 2014, the export of cod fillets was constituted of roughly 30% fresh fillet, 30% block frozen fillets and 40% of other frozen fillets. The price differences are great between the products. Block frozen fillets received NOK 29 per kg, other frozen fillets NOK 46 per kg, while the export price of fresh fillets where NOK 62 per kg (more than the double of the block frozen), Figure 30. The largest market for frozen fillets are Great Britain with about 45 per cent, before France (20 %). Most fresh fillets export goes to Denmark (76 %), while 10 % goes to France and 5 % to Sweden and UK, respectively. In the graph below, the only distinction is made between frozen and fresh fillets, showing volumes and prices in the period 2000–2014. | ||

| − | [[File: | + | [[File:D31 fig 30.png|center|Figure 30]] ''Figure 30. Export of fresh and frozen cod fillets from Norway, volume and price (FOB), 2000-2014'' |

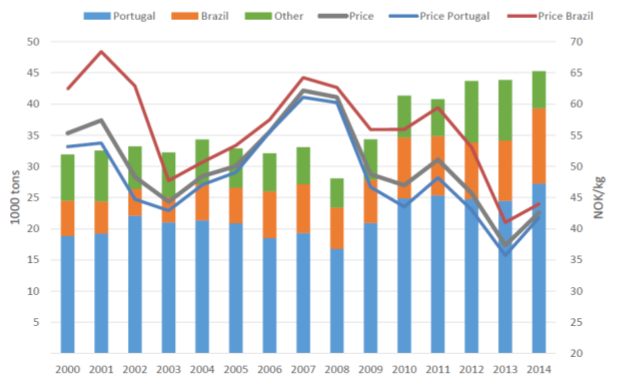

Clipfish have had a relative stable share of total export value until 2013, when it decreases from roughly 1/3 to 28 %, and then to 26 % in 2014. The volumes exported are relatively stable with right above 30 000 tons until 2008 when it falls back to 28 000 tons, before it increases steadily to 45 000 in 2014, Figure 31. The market for clipfish is primarily Portugal, who receives annually between 56 per cent and 2/3 of the clipfish export. Also Brazil is an important market – to a larger degree throughout the period – taking between 13 and 27 per cent. | Clipfish have had a relative stable share of total export value until 2013, when it decreases from roughly 1/3 to 28 %, and then to 26 % in 2014. The volumes exported are relatively stable with right above 30 000 tons until 2008 when it falls back to 28 000 tons, before it increases steadily to 45 000 in 2014, Figure 31. The market for clipfish is primarily Portugal, who receives annually between 56 per cent and 2/3 of the clipfish export. Also Brazil is an important market – to a larger degree throughout the period – taking between 13 and 27 per cent. | ||

| − | [[File: | + | [[File:D31 fig 31.png|center|Figure 31]] ''Figure 31. Norwegian export of clipfish (volume and prices), 2000-2014'' |

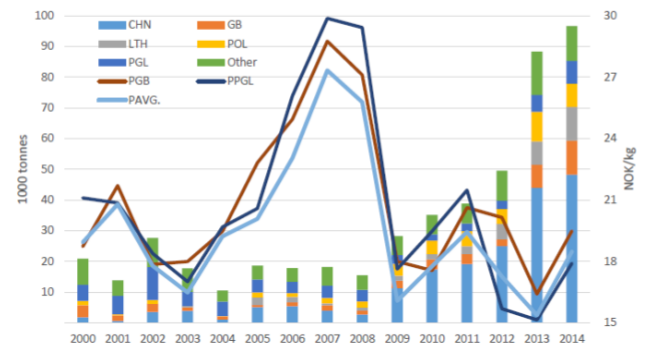

The export of frozen unprocessed cod is of relative new date, triggered by the filleting industry’s supply of fresh cod from Russian vessels after the break down in the early 1990’s, which enabled them to freeze the catch from own vessels and steer them to profitable market opportunities, just like the autoliners had been doing for years. By freezing the cod on-board right after catch, quality is kept intact and the logistic restrictions, regarding the raw materials deterioration possibilities is more or less curtailed. Figure 32 shows the vast increase in the export of unprocessed frozen cod in the years after 2008. Until then the annual quantities was in the range of 10–28 000 tonnes. | The export of frozen unprocessed cod is of relative new date, triggered by the filleting industry’s supply of fresh cod from Russian vessels after the break down in the early 1990’s, which enabled them to freeze the catch from own vessels and steer them to profitable market opportunities, just like the autoliners had been doing for years. By freezing the cod on-board right after catch, quality is kept intact and the logistic restrictions, regarding the raw materials deterioration possibilities is more or less curtailed. Figure 32 shows the vast increase in the export of unprocessed frozen cod in the years after 2008. Until then the annual quantities was in the range of 10–28 000 tonnes. | ||

| Line 643: | Line 643: | ||

Thereafter it annually grew with 10-80 per cent annually. This growth is coinciding with quota increases and corresponding price falls, and to some degree the financial crisis in 2008/2009. The largest import counties have been relative stable over time. Since 2005, China becomes a main importer at the same time as Lithuania. At the end of the period, the exported volumes have increased from 20 000 to nearly 100 000 tonnes, and frozen round cod is the largest cod export product in volume, and the second largest in value – after clipfish. | Thereafter it annually grew with 10-80 per cent annually. This growth is coinciding with quota increases and corresponding price falls, and to some degree the financial crisis in 2008/2009. The largest import counties have been relative stable over time. Since 2005, China becomes a main importer at the same time as Lithuania. At the end of the period, the exported volumes have increased from 20 000 to nearly 100 000 tonnes, and frozen round cod is the largest cod export product in volume, and the second largest in value – after clipfish. | ||

| − | [[File: | + | [[File:D31 fig 32.png|center|Figure 32]] ''Figure 32. Norwegian export of frozen cod (headed and gutted) to largest recipients'' |

In the five-year period from 2008 to 2013, Norwegian cod landings rose from 200 to 450 000 tonnes, while average export price was halved, from 50 NOK/kg to 25 NOK/kg. The large increase in the export of unprocessed products can be due to both capacity reasons and the economic rationales behind. For more information on the development on the export of frozen cod, see for instance Egeness (2013). | In the five-year period from 2008 to 2013, Norwegian cod landings rose from 200 to 450 000 tonnes, while average export price was halved, from 50 NOK/kg to 25 NOK/kg. The large increase in the export of unprocessed products can be due to both capacity reasons and the economic rationales behind. For more information on the development on the export of frozen cod, see for instance Egeness (2013). | ||

| Line 653: | Line 653: | ||

Canada is a major seafood exporting nation, ranked 7 th among the major exporters worldwide in terms of value. Exports of Atlantic cod however are minor on the global market. Exports of cod have decreased from 20,385 t in 2001 (€117 million) to 6,925 t in 2014 (€31 million) (average export price (€4.45), Figure 33. Similar trend can be observed for the export of cod from NL, however, on average, the export value of NL cod is lower than the national average. In 2014 the export price dropped to €3.67/kg, the lowest in 15 years. Major exporting destinations are the USA and the UK which in 2014 accounted for 48.6% and 39.4% of NL cod exports respectively. | Canada is a major seafood exporting nation, ranked 7 th among the major exporters worldwide in terms of value. Exports of Atlantic cod however are minor on the global market. Exports of cod have decreased from 20,385 t in 2001 (€117 million) to 6,925 t in 2014 (€31 million) (average export price (€4.45), Figure 33. Similar trend can be observed for the export of cod from NL, however, on average, the export value of NL cod is lower than the national average. In 2014 the export price dropped to €3.67/kg, the lowest in 15 years. Major exporting destinations are the USA and the UK which in 2014 accounted for 48.6% and 39.4% of NL cod exports respectively. | ||

| − | [[File: | + | [[File:D31 fig 33.png|center|Figure 33]] ''Figure 33. Canadian exports (in $ CND) of Atlantic cod. Source; Statistics Canada, international Trade division'' |

==== UK ==== | ==== UK ==== | ||

| Line 659: | Line 659: | ||

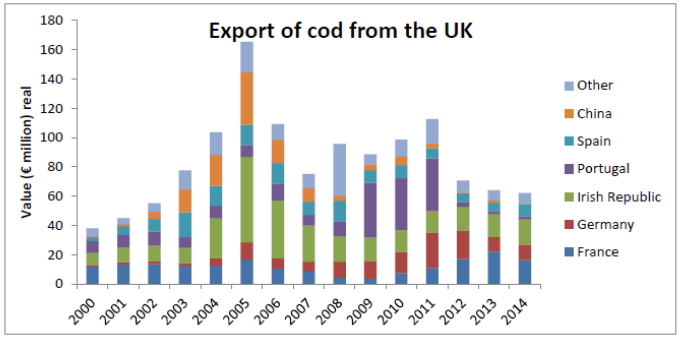

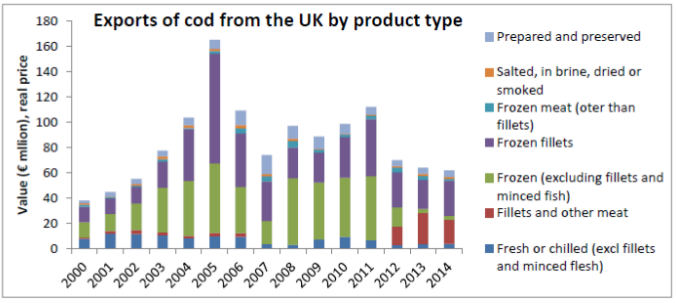

In 2014, the UK exported 14,900 tonnes of cod products (equivalent to 41,200 t live weight) with a with a total value of €62.1 million, a decline of about 50% since 2011, 92% of the total cod export from the UK was to other EU member states and 8% to non-EU countries; Within the EU, exports to France, Germany, Irish Republic, Portugal and Spain comprised 91% of the 91% of the total export to EU in 2014. China was the single biggest importer of UK cod outside the EU, Figure 34. Frozen fillets were the main type of product exported from the UK by volume and value in 2014, followed by fresh fillets and other meat, Figure 35. | In 2014, the UK exported 14,900 tonnes of cod products (equivalent to 41,200 t live weight) with a with a total value of €62.1 million, a decline of about 50% since 2011, 92% of the total cod export from the UK was to other EU member states and 8% to non-EU countries; Within the EU, exports to France, Germany, Irish Republic, Portugal and Spain comprised 91% of the 91% of the total export to EU in 2014. China was the single biggest importer of UK cod outside the EU, Figure 34. Frozen fillets were the main type of product exported from the UK by volume and value in 2014, followed by fresh fillets and other meat, Figure 35. | ||

| − | [[File: | + | [[File:D31 fig 34.png|center|Figure 34]] ''Figure 34. Value of exports of cod from the UK by country of destination. Source: HM Revenue & Customs'' |

| − | [[File: | + | [[File:D31 fig 35.png|center|Figure 35]] Figure 35. Value of cod exports from the UK by type of product. Source: HM Revenue & Customs |

=== Consumption === | === Consumption === | ||

| Line 705: | Line 705: | ||

=== Introduction === | === Introduction === | ||

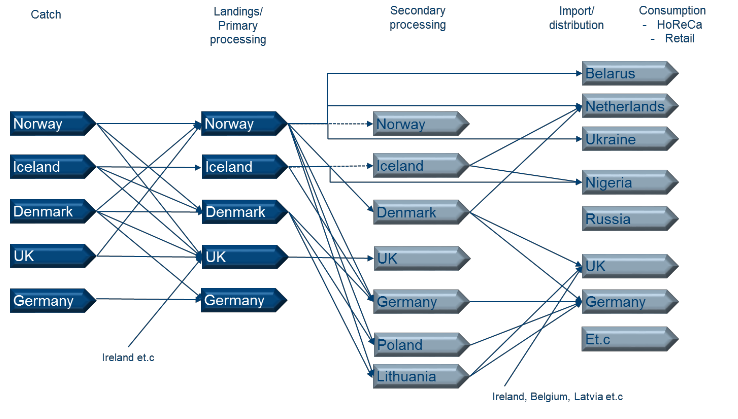

| − | This section of the Deliverable describes the structure of the value chain of Atlantic herring (Clupea | + | This section of the Deliverable describes the structure of the value chain of Atlantic herring (Clupea harengus) focusing on the following countries: Norway, Iceland, Denmark, UK, Canada and Germany. In this section, we will describe landings, processing and consumption of herring. Figure 36 a visualization of the value chain, showing the different stages, and with arrows suggesting the most important flows through the chain. This is by no means a complete rendering of the many value chains for herring, but it illustrates some important features. The most important is probably that herring finds various ways from catch to consumption. |

| − | harengus) focusing on the following countries: Norway, Iceland, Denmark, UK, Canada and Germany. | ||

| − | In this section, we will describe landings, processing and consumption of herring. | ||

| − | Figure 36 a visualization of the value chain, showing the different stages, and with arrows suggesting | ||

| − | the most important flows through the chain. This is by no means a complete rendering of the many | ||

| − | value chains for herring, but it illustrates some important features. The most important is probably | ||

| − | that herring finds various ways from catch to consumption. | ||

| − | [[File: | + | [[File:D31 fig 36.png|center|Figure 36]] ''Figure 36. The European value chain for herring'' |

| − | ''Figure 36. The European value chain for herring'' | + | |

| + | Firstly, we have distinguished between catch and landings, as much of the herring is landed in another country, at the same time as landings from foreign vessels benefit the processing industry. That there is a certain exchange of raw material holds true for most countries, with Iceland as a notable exception. Let’s put forward some examples of flows through the value chain: | ||

| + | |||

| + | *Catch from Norwegian boats will mostly receive primary processing in Norway, with only a | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

small portion receiving secondary processing. | small portion receiving secondary processing. | ||

| − | *Some herring will be exported directly from Norway to Germany, some will end up in | + | |

| + | *Some herring will be exported directly from Norway to Germany, some will end up in | ||

| + | |||

Germany after secondary processing in for instance Poland or Lithuania. | Germany after secondary processing in for instance Poland or Lithuania. | ||

| − | *Herring is exported from Norway to The Netherlands, but some of the herring going to The | + | |

| + | *Herring is exported from Norway to The Netherlands, but some of the herring going to The | ||

| + | |||

Netherlands will be exported to other, mostly African, countries. | Netherlands will be exported to other, mostly African, countries. | ||

| − | *Denmark receives much of their landings from Norwegian boats, much of the processing is | + | |

| + | *Denmark receives much of their landings from Norwegian boats, much of the processing is | ||

| + | |||

thus based on imports | thus based on imports | ||

| − | *Different products categories might have different “routes” through the value chain, both | + | |

| + | *Different products categories might have different “routes” through the value chain, both | ||

| + | |||

geographically and in terms of number and types of intermediary firms | geographically and in terms of number and types of intermediary firms | ||

| − | ===Catch and Landings=== | + | === Catch and Landings === |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

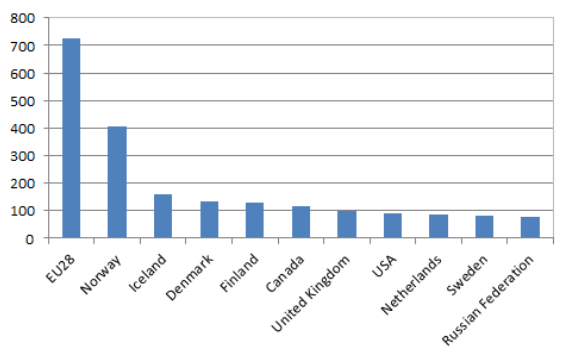

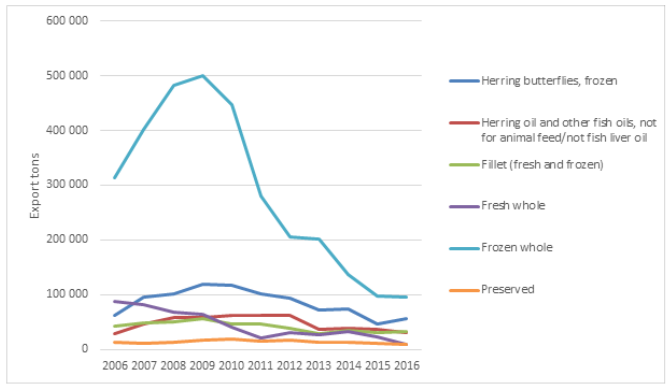

| − | + | The richest herring stocks in the Northeast Atlantic are found off the Norwegian coast (Norwegian spring-spawning herring, also known as Atlanto-Scandian herring), in Icelandic waters (Icelandic summer-spawning herring) and west of the Faroe Islands (Atlanto-Scandian herring). Herring is also found around the British Isles and in Skagerak. In 2014, world catches of Atlantic herring totalled 1.6 million tons. Almost 45% of those catches were registered by EU28-vessels, with Norwegian and Icelandic vessels accounting for additional 25% and 10% (see Figure 37). Catches by Danish and Finish vessels were around 130 thousand tons, vessels from the UK caught just under 100 thousand tons and Dutch and Swedish vessels registered 80-85 thousand tons. Other EU-fleets caught less. | |

| − | |||

| − | + | [[File:D31 fig 37.png|center|Figure 37]] ''Figure 37. Herring catches in 2014. Thousand tons'' | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | Like for many other pelagic species, herring catches can fluctuate a great deal between years. This is evident in Figure 38 and Figure 39 which shows the development of herring catches of vessels from five of the six countries included in this case study, Norway, Iceland, Denmark, the UK, and Germany, during the period 2000-2014. The figures also reveal a general downward trend during this period which is especially strong for Norway and Iceland. EU28-catches have on average been close to 700 thousand tons per year, while Norwegian catches have fluctuated between 600 thousand and 1 million tons. | |

| − | Figure | ||

| − | tons | ||

| − | [[File: | + | [[File:D31 fig 38.png|center|Figure 38]] Figure 38. Development of herring catches of Norway, Iceland, Denmark, the UK and Germany 2000-2014. Thousand tons |

| − | Figure | ||

| − | + | [[File:D31 fig 39.png|center|Figure 39]] Figure 39. Landing of Atlantic herring in Canada by volume (metric tonnes live weight). Source: MemU | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | Modern herring vessels usually employ either purse seine or pelagic trawl. The vessels are typically also engaged in other pelagic fisheries, such as mackerel, capelin and blue whiting. The vessels are generally large (above 40 m length, often 60-70 meters, and/or larger than 1400 GRT), and most are equipped with on-board chilling facilities, some also with freezing facilities. Increasing boat size, more efficient fishing gear and fish-finding technology all contribute to a trend of consolidation of vessel and quota ownership for pelagic species across all main producer countries. This trend is thus driven by economies of scale in pelagic fisheries, as well as regulatory changes allowing for concentration. Purse seine was the main gear type used by vessels from Norway, Denmark and the UK, while Icelandic vessels more often employed pelagic trawl. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | are generally | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | of | ||

| − | |||

| − | |||

| − | all | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

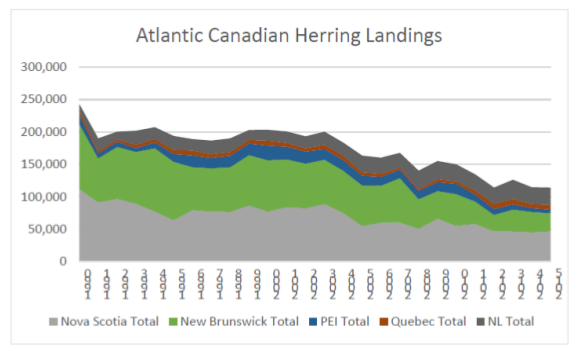

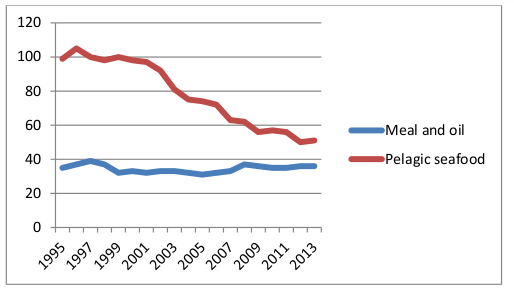

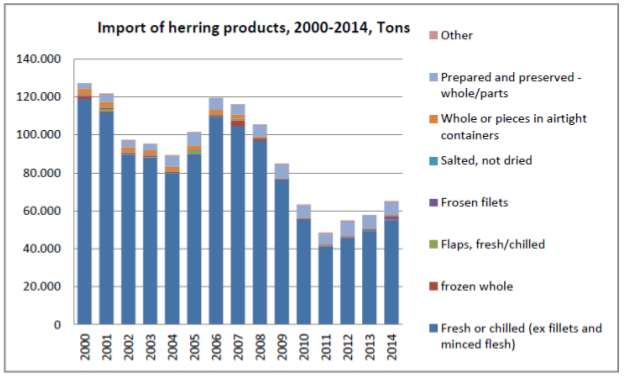

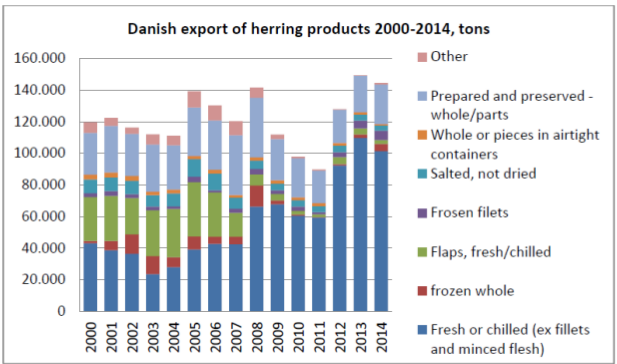

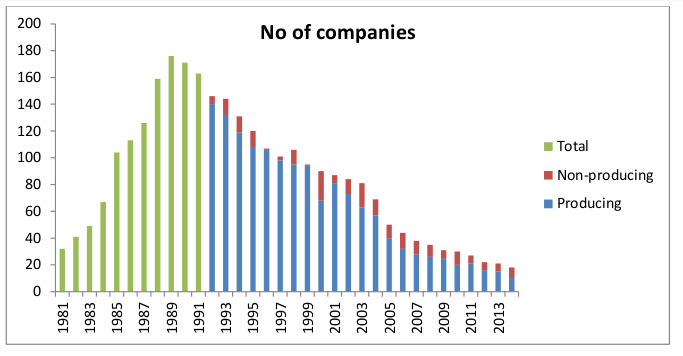

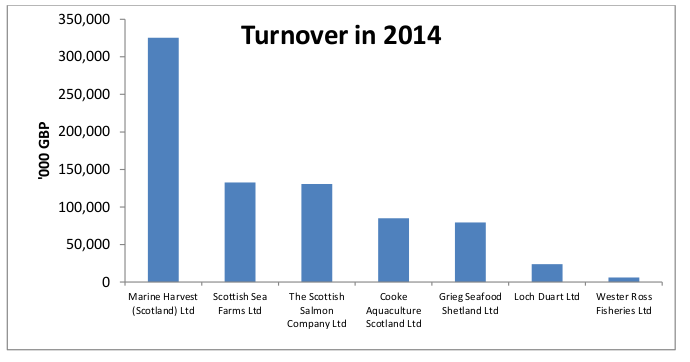

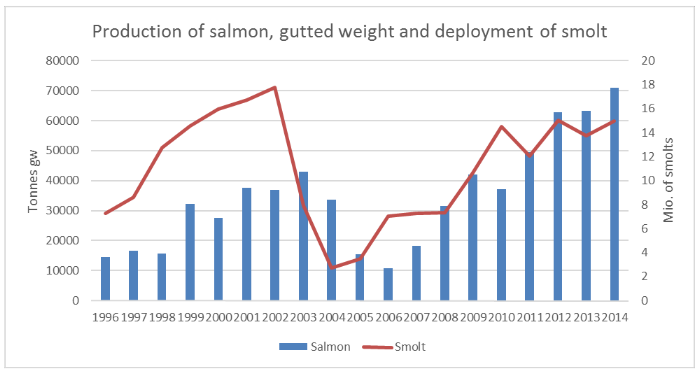

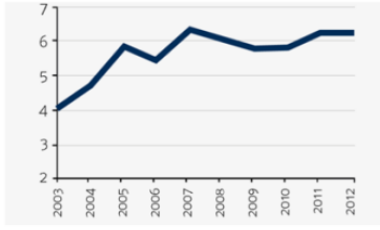

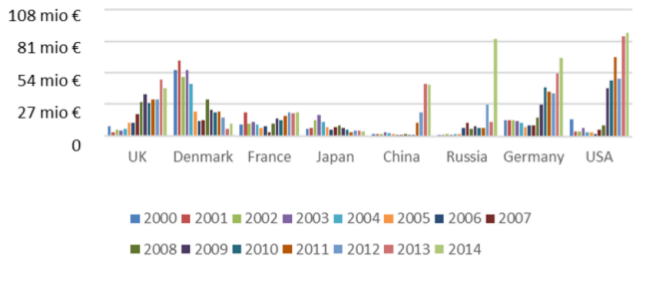

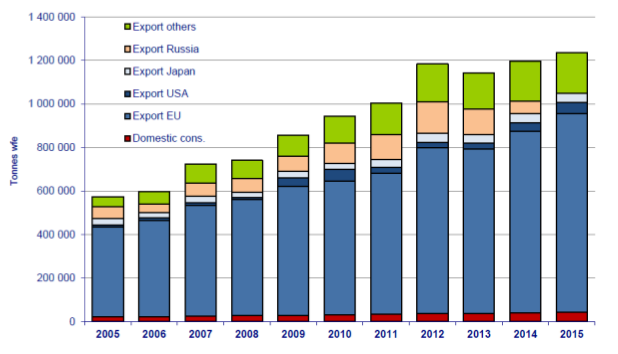

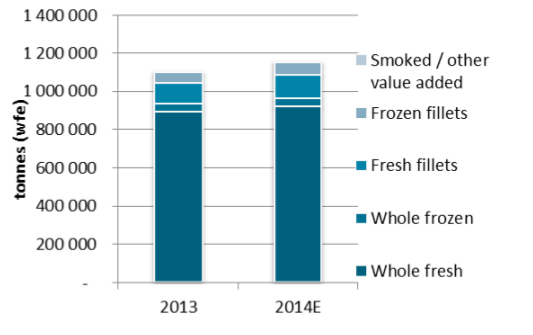

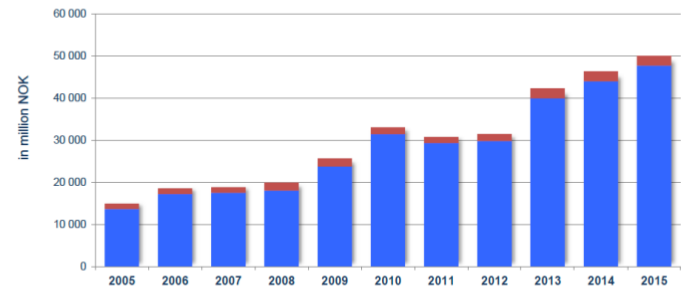

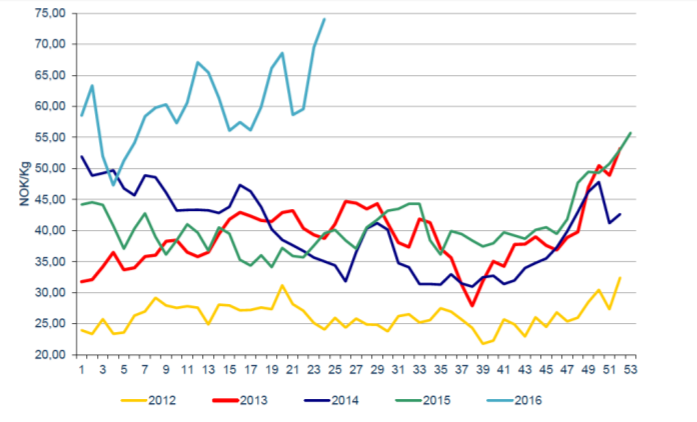

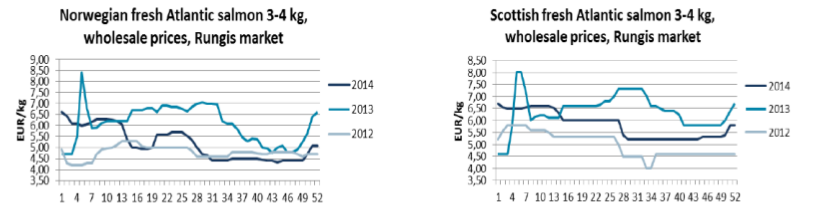

| − | + | Norwegian catches have fluctuated a great deal in the last 15 years. They reached a high of more than 1 million tons in 2008 and 2009, but had in 2014 declined to 407 thousand tons. During the period 2000-2014 catches averaged 711 thousand tons. In Norway, most of the catches are registered by vessels larger than 28 m which operate purse seine. Up to quite recently, a substantial share of the herring catches was also caught by smaller vessels of the coastal fleet, for which it was an important fishery. Norwegian vessels land by far the largest share of their landings in Norway, with only a small proportion landed abroad. Some landings by foreign vessels, mainly Danish, are also registered in Norwegian ports. Norwegian vessels harvest the Norwegian Spring-spawning herring stock and North Sea herring. Icelandic herring catches have been relative stable around 240 thousand tons in the period 2000- 2014, ranging from 115 thousand tons in 2012 to 370 thousand tons in 2008. The last decade has witnessed a radical change in the composition of the Icelandic herring fleet. As late as 2003, nearly all herring was caught by relatively small vessels (50 GRT or less) employing purse seine, but catches of that fleet segment have diminished rapidly in recent years. Their place has been taken by modern large vessels (1400 GRT or larger) that can both employ pelagic trawl and purse seine. This fleet segment has in recent years registered around two thirds of all Icelandic pelagic catches, with slightly smaller vessels (1000-1400 GRT) catching additional 17% percent, and the smallest fleet registering the rest. Icelandic vessels generally land herring as fresh chilled or frozen whole (headed and gutted) or as frozen fillets. Icelandic vessels rarely land their catches in foreign ports. Icelandic vessels harvest the Norwegian Spring-spawning herring and the more local Icelandic Summer- spawning herring. Annual catches by the Danish fleet averaged 125 thousand tons during 2000-2014. Herring catches were only around 80 thousand tons in 2010-11, but have since rebounded and were around 140 thousand tons in 2013-14. The Danish herring catches are mostly registered by 11-16 vessels which are generally larger than 40 m and employ purse seine and pelagic trawls. In recent years, foreign vessels have been responsible for around half of herring catches in Denmark, while Danish vessels have landed have their catches abroad, mostly in Norway or Germany. The catch is generally landed directly to the processor, e.g. only 10 % of Danish landings in Denmark are registered at the Danish auctions the rest is landed directly to the processor (Ministry of Environment and Food, auction data). Danish vessels mainly operate in the North Sea. During the period 2000-2014, UK herring catches averaged 87 thousand tons, from a low of 53 thousand tons in 2014 and to a high of 126 thousand tons in 2005. The UK herring fleet is composed of 30 vessels larger than 40 m. Most of the herring landed by the UK fleet is captured in the North Sea. The UK fleet frequently lands its catches abroad; during the period 200-2014, 40-63% of the catches were landed in foreign ports, mostly in Norway and the Netherlands. Foreign vessels, above all from Denmark, Norway and Ireland, also often land their catches in the UK. German herring catches hovered around 60 thousand tons during 2000-2014. In 2009-2011 catches were on average around 40 thousand tons, less than half of what they had been five years earlier. The German fleet is dominated by one large pelagic trawling company (Parlevliet & van der Plas) that currently operates eight large, modern vessels, but small gillnet boats (12 m) also make up some of the herring catches. Total landings of Atlantic herring in Canada have declined by 56% since 1990 from 260,273 metric tonnes to 114,200 metric tonnes in 2015. Although the total landings of Atlantic herring have decreased since 1990, the total landed value has remained relatively stable averaging $36.3 million between 1990 and 2015. Atlantic herring in Canada is harvested from FAO Fishing Area 21 which includes the provinces of Nova Scotia, New Brunswick, Newfoundland and Labrador, Prince Edward Island and Quebec. There are eight main NAFO divisions for Atlantic herring in Canada. These include: (1) Scotia‐Fundy (4VWX) ‐ Four Areas (4Vn, 4Vs, 4W & 4X); (2) Southern Gulf of St. Lawrence (4T); West Coast Newfoundland (4R); and (4) East & South Coast Newfoundland (3KLP) ‐ One Area Three Zones (3K, 3L & 3P).In 2014 the majority (90%) of the landings were landed in Nova Scotia (39%), followed by New Brunswick (28%) and Newfoundland and Labrador (22%). Fishing gear used in Atlantic Canada for Atlantic herring include 2 types: (1) Fixed gear (traps, gillnets, weirs); and (2) Mobile gear (purse seines, tuck‐ring seines and mid‐water trawls). NAFO region 4R has MSC certification for purse seines, and the Gulf of St. Lawrence fall fishery is MSC certified for gillnets. Canada’s Atlantic herring fishery occurs mainly in the spring (April/May) and summer (July/August). | |

| − | + | === Trade in raw material/freshly caught fish === | |

| − | |||

| − | |||

| − | |||

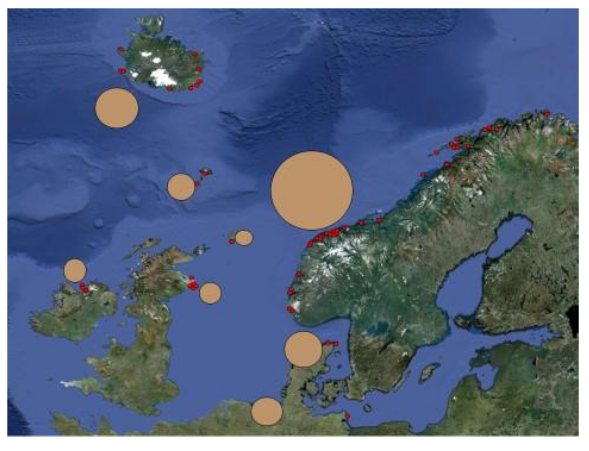

| − | + | Landings often take place in a different country than the origin of the boat. The North Sea basin is to some extent a common market for landings, Figure 40. This trade sometimes takes place through an auction, like the Norwegian Norges Sildesalgslag, or through direct agreements between boats and processing facilities. | |

| − | |||

| − | + | [[File:D31 fig 40.png|center|Figure 40]] ''Figure 40. The North Sea basin is to some extent a common market for landings. The size of each circle reflect landings in 2014. Red dots represent pelagic processing plants'' | |

| − | + | === Processing of herring === | |

| − | |||

| − | |||

| − | |||

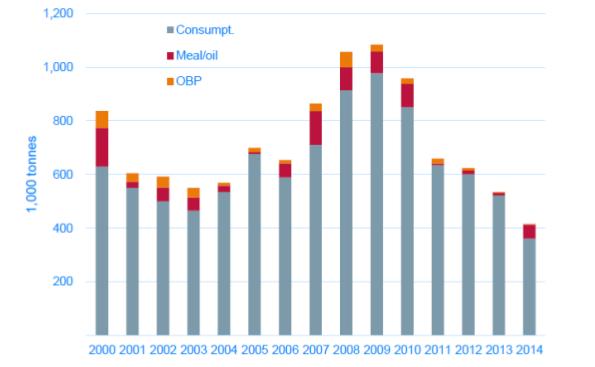

| − | + | The vast majority of the herring captured in the countries examined here was destined for human consumption. The share of herring for human consumption has been growing over time as can be seen as an example for the Norwegian catch, Figure 41. A small fraction is processed before landing (OBP is short for On-board Processing). | |

| − | |||

| − | + | [[File:D31 fig 41.png|center|Figure 41]] ''Figure 41. Landings of herring in Norway by the Norwegian fleet by designated use. Source: Nofima'' | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

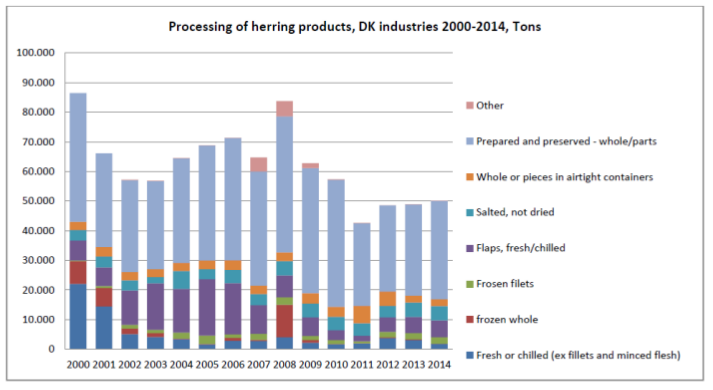

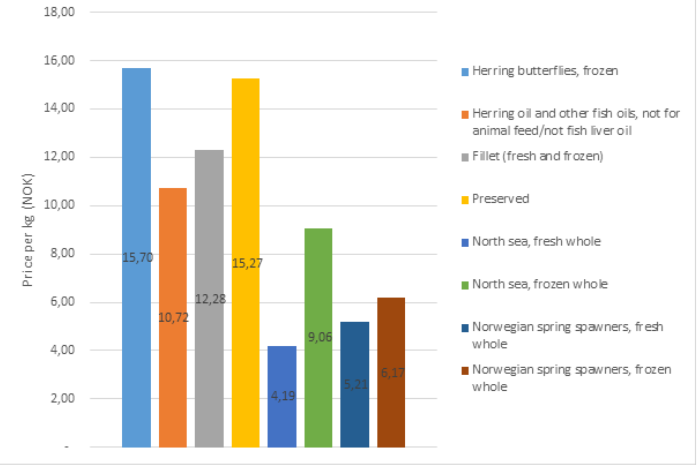

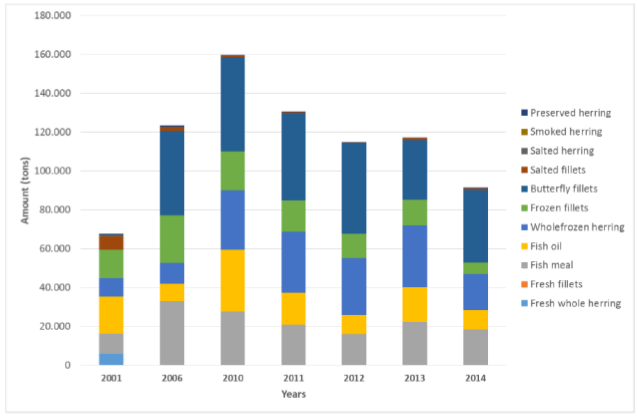

| − | + | In all countries, the bulk of the herring was primary processed by a few vertically integrated large companies. The companies either buy herring from vessels (as in Norway and Denmark) or catch the herring using their own vessels (and own quota, as in Iceland). They process it into the various commodities and use the rest material for fish meal and oil, also owned by the large companies. Many of them additionally sell their own products through marketing companies which they own fully or partially. The level of concentration in processing has followed suit with the concentration in the capture sector. The fish is produced mainly into fillets, butterfly fillets or headless and gutted herring; all as frozen products. Less than 10% of the overall catch is used fresh for salting or vinegar curing into fillets, fillets bits and headless and gutted fish intended for the Scandinavian and German market. Of the countries examined here, Denmark and Germany undertook most of the secondary processing, while the main producer countries (Iceland and Norway) exported unprocessed or primary processed herring products. The secondary processing in Scandinavia and Germany consists of making various marinated herring products in clear brines or sauces in jars, tins, plastic buckets or in vacuum packs Some of the herring is also canned into tins, e.g. as smoked or placed in various brines and sauces. In Norway there were around 100 primary processing plants specialising in pelagic fish in 1995, of which about 50 are left today, Figure 42. However, in this period production volumes have increased, so the explanation lies mostly in the construction of larger, more automated and efficient factories. | |

| − | |||

| − | + | [[File:D31 fig 42.png|center|Figure 42]] ''Figure 42. Pelagic fish processing factories in Norway according to designated use of output. Source: Nofima'' | |

| − | |||

| − | |||

| − | |||

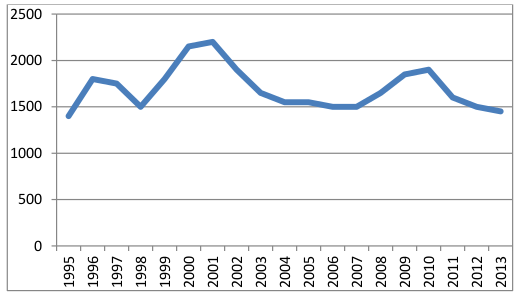

| − | + | Around 1500 jobs were created by the pelagic processing sector in 2013 and has reached peaks of up to 2200 jobs in the period 1995-2013, Figure 43. Employment varies according to fluctuations in quotas (reduced herring quotas is partly offset by increased mackerel quotas, but automation continues). Increasing automation is likely to result in fewer jobs in the future. | |

| − | |||

| + | [[File:D31 fig 43.png|center|Figure 43]] ''Figure 43. Number of jobs in the pelagic fish processing industry in Norway. Source: Nofima'' | ||

| − | In recent years the herring primary producing companies in Iceland have become bigger and quite | + | In recent years the herring primary producing companies in Iceland have become bigger and quite successful financially by focusing on, not only herring but additionally other pelagic fish species such as capelin, blue whiting, and mackerel. They have become large and vertically integrated by catching and landing fresh fish by own vessels, by primary processing and freezing the fish and finally by producing fish meal and oil from the discards and rest materials. Necessary investments in automation of filleting and in facilities for freezing and storage have been made. With this set up, the companies have been able to get an excellent return on capital, efficient use of the vessels, facilities and equipment. |