SFS

Contents

- 1 Success & Failure Stories

- 1.1 Introduction

- 1.2 Methods

- 1.3 Background: literature review

- 1.4 Results & Data

- 1.5 Tool Overview

- 1.6 References & Readings

Success & Failure Stories

Introduction

In 2012, the food and drink manufacturing industry in the European Union was the largest manufacturing sector in terms of value of the output with 15% of the total manufacturing turnover. It also remains one of the largest in terms of employment and number of companies, the large majority of which are small and medium scale enterprises (SMEs) (ECSIP Consortium, 2016).

Within the food and drink industry, the seafood processing sector had the smallest share of turnover in 2012. With 3570 companies, it occupied 0.01% of the total number of companies in the food sector (ECSIP Consortium, 2016). Nevertheless, the enterprises operating in the EU food and drink industry are a vital link in the supply chain, enabling wider economic activity and employment (Traill & Grunert, 1997).

In the context of globalisation and increased competition on domestic and foreign markets, innovation is seen as a key pathway to creating and sustaining competitive advantage at the firm level as well as stimulating wider economic growth (Porter, 1985, 1990). Indeed, one of the five targets of the Europe 2020 strategy is 3% of the GDP of the EU to be invested in R&D, a tool for innovation (EC, 2016). The food and drink industry, however, has been scored as a low-medium R&D intensity sectors, a group of sectors with R&D intensity between 1% and 2% of net sales, which comes at the background of companies in the automobile and electronics industries with R&D investment of more than 20% (Hernández et al., 2014). Nevertheless, as we will see below, this may not necessarily mean lack or a low level of innovation.

What is innovation?

Innovation is a ‘good, service or idea that is perceived by someone as new’(Grunert et al., 1997). According to the same authors, innovation may be related to invention but not all product innovations are based on inventions. New product could merely be an improved existing product. Schumpeter (1939) distinguishes between five types of innovation: introduction of new products; introduction of new methods of production; opening of new markets; development of new sources of supply for raw materials or other inputs and creation of new market structures in an industry. Similarly, The Oslo Manual on collecting and interpreting innovation data distinguishes between four innovation areas: product, process, marketing and organisation (OECD, 2005). In the context of the food industry, innovation can include new products, new types of packaging (including both the physical characteristics of packaging and the contents of information on it, new recipe (new flavours, new additives, conservation methods), range extension, re-launch, new marketing methods and implementation of a new or significantly improved logistical process (ECSIP Consortium, 2016).

The focus of this study is primarily on product innovation. However, the distinction between product and process innovation is not always clear-cut, since product and process innovation are often dependent on each other. Process innovation has been defined as “an investment into a company’s skills, resources and competences, which allows the company to introduce cost-saving changes in the production processes but also to introduce new technology which allows the production of a range of products quite different from the existing one” (Grunert et al., 1997). Modern market pressures have pushed food processing companies to move away from a focus of process improvement and cost reduction alone, which used to be the norm in the past, towards creating products that meet the consumer demands more successfully, where product innovation plays a key role (Fortuin & Omta, 2009). In the present-day food industry the introduction of new products is seen as an essential element of competition between companies (Grunert et al., 1997).

Why look at innovation

It is widely acknowledged that innovation is required for the growth of output and productivity. Schumpeter (1939) argues that economic development is driven by innovation through a process of replacement of old technologies with new, which he labels “creative destruction”. But innovation is also seen as a key to business success. A large study by the American Management Association, involving 1396 executives from large multinational companies showed that more than 90% of the participants believed innovation to be important or extremely important for the long-term success of the company and that this will still be the case in ten years’ time (AMA, 2006).

However, unsuccessful innovation may be even more harmful than no innovation, given the high costs associated with it (Traill & Grunert, 1997). The commonly reported figures for new food product failure are between 70% and 90% (Stewart-Knox & Mitchell, 2003). However, as pointed out by Grunert et al. (1997) those figures may be overstated since the definition of success, usually measured by the period which a product has been on the market, is not standard, and indeed a product may be successful even though short lived, depending on its intended function. For example, a range of products can be introduced by a company to diffuse the success of a new product launch by a competitor, being consequently withdrawn but nevertheless strategically successful. Similarly, the definition of a new product varies among authors. It has been argued that if a new product is ‘one that is new to the consumer’ only 7-25% of food products launched can be considered truly novel (Rudolph, 1995).

Aims and objectives

In this report we mainly aim at addressing four research questions:

Q1: How has the seafood innovation developed over time in general and for the selected species?

Q2: What drives product innovation at the company level?

Q3: What factors determine the focus of innovation?

Q4: What factors are responsible for success or failure in product innovation?

Methods

The present report was developed through a mixed research method – a combination of qualitative and quantitative analysis. The combination of data types can be highly synergistic. Quantitative evidence can indicate relationships which may not be salient to the researcher, while qualitative data are useful for understanding the rationale underlying the relationships showed in the quantitative data or suggested through theory (Eisenhardt 1989).

The report starts out with an analysis of The Global New Products Databased (GNPD) which is constructed by Mintel, a market intelligence agency, working across 34 countries. The main objective of GNPD is to provide data giving the depth of resources necessary to track trends in product innovation and retail success. Product innovation are tracked on shop and online across 62 of the world’s major economies; and around 33,000 new products a month are added into the database. Eighty fields of information ranging from companies information and flavour to packaging and positioning are noted. This database allows access to the products characteristics, the marketing positioning and the type of launches. However, it only concerns packed products. It provides detailed data on new products launched in the food, beverage, beauty and personal care, healthcare, household goods and pet care markets.

The innovation taken into account into the database can be from five different launch types: a totally new product, a new packaging, a new recipe, an extension of the range and a product relaunch. The product has to be claimed as “new” to be picked up. A new product corresponds to a new line or a new family of products for the brand, this kind of launch is brand depending. This also includes brand products that are launched in a new country where the product was not commercialized (Mintel International Group Ltd. 2012). A new packaging is based on the visual aspect of the product, it corresponds to product labelled as new look, new size or new packaging (Mintel International Group Ltd. 2012). A new recipe concerns the new ingredients formulation of an existing product. An extension of the range depends of the brand line; it is assigned when an innovation is the horizontal extension of an existing line (Mintel International Group Ltd. 2012). Finally, a relaunch is assigned to an innovation when it is indicated on the product packaging or when a secondary information source informs consumers (trade show, website or press). It is also assigned when the product has been both reformulated and it has a new package (Mintel International Group Ltd. 2012). Thus, there are mainly product and marketing innovations valorised in this database, as major process or social innovations are not necessarily highlighted to shopper.

For this analysis on European Seafood market, we looked at food product containing seafood as major ingredients (seafood has to be in the five main ingredients to be selected for this analysis). The European market as delimited (and covered) by Mintel concerns 25 countries: Germany, Austria, Belgium, Croatia, Denmark, Spain, Finland, France, Greece, Hungary, Ireland, Italia, Norway, Netherland, Poland, Portugal, Czech Republic, Romania, United Kingdom, Russia, Slovakia, Sweden, Swiss, Turkey and Ukraine.

Secondly the report focus on a primarily qualitative analysis - an explorative multiple case study analysis where the unit of analysis is the firm, although special attention is also given to one of the main successful or unsuccessful company’s products. The research strategy of case studies was chosen because it focused on understanding the dynamics present within single settings, at numerous levels of analysis, and can be used to accomplish various aims, ranging from providing a description to generating theory (Eisenhardt, 1989).

The cases were identified from secondary data (e.g. newspapers, company sites, specialized literature, innovation awards, etc.). Then, a first stage selection based on careful cross-checks with databases such as Lexis Nexis4 and GNPD, resulted in 60 proposed cases (9 product failures and 51 successful products). From them, 17 were selected (4 failures and 13 successes) for in-depth studies, in order to provide a detailed view on the successful – or unsuccessful – industry practice /or learnings.

All the selected cases belong to the seafood industry and have at least one product based mainly on one of the following fish species: salmon, trout, seabream, seabass, cod, pangasius or hearing. Moreover, the final selection of the cases was done balancing the different types of innovations, claims, fish species, markets and successful/failed products, among the cases. The selected cases can be observed in the Table 1.

Table 1.Case studies general information

| Case | Innovation | Major claim | Fish species | Markets | Launching year | Success/failure |

|---|---|---|---|---|---|---|

| A |

|

|

Salmon, Seabass, Seabream | UK | 2010 | Success |

| B |

|

|

Herring | France | 2012 | Failure |

| C |

|

|

Salmon | United States, Canada, European Union | 2014 | Success |

| D |

|

|

Salmon | Italy | 2000 | Success |

| E |

|

|

Salmon, Cod | United States | 2014-2015 | Success |

| F | *New product | *Natural

|

Trout | Italy | 1989 | Success |

| G |

|

|

Trout | Italy | 2015 | Failure |

| H |

|

|

Trout | Italy, Switzerland | n.d | Success |

| I |

|

|

Seabass | Italy | 2011 | Success |

| J |

|

|

Pangasius | Europe, Asia and USA | 2005 | Success |

| K |

|

|

Trout | UK | 2008 | Success |

| L |

|

|

Salmon | Spain | 2013 | Success |

| M |

|

|

Salmon, cod, seabass, seabream | Europe | n.d | Success |

| N |

|

|

SeaBream | Greece, Russia | n.d | Failure |

| O |

|

|

SeaBass | Croatia, Italy, Germany | 2011 | Failure |

| P |

|

|

Salmon | Norway | n.d | Success |

| Q |

|

|

Cod | Germany | n.d | Success |

From the selected cases, 13 are product innovations, frequently related to new recipes (4 cases) or to an extension of product range (2 cases). There is also one case in which the new product development is related to a new process. Among the claims, the most common ones are convenience (9 products), health (5 products), high quality (5 products) or natural (4 products). Less common claims include taste or gourmet (2 products) and the ‘local’ claim (1 product). Regarding the fish species, 3 of the analyzed products are based on several fish species (salmon, cod, seabass and seabream). The rest of the products are focused on one particular specie: salmon (5 products), trout (4 products), seabass (2 products), seabream (1 product), cod (1 product) and pangasius (1 product).

Following the selection of the cases, multiple types of data compilation are used to develop the case studies: archives, interviews, questionnaires, and observations (Yin 1994). The case analysis was structure along a common framework derived from literature review on food/fish innovations. The major areas were developed in a semi-structured interview guideline, sent with instructions to all partners. The guide included information as aspects of company general information, market structure, innovative practices, innovation inside the firm, sources of innovation, success/failure perception, and more detailed information on the selected successful/fail product.

All firms were contacted by phone and additional information was sent via e-mail by local researchers. The semi-structured interviews were developed at the firms in their local language in order to enhance understanding. The interviews were carried by one or two local researchers, and when possible, these were recorded. The interviews were reinforced with additional secondary data collection and analysis. Then, based on the interview material and secondary data, a cross case analysis is performed with the objective of identifying commonalities and differences between the firms, operative markets, species, and successful/failure outcomes.

The analysis of the information is done through a cross-case analysis. All the results are presented based on the analysed case studies. Additionally, the report offers some comparisons of the qualitative and quantitative results. The general framework used for the analysis is divided into three main levels even though these clearly interrelate and interact: 1. Innovative potential at the supra-company level - the wider environment 2. Company’s innovative potential 3. Influences on innovation success at the project level When investigating at the innovative potential at the supra-company level – i.e. the wider environment we look for factors like market structure/characteristics, the firm’s perspective on consumer trends (needs/wants), value chain organization and regulation.

When looking at the innovative activity at the company level we looked for factors like company size, resource availability and experience. Further firm strategy and orientation, capabilities and relationships with other companies/institutions where investigated.

Finally, when it comes to each of the selected case products, the material was analysed based on factors such as; source of the innovation, innovation strategy, organisation of the NPD (individuals, relations, management involvement, etc), type of innovation (incremental, radical, ‘originality’), market and consumer knowledge, process of new product development and perception of success and effect on performance.

Background: literature review

The EU food industry is a dynamic arena affected by wider socio-economic processes. To remain competitive in the modern world, food manufacturers must develop capacity to innovate quickly and effectively as reliance on a stable range of traditional foods can no longer ensure business success (Grunert et al., 1997). The following discussion starts with an overview of the major trends in the industry, particularly as they relate to pressures on the industry to innovate. It then proceeds with a review of the factors deemed important for the success or failure of new food products.

Drivers of innovation – the bigger picture

Over the last several decades, significant changes in the patterns of food consumption have been observed in industrialised countries, with inevitable influence on the rate and direction of product innovation. The drivers for these changes will be examined from different perspectives, which however, are inherently related to and reinforcing each other.

Economic factors

Generally, growing disposable incomes in industrialised countries has translated into changes in the patterns of expenditure on food, such that an overall higher level of expenditure on food, through consumption of higher quality and more diversified foods rather than higher quantity, can be observed (Traill, 1997). When it comes to seafood, however, the development of consumer prices has played a similarly important role in determining consumption trends. Since price is often cited among the main barrier to consumption of fish and seafood (Birch, Lawley, & Hamblin, 2012; Liu, Bui, & Leach, 2013; Myrland, Trondsen, Johnston, & Lund, 2000; Trondsen, Scholderer, Lund, & Eggen, 2003; Verbeke & Vackier, 2005), a decrease in their prices relative to other sources of protein can act as a driver for consumption and overall expansion of the market. Indeed, good illustrations of this are shrimp, salmon, tilapia and pangasius, all of which are internationally traded commodities whose real prices have declined over time due to increased and more efficient production methods (Asche, Bjørndal, & Young, 2001). For example, shrimp and salmon have been leading the international farmed seafood market for almost three decades, with current real prices a third of what they were three decades ago (Asche, Roll, & Trollvik, 2009). However, relative prices of close substitutes remain still important for consumers. This is particularly true at times of economic recession, when clear declines in seafood consumption can be seen as consumers ‘trade down’ the food basket (Seafish, 2015).

Consumer concerns

A wide array of non-economic factors is also at play in determining the trends in food consumption. Increasingly, these relate to ‘intangible’ aspects of the product, such as ethical and sustainable sourcing.

Diet and health

As the populations of many industrialized countries are becoming older, richer, more educated and more health conscious, the demand for food that promotes health and well-being is growing (FAO, 2008). Seafood has often been promoted as a having a variety of positive health properties. Because of that, seafood, and especially oily fish, can also be seen as a functional food (Gormley, 2006), a fast growing market with high opportunities for innovation (Khan, Grigor, Winger, & Win, 2013). However, risks of eating fish linked to contamination with carcinogens has also been communicated to the public (Sidhu, 2003). As a result there is a general confusion over the right choice of seafood (Oken et al., 2012), the individual choice whether to consume fish or not being eventually dependent on the type and accuracy of information consumers are exposed to (Burger & Gochfeld, 2009).

Environmental concerns

Consumers, as well as major distributors, are increasingly concerned about the sustainability and risk of depletion of marine stocks. While the range of fish and seafood products labelled as sustainably sourced is expanding and the demand for sustainable seafood products is rising (Roheim, 2009), there is a debate whether this is due to genuine consumer demand or due to influences by NGOs and branding strategies by retailers (Gutierrez & Thornton, 2014). Gulbrandsen (2006) and Bush et al (2013) for example argue that most markets for eco-labelled forestry and fisheries products have been created as a result of pressure by environmental groups on consumer-facing corporations, rather than resulting from consumer demand. In any case, consumers have as a result an increasing abundance and diversity of certified seafood product to choose from. Increasingly, consumer behaviour is shaped by the growing popularity of sustainable seafood guides, such as Monterey Bay Aquarium’s Seafood Watch and MCS Good fish (Roheim, 2009). However, the availability of too much information from different sources, with sometimes conflicting advice can lead to consumer confusion and even negatively impact consumption (Oken et al., 2012; Roheim, 2009). The issue whether demand is genuinely ‘consumer driven’ or resulting from a ‘retailer push’ would remain nevertheless important to the performance of new seafood products on this market.

Production methods and safety

Consumers have become increasingly concerned about the ways in which food is produced, with ranging attitudes towards the use of certain new food technologies (Grunert et al., 1997). More stringent demands for assurance concerning safety is yet another high-profile issue that has emerged in recent years and shaping consumption patterns. As a result a variety of safety certifications have been developed which have become requirements by supermarket chains. European retailers for example increasingly expect supplies to comply with quality standards such as BRC and IFS, as well as traceability (CBI, 2015).

Societal change

Significant increase in the demand for convenience food can be attributed to increased participation of women in the work force (Traill, 1997). Due to factors such as time pressure, there is a strong rise in the demand for products that are ready to eat or require little preparation before serving (Brunner, van der Horst, & Siegrist, 2010). And while fish has been widely considered inconvenient because of the time and skills required for preparation (Olsen, Scholderer, Brunsø, & Verbeke, 2007), the current wide availability and expanding market for value added convenience seafood sets a new norm of how fish is consumed (Olsen, 2004). For example, the development of vacuum packed, pre-cooked mussels with sauce has been highly successful on the UK market, driven by the convenience, longer shelf life and versatility. In 2008 the ratio of Scottish produced mussels going to fresh counter market and to value added market were 70% to 30% respectively with a combined value of £6 million while in 2015 the ratio was 25% to 75% respectively with combined value of £15 million (Cameron, 2015). The trend in expanding value added seafood markets presents a vast opportunity for innovation in the field, with particular reference to younger generations.

Further, according to Olsen (2003) frequency of seafood consumption is positively correlated with chronological age, mediated by attitudes toward eating seafood, health involvement and perceived convenience. Markets where population is aging, and the number of one-person single households is growing, such as the UK and other European countries, present an opportunity for innovation tailored to this particular consumer group.

Availability of food products

The increase in the global supply of seafood over the last few decades, combined with technological innovations, has facilitated the international orientation of the seafood industry. In particular, progress in storage and preservation and improved logistics leading to lower costs have allowed international trade to grow (Asche, Bellemare, Roheim, Smith, & Tveteras, 2015). An increased range of raw material available to processors has stimulated experimentation with new species and served as a basis for a wide variety of seafood product innovations. Notable examples are pangasius, tilapia and shrimp.

Food retailing

Food retailing in Europe has become concentrated in the hands of leading multiple retailers with inevitable impact on innovation not only for processors but throughout the value chain (Murray & Fofana, 2002). One of the most powerful tools of retailers exerting control on the value chain is their ‘private label’ products (Bunte et al., 2011). It is generally accepted that private labels utilize markets created by branded products, by ‘imitating’ successful products. Private label products require little advertising as they rely on the image of the store, thus they are well placed to compete on price with the highly advertised branded products, pushing leading manufacturers to innovate even faster. At the same time, ‘private labels’ provide an opportunity for small and medium scale enterprises to supply the market while avoiding the prohibitive costs of developing a recognised brand (Traill, 1997).

Factors for success in innovation

A considerable amount of insight on the key success and failure factors in new product performance has been published in the late twentieth century. This has led to the generation of a plethora of factors deemed critical for successful innovation, often cited with contradictory outcomes (Balachandra & Friar, 1997; Grunert et al., 1997). The discrepancies could partly be explained by the lack of methodological standardisation in the study designs and definition of key variables, but also by the contextual differences. The vast majority of these studies focus on high-tech industries such as electronics, biotechnology, or pharmaceutical (Fortuin, Batterink, & Omta, 2007). The number of foodrelated studies on innovation is considerably smaller, while regarding seafood it is negligible. While drawing from a wider industrial base, the following synthesis will review the factors with higher relevance to the food industry, wherever possible illustrating with examples from the seafood sector.

Enabling environment

Porter (1990) argues that government policies play a key role in determining the competitiveness of enterprises as they directly influence the factors responsible for competitive advantage, with inevitable influences on innovation potential. Indeed, as pointed by Lindkvist & Sánchez (2008), prohibitive regulations have had a negative impact on the innovative activities and overall competitiveness of the Norwegian salt fish producers on the Spanish market. In particular, laws not allowing the processors to own fishing vessels have resulted in a fragmentation of the value chain and low level of control over the quality and timing of raw material supply. This has been further exacerbated by prohibitions on the use of chemicals other than ascorbic salts in the process of salting fish, leading to products of perceived inferior quality compared to the phosphate and antioxidant treated Icelandic products.

At the company level

Interaction with other companies

Innovation capabilities at the company level can be influenced by the existence of clusters of companies producing interrelated products and having high level of coordination between their activities, thus exploiting a larger pool of skills and enhancing their innovative power. The same advantages can be exploited in a network of companies, not necessarily physically clustered together (Grunert et al., 1997).

In a similar fashion, vertical cooperation can bring advantages to the innovative activities of the firm in the form of generation of market intelligence by sharing of information between downstream and upstream members, increasing the firm’s portfolio of competences and improving cross-functional communication.

However, it has been argued that the inflexibility created by committing to a few partners may act as an impediment to market intelligence generation and competence expansion. Similarly, increased levels of bureaucracy, especially in connection with large retail chains with emphasis on price instead of differentiation, may inhibit upstream innovation. In such cases, the choice of co-operation partners becomes a crucial issue.

In addition to regulations, a lack of cooperation in innovation and market development, due to mistrust and protection of self-interests, between producers of salt cod in Norway has been cited as a central factor for the loss of market share to Icelandic producers on the Spanish market (Lindkvist, 2010).

The role a company plays in the supply chain can directly influence its innovative potential. Harmsen & Traill (1997) show that the seafood company ‘Royal Greenland’ increased considerably its innovation activities when it expanded its customer base from food service to retail. Similarly, Christensen et al. (2011) find that firms delivering directly to end users were more likely to be innovative than those delivering to the processing or wholesale links of the value chain.

Size of company

Size of the company has been a central variable in much of the literature on innovation activity at the company level. The neo-Schumpeterian view maintains that large companies are more innovative than small companies, largely because of better resource base; human and financial (Grunert et al., 1997). In fact, previous research has shown that small firms face the liability of smallness (Aldrich and Auster, 1986; Freeman et al., 1983), that refers to the limited access to financial resources and competitive human capital. Such constrains might generate a limited market power and a small customer base (Carson, 1985), as the firms are unknown to their potential customers (Gaddefors and Anderson, 2008). Thus, these companies must devote several resources to building an identity, but the process is lengthy and costly (Gruber, 2004).

An alternative view, argues that SMEs tend to be market makers while large companies tend to be imitators, if the potential market volume allows large scale production. It has also been argued that SMEs are more prone to innovate because of organisational and behavioural characteristics allowing them to react to market changes more quickly e.g. little bureaucracy, high commitment and motivation by managers, higher exposure to competition, lower innovation costs, higher R&D efficiency. Similarly, it has been hypothesised that radical innovation is more typical of small and medium scale companies because it does not fit with the pragmatic philosophy of larger companies which are looking for a systematic innovation process. Nevertheless, according to Grunert et al. (1997), there is no consensus in the literature regarding the influence of firm size on its innovativeness.

Orientation of the company

Innovative activity can be seen as pertaining to a particular innovation or to the company in general. When it comes to particular innovations, it has the dimension of how new it is to the market and how new it is from a technological point of view. Innovation at the company level can be broken down to innovation speed, innovation willingness, innovation capacity and innovation quality (Grunert et al., 1997).

Earle (1997) argues that successful innovation is reliant on innovation-oriented company and positively reactive environment. It is the company’s strategic decision whether to pursue an innovation course or not. A firm may take either reactive or proactive approach in innovation to either avoid losing market share to an innovative competitor or to gain strategic market position relative to its competitors.

Depending on their involvement with innovation activities companies can be divided into innovative (or prospectors); improvers, getting involved once the initial products have been already developed;

‘me too’ companies, copying what others have already introduced on the market; and ‘die hard’ ignoring innovation altogether (Earle, 1997; Fortuin et al., 2007). The spectrum can be illustrated again by Icelandic companies producing salt cod for the Spanish market at one end and their Norwegian counterparts at the other (Larsen, 2014; Lindkvist, 2010).

Grunert et al. (1997) presents a further nuanced picture of innovation at the company level by providing two different perspectives: the first linking innovation with technological change, the driving force of economic growth, which is linked to, and can be measured by, R&D activities. As such the food industry could be classified as a low-tech industry due to the small R&D to sales ratios typically reported. In this view innovation could be regarded as a ‘technology push’.

On the other hand, from a marketing perspective, innovation can also be viewed as an activity required for fulfilling the unfilled needs and wants of potential customers using the skills, competences and resources of the company, often referred to as ‘market-orientation’ of the company, or ‘demand pull’. This view maintains that R&D activities do not guarantee innovative success alone, but only in interaction with the needs in the market (Gupta, Raj, & Wilemon, 1986).

As seen before, the food industry is generally considered as one with a low R&D expenditure. Indeed, Harmsen, Grunert, & Declerck (2000) in a series of case studies from the food industry showed that R&D is of minor importance in the innovation process, but innovative activities are nevertheless carried out. This was supported by findings by Avermaete et al. (2004) from a study on small-scale food manufacturers and by Christensen, Dahl, Eliasen, Nielsen, & Østergaard (2011) from a wider sectorial analysis. This has led Harmsen et al. (2000) to revise the framework proposed by Grunert et al. (1997) by focusing greater attention on ‘market orientation’ and ‘competencies’ and their interaction as explanatory factors for success. In their revised framework, orientation was seen as relating to ‘product’, ‘process’ and ‘market’, rather than simply markets. Competencies of the firm relate to the types of orientation but all three types, albeit to different degrees, were required for successful innovation. In-house capabilities of the work force were found to be strong determinants of innovation, particularly in small food firms (Avermaete et al., 2004). That is where the culture of the company and its vision are critical to successful innovation. It has been suggested than unconventional individuals rather than conventional science or engineering are central to innovation success. However, without entrepreneurial spirit and openness, new ideas by such individuals can be dismissed.

At the project level

There is a great number of studies identifying performance factors and Ernst (2002) provides an extensive review of the topic. Here we focus on some of the most often cited groups of factors, particularly as they relate to the food industry and over which there seems to be some level of consensus.

Among others, the success and failure of new food products has been related to the process of new product development (Stewart-Knox & Mitchell, 2003). The process comprises five to eight steps spanning from idea generation to launch activities, going through screening, research, development and testing. The sequence in which those activities are undertaken has been linked to success in the past. For example (Cooper & Kleinschmidt, 1987) argue that companies which taking a stepwise approach were more successful. However, in later publications the same authors show that concurrent, overlapping, flexible approach has better potential than a simplistic stepwise model (Cooper & Kleinschmidt, 2007). The common ground is the requirement for repeated evaluation throughout the process.

Market and consumer knowledge and retailer involvement in the process of new food product development has also been highlighted as a factors critical for success (Kristensen, Ostergaard, & Juhl, 1998; Stewart-Knox & Mitchell, 2003). Similarly, the involvement (as well as its intensity and quality), of the final consumer during the process of product development has been claimed to have positive impact on the outcome of innovation (Gruner & Homburg, 2000). Hoban (1998) has shown that new product developers in the USA rely heavily on retailer customers for market information, and few draw on other sources of information, consequently the retailer involvement has become increasingly important but does not guarantee success. The importance of gathering of information from a variety of independent sources, including retailers, suppliers, research centres, consumers, prior to the development of new products has been emphasized as a unique to the food industry (Stewart-Knox & Mitchell, 2003). Similarly, in a number of publications Cooper emphasizes the importance of market research up-front of the initiation of the process of product development (G. R. Cooper & Cooper, 1994; R. G. Cooper, 1999; R. Cooper, 1996). However, McGinnis & Ackelsberg (1983) note that market analysis can limit the innovators to existing markets with small incremental innovations rather than direct them to undeveloped markets with major innovations. Therefore, a careful balance must be maintained between market analysis and thinking ‘out of the box’ (Balachandra & Friar, 1997). Furthermore, good market analysis is dependent on the quality of data, but as the same authors have pointed out, analysing customer needs may not yield accurate information as the needs may not be known by the customers themselves. In an earlier paper (Balachandra, 1984) suggests the need for an existence of a strong market, instead of a potential market, as the difficulties associated with consumer research can be thus avoided.

Most prospector organise the innovation processes, including new product development, in projects where different functional areas of the firm are represented in cross-functional teams co-operating throughout the process (Fortuin et al., 2007). As Robert G Cooper (1999) points out important decisions as to whether to initiate a project, terminate or redirect it are rarely based on a systematic analysis of the factors determining success or failure, but rather on the experience of the team.

Overall, factors linked to product development strategy, indicate the need for a purposeful and goaloriented approach to product development and balanced technological and market-related aspects, as well as a synergy with existing activities (Earle, 1997).

Although often pointed out as a critical factor for success in wider industrial innovation (Ernst, 2002), involvement of senior management throughout the process of food product development has not been consistently shown to be critical for success (Stewart-Knox & Mitchell, 2003), perhaps in part due to the variety of sizes of companies investigated in different studies and the different roles senior management play in them. In an UK study (Stewart-Knox, Parr, Bunting, & Mitchell, 2003), involvement of senior management seemed to be unrelated, while in Denmark (Kristensen et al., 1998) it was found to be a determinant for success.

Similarly, the rate of new product introduction has also been shown to drive success in opposing directions. Higher rate of introduction implies the growth stage of a product, therefore a higher chance of success, but at the same time greater intensity of competition – a negative factor for commercial success (Balachandra & Friar, 1997).

Generally, original products seem to be more successful than adapted products, because food products market can become quickly overcrowded, although that may be context specific (StewartKnox & Mitchell, 2003). And despite that the failure rate for truly new food products has been shown to be as low as only 25% (Hoban, 1998), only a small proportion of new food products are truly novel (Rudolph, 1995).This may be due to a fear of failure of a new product and taking the ‘safe’ approach of redeveloping old products, which however, only perpetuates the problem of high rate of product failure.

Results & Data

Results from GNDP and discussion

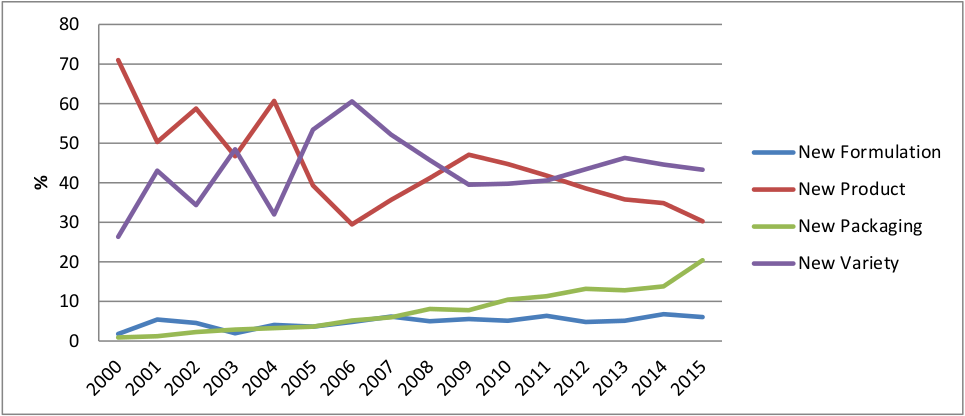

Between 2000 and 2015, 22,406 seafood products have been launched on the European Market (based on Mintel’s Global New Products Database (GNPD), 2016). Over this period, the average repartition by launch type is: 44.16% new varieties, 38.64% new products, 11.72% new packaging, 2.99% new formulations, and 2.49% product relaunches. As new formulation and relaunch are not very frequent strategies, we will regroup these two types of launch for further analyses (which is logical as a part of relaunch is reformulated products). Behind the type of launch we can underline several types of innovation strategies. First, new product tries to develop a new market answering to new needs. In this case, the innovation can be considered as a breakthrough innovation and it is the most risky innovation for firms. New packaging, new variety and new formulation are more adaptation or renovation innovation, and even if not without risk, they are supported by an existing market.

Figure 1. Products repartition over type of launch. Source: GNPD, 22,406 Observations

Thus, we can observe that the strategy of innovation has evolved over the period (see Figure 1 ). The part of totally new products as decreased, in favour of new variety and new packaging. In a very competitive global market, as two third of innovation disappeared within the first two years (Aurier & Sirieix, 2009), firms seems to favour adaptation and renovation, with a decrease in risk- taking.

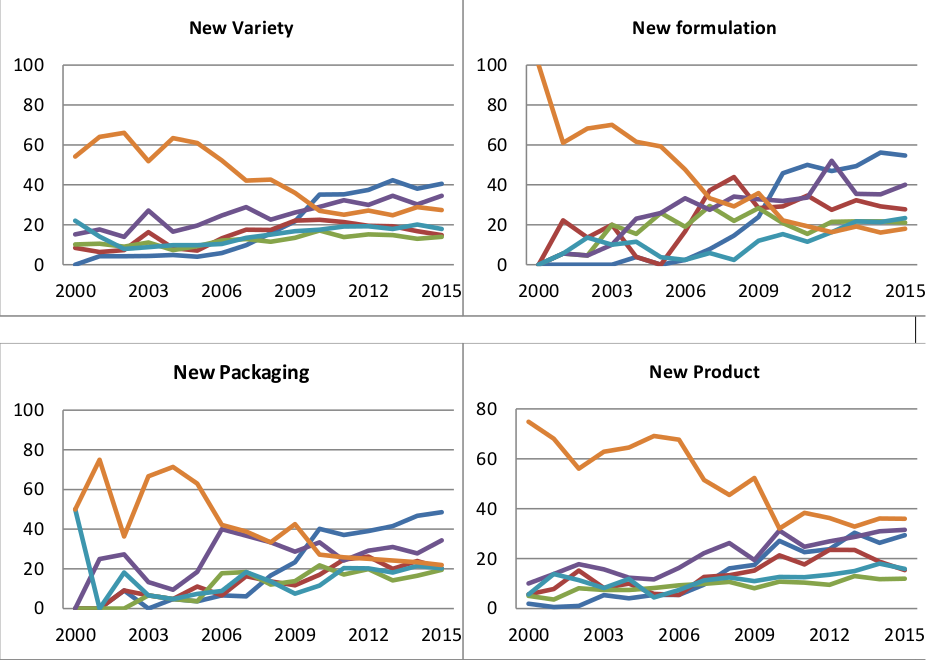

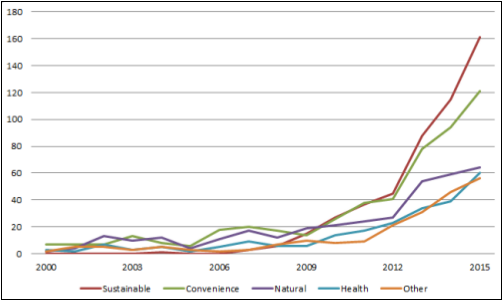

These choices over type of launch can also be linked to the product positioning strategy. Different product positioning can be used to match products with consumer’s expectations. This positioning claims can be related to sustainable claims (e.g. organic, environmentally friendly products and eco- labelled), convenience claims (e.g. Ease of Use and Microwaveable), natural claims (e.g. No additives/Preservatives and GMO Free), health claims (e.g. Antioxidant and Vitamin/Mineral Fortified) or other claims (e.g. Fair Trade, Kasher and Premium). Between 2000 and 2015, 63.76% of seafood innovations have at least one claim, the number of products without any claim is continuously decreasing over the period considered. No claim products represent 69.64% of product launched in 2000 and only 28.27% in 2015. Most used positioning is sustainable (28.14% of seafood products over the period) and convenience claims (28.19% of seafood products over the period), which correspond to main consumers concerns in regard of fish consumption. Indeed the convenience in fish product is an important restraint to fish consumption: some consumers do not have the knowledge to prepare unprocessed fish, and fish is not viewed as an easy product to buy, to conserve and to cook (Brunsø et al., 2008). Furthermore, the convenience positioning is a more general food tendency leading to less cooking times and more easy-to-eat/easy-to-cook products. In regards of the sustainable concerns, this issue is important for seafood industries as some stocks are over exploited (FAO, 2014). And, as for convenience claims, sustainable claims on seafood products respond to a more general tendency on sustainability of food production, illustrated by the increase of organic products on shops shelves all across European countries.

Figure 2. Repartition of claims by type of launch (%) between 2000 and 2015. Source: GNPD, 22,406 observations (New product: 8,657; New Packaging: 2,627; New Formulation: 1,228; New Variety: 9,894)

We observe different strategies over the different type of launch (see Figure 2 ). First, we assume that the choice of the product positioning can be either previous to the choice of launch either viewed as an opportunity after the choice of launch type. In the case of new product, the share of products without any product positioning is the most important compared to others categories, while this share is the lower for new formulation. In the case of totally new product, the innovation has been created for answer to new consumer needs, with probably less expectations in terms of product positioning, which can explain the higher share of products without claims. When a firm chooses to relaunch a product or to change the formulation it is generally to fit more to consumer’s expectation with no major change. In this situation the use of claims is an easy way to communicate on product characteristics, as convenience or sustainable dimension of the product. Those characteristics are either non-existent before the change either already existent but were not claimed to the consumer. The same opportunity occurs with a new variety or a new packaging: this innovation strategy of renovation/adaptation is a chance to expand the line to new positioning, to reach more consumers. In regards of the repartition of innovation across Europe, countries with more innovations are France, United-Kingdom, Spain and Germany, representing 54% of innovations. Nonetheless, it is complicated to go on some deeper conclusion, as there is a possible bias on the shopping execution by Mintel across countries, as well as some differences on the seafood market size across those countries. It is more interesting to look at the country of origin of the innovative firms, as well as the repartition of innovation between national brand and private brand ( Table 1 ).

Table 1. Top 10 of innovative firms. Source: GNPD; 22,406 observations.

| Firm | Firm Type | Firm Nationality | Number of products | Percentage |

|---|---|---|---|---|

| Lidl | Retailer | Germany | 833 | 3.72 |

| Marks&Spencer | Retailer | United-Kingdom | 734 | 3.28 |

| Tesco | Retailer | United-Kingdom | 497 | 2.22 |

| Aldi | Retailer | Germany | 354 | 1.58 |

| Findus | Manufacturer | United-Kingdom | 304 | 1.36 |

| Iglo | Manufacturer | United-Kingdom | 261 | 1.16 |

| Carrefour | Retailer | France | 250 | 1.12 |

| Picard | Retailer | France | 245 | 1.09 |

| Asda | Retailer | United-Kingdom | 239 | 1.07 |

| Auchan | Retailer | France | 232 | 1.04 |

If the majority of innovation are from national brand companies (61.82% of innovations between 200 and 2015), the top 10 company are for the most part retailer, with private brand products. They represent 17.64% of seafood innovation. Only two manufacturers reach the top 10: Findus and Iglo, generally the two leaders in the seafood market. We underline that most of those companies use more claims that other companies (the average of products with at least one claim is 63.66% for the entire sample - Table 2 ).

Table 2. Top 10 of innovative firms - products positioning. Source: GNPD; 22,406 observations.

| Firm | Percentage of products with at least one claim. | Percentage of products with sustainable claim. | Percentage of products with natural claim. | Percentage of products with health claim. | Percentage of products with convenience claim. | Percentage of products with other claim. |

|---|---|---|---|---|---|---|

| Lidl | 59.78** | 28.93 | 3.48*** | 4.68*** | 16.33*** | 27.01*** |

| Marks & Spencer | 79.97*** | 57.36*** | 23.02*** | 6.21*** | 41.83*** | 15.53 |

| Tesco | 84.51*** | 44.06*** | 28.57*** | 15.69* | 29.58 | 41.45*** |

| Aldi | 68.93** | 41.53*** | 17.51 | 9.89* | 22.60** | 20.90*** |

| Findus | 72.37*** | 49.01*** | 21.38 | 13.49 | 40.79*** | 8.88*** |

| Iglo | 90.04*** | 74.33*** | 52.87*** | 16.09 | 32.57 | 18.39 |

| Carrefour | 47.20*** | 10.80*** | 6.40*** | 6.40*** | 24.40 | 14.80 |

| Picard | 68.57 | 21.63** | 0*** | 2.04*** | 53.88*** | 6.94*** |

| Asda | 82.01*** | 33.05* | 53.14*** | 48.95*** | 23.01* | 34.31*** |

| Auchan | 62.07 | 19.83*** | 9.48*** | 1.72*** | 29.74 | 28.88*** |

| All companies | 63.66 | 28.14 | 17.86 | 13.05 | 28.19 | 15.67 |

Mean comparison test (t-test): significant at *10%, **5%, ***1%

Companies using more claims are positioning more than average in at least two claims. For example, “Marks & Spencer” has more products with claims than the average, and that is for sustainable, natural, health and convenience claims. Only other claim isn’t used significantly more by “Marks & Spencer”. Over the 10 companies, only two are using fewer claims than others: Lidl and Carrefour, two retailers companies. Some companies are specialized in one specific claim: Lidl uses less claims than other, excepted for other claim; Picard is not significantly different in claims use, excepted for convenience which is used significantly higher than average. Picard is a retailer, with a premium positioning over the frozen distribution network, selling almost exclusively its one private brand. This convenience positioning can be linked with the product storage, as frozen products communicate more on convenience, e.g. the use of microwave to defrost the product. The two manufacturers present in this top 10 use more claims than average. Iglo is more positioned on sustainable (almost 75% of its products) and natural (around 50% of its products). On its side Findus, although on sustainable claim too, is well positioned on convenience claim.

In the GNPD, the seafood storage can be refrigerated (38.19% of innovations), frozen (31.39%) or ambient (30.41%). There is slightly more products with at least one claim in the frozen category and slightly less in refrigerated ( Table 3 ). There is more convenience claim in frozen category while there is less health claim. This can be explained by two main reasons. For the convenience claim, as said before, frozen products are intrinsically linked with this positioning (e.g: rapid defrost). Then, the frozen products can be perceived as less healthy than fresh one, and in that case this claim is not sought by consumer. Inversely, there is less convenience claim in ambient category while there is more health (as well as more sustainable and natural claims). In this category, there is less intrinsic need to claim on convenience (e.g. can technology has not changed so must from consumer side, there is not so much “more easy to open”). Furthermore, the fatty fish (as sardine and mackerel) are more often commercialized in can, thus in ambient (77% of bluefish), while the lean fish (as cod and pollock) are more often commercialized in frozen (cod 52%, pollock 77.24%). Yet, fatty fish are rich in omega 3, which can be pointed to the consumer through health claim, which could explain, at least partially, the difference between storage.

Table 3. Repartition of claims by storage. Source: GNPD; 22,406 observations

| Percentage of products with at least one claim. | Percentage of products with sustainable claim. | Percentage of products with natural claim. | Percentage of products with health claim. | Percentage of products with convenience claim. | Percentage of products with other claim. | ||

|---|---|---|---|---|---|---|---|

| Refrigerated | 62.95* | 24.55*** | 18.88* | 12.64 | 27.72 | 18.21*** | |

| Frozen | 65.07** | 28.96* | 15.92 | 10.87*** | 33.88*** | 16.12 | |

| Ambient | 63.21 | 31.87*** | 18.63* | 15.82*** | 22.96*** | 12.02*** |

Mean comparison test (t-test): significant at *10%, **5%, ***1%

We can look at the species mainly used in the seafood innovation in European market. The recognition of species is not easy as there is no obligation for transformed products in Europe to clearly identify the kind of fish used in the product. Thus, 14.57% of seafood innovation cannot be linked to a specific species ( Table 4 ). The seafood ingredients are presented on the product as fish or seafood. Furthermore, the scientific name is almost never specified, which makes the distinction between close species (between tunas for example) complicated. Nonetheless, regarding general fish species, we have some interesting result. The most important species in terms of innovation are Salmon (20.37% of seafood innovation contains salmon), Crustaceans (17.17% of seafood innovation contains crustaceans) and Tuna (15.65% of seafood innovation contains tuna). Those species correspond to the more consumed species in Europe: Salmon and shrimps are part of the main seafood consumed in France (FranceAgriMer (2014)), salmon is also largely consumed in Belgium and Netherland (Brunsø, 2008) while tuna is largely consumed in Spain (Brunsø, 2008). The species with the greatest number of products with at least one claim are the Pangasius, the Haddock and the Seabass. Behind those three species, there is different reality. Pangasius is not a common species in Europe; it is not an endogenous one as Pangasius is mostly raised in Asia. To thwart a poor image of this fish in Europe, it’s seems that companies tried to communicate on the sustainability, as it is the species with the most important share of sustainable claim. For the Haddock and the Seabass, the positioning is mostly on sustainability/naturality and convenience. The convenience claims are also mainly used for the shellfish and the mussel, underling a need for consumer to be helped in the way to consume shellfish (cleaning & cooking). The products with the smallest claim use are the bluefish products (Clupeidae, mackerel, and anchovy), generally commercialized in can, well known from consumer, and already easy to use.

Table 4. Repartition of seafood innovation in regards of the species. Source: GNPD; 22,406 observations

| Species | Number of products | Frequency on European market (%) | Percentage of products with at least one claim. | Percentage of products with sustainable claim. | Percentage of products with natural claim. | Percentage of products with health claim. | Percentage of products with convenience claim. | Percentage of products with other claim. |

|---|---|---|---|---|---|---|---|---|

| Bluefish | 1970 | 8.79 | 51.88 | 21.32 | 11.78 | 13.76 | 14.47 | 11.88 |

| Trout | 437 | 1.95 | 58.12 | 20.82 | 12.36 | 11.44 | 22.88 | 20.59 |

| Cephalopods | 1097 | 4.89 | 52.87 | 10.76 | 14.49 | 8.84 | 33.18 | 10.85 |

| Herring | 917 | 409 | 57.25 | 35.88 | 20.83 | 8.29 | 8.94 | 8.40 |

| Cod | 1508 | 6.73 | 69.50 | 33.02 | 23.41 | 15.58 | 34.15 | 14.32 |

| Crustaceans | 3848 | 17.17 | 59.69 | 21.52 | 16.09 | 10.50 | 30.93 | 16.32 |

| Flatfish | 273 | 1.22 | 62.64 | 37.00 | 12.45 | 10.99 | 23.08 | 14.65 |

| Haddock | 327 | 1.46 | 83.49 | 40.98 | 29.97 | 20.49 | 32.11 | 25.08 |

| Shellfish | 999 | 4.46 | 64.16 | 20.22 | 14.51 | 10.11 | 41.34 | 17.42 |

| Mussel | 724 | 3.23 | 64.64 | 18.78 | 15.19 | 14.78 | 44.75 | 9.53 |

| Pangasius | 149 | 0.66 | 75.84 | 47.65 | 14.77 | 16.11 | 34.23 | 22.15 |

| Pollock | 1608 | 7.18 | 75.81 | 38.99 | 23.69 | 19.22 | 41.85 | 15.67 |

| Salmon | 4565 | 20.37 | 67.19 | 29.40 | 17.85 | 11.11 | 29.16 | 21.56 |

| Seabass | 91 | 0.41 | 82.42 | 28.57 | 29.67 | 14.29 | 45.05 | 21.98 |

| Tuna | 3506 | 15.65 | 66.12 | 40.25 | 15.74 | 13.72 | 23.05 | 12.18 |

| Seafood | 3265 | 14.7 | 60.31 | 13.32 | 22.39 | 12.96 | 29.68 | 15.62 |

| Freshwater Fish | 263 | 1.17 | 63.50 | 17.49 | 21.67 | 10.65 | 33.46 | 15.59 |

| Other fish* (species specified) | 376 | 1.67 | 60.11 | 16.22 | 22.87 | 18.35 | 29.26 | 16.49 |

*Species representing less than % of innovations have been gather in one category, except Pangasius.

Results from GNPD by species

COD

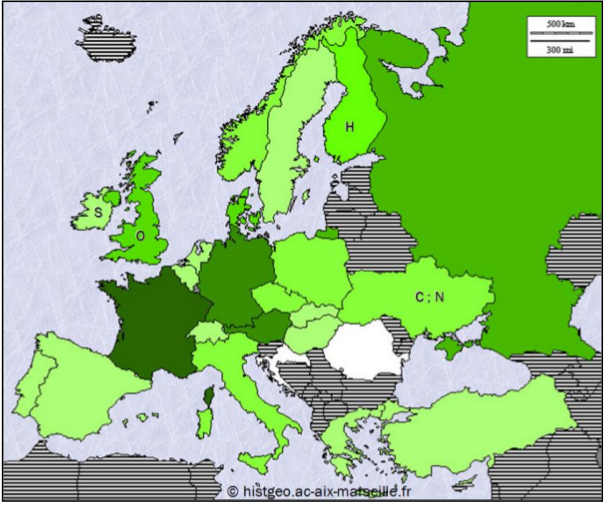

Innovations for products containing Cod follow the same path as global seafood products, and the number of innovation increases over years ( Figure 3 ). One thousand five hundred and eight (1,508) products have been launched over the period (2000-2015), which represents 6.73% of total seafood innovations. The share of innovation with cod over all seafood innovations is decreasing across European countries, especially in Czech Republic. The only country with an increasing share of cod innovations is Figure 3. Innovations by claims Source: GNPD; 1,508 Observations Sweden. Most of them are a new variety extending existing range (47%) or a totally new product (34%). There is also more reformulation in cod innovations than for others species. As seafood in general, majority of innovation containing cod have at least one claim (69.50% of products). The positioning is mainly convenience (34.15%), sustainable (33.02%) and natural (23.15%). At the European level, the number of innovations with sustainable claims is increasing faster than for other species, but this rate is slower for any other claims, showing a market tendency of cod products over sustainability .

Figure 3. Innovations by claims Source: GNPD; 1,508 Observations

We observe that at the European level the five most innovative companies for cod products are from United-Kingdom (Marks & Spencer, Findus, Tesco, Iglo) or Germany (Lidl) ( Table 5 ), and belong to the top 10 firms in seafood innovations. Distribution of innovation among firm is more concentrated for sustainable and natural claims, but can be considered as weak as companies on the top 5 share only 33.99% of innovations maximum. The major companies are present over all positioning; most of them are retailer companies. Only no claims products bring companies less innovative compared to the previous one (Delabli and Sagit).

Table 5. Major firms by claims (for Cod products). Source: GNPD, 1,508 observations

| Top 5 firms | Nbr of products | Share of top5 firms | ||

|---|---|---|---|---|

| All cod | Marks & Spencer, Findus, Tesco, Lidl, Iglo | 1508 | 18.97 | |

| Sustainable Claims | Marks & Spencer, Findus, Lidl, Iglo, Birds Eye | 498 | 32.33 | |

| Natural Claims | Birds Eye, Marks & Spencer, Iglo, Asda, Tesco | 353 | 33.99 | |

| Convenience Claims | Marks & Spencer, Findus, Picard, Lidl, Tesco | 515 | 19.61 | |

| Health Claims | Asda, Marks & Spencer, Tesco, Findus, Iglo | 235 | 26.38 | |

| Other Claims | Tesco, Lidl, Sainsbury’s, Birds Eye, Coop | 216 | 27.78 | |

| No claims | Findus, Marks & Spencer, Bofrost, Delabli, Sagit | 460 | 14.13 |

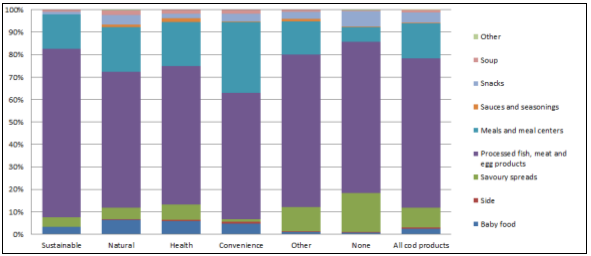

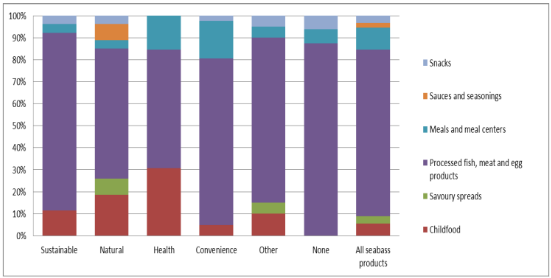

Some categories of foods are more represented under some positioning than other ( Figure 4 ). The share of child food represents 2.51% for all cod products and increases to 6.51% under natural claims, more that for sustainable claims (3.21%). The most important category, processed fish, represents 66.51% of all cod products, which is the same as for all observations seafood product (66.01% is processed fish), and stay stable over claims/no claims products. The result for meals shows a more important share of convenience claims products compared to all cod products. In regards of the conditioning, cod products are mainly frozen products (52.29%) and refrigerated (35.43%). The repartition between private label and national label are a little more in favour of private brand (41.38%) than for seafood as an all.

Figure 4. Repartition of innovations by food categories Source: GNPD; 1,508 observations

To conclude, cod innovations increase across European market, even if the share of cod over all seafood products is decreasing. Still, the cod products drive sustainable innovation as its contribution to this marketing positioning is increasing faster than others species. It shows an orientation of cod innovation over sustainable claims (SC) (65.26% of SC is environmentally friendly product, as MSC label). An important part of cod innovations is frozen.

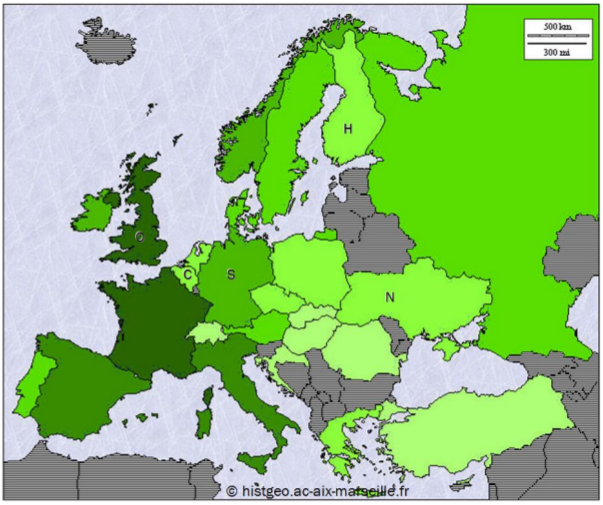

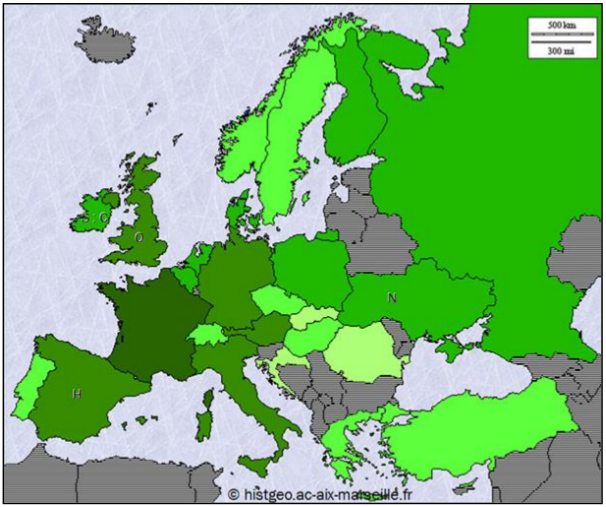

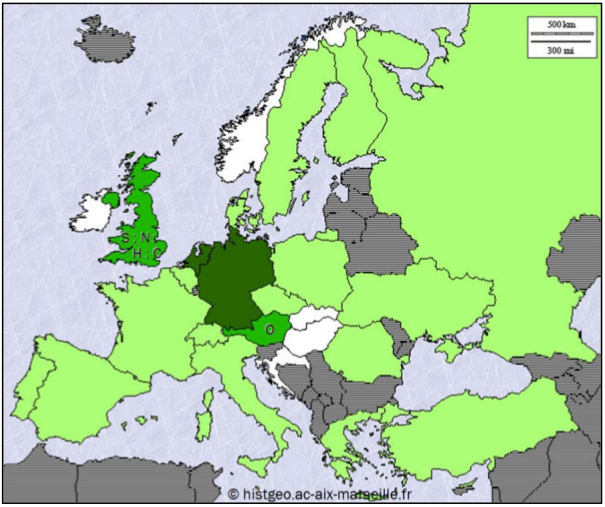

Figure 5. Distribution of innovations containing Cod across Europe. Source: GNPD—1,508 Observations

Legend: Darker green = most important number of innovations, lighter green =less important number of innovations (white=no observations for cod, stripes countries are not into the GNPD database). S (N/H/C/O): Country with the most important share of sustainable (natural/ health/ convenience/ other) claims on its cod products.

Herring

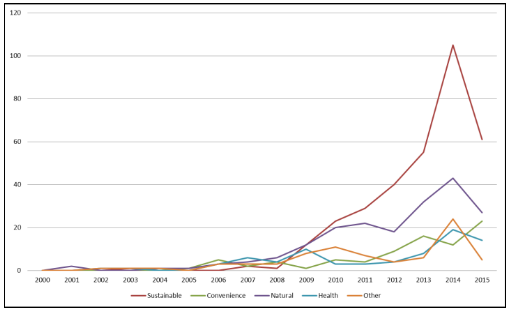

Innovations for products containing Herring follow the same path as overall seafood products, and the number of innovation increases over years ( Figure 6 ). Nine hundred and seventeen (917) products have been launched over the period (2000-2015), which represents 4.09% of total seafood innovations. The share of innovation with herring over all seafood innovations is decreasing across European countries, meaning the number of herring innovations increases slower than all seafood innovation. Most of them are totally new product (42%) or new variety (43%). As seafood products in general, majority of innovation containing herring has at least one claim (57.27%). Positioning is mainly sustainable (35.88%) and natural (20.83%). Convenience claim is underrepresented on herring innovations compared to overall seafood innovation (8.94% vs 28.19%). Nonetheless, the increase of convenience (as well as for natural) claims is faster for herring than for other species, meaning this situation may change within a few years.

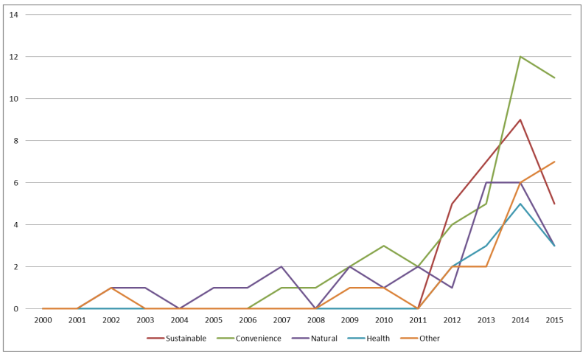

Figure 6. Innovations by claims. Source: GNPD, 917 observations

Looking at the innovation for herring products, we can see that at the European level the five most innovative companies for herring products are from Germany and Poland ( Table 6 ). A large majority of the companies in the top five, regardless of the claims, are from Germany. The others are from Russia, Poland, Belarus and Sweden. A majority of leading companies are manufacturer. The herring products represent more than 50% of innovation for the top five firms (except for Lidl): 75.76% of innovation by Nadler Feinkost (Germany, Manufacturer) contains herring.

Table 6. Major firms by claims (for Herring products). Source: GNPD, 917 observations

| Top 5 firms | Nbr of products | Share of top5 firms | ||

|---|---|---|---|---|

| All herring | Appel Feinkost, Lidl, Homann Feinkost, Lisner, Nadler Feinkost | 917 | 18.65 | |

| Sustainable Claims | Appel Feinkost, Lidl, Aldi Nord, Nadler Feinkost, Aldi | 329 | 29.79 | |

| Natural Claims | Homann Feinkost, Aldi Nord, Edmund Merl, Nadler & Appel Feinkost | 191 | 28.80 | |

| Convenience Claims | Santa Bremor, Russkoye More, PKP Meridia, Lisner, Homann Feinkost | 515 | 31.71 | |

| Health Claims | Appel Feinkost, Larsen Danish Seafood, Aldi, H. Kuhlmann, NR Fish | 76 | 34.21 | |

| Other Claims | Appel Feinkost, H.Kuhlmann, Kaufland Warenhande, Lisner, Abba Seaf. | 77 | 27.27 | |

| No claims | Appel Feinkost, Abba Seaf., Lisner, Lidl, Homann Feinkost | 392 | 14.13 |

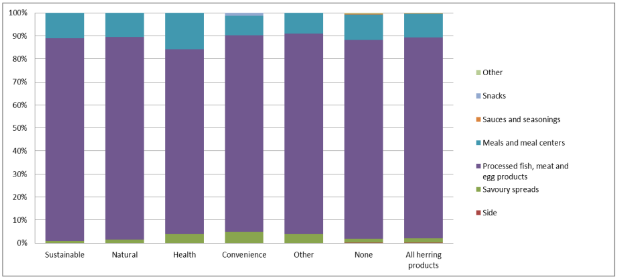

Some categories of foods are more represented under some positioning than other ( Figure 7 ). First, there is no child food or soup containing herring. A large majority of herring innovations are processed fish (87.35% versus 66.01% for all seafood innovations), and Meals (10.14%). Beside some savoury spread products, other categories with herring are almost inexistent. The repartition over claims is quite the same as for all herring products, only the repartition on health claims favours meals products. In regards of the conditioning, herring innovations are mainly refrigerated (65.46%) and only few references are frozen (2.19% versus 31.39% for all seafood products). The share of national brand over private label is higher for herring than for all seafood products (77.21% versus 61.82%).

Figure 7. Repartition of innovations by food categories Source: GNPD; 917 observations

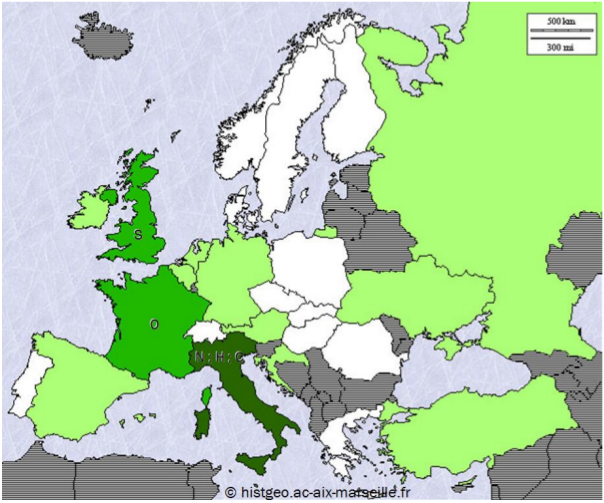

To conclude, herring innovative products are mainly produced in Germany and East European countries. Even if the number of innovation for this species increases at a lower rate than for others species, innovative herring products with sustainable claims don’t follow the same path and increase faster than all seafood innovation in this positioning. Despite an absence of firms on the major innovative one (for herring products), the UK market is well positioned on other and health claims.

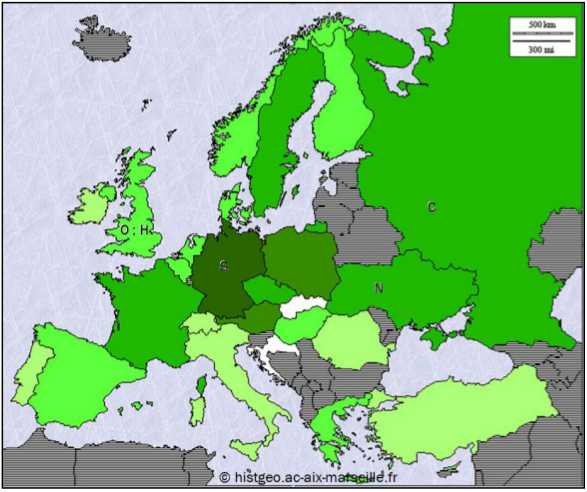

Figure 8 Distribution of innovations containing Herring across Europe. Source: GNPD—917 Observations Legend: Darker green = most important number of innovations, lighter green =less important number of innovations (white=no observations for herring, stripes countries are not into the GNPD database). S (N/H/C/O): Country with the most important share of sustainable (natural/ health/ convenience/ other) claims on its herring products.

Trout

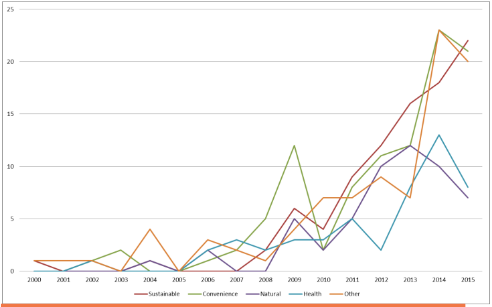

Innovations for products containing Trout follow the same path as global seafood products ( Figure 9 ), and the number of innovation increases over years. Four hundred and thirty seven (437) products have been launched over the period (2000-2015), which represents 1.95% of total seafood innovations. Despite a few references, the share of innovations with Trout over all seafood innovations is decreasing, for all countries. For trout, most of them are totally new products (42%) or a new variety extending an existing range (44%). As seafood products in general, majority of innovation containing trout have at least one claim (58.12% of products). The positioning is mainly convenience (22.88%) sustainable (20.82%), and other claims (20.59%). Nonetheless, the number of innovations with sustainable claims is increasing slowly compared to other species, leading Trout to be the less innovative species in regards of sustainability at the European level. Only the number of products with natural claims is increasing a tiny bit faster than for others species. Despite few references, Swiss is the country with the faster increase of innovation with trout.

Figure 9 Innovation by claims Source: GNPD; 437 observations

Looking at the innovation for trout products, we can see that at the European level the five most innovative companies for trout products are from Germany (Lidl, Gottfried Friedrichs), France (Aqualande, Carrefour) and UK (Marks & Spencer) ( Table 7 ). Two of those innovative firms are retailers. The trout innovations are not in a concentrate market as the top 5 firms represent only 16.02% of the innovation. Looking at the positioning scale, the east countries companies are well represented, especially on the natural claims (Russkoye More — Russia, Amstor— Ukraine).

Table 7. Major firms by claims (for Trout products). Source: GNPD, 437 observations

| Top 5 firms | Nbr of products | Share of top5 firms | ||

|---|---|---|---|---|

| All trout | Lidl, Gottfried Friedrichs, Aqualande, Marks & Spencer, Carrefour - CMI | 437 | 16.02 | |

| Sustainable Claims | Aqualande, HiPP, Marks & Spencer, Distriborg, Monoprix | 91 | 23.08 | |

| Natural Claims | Aqualande, Russkoye More, Amstor, Fischzucht Alexander Quester,HiPP | 54 | 22.22 | |

| Convenience Claims | Lidl, Marks & Spencer, Labeyrie, Nestle, PKP Meridian | 100 | 19.00 | |

| Health Claims | Aqualande, HiPP, PKP Meridian, Nestle, Saarioinen | 50 | 40.00 | |

| Other Claims | Lidl, Gottfried Friedrichs, Aldi, Carrefour – CMI, Marks & Spencer | 90 | 30.00 | |

| No claims | Gottfried Friedrichs, Lidl, Aldi, Bofrost, Vejle Seafood | 183 | 16.39 |

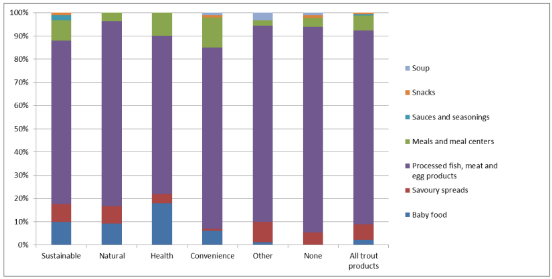

Some categories of foods are more represented under some positioning than other ( Figure 10 ). Indeed baby food represent only 2.98% of products innovation containing trout but represent 18% of products with health claims and around 9% for sustainable and natural. Furthermore, all baby food containing trout have a marketing positioning. Meals and meal centers category more presents 13% of trout products with convenience claims when it represents only 6.41% of all trout products. The trout based product are mainly processed fish, 82.61% which is higher than for all seafood innovation, as only 66.01% of seafood innovation are processed fish. In regards of the conditioning 77.35% of trout products are refrigerated (versus 38.19% for all seafood products). The repartition between private label and national label is identical to the seafood category as an all, that to say around 61% of products innovation from national brand.

Figure 10. Repartition of innovations by food categories Source: GNPD, 437 observations

To conclude, products containing trout are not the most innovative seafood products, few references have been listed in the database used. The number of sustainable innovations increased slower than for other species, but faster for natural innovations even if the coefficient is weak. The most innovative firms are not necessarily the same than for seafood in general, and the most innovative countries (number of products) are not the most strategic on market differentiation through the use of claims.

Figure 11 Repartition of innovations with trout across Europe. Source: GNPD; 437 observations Legend: Darker green = most important number of innovations, lighter green =less important number of innovations (white=no observations for trout, stripes countries are not into the GNPD database). S (N/H/C/O): Country with the most important share of sustainable (natural/health/convenience/other) claims on its trout products.

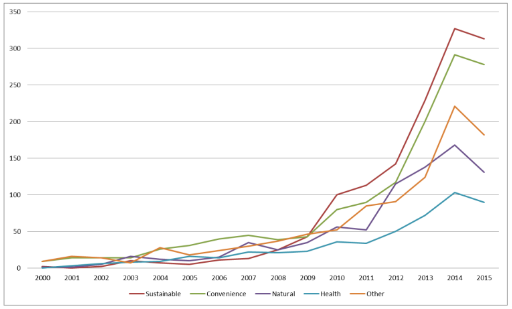

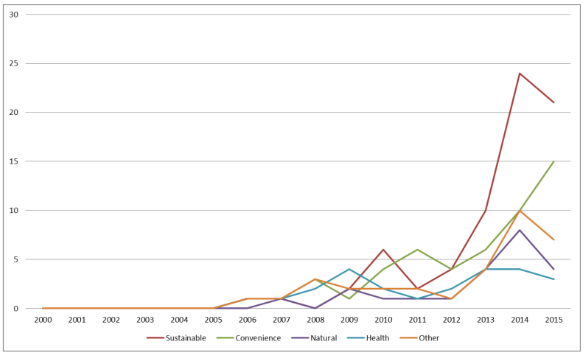

Salmon

Innovations for products containing Salmon follow the same path than global seafood products, and the number of innovation increases over years ( Figure 12 ). The salmon is the most important species in seafood innovation. Four thousand five hundred and sixty five (4,565) products have been launched over the period (2000-2015), which represents 20.37% of total seafood innovations. On the period, the share of innovation with salmon over all seafood innovations is stable at the European level, but it increases in Ukraine, Ireland, Denmark and it decreases in Turkey, UK and Portugal. Most of them are a new variety extending existing range (46%) or a totally new product (38%) As seafood in general, majority of innovation containing salmon have at least one claim (67.10% of products) and the share of salmon innovation with claims increases, the fastest increase being for Ukrainian market. The positioning is mainly sustainable (29.40%), convenience (29.16%), and other (21.56%) Only convenience and other claims increase slower for salmon than for other species, but the share of these claims is already high for salmon products.

Figure 12. Innovations by claims. Source: GNPD, 4,565 observations

Innovative salmon products are mainly support by firms from the top 10 of most innovative firms ( Table 2 & Table 8 ) as Marks & Spencer, Lidl, Aldi and Tesco. Only two companies on most important innovative firms are not retailers (Labeyrie and Nestlé), and all of them are major companies in Europe. For a large majority, salmon represents one third of their innovation. Only the companies Labeyrie is specialised in Salmon, as this species represents 85% of the brand new products.

Table 8. Major firms by claims (for Salmon products). Source: GNPD, 4,565 observations

| Top 5 firms | Nbr of products | Share of top5 firms | ||

|---|---|---|---|---|

| All salmon | Marks & Spencer, Lidl, Labeyrie, Tesco, Aldi 4 | 565 | 16.23 | |

| Sustainable Claims | Marks & Spencer, Tesco, Labeyrie, Waitrose, Lidl 1 | 342 | 26.75 | |

| Natural Claims | Marks & Spencer, Labeyrie, Tesco, Asda, Iglo | 815 | 21.23 | |

| Convenience Claims | Marks & Spencer, Labeyrie, Tesco, Picard, Waitrose 1 | 331 | 18.48 | |

| Health Claims | Asda, Marks & Spencer, Albert Heijn, Tesco, Nestle | 507 | 20.12 | |

| Other Claims | Lidl, Tesco, Marks & Spencer, Labeyrie, Aldi | 984 | 25.30 | |

| No claims | Lidl, Marks & Spencer, Labeyrie, Aldi, Picard 1 | 498 | 14.13 |

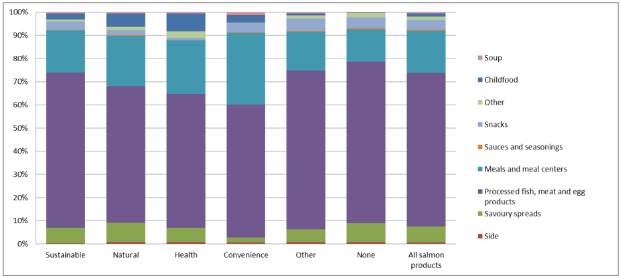

Some categories of foods are more represented under some positioning than other ( Figure 13 ). The repartition of food categories across claims is consistent for salmon products, and is consistent with seafood in general. Only the repartition changes for health claim, as the share of child food increases (7% versus 1.38% for all salmon products) at the depend of all others categories; and the repartition for convenience claim, as the share of meals increases (31% versus 18% for all salmon products). In regards of the conditioning 64,65% of trout products are refrigerated (versus 38.19% for all seafood products). The repartition between private label and national label is close to the seafood category as an all, that to say around 57.44% of products innovation from national brand (versus 61.82% for all seafood).

Figure 13 Repartition of innovations by food categories Source: GNPD, 4,565 observations

To conclude, salmon is an important species due to the number of innovations, but the share of salmon is relatively stable over the period. Major companies in salmon market are major retailers in the European market, and only few salmon specialized companies, as Labeyrie, are present among the most innovative companies. The use of sustainable claims increases, but this increase is not significantly different than the average increase of all others species in the European market.

Figure 14. Repartition of innovations with salmon across Europe. Source: GNPD; 4,565 observations Legend: Darker green = most important number of innovations, lighter green =less important number of innovations (white=no observations for salmon, stripes countries are not into the GNPD database). S (N/H/C/O): Country with the most important share of sustainable (natural/health/convenience/ other) claims on its trout products.

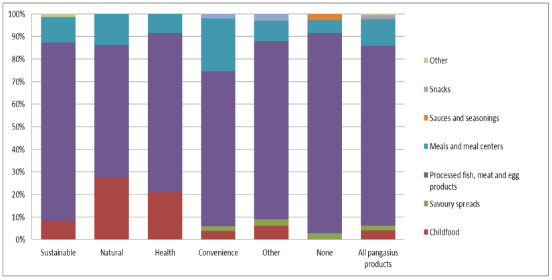

Pangasius

Innovations for products containing pangasius follow the same path as global seafood products ( Figure 15 ). Nonetheless, the number of products with pangasius launched in Europe is still very low as only 149 products have been launched over the period, that to say only 0.67% of total seafood innovations. The share of innovation with pangasius over all seafood is decreasing over the period. Most of them are a new variety extending existing range (48%) or a totally new product (41%). There is less new packaging in pangasius innovations than for others species, but there is more range extension. As seafood in general, majority of innovation containing pangasius have at least one claim (75.84% of products). The positioning is mainly sustainable (47.65%), convenience (34.23%) and other (23.15%). At the European level, the share of pangasius innovation with claims is stable, only Belgium market shows an increase in this share. The share of products with natural and sustainable claims increase, but with a slow slope and at a lower rate than others species.

Figure 15 Innovations by claims Source: GNPD, 149 observations

The innovation for pangasius products come mainly from two firms from the top 10 of innovative firms: Lidl and Aldi (both retailers and German). The top five firms are well represented on the majority of claims (besides natural and no claims). The firms in the pangasius market are mostly major companies where innovations with pangasius represent less than 5% of the firm innovation. However, some companies with only few innovations (less than 5) are specialized on pangasius innovations (Seamark, Alfredo Foods or DM Drogerie Markt).

Table 9. Major firms by claims (for Pangasius products). Source: GNPD, 149 observations

| Top 5 firms | Nbr of products | Share of top5 firms | ||

|---|---|---|---|---|

| All pangasius | Lidl, Aldi, Young’s, Queens Products, Albert Heijn | 149 | 30.20 | |

| Sustainable Claims | Lidl, Young’s, Aldi, Queens Products, Okoland | 71 | 49.30 | |

| Natural Claims | DM Drogerie Markt., Okoland, Tesco, Young’s, ATB Market | 22 | 54.55 | |

| Convenience Claims | Lidl, Aldi, Queens Products, Tesco, Albert Heijn | 51 | 41.18 | |

| Health Claims | Adli, DM Drogerie Markt., Young’s, Albert Heijn, Alfredo Foods | 24 | 54.17 | |

| Other Claims | Young’s, Lidl, Albert Heijn, DM Drogerie Markt., Seamark | 33 | 45.45 | |

| No claims | Appel Feinkost, Bofrost, Dia, Frost Invest, Iceland | 36 | 27.78 |

Some categories of foods are more represented under some positioning than other. First, there are no side and soup products with pangasius in it. The majority of pangasius products are processed fish (more than for all seafood, 80% versus 66%) and meals (less than for all seafood, 11% versus 17%). Another category is more important for pangasius than for all seafood being the child food sector (4% versus 1%) and it is even greater for natural claim (27% versus 4%) and sustainable claim (8.5% versus 1.8%). As said before, the important share of natural and sustainable claims on pangasius products is a way to thwart a poor image of this fish in Europe. As it is in line with the general consumer expectation on the child food market this result is not surprising. The majority of pangasius innovations are frozen (70%) or fresh (19%). The share of national brand and private label are quiet similar (53.69% and 46.31% respectively), which shows a more important representation of private label than for all seafood (38%).

Figure 16. Repartition of innovations by food categories Source: GNPD, 149 observations

To conclude, pangasius is not a widespread fish in Europe, and it represents only 0.67% of seafood innovation. Nonetheless, pangasius products have a clear positioning on naturalness and sustainability, probably in order to thwart the poor perception of this fish in European market.

Figure 17. Repartition of innovations with pangasius across Europe. Source: GNPD; 149 observations Legend: Darker green = most important number of innovations, lighter green =less important number of innovations (white=no observations for pangasius, stripes countries are not into the GNPD database). S (N/H/C/O): Country with the most important share of sustainable (natural/ health/ convenience/other) claims on its trout products.

Seabass & Seabream

Innovations for products containing seabass and seabream (thereafter seabass) follow the same path than global seafood products, and the number of innovation increases over years. However, only 91 innovative products have been launched during 2000-2015 in the European market, which represents 0.41% of total seafood innovations. The small number of innovation underlines the fact that seabass is not commonly transformed, it is generally consumed (bought by end consumer) as whole fresh. If the number of product increases, the share of innovation with seabass over all seafood innovations decreases. Most of them are a new variety (48%) or a totally new product (45%). There is less new packaging in seabass innovations than for others species (2% versus 11.72%). A large majority of innovation containing seabass have at least one claim (82.42% of products). The positioning is mainly health (85.71%), other (78.02%) and sustainable (71.43%). At the European level, the share of seabass products with claims increases, especially in Turkey. The use of health claims increases faster for seabass than the average of other species, and it is also true for the use of sustainable claims.

Figure 18. Innovations by claims Source: GNPD, 91 observations