PSC

Contents

Product Success Check

Introduction

Consumers are too numerous, dispersed, and varied in their buying requirements to make it possible to serve all efficiently and in the same manner. At the same time, in today’s competitive landscape, companies follow more and more customized approaches to serve and satisfy the consumers which again drives their ever more differentiated wants. As a consequence, markets become “demassified”, dissolving more and more into “micromarkets”, characterized by different consumers purchasing different products in different distribution channels and attending to different communication channels. Segmentation aims at identifying such micro markets, i.e. groups of consumers that share the same expectations and behavioural patterns. The identification of the most attractive micromarkets, i.e. segment(s), for the company and its products therefore is imperative not only for successful commercialization but also for new product development.

Following a strategic approach to markets, the company distinguishes the major market segments based on the profiling of different consumer groups along their wants, consumption and purchasing behaviour; socio-demographic characteristics etc.; targets one or more of these segments; and develops products (and marketing programs) tailored to the profile and expectations of each selected segment.Tailoring starts with an understanding of the customers and providing them with the product and service they expect but, importantly, embraces also price, distribution and communication efforts to reach the target segment efficiently. The firm focus is on the buyers whom they have the greatest chance of satisfying. Having satisfied customers is at the basis for company success and the first step to repeat purchase and customer loyalty.

Evidence for new product development or new product commercialization success factors shows that the analyses of market segments, targeting, positioning and the alignment with the firms’ offer and resources are crucial to both new product development and new product commercialization (e.g. Montoya-Weiss & O’Driscoll, 2000; Florén et al., 2017). It follows that segmentation helps companies to navigate an increasingly competitive market, to understand their customers better, to develop offerings that satisfy specific wants, and to address diversity in an efficient manner.

The approach to developing a robust model to analyze the likelihood that new seafood product launches will be successful follows this perspective. We develop both country specific consumer segmentations in Italy, Germany, France, Spain and the UK, as well as an overarching European segmentation useful for companies that are innovating and developing new fish products or have fish products on offer and would like to improve their commercialization. The segmentations are based on latent class analyses of representative samples of consumers (800 in each of the five countries) who replied to an online survey in June-July 2017.

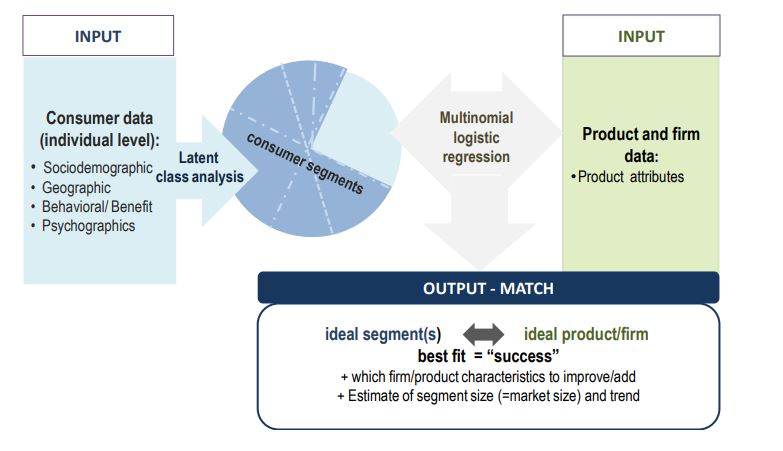

Although the segment profiles by themselves are informative, the methodology used contains an additional step in order to help the company select the most appropriate target(s). In this second stage, multinomial regression matches product (and firm) attributes with the most attractive consumer segment(s). A comparison of the segment, i.e. consumer profile, with the product attributes will further inform the company on how to improve the product and/or its marketing effort in order to tailor more closely to segment wants and characteristics and ultimately launch and commercialize successfully. Figure 1 gives an overview of the success analysis model.

Figure 1: The success analysis model at a glance

Methods

Survey design

Based on the objective of consumer segmentation, a questionnaire including socio-demographic, geographic, psychographic and benefits/behavioural dimensions of consumers and their behaviour was designed. It is built on previous literature (e.g. Ailawadi et al., 2001; Candel, 2001; Pieniak et al., 2007; Verbeke et al., 2007; Verbeke and Vackier, 2005), on studies on consumer behaviour regarding fish related products (EUMOFA, 2016; European Commission, 2016; ISMEA, 2014) and on qualitative insight gained through explorative in-depth interviews with fish consumers in each of the countries under study (performed in task 4.1.). Constant interaction with partners in all countries ensured equivalence and adaptation of the questionnaire in case culturally-specific measures were needed. The questionnaire was developed in English and cross-checked with a native English speaker from the partner in the United Kingdom, to ensure the right use of words and concepts from the local culture. Then, the questionnaire was translated to each of the languages of the remaining countries (Spanish, Italian, French and German) and back-translated. The translators and back-translators were bilingual in the target language and English.

The survey instrument was administered online. In order to keep the time to complete the questionnaire manageable, different flows along the questionnaire were developed so that only relevant questions and options were displayed. On average, the time needed to complete the questionnaire was around 11 minutes, in line with recommendations regarding length of online questionnaires.

Constructs and Measures - Segmentation criteria

Market segments are large identifiable groups consisting of individuals that are characterized by homogenous buying attitudes, preferences, purchasing power, usage patterns etc. Any of these characteristics can be used to segment markets and to profile the consumers in the respective segments. We use combinations of sociodemographic, psychographic, benefit and behavioural criteria to build and profile segments. Demographic variables have obvious potential as segmentation criteria. The most commonly used variables include gender, age, income level, and educational achievement. Frequently, use is made of a battery of demographic variables when delineating market segments. Psychographic segmentation involves using "lifestyle" factors in the segmentation process. Appropriate criteria are usually of an inferred nature and concern consumer interests and perceptions of "way of living" in regard to work and leisure habits. Critical dimensions of lifestyle thus include activities, interests, and opinions. In the food context examples include interest in cooking, looking for new ways or recipes to cook etc. (e.g. Grunert et al., 1993). Behavioural variables pay attention to patterns of consumption (e.g. low-medium-high usage rates) or loyalty with respect to brand/products among others. Behaviourally defined segments may focus on a specific aspect of behaviour which is not broad enough to be defined as a "lifestyle". Benefit segmentation aims at proactively defining an (unfilled) need.

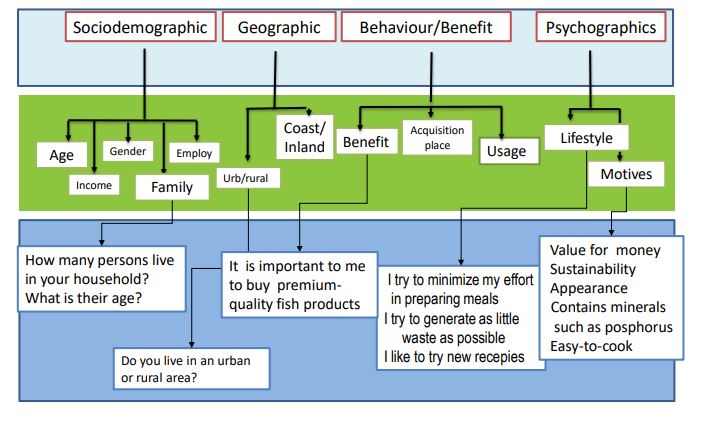

We apply a domain-specific segmentation base and integrate it with some general segmentation bases; this is pragmatic and relevant for identifying within-country segments but also in order to identify cross-country segments and related commonalities and differences. The major segmentation categories with respective variables (illustrative) are show in Figure 2 .

Figure 2: Profiling consumer segments along socio-demographic, geographic, behavioural/benefit- and psychographic criteria

In general, operationalization followed extant literature and market studies (e.g. ISMEA 2014;

EUMOFA 2017), the results from the explorative in-depth interviews, a pre-test (done in Italy with 91

respondents) and an iterative discussion with international researchers from the countries under

study. Seven point Likert-scales were used throughout the questionnaire. All Likert-scale questions

followed Friedman et al.’s(1993) recommendations on setting the negative statements on the left side

to avoid the “left side bias” generated by the positive statement. We briefly describe the criteria and

their measurement next (for more details please see the questionnaire in Appendix 1).

Consumer sociodemographic data

The sociodemographic variables we use include: age, gender, employment status, family composition, education and income. Age is measured as a continuous variable from 18 years onwards. Family size and structure are measured through two questions: first, respondents were asked to report the number of people living in their household (including themselves). Since the presence of children or elderly has been shown to be a major determinant of fish consumption and consumption patterns in earlier studies, respondents then were asked to indicate also the age of each family member and whether the member consumes fish.

Employment status is measured through a single selection question including the following categories: full-time, part-time, self-employed, homemaker, retired, student, unemployed, other. The education levels are based on ISCED (UNESCO, 2012) and are re-arranged in the following way: less than primary, primary and lower secondary education (ISCED levels 0-2); upper secondary (ISCED level 3); university or college below a degree (ISCED levels 4-5); bachelor (ISCED level 6); Postgraduate (ISCED levels 7-8). The income variable was introduced with options representing income levels from very low to very high. Country-specific ranges were set for each income level (using secondary data from e.g. Deutsches Statistisches Bundesamt, 2017; European Commission, 2016; Eurostat, 2017) and allowance was also made for the fact that the UK has its own currency.

Consumer geographic data

To account for potentially varying consumer profiles within each country, the geographical variables are measured through three questions. In the first one, respondents were asked to identify in which type of geographical area they live: urban (more than 50.001 inhabitants), intermediate (between 5.000 and 50.000 inhabitants), rural (less than 4.999 inhabitants). In the second one, respondents were asked to specify if they lived in an area with a coastline or not. In the third question, respondents reported their macro-geographical region of residence in their country according to the NUT3 classification (Eurostat, 2013).

Benefits and behavioural measures

The benefits and behavioural measures we include are consumer involvement in buying fish, places of acquisition, fish attributes important to the selection, fish- and overall food expenditure, situations for fish consumption, sources of information and past/expected future consumption behaviour. Consumer involvement was used for screening as we included only those people who were at least fairly involved in their household’s fish purchasing process.

Consumption frequency (i.e. usage rate) was based on Thong & Solgaard (2017) (never, few times a year, once a month, 2-3 times a month, 1-2 times a week, 3-4 times a week, almost every day) and included total fish consumption (i.e. fish consumption also in restaurants, canteens etc.), fish consumption by species (salmon, cod, seabass, seabream, herring, trout, pangasius) and by formats. Moreover, the usage rate was used for screening as only fish consumers were included in the survey.

The fish purchasing places and usage occasions were taken from the results of the explorative in-depth interviews and a continuous interaction with international researchers from the countries under study (e.g. at home, for a barbecue, at the restaurant, at the supermarket, online, at the fishmonger). We asked not only for the preferences of the attributes of the fish the consumers buy, but also for their importance to the purchase in order to account for the fact that consumers usually have to make a choice across attributes.

Food and fish products expenditure was measured through an open question in which the respondents were asked first to report their monthly expense on food related products and second, their expenses on fish products.

In order to understand the use of information sources, we asked respondents to report the frequency of consulting various information sources (e.g. family members, fish seller, supermarkets and in-store promotion, advertising, social media, medical advice, labels and information on the packaging of the product etc.).

Regarding past/future consumption, a new measure was developed based on the explorative in-depth interviews and on some previous qualitative studies (European Commission, 2016; ISMEA, 2014). We asked respondents to report changes (increase/decrease) in fish consumption over the past three years/expected for the next three years. If changes were reported, we also asked to indicate the reason for the change (e.g. income, available time for cooking, fish prices, health awareness, variety of choices). Importantly, this information was used to estimate the future segment trend, i.e. stable, increasing, or declining.

Psychographics

The psychographic dimension includes attitudes, preferences, consumption motives and lifestyle. Attitudes refer to the degree to which a person has a favourable or unfavourable evaluation towards a product or behaviour. Following literature, the measure of consumer attitudes included bipolar adjectives such as items regarding the source of the fish (wild/farmed), the price (expensive/cheap), formats (frozen/fresh) and production level (processed/unprocessed) and other bipolar pairs such as branded/unbranded, organic/not organic, natural/enhanced and EU origin/Outside EU origin.

Additionally, based on the exploratory in-depth interviews and the feedback of the international research team, the following adjectives were also added: local-origin/national-origin, familiar products or producers/new products or producers, traditional products/products for special dietary needs. Consumer motives as well as attitudes are extremely important in consumer research as they explain the reasons behind consumer behaviours. We included quality and sensory appeal motivation items, health motives as well as items related to price sensitivity and convenience motives and items related to ethical and environmental concerns.

Life style includes factual and procedural knowledge, based on subjective perceptions and experiences which encourage enduring dispositions to behave in certain ways. Life style might transcend individual products, but may be also specific to a product class (Grunert et al., 1993). In the present study, general and fish specific items were included, e.g. I like to try new recipes, I always inform myself on the nutrients I can assimilate from fish. We included convenience lifestyle items, ethical and environmental and health items together with novelty and innovativeness statements. Self-efficacy items (e.g. regarding the knowledge, evaluation and the preparation of fish) are present too.

Sample

The average apparent fish consumption per capita in the EU is the second highest in the world (at around 22 kg/capita/year), and some individual EU Member States are among the highest fish consuming countries in the world (EEA, 2016). The five selected nations under study had the highest household expenditure and volume in fishery and aquaculture products in 2015, representing in total the 72% of all consumer expenditures. Their importance is underlined also with the fact that they covered around 86 % of the total EU fresh fish consumption in volume and 85 % in value in 2015 (EUMOFA, 2016).

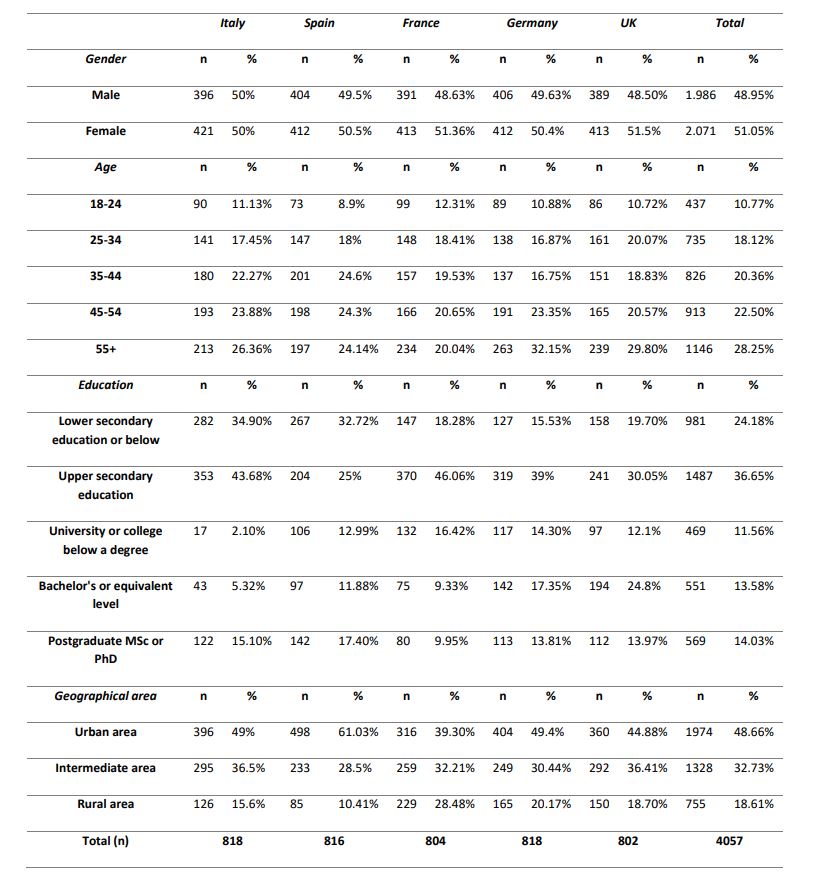

Within-country representativeness was ensured using a stratified random sample (Lohr, 2010), which is more likely to produce a representative sample (Reynolds et al., 2003). Each country was divided into different stratums for the sociodemographic variables described earlier, where the percentages of the sample assigned to each sociodemographic stratum were established based on the total distribution of the population of each country. The percentages for age, gender and geographical regions were obtained from Eurostat (2017) and were established based on the population between 18 to 74 years old in 2016. Age was divided into five stratums: 18-24 years old, 25-34 years old, 35-44 years old, 45-55 years old and >=55 years old. The geographical regions stratums were defined according to the NUT3 European classification of small regions (Eurostat, 2013). Representativeness of the education categories from the ISCED outlined earlier in the countries was established according to the OECD (2016, p. 43) as this source provided a more detailed classification than Eurostat (2017). The measures were based on the population between 18 to 64 years old.

Data collection

The target samples were 800 adults aged 18 and older from Italy, Germany, France, Spain and United Kingdom. The respondents had to be fish consumers (no restrictions on frequency) of at least one of the target species (salmon, cod, seabream, seabass, herring, trout, and pangasius) and be fairly or completely involved in the fish buying process in their households. The data was collected through an online survey developed on the Qualtrics platform. Before collecting survey data, a pilot test of the survey was performed with partners and with 91 Italian fish consumers. The feedback provided was used to improve the questionnaire. The final version of the questionnaire was launched in parallel in all five countries to ensure data collection equivalence (Hult et al., 2008). The data collection took a month, from June 23rd until July 24th, 2017.

Respondents were selected from a market research panel with qualifying demographic characteristics. They were sent an invitation to fill in with information on questionnaire length and the available incentives. Each sample stratum from the panel base was proportioned to the general population and then randomized before the survey was deployed. To exclude duplication and to ensure validity, every IP address was checked using a sophisticated digital fingerprint and deduplication technology (Qualtrics, 2014).

All data were collected through the online survey. Although online questionnaires present many advantages such as reduced cost, time and access to unique populations they also have some limitations such as the access to older and less educated consumer groups (Wright, 2006). For this reason, some of the stratums percentages originally defined for education and age had to be slightly modified, to reach the target of 800 respondents per country in a reasonable time frame. The changes were always done by increasing mainly the percentage of respondents in the closest categories from the one with the low quota response. On average, respondents took 11.4 minutes to complete the questionnaire.

In total, 4414 completed and usable questionnaires were collected, from which 4000 were representative for each country (800 responses per country) and sample stratum, according to the age, gender, education level and macro-geographical area. The main sample characteristics are reported in Table 1.

Table 1: Sample characteristics

Statistical Methods

====Exploratory and Confirmatory Factor Analysis (EFA – CFA) for questionnaire validation=====

We followed the commonly used combination of exploratory factor analysis (EFA) and confirmatory factor analysis (CFA) to validate our questionnaire. Construct validity of the items of the questionnaire is investigated firstly with EFA to uncover the factor pattern underlying the questionnaire, and then CFA is used to validate the factor structure provided by EFA. We performed factor analysis i) overall and ii) within country (stratified analysis). Finally, we performed a multi-group confirmative factor analysis to assess the measurement invariance (i.e. configural, weak and strong invariance) (Meredith, 1993) between countries.

Factor analyses were performed using R (R Core Team, 2015) and the R-packages polycor (Fox, 2016), paran (Dinno, 2012), psych (Revelle, 2017) and lavaan (Rosseel, 2015).

All results confirm validity of our survey instrument: the EFA statistics, i.e. eigenvalue >1 and Horn’s parallel analysis, identified seven factors for Europe and each individual country. By CFA, only the items with high factor loadings were retained (83,3%) to maintain factor consistency. Overall, CFA fit indices were adequate for both European and for single country analyses. Indices of unidimensionality (AVE>0.2), reliability (omega>0.7) and general factor validity (rho>0.8) were satisfactory for each factor, and the item–factor correlations (>0.4) proved high-quality specific factor validity for all items. In addition, the indices were also satisfying in the CFAs stratified by country and in the multi-group analysis, by retaining the same items. Finally, concerning multi-group analysis, the testing of the measurement invariance showed a weak invariance, i.e. the factor loadings are equal across countries (results are available upon request).

====Latent Class Analysis (LCA) and multinomial logistic regression for segmentation and for matching consumer segmentations with products/firms====

Latent class analysis (LCA) can be viewed as a special case of model–based clustering for multivariate discrete data. It is assumed that each observation comes from one of a number of classes, groups or subpopulations, with its own probability distribution. The overall population thus follows a finite mixture model. When observed, data take the form of categorical responses as, for example, in consumer behaviour surveys, it is often of interest to identify and characterize clusters of similar individuals.

In the context of marketing research, one will typically interpret the latent number of mixture components as clusters or segments. In fact, LCA provides a powerful tool and the state-of-the-art technique to identify market segments. In line with our objective, latent class analysis has been suggested as a model-based tool for regular market segmentation (Wedel & Kamakura, 2000) and international market segmentation (Steenkamp & ter Hofstede, 2002).

In the following we describe the standard latent class model and its parameter estimation and we report the problem of model selection and goodness of fit criteria. Subsequently, we present the extension of the basic model which permits the inclusion of covariates to predict latent class membership. We discuss three-step approaches for LCA with covariates. Lastly, we present the empirical application.

The formal models of LCA

Let 𝑋 represent the latent variable and 𝑌𝑙 one of the L observed or manifest variables, where 1 ≤ 𝑙 ≤ 𝐿. Moreover, let C be the number of latent classes and 𝐷𝑙 the number of levels of 𝑌𝑙. A particular latent class is enumerated by the index x, x = 1, 2, ..., C, and a particular value of 𝑌𝑙 by 𝑦𝑙, 𝑦𝑙= 1, 2, ..., 𝐷𝑙.

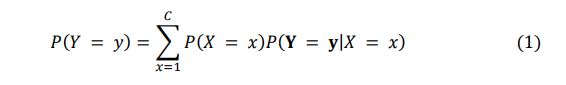

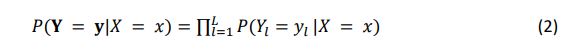

The vector notation Y and y is used to refer to a complete response pattern. The basic idea underlying any type of LC model is that the probability of obtaining response pattern y, 𝑃(𝐘 = 𝐲), is a weighted average of the C class-specific probabilities 𝑃(𝐘 = 𝐲|𝑋 = 𝑥); that is,

Here, 𝑃(𝑋 = 𝑥) denotes the proportion of persons belonging to LC 𝑥. In the classical LC model, this basic idea is combined with the assumption of local independence. The 𝐿 manifest variables are assumed to be mutually independent within each LC, which can be formulated as follows:

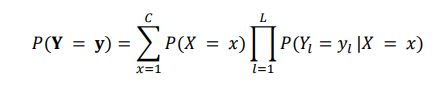

After estimating the conditional response probabilities 𝑃(𝑌𝑙 = 𝑦𝑙 |𝑋 = 𝑥), comparing these probabilities between classes shows how the classes differ from each other, which can be used to name the classes. Combining the two basic equations (1) and (2) yields the following model for 𝑃(𝐘 = 𝐲) marginal probability:

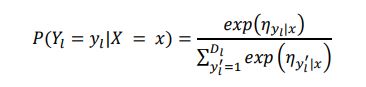

The model is formulated for nominal indicators 𝑌𝑙 and consequently a multinomial logit distribution is hypothesized for the conditional probability to obtain 𝑦𝑙 to l-th, given the affiliation to the latent class x, 𝑃(𝑌𝑙 = 𝑦𝑙 |𝑋 = 𝑥). The conditional probability is parameterized as follows

Where the linear term 𝜂𝑦𝑙 |𝑥 = 𝛽𝑦𝑙 + 𝛽𝑦𝑙𝑥, the parameter 𝛽𝑦𝑙 is the intercept and 𝛽𝑦𝑙𝑥 is the effect of the latent variable X on the indicator 𝑌𝑙.

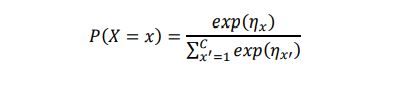

In the same way, the probability associated with the latent variable X has a nominal logit distribution:

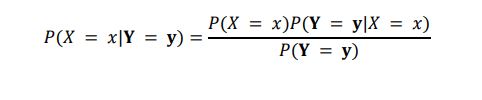

Similarly to cluster analysis, one of the purposes of LC analysis might be to assign individuals to latent classes. The probability of belonging to LC x – often referred to as posterior membership probability – can be obtained by the Bayes rule,

The most common classification rule is modal assignment, which amounts to assigning each individual to the LC with the highest 𝑃(𝑋 = 𝑥|𝐘 = 𝐲).

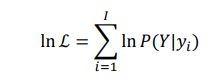

The parameters of LC models are typically estimated by means of maximum likelihood (ML):

Where i is a particular pattern of response, I is the number of all potential patterns of response, (𝐼 =∏ 𝐷𝑙𝐿𝑙=1) and 𝑃(𝐘 = 𝐲𝑖). Among the most popular numerical methods for solving the Maximum Likelihood Estimation (MLE) problem is the Expectation-Maximization (EM) algorithm (Dempster et al., 1977). The EM algorithm treats the estimation of LC model parameters as an estimation problem similar to those for missing data (i.e. multiple imputation). More details about the model and the parameter estimation are provided in Lazarsfeld and Henry (1968), Goodman (1974); Haberman (1979), Clogg (1995), Agresti (2002) and Bartholomew, Knott and Moustaki (2011).

An advantage of LCA as compared with other clustering techniques is the variety of tools available for assessing model fit and for determining the appropriate number of latent classes. In some applications, the number of latent classes will be selected for primarily theoretical reasons. In other cases, however, the analysis may be of a more exploratory nature, with the objective being to locate the best fitting or most parsimonious model. The researcher may then begin by fitting a complete “independence” model with C = 1, and then iteratively increase the number of latent classes by one until a suitable fit has been achieved.

Parsimony criteria seek to strike a balance between over- and under-fitting the model to the data by penalizing the log-likelihood by a function of the number of parameters being estimated. The two most widely used parsimony measures are the Bayesian information criterion, or BIC (Schwartz 1978) and Akaike information criterion, or AIC (Akaike 1973). Preferred models are those that minimize values of the BIC and/or AIC.

BIC will usually be more appropriate for basic latent class models because of their relative simplicity (Lin and Dayton 1997; Forster 2000). Calculating Pearson’s χ2 goodness of fit and likelihood ratio chisquare (G2 ) statistics for the observed versus predicted cell counts is another method to help determine how well a particular model fits the data (Goodman 1970). The entropy of a model is also used as a model selection criterion, either by itself or together with other statistics.

Latent class with covariates (using multinomial logistic regression)

In most LC analysis applications, one not only wishes to build a measurement or classification model based on a set of responses, but also to relate the class membership to explanatory variables. In a more explanatory study, one may wish to build a predictive or structural model for class membership whereas in a more descriptive study the aim would be to simply profile the latent classes by investigating their association with external variables (Vermunt, 2010). The latent class regression model (LCRM) generalizes the basic latent class model by permitting the inclusion of covariates to predict individuals' latent class membership (Dayton and Macready, 1988; Hagenaars and McCutcheon, 2002).

In the LCA literature two ways for dealing with covariates have been proposed: a one-step and a threestep approach. The former involves simultaneous estimation of the LC (measurement) model of interest with a logistic regression (structural) model in which the latent classes are related to a set of covariates. An alternative estimation procedure that is sometimes used is called the “three-step" approach: estimate the basic latent class model, calculate the predicted posterior class membership probabilities and then use these values as the dependent variable(s) in a regression model with the desired covariates. Since the one-step presents certain disadvantages – for example, it limits the number of covariates that can be considered in the model (Vermunt, 2010) - we use the three-step approach in order to avoid such limitation. In a subsequent step, this allows us to predict the consumer segment and perform a matching between segmentation and firms’ characteristics, in order to detect the best segment for the firm. According to this, the causal relationship firm-to-consumer segment will be explained by multinomial logistic regression models where the consumer segment will be the dependent variable and the selected covariates (i.e. organic, wild, cheap etc.) will be the choice factors. Theoretical details and the generic equation of the multinomial logistic regression model are reported in Agresti (2002). LCA and multinomial regression were performed using poLCA (Linzer & Lewis, 2011) and nnet (Venables et al., 2002) R-packages (R Core Team, 2017), respectively.

Models

Reports &Data

The tool