Difference between revisions of "PSC"

Jacandrade (talk | contribs) |

|||

| (4 intermediate revisions by one other user not shown) | |||

| Line 12: | Line 12: | ||

| | ||

| − | Consumers are too numerous, dispersed, and varied in their buying requirements to make it possible | + | Consumers are too numerous, dispersed, and varied in their buying requirements to make it possible to serve all efficiently and in the same manner. At the same time, in today’s competitive landscape, companies follow more and more customised approaches to serve and satisfy the consumers which again drives their ever more differentiated wants. As a consequence, markets become “demassified”, dissolving more and more into “micro-markets”, characterised by different consumers purchasing different products in different distribution channels and attending to different communication channels. Segmentation aims at identifying such micro markets, i.e. groups of consumers that share the same expectations and behavioural patterns. The identification of the most attractive micro-markets, i.e. segment(s), for the company and its products therefore is imperative not only for successful commercialisation but also for new product development. |

| − | to serve all efficiently and in the same manner. At the same time, in today’s competitive landscape, | ||

| − | companies follow more and more | ||

| − | again drives their ever more differentiated wants. As a consequence, markets become “demassified”, | ||

| − | dissolving more and more into | ||

| − | different products in different distribution channels and attending to different communication | ||

| − | channels. Segmentation aims at identifying such micro markets, i.e. groups of consumers that share | ||

| − | the same expectations and behavioural patterns. The identification of the most attractive | ||

| − | i.e. segment(s), for the company and its products therefore is imperative not only for | ||

| − | successful | ||

| − | Following a strategic approach to markets, the company distinguishes the major market segments | + | Following a strategic approach to markets, the company distinguishes the major market segments based on the profiling of different consumer groups along their wants, consumption and purchasing behaviour; socio-demographic characteristics etc.; targets one or more of these segments; and develops products (and marketing programs) tailored to the profile and expectations of each selected segment.Tailoring starts with an understanding of the customers and providing them with the product and service they expect but, importantly, embraces also price, distribution and communication efforts to reach the target segment efficiently. The firm focus is on the buyers whom they have the greatest chance of satisfying. Having satisfied customers is at the basis for company success and the first step to repeat purchase and customer loyalty. |

| − | based on the profiling of different consumer groups along their wants, consumption and purchasing | ||

| − | behaviour; socio-demographic characteristics etc.; targets one or more of these segments; and | ||

| − | develops products (and marketing programs) tailored to the profile and expectations of each selected | ||

| − | segment.Tailoring starts with an understanding of the customers and providing them with the | ||

| − | product and service they expect but, importantly, embraces also price, distribution and | ||

| − | communication efforts to reach the target segment efficiently. The firm focus is on the buyers whom | ||

| − | they have the greatest chance of satisfying. Having satisfied customers is at the basis for company | ||

| − | success and the first step to repeat purchase and customer loyalty. | ||

| − | Evidence for new product development or new product | + | Evidence for new product development or new product commercialisation success factors shows that the analyses of market segments, targeting, positioning and the alignment with the firms’ offer and resources are crucial to both new product development and new product commercialisation. It follows that segmentation helps companies to navigate an increasingly competitive market, to understand their customers better, to develop offerings that satisfy specific wants, and to address diversity in an efficient manner. |

| − | the analyses of market segments, targeting, positioning and the alignment with the firms’ offer and | ||

| − | resources are crucial to both new product development and new product | ||

| − | It follows that segmentation helps companies to navigate an increasingly competitive market, to | ||

| − | understand their customers better, to develop offerings that satisfy specific wants, and to address | ||

| − | diversity in an efficient manner. | ||

| − | The approach to developing a robust model to | + | The approach to developing a robust model to analyse the likelihood that new seafood product launches will be successful follows this perspective. We develop both country specific consumer segmentations in Italy, Germany, France, Spain and the UK, as well as an overarching European segmentation useful for companies that are innovating and developing new fish products or have fish products on offer and would like to improve their commercialisation. The segmentations are based on latent class analyses of representative samples of consumers (800 in each of the five countries) who replied to an online survey in June-July 2017. |

| − | launches will be successful follows this perspective. We develop both country specific consumer | ||

| − | segmentations in Italy, Germany, France, Spain and the UK, as well as an overarching European | ||

| − | segmentation useful for companies that are innovating and developing new fish products or have fish | ||

| − | products on offer and would like to improve their | ||

| − | latent class analyses of representative samples of consumers (800 in each of the five countries) who | ||

| − | replied to an online survey in June-July 2017. | ||

| − | Although the segment profiles by themselves are informative, the methodology used contains an | + | Although the segment profiles by themselves are informative, the methodology used contains an additional step in order to help the company select the most appropriate target(s). In this second stage, multinomial regression matches product (and firm) attributes with the most attractive consumer segment(s). A comparison of the segment, i.e. consumer profile, with the product attributes will further inform the company on how to improve the product and/or its marketing effort in order to tailor more closely to segment wants and characteristics and ultimately launch and commercialise successfully. Figure 1 gives an overview of the success analysis model. |

| − | additional step in order to help the company select the most appropriate target(s). In this second | ||

| − | stage, multinomial regression matches product (and firm) attributes with the most attractive | ||

| − | consumer segment(s). A comparison of the segment, i.e. consumer profile, with the product attributes | ||

| − | will further inform the company on how to improve the product and/or its marketing effort in order to | ||

| − | tailor more closely to segment wants and characteristics and ultimately launch and | ||

| − | |||

| − | '''Figure 1: The success analysis model at a glance''' | + | '''Figure 1: The success analysis model at a glance''' [[File:Psc fig 1.JPG|center|Figure 1: The success analysis model at a glance]] |

| − | [[File: | ||

| + | | ||

== The tool == | == The tool == | ||

| Line 64: | Line 30: | ||

---- | ---- | ||

| − | The PSC tool is being developed as a proxy for the multinomial regression algorithm created as a result of | + | The PSC tool is being developed as a proxy for the multinomial regression algorithm created as a result of the research phase of the project. It presents the user with an interface to select the variables to be used in the algorithm which will calculate the profile and consumption probability of the product being analysed, and display to the user the results in a graphical, user friendly form. |

| − | the research phase of the project. It presents the user with an interface to select the variables to be | ||

| − | used in the algorithm which will calculate the profile and consumption probability of the product being | ||

| − | analysed, and display to the user the results in a graphical, user friendly form. | ||

=== PSC home page === | === PSC home page === | ||

| − | The suer can access the PSC tool home page by clicking the quick access link in the DSS homepage or by | + | The suer can access the PSC tool home page by clicking the quick access link in the DSS homepage or by clicking the appropriate link in the top navigation bar. |

| − | clicking the appropriate link in the top navigation bar. | ||

| − | ''PSC home page'' | + | ''PSC home page'' [[File:Psc home 1.png|center|PSC home page]] [[File:Psc home 2.png|center|PSC home page]] |

| − | [[File: | ||

| − | [[File: | ||

| + | Once in the PSC home page, the user must initially select 5 different attributes for the product being analysed in the ''Product attributes'' section. These are required attributes and must be selected before being able to see the results. Once these attributes are set, the user can additionally select more detailed attributes in the ''Other marketing attributes'' sections to increase the relevancy of the resulting analysed profile. Optionally, the user can also select preferred presentation formats in the selection box above the ''Perform product success check'' button, which will then be highlighted in the results page preferences graph. | ||

| − | + | Behind the scenes, when the user clicks the button to perform the PSC, the tool wraps the attributes chosen by the user and hands over to the R language script developed in the research part of the project, which in turn calculates the multinomial regression for the given attributes and returns the results to the DSS tool. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | results | ||

| − | + | === The results === | |

| − | the | + | |

| − | + | ''PSC results page'' [[File:Psc results 1.png|center|PSC results page]] [[File:Psc results 2.png|center|PSC results page]] | |

| − | + | ||

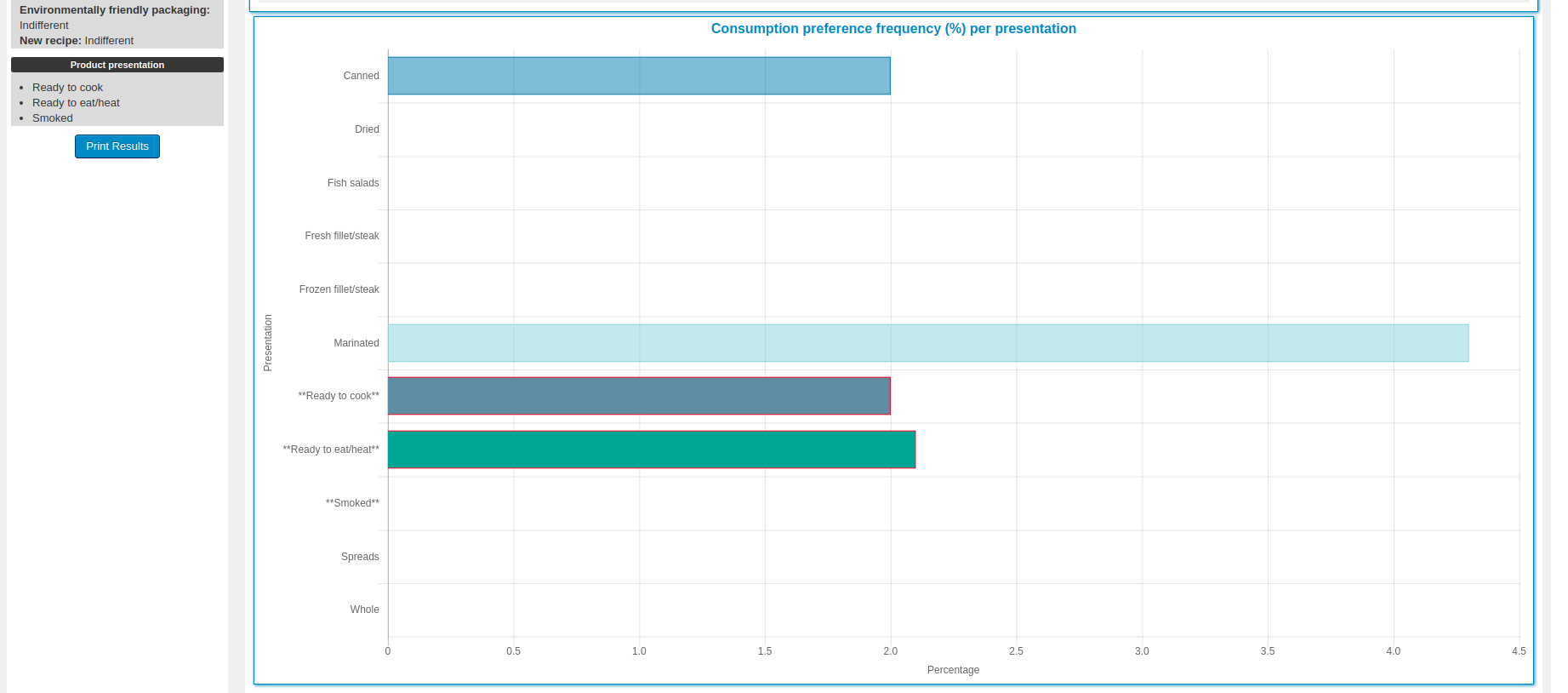

| + | After a user click the button to perform the product success check, the results page will be displayed containing the description of the best matching consumer profile for the analysed product, as well as a graphical comparison of consumption probabilities for different product formats. The presentation formats selected in the previous page will be highlighted in the graph, and the selected attributes used for the regression will be displayed in the sidebar on the left. | ||

| + | |||

| + | | ||

| + | |||

| + | === Segments description === | ||

| + | |||

| + | The table here below presents a summary of the segments identified in the single countries (and in the “total” EU countries) under study. Some segments are cross-national or pan-European (light blue, light red), while others are specific to a few (grey cells)/only one country (dark green). [[File:Psc table 1.png|center|Segment tables]] | ||

| + | |||

| + | ==== Italy ==== | ||

| − | === The | + | '''The health & environmentally conscious''' consumer represents 13 % of the Italian consumers (trend: stable). Members of this segment are willing to pay (second highest expenditure for fish in Italy) for beneficial effects for both personal and environmental health. Predominantly women aged 50 + value items such as environmentally friendly, sustainability and natural ingredients, nutrients, easy-to digest characteristics highly. Appearance and traceability are also important to this segment, pointing to critical evaluation and check of quality/safety issues related to fish. They prefer wild fish, boneless and traditional recipes. Their favourite place of purchase is the supermarket/fishmonger which are also their sources of information. The segment’s usage rate is medium-high. Of note, consumers here like all fish species (although they consume sea bream and sea bass most) and buy a broad range of formats. The women and their small families (3 persons) reside in bigger urban centres, with children who are grown up but still live at home. |

| + | |||

| + | '''The brand-convenience-taste''' consumers reflect only a small but growing portion of the Italian market (7 %). This group of young consumers with small families declares to have a preferred brand and to favor taste over nutritional aspects. Highly important to them are availability of the fish, new formats, labels and omega 3. The consumers here also value fish products that take little time to prepare while nutrients or sustainability claims are of no importance to them. Consistent with a brand buyer is also the fact that these consumers are not self-efficacious– they rely instead on the familiarity and security that comes with a preferred brand and label (another aspect of “convenience”). In line with this profile is the supermarket as the only place of purchase, which is also, together with advertisements, the segment’s main source of information. People in this group live predominantly in rural areas of the country. The favourite species are salmon (ready-to-eat/to cook, fresh fillet), sea bream (fresh fillet) and cod (frozen fillet) with overall medium consumption and average expenditure. | ||

| + | |||

| + | '''The self-efficacious cooking artist''' represents 14 % of Italian consumers (trend: growing). Here we find the self-efficacious (all items that point to knowledge and evaluation of fish score high) relatively young male who likes to cook, is creative in meal preparation and looks for versatility. Consistent with the passion for cooking, saving time in meal preparation is unimportant to him. He looks for healthy products (with traceability) but also for a reasonable price-quality ratio. He and his partner (or small family) live in coastal/rural areas as well as in urban centres. The favourite place of purchase is the supermarket or the fishmonger, the source of information is the label or the advice from the fishmonger. Chooses predominantly sea bream, sea bass and cod in a wide range of formats (except ready to eat). Fish expenditure is average, in line with the fact that those who have more knowledge of fish can find more alternatives among available products. | ||

| + | |||

| + | '''The local connoisseur''' represents the biggest segment in Italy (24%/growing). This is the group of consumers who know everything about fish (high values across self-efficacy items), use its versatility and experiment with new formats or recipes. Relatively young women here (with small family) strongly emphasise the health-nutritional aspect and underline easy digestion. This group of consumers also favours local origin. They pay attention to environment and sustainability issues and indicate the preference for a (local) brand or seller. Emphasising value for money, they do not trade off quality for price (but would instead go for a cheaper species or stock the fish in order to be flexible). They prefer wild fish, are indifferent to bones, and are inclined to traditional preparation. Their consumption is medium-high (mainly sea bream, sea bass, less cod and salmon in a wide range of formats) with an expenditure that is the highest across all Italian segments. These consumers buy in the supermarket or at the fishmonger and do not indicate any sources of information. | ||

| + | |||

| + | '''Price-wise convenience''' consumers (14%/stable) represented in segment 5 are very price conscious, reflected also in their low expenditure on fish. People here are not knowledgeable about fish. They strongly underline health, easy-to-cook characteristics and texture. In line with this profile is their fish selection – they favour cod and salmon (fresh and frozen fillets but also canned, smoked, ready-to-cook/ready-to eat). Both genders aged 54 + are represented here, mainly living with one grown up child in rural and urban areas. Preferably they buy in supermarkets which are, together with advertisements, also the source of information. | ||

| + | |||

| + | '''The self-efficacious pragmatic fish''' consumers, a large (23%) and growing segment with high fish expenditure. They value the health benefits of fish, look for conservation and versatility. Preferences here bring together the health of both, individuals and the environment, added is a strong emphasis on value for money. Although this segment is knowledgeable about fish and its preparation, the profile seems to reflect a pragmatic instance of “having to eat and cook fish” without related pleasure of doing so. In fact, this segment has only two favourite species, namely salmon and cod, which they consume frequently, predominantly as fresh/frozen fillets. Women aged 45 + with small families, medium-high education and income represent the socio-demographic profile of this segment best. | ||

| + | |||

| + | '''Indifferent''' consumers are the smallest group of consumers (6%/stable), represented by relatively young male with small family living in rural or intermediate areas of Italy. Their favourite place of purchase is the supermarket. They consult the label or ads for fish information. Species include sea bream and salmon and their expenditure is among the lowest across the segments. | ||

| + | |||

| + | | ||

| + | |||

| + | ==== Spain ==== | ||

| + | |||

| + | Segment 1 represents '''brand/seller “dependent” high quality''' consumers who are not self-efficacious (23%/growing). The preferred “brand“ here is either the shop/seller or the brand itself. Consumers do not feel on the safe side regarding fish evaluation and preparation and thus rely on the trusted seller/brand of whom they learn. They give importance to inclusive health (individual and environment) and have a broad quality understanding for which they are ready to pay. This segment shows high fish consumption and the highest expenditure for fish. Consistent with the fact that they like to cook but do not indicate corresponding competence they go for a very limited range of species. They buy in supermarkets or at the fishmonger and listen to the advice of the fishmonger or seller. Women aged 46 + with small children (who eat fish) and low-medium education but relatively high income best represent this group of consumers. Favourite species are sea bream (whole/fresh fillet) and cod (fresh/frozen fillet, dried). | ||

| + | |||

| + | '''Self-efficacious selfish brand buyer''' (23%/growing): also this group of consumers has a preferred brand/seller but it is, as compared to segment 1, self-efficacious. It is “egoistic” in terms of health orientation as only items which focus on individual health are important (while environmental attention is unimportant) to this segment. Men around 55 here take care of their family which lives in cities close to the coast. They are medium sea bass and salmon consumers who spend relatively little on fish. | ||

| + | |||

| + | '''The independent “good for me” connoisseur''' (9%, growing) values taste and nutrition equally. Members of this segment love fish (sensory appeal) and they value its benefits for health. They cross-check on labels and expect a guaranteed origin. In line with this, the segments favourite species is wild fresh sea bass which is consumed in high quantities. Women aged 48, living with family in cities at the coast are willing to spend for their selected premium sea bass which they preferably buy at the fishmonger or in the supermarket. | ||

| + | |||

| + | The consumers in the 4th and biggest (29 %, stable) segment in Spain are directed towards '''nutritional-digestive and inclusive health (360 degree-health)'''. Consistent with this emphasis is the importance given to origin and traceability. Value for money is crucial to this segment, and they value conservation. Their medium-high fish consumption is reflected also in a relatively high fish expenditure mainly spent on fresh sea bream and salmon (fresh/smoked). Young women here take care of their families with young children. | ||

| + | |||

| + | '''(Salmon) Cooking artists (9%/stable)''', very young couples (24 +), like to cook and trust in their competence of fish (salmon) preparation, they are creative and experiment with new formats, and they emphasise versatility. None of the health related items is of importance. The young couples go mainly for wild salmon (medium –high consumption) in the supermarket. Salmon is the dominant species they buy in all formats. Consistent with the artist stance is also the (low) use of an exotic species such as herring. The main source of information is the seller. | ||

| + | |||

| + | '''The indifferent''' (7%/stable), with medium-low consumption of salmon and cod, spends little on fish. Typically consumers here are young male, small family size, low education level living in urban centers in the countryside. | ||

| + | |||

| + | ==== ==== | ||

| + | |||

| + | ==== France ==== | ||

| + | |||

| + | '''The good for me health''' consumer represents 29 % of the French market (trend: stable) that expects mainly health benefits from fish consumption and looks for guarantees in terms of sustainability certifications and traceability. Predominantly consisting of male in their fifties, highly educated and with high income, this segment appreciates “easy-to-cook” products and emphasises value for money. It is characterised by low-medium consumption and low expenditure for sea bream (either fresh fillet or ready-to-eat). Shopping for two, predominantly in supermarkets, these men use the label or the seller for information. | ||

| + | |||

| + | '''The health oriented (selfish), (not creative) cook''' (23%/growing) is medium-high in fish consumption and the highest in expenditure. Women aged around 45 highly value the health benefits of fish, they like cooking and the variety and versatility that comes with many species and a wide range of formats (herring, cod and sea bream) in traditional preparations. They purchase in the supermarket for a small family and take information from the label and the seller. | ||

| + | |||

| + | '''The cooking artist''' represents around a quarter of fish consumers in France (trend: stable). This profile cuts across all ages, also the very young. They choose carefully, go for high quality for which they are ready to pay and they consult many information sources. Health is not on the agenda of this segment and they have no environmental concerns. They shop for sea bream at the supermarket or at the fishmonger. The couple prefers fresh, but they are flexible and willing to try different formats and recipes. | ||

| + | |||

| + | '''Self-efficacious convenience''' consumer to whom, beyond inclusive health, convenience is central (31%/stable). They give importance to each and every aspect and thus represents very demanding consumers. This consumer critically checks the expected quality: reads labels and values certificates and guarantees. Medium consumption of varied fish species and broad range of formats (reflecting convenience), and second highest expenditure on fish. Relatively young women and men are representing the class, living in the countryside/intermediate cities in small families. | ||

| + | |||

| + | '''The indifferent''' in France are the smallest group of consumers (7%/stable). The class is on a medium-low level in fish consumption and the lowest expenditure for trout, salmon and cod. Prefer mainly in fresh and frozen formats. The segment is predominantly young singles or couple, living in the countryside in smaller cities. | ||

| + | |||

| + | In all segments salmon and trout is consumed. The species mentioned above distinguish the segments from this overall baseline consumption. | ||

| + | |||

| + | ==== ==== | ||

| + | |||

| + | ==== Germany ==== | ||

| + | |||

| + | '''The cooking artist''' (12%/stable) is loyal to a brand/seller and gives importance to local origin. Consumers in this segment share the characteristics that cut across-countries for the cooking artist: they like to cook/are capable of preparing fish, value versatility, are creative and ready to try new formats. Taste here clearly dominates nutritional aspects (only Omega 3 is of importance). Consumers in this segment are not price sensitive, a fact reflected also in the highest fish expenditure across German segments. They prefer fresh fish, medium usage rate, mainly salmon but also the more “exotic” sea bream (the only segment in Germany) and sea bass. The class includes both genders, they are young, live with a small family with smaller kids in cities in the countryside. | ||

| + | |||

| + | '''Healthy & environmentally-conscious''' consumers make up a third of the German market (growing). To consumers in this segment, a healthy diet and a natural product and the texture are central. Health here is inclusive of the environment, consumers value sustainability certification and put emphasis on a guaranteed origin. They are not self-efficacious and thus trust their “seller/brand”, but also consult the label and ask for guarantees. The group is ready to pay for the value they ask for, i.e. a healthy & environmentally safe diet, which is reflected in high fish expenditure. The class includes both genders aged over 54 involved in decisions and patterns of fish consumption (salmon, trout and sea bass; fresh and frozen); consistent with their health focus their consumption is medium high. | ||

| + | |||

| + | '''The convenience- brand loyal''' consumer (23%/growing), looks for value for money. Brands provide the benefits she asks for: nutrients, sustainability certification, traceability, label. Ready-to-eat is emphasised which together with fresh formats may satisfied her want for creativity. Predominantly relatively young female living in a two-person-household in cities in the countryside with lower fish expenditure and medium fish consumption represent this cluster best. The members of this segment shop in supermarkets where they get information in-store, from the seller or from the label. | ||

| + | |||

| + | The fourth segment comprises '''healthy cooking artists''' who like variety. Being a premium segment in terms of expenditure, this profile unites the cooking artist with a focus on health. Versatility is important, but experimentation is also reflected in a broad range of species and formats. The socio-demographic profile of women over 54, with medium high education, in 2 person-households, is very much in line with this segment. | ||

| + | |||

| + | '''Cheap brand and taste''' consumer (16%/stable): People in this segment have learned the claims of their preferred brand (but they are not knowledgeable about fish), omega 3 and tasty, they are price-conscious and, overall, seem to go for an easy buy without much involvement or major decision criteria. Fish here offers the best compromise between health and taste. No importance is given to origin and traceability. Male in their forties (couple) spend little for medium-low consumption. | ||

| + | |||

| + | '''The indifferent''' present around 7 % of the market, predominantly young and single. Medium consumption, relatively high expenditure and a broad range of species and formats. | ||

| + | |||

| + | Of note, herring is consumed in all segments. The species mentioned above distinguish the segments from this overall baseline consumption. | ||

| + | |||

| + | | ||

| + | |||

| + | ==== UK ==== | ||

| + | |||

| + | '''Healthy convenience''' consumers (22 %, growing) have their focus on “easy” to cook, to stock, to use (versatile). Health is also central, with a strong focus on digestion and environmental concern and the request for traceability. The segment is characterised by medium consumption and highest expenditure on fish across the segments. Women, aged above 50 with medium-high education and a 2-person household describe the segment best. Members of this segment appreciate wild fish; their favourite species are sea bream, sea bass – fresh fillets, ready-to-eat, whole fish. | ||

| + | |||

| + | '''Selfish health & convenience''' consumers, the biggest segment (43 %, growing) are typically younger couples with medium – low income but relatively high expenditure on fish. They are informed and are consulting many information sources, do not trade off quality for price and are indifferent to brands, origin and traceability. The focus is on health, but also easy to cook, versatility, and conservation are important. Consume salmon and sea bass in medium quantity. This segment is similar to segment 1 in convenience but health is not inclusive and more focused on nutrients than on digestion and its information behaviour is more extensive. | ||

| + | |||

| + | '''Cooking artist''' (8 %/stable trend). Similar to her counterparts in the other countries, the British cooking artist likes to cook and to experiment with new formats. Taste is an important theme, while she is indifferent to health and environmental concerns; dietary issues are not important. British cooking artists are not really knowledgeable about fish. Women aged 44+ in small families with children eating fish do best describe the socio-demographic characteristics. Prefer wild, favourite species sea bream and cod. Given the low income she really likes and spends (over proportionally) for fish. | ||

| + | |||

| + | '''Self-efficacious & local ecologist''' (13 %/growing segment) are very young singles or 2-person households. They are knowledgeable and environmentally conscious. At the same time they give much importance to the local context. The segment members enjoy cooking and they trust in their meal preparation. Medium consumption of salmon, sea bream, sea bass, but with low expenditure. | ||

| + | |||

| + | The segment of '''indifferent''' (14 %, growing) is composed of young male, single or in a household of two, and low to medium education. Prefer salmon and cod, ready to eat, ready to cook. Medium consumers, low expenditure. | ||

| + | |||

| + | In all segments cod is consumed. The species mentioned above distinguish the segments from this overall baseline consumption. | ||

| + | |||

| + | ==== ==== | ||

| + | |||

| + | ==== Europe ==== | ||

| + | |||

| + | We construct 11 European segments which are briefly discussed here below. | ||

| + | |||

| + | '''The salmon fan''' segment (9 %/growing), in line with the only species it consumes, values highest omega 3, availability, versatility and value for money. These consumers also clearly favor taste over nutritional aspects. Consumers here are women in their forties, living in households of two persons with medium – high salmon consumption of all formats and relatively high expenditure. In terms of relative composition, this segment is very prominent in the UK (29 %). | ||

| + | |||

| + | Segment two represents the '''self-efficacious inclusive health''' consumer, one of the largest EU segments (17 %, growing): knowledgeable people who appreciate the health-nutritional aspect of fish. Dietary considerations are not important (e.g. nr. of calories). Health includes the well being of the environment. People emphasise value for money, expect traceability and certification but are indifferent with regard to organic products. Male and female consumers aged around 50, with medium expenditure and fish consumption; favourite species are salmon, sea bream, cod with wide variety of formats. Germans make up 24 % of this segment. | ||

| + | |||

| + | '''Cooks with inclusive health focus''' (11%) characterise segment 3. They enjoy meal preparation (but are neither creative nor knowledgeable of fish) and emphasise omega 3 and “easy-to-digest” attributes. Their overall important theme is individual and environmental health, and, importantly, animal welfare, which is cross-checked with label and certifications. The segment is not price sensitive and is ready to pay for the expected value. Relatively young men here take care of small families who live in urban centres in the countryside. Low-medium consumption, but relatively high expenditure on fish. UK dominated with 27% of consumers in this segment (trend: stable). | ||

| + | |||

| + | '''Tasty and easy quality''' (8%). To this segment value for money is important as are “easy to cook” and quick preparation of meals. Availability and conservation is stressed, emphasising the time/convenience posture of the segment. Taste and texture are valued more than health aspects. No environmental concerns and also self-efficacy criteria are low/indifferent. Young male (early thirties) with medium-high education take care of small families. They prefer wild over farmed and spend much for taste and easy quality - high expenditure for medium-high fish consumption. Segment is mainly populated by French, Spanish and Italians (trend: increasing). | ||

| + | |||

| + | Segment 5 is the '''360 degree- health oriented''' segment (11%), which gives much importance to natural fish products. Also “easy to digest” and nutrients are of utmost importance, as is the absence of smell and a guaranteed origin. It is the only segment where people also have a concern regarding negative effects of farming. Consistent with this preference they favour wild fish. The segment is characterised by medium-high fish consumption with corresponding high expenditure. Women in their 50s in 2-people households with medium education represent best the demographic profile of the segment. Italians dominate this segment (trend: increasing ). | ||

| + | |||

| + | Segment 6, one of the smallest in EU (5 %), is characterising the '''innovative brand buyer'''. Consumers here have a favourite brand to which they are also loyal. “Claim”-related items are important but not supported by corresponding factual knowledge. People here are also the only ones to underline new dietary preparations (e.g. gluten free products), they prefer products that take little time for preparation, and they emphasise conservation and versatility. Time, overall, is an important factor for this group. The known brand is a response to this: choosing the familiar brand saves time in terms of reflection/selection and it is a guarantee for satisfied expectations. Consumption of this segment is high with corresponding highest expenditure across all segments. British, Italian and French women around 45, with small families make up this segment (trend: increasing). | ||

| + | |||

| + | '''Indifferent''': the majority of indifferent consumers is divided among UK (31 %) and France (27 %), followed by Spain and Germany (15 % and 14 %, respectively), with a stable trend. Only 12 % of the class is populated by Italian consumers. This segment is characterised by male and female aged 18-40, with low education and medium-low consumption. Expenditure, not surprisingly, is the lowest. | ||

| + | '''Healthy convenience''' (6 %). Segment 8 consumers look for easy to cook meals that take little time to prepare, appreciate conservation and general health/environmental benefits. Being demanding on all dimensions, they are ready to pay for the corresponding products. As confirmed by high fish expenditure, consumers do not trade off value for money. Here young dads with medium-high education take care of their bigger families’ health by balancing it with the need to have meals easily and quickly prepared (trend: stable). Only Italy is underrepresented (16 %) in this overall balanced segment. | ||

| − | '' | + | This group –'''the local – natural brand/seller''' (5 %) - values “local” and natural highly. More than emphasising the presence of positive nutrients and elements, consumers here emphasise the absence of ingredients and substances. They are self-efficacious, trust a certain – local – brand or seller to whom they are loyal. They also stress availability. Fish consumption is medium – low, expenditure is at the lower level across segments. The socio-demographic show relatively young men and women in households of three holding a medium education level. German consumers account for 27 % of this small segment (trend: stable). |

| − | |||

| − | |||

| − | + | In this segment we find the '''cook with selfish health focus''' (8%) who likes taste and nutrition. Broader health, dietary or environmental concerns are not considered important. Consistent with enjoying the preparation and consumption of fish, this segment’s expenditure is medium-high with corresponding high expenditure. Relatively young Spanish women in small households without children best describe the consumers of this segment (trend: increasing). | |

| − | |||

| − | |||

| − | |||

| − | |||

| + | '''Cooking artists''' (17 %, stable) are creative, like to experiment with new formats, like to cook and are self-efficacious. No environmental and health concerns. Women in their fifties in small households (2-3 members) with medium consumption and relatively low expenditure characterise this segment’s demographic profile. The majority of the class is made of Italians, while the minority comes from UK. | ||

== References & Readings == | == References & Readings == | ||

Latest revision as of 16:40, 22 October 2018

Contents

Product Success Check

Introduction

Consumers are too numerous, dispersed, and varied in their buying requirements to make it possible to serve all efficiently and in the same manner. At the same time, in today’s competitive landscape, companies follow more and more customised approaches to serve and satisfy the consumers which again drives their ever more differentiated wants. As a consequence, markets become “demassified”, dissolving more and more into “micro-markets”, characterised by different consumers purchasing different products in different distribution channels and attending to different communication channels. Segmentation aims at identifying such micro markets, i.e. groups of consumers that share the same expectations and behavioural patterns. The identification of the most attractive micro-markets, i.e. segment(s), for the company and its products therefore is imperative not only for successful commercialisation but also for new product development.

Following a strategic approach to markets, the company distinguishes the major market segments based on the profiling of different consumer groups along their wants, consumption and purchasing behaviour; socio-demographic characteristics etc.; targets one or more of these segments; and develops products (and marketing programs) tailored to the profile and expectations of each selected segment.Tailoring starts with an understanding of the customers and providing them with the product and service they expect but, importantly, embraces also price, distribution and communication efforts to reach the target segment efficiently. The firm focus is on the buyers whom they have the greatest chance of satisfying. Having satisfied customers is at the basis for company success and the first step to repeat purchase and customer loyalty.

Evidence for new product development or new product commercialisation success factors shows that the analyses of market segments, targeting, positioning and the alignment with the firms’ offer and resources are crucial to both new product development and new product commercialisation. It follows that segmentation helps companies to navigate an increasingly competitive market, to understand their customers better, to develop offerings that satisfy specific wants, and to address diversity in an efficient manner.

The approach to developing a robust model to analyse the likelihood that new seafood product launches will be successful follows this perspective. We develop both country specific consumer segmentations in Italy, Germany, France, Spain and the UK, as well as an overarching European segmentation useful for companies that are innovating and developing new fish products or have fish products on offer and would like to improve their commercialisation. The segmentations are based on latent class analyses of representative samples of consumers (800 in each of the five countries) who replied to an online survey in June-July 2017.

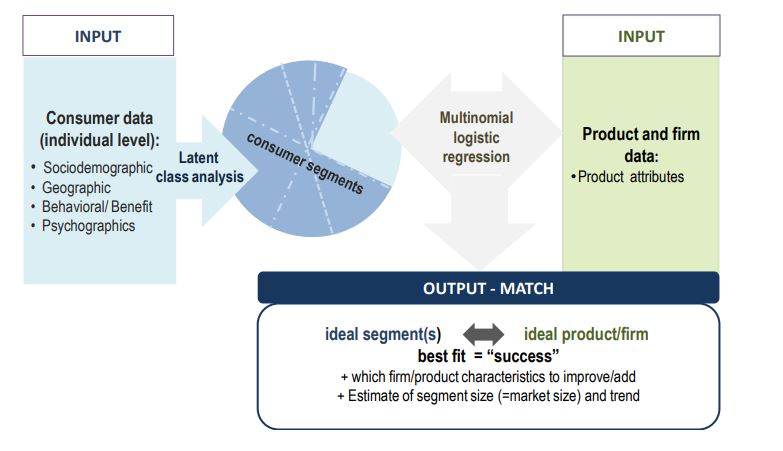

Although the segment profiles by themselves are informative, the methodology used contains an additional step in order to help the company select the most appropriate target(s). In this second stage, multinomial regression matches product (and firm) attributes with the most attractive consumer segment(s). A comparison of the segment, i.e. consumer profile, with the product attributes will further inform the company on how to improve the product and/or its marketing effort in order to tailor more closely to segment wants and characteristics and ultimately launch and commercialise successfully. Figure 1 gives an overview of the success analysis model.

Figure 1: The success analysis model at a glance

The tool

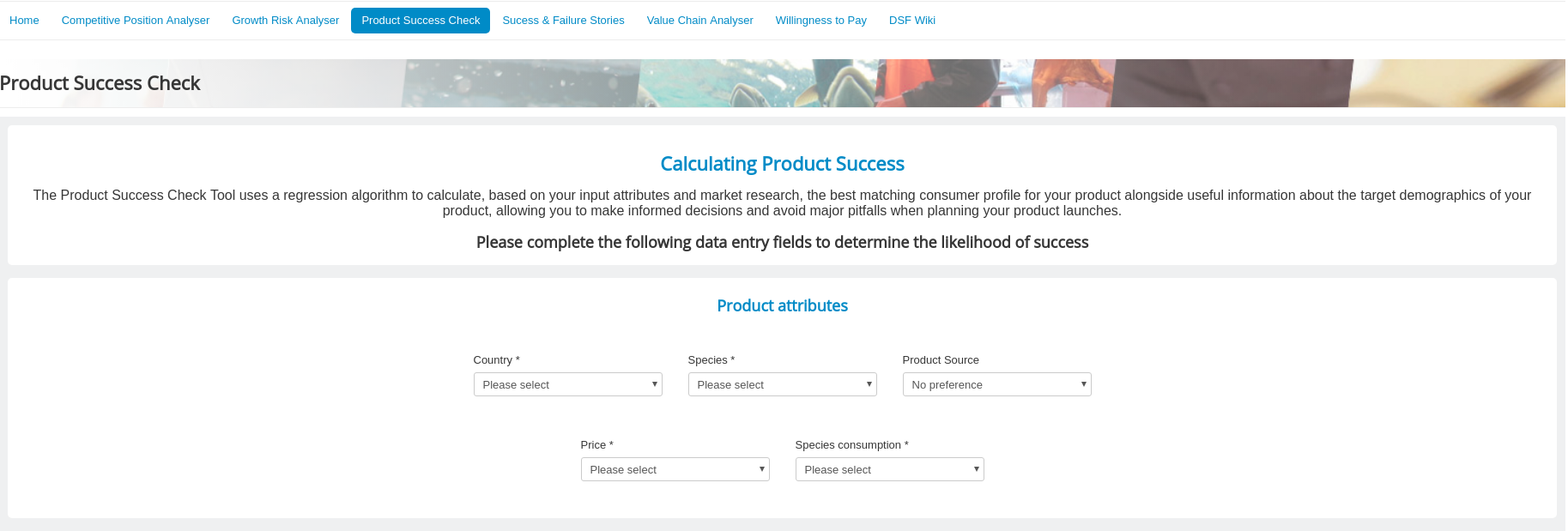

The PSC tool is being developed as a proxy for the multinomial regression algorithm created as a result of the research phase of the project. It presents the user with an interface to select the variables to be used in the algorithm which will calculate the profile and consumption probability of the product being analysed, and display to the user the results in a graphical, user friendly form.

PSC home page

The suer can access the PSC tool home page by clicking the quick access link in the DSS homepage or by clicking the appropriate link in the top navigation bar.

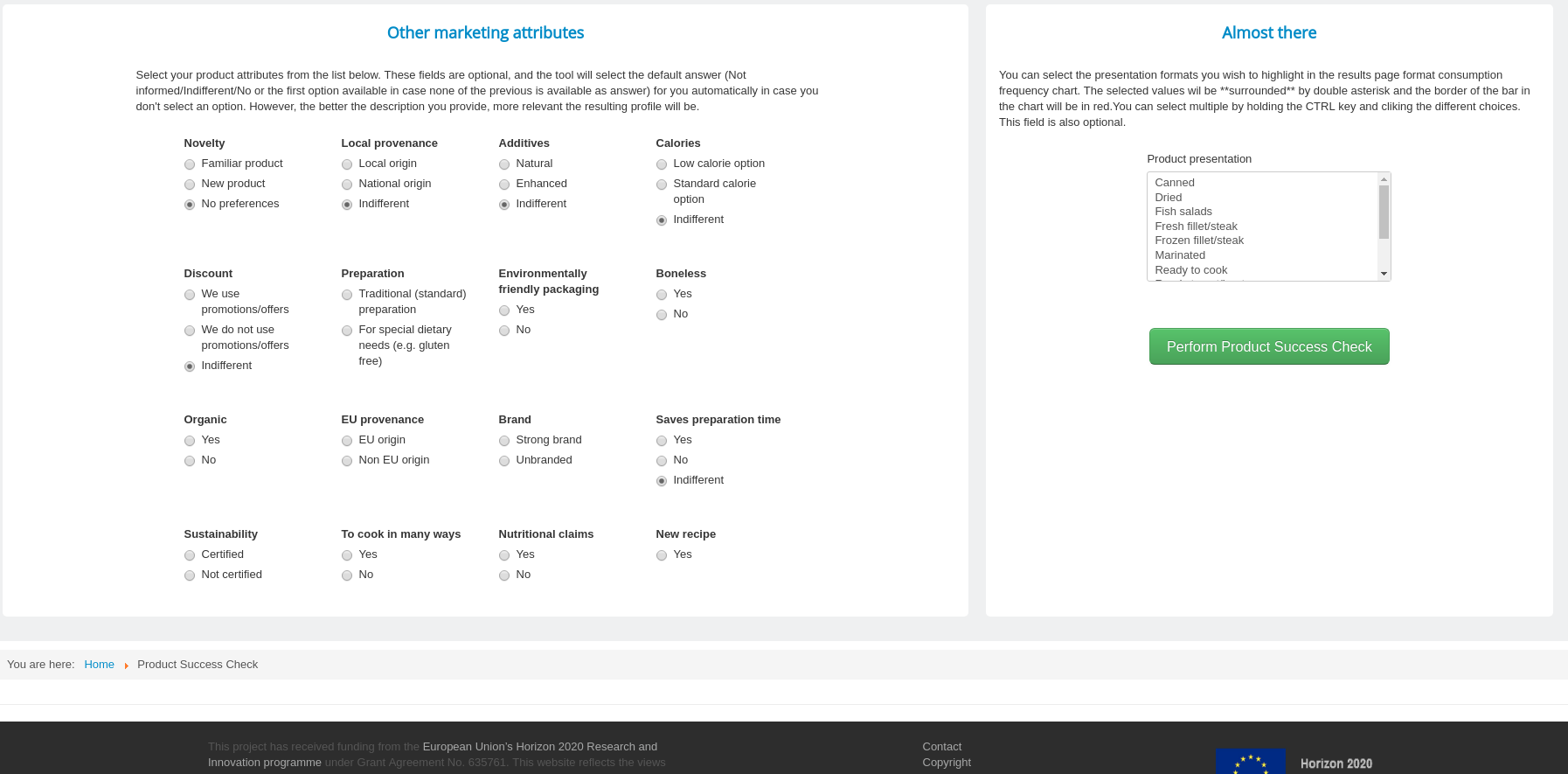

PSC home pageOnce in the PSC home page, the user must initially select 5 different attributes for the product being analysed in the Product attributes section. These are required attributes and must be selected before being able to see the results. Once these attributes are set, the user can additionally select more detailed attributes in the Other marketing attributes sections to increase the relevancy of the resulting analysed profile. Optionally, the user can also select preferred presentation formats in the selection box above the Perform product success check button, which will then be highlighted in the results page preferences graph.

Behind the scenes, when the user clicks the button to perform the PSC, the tool wraps the attributes chosen by the user and hands over to the R language script developed in the research part of the project, which in turn calculates the multinomial regression for the given attributes and returns the results to the DSS tool.

The results

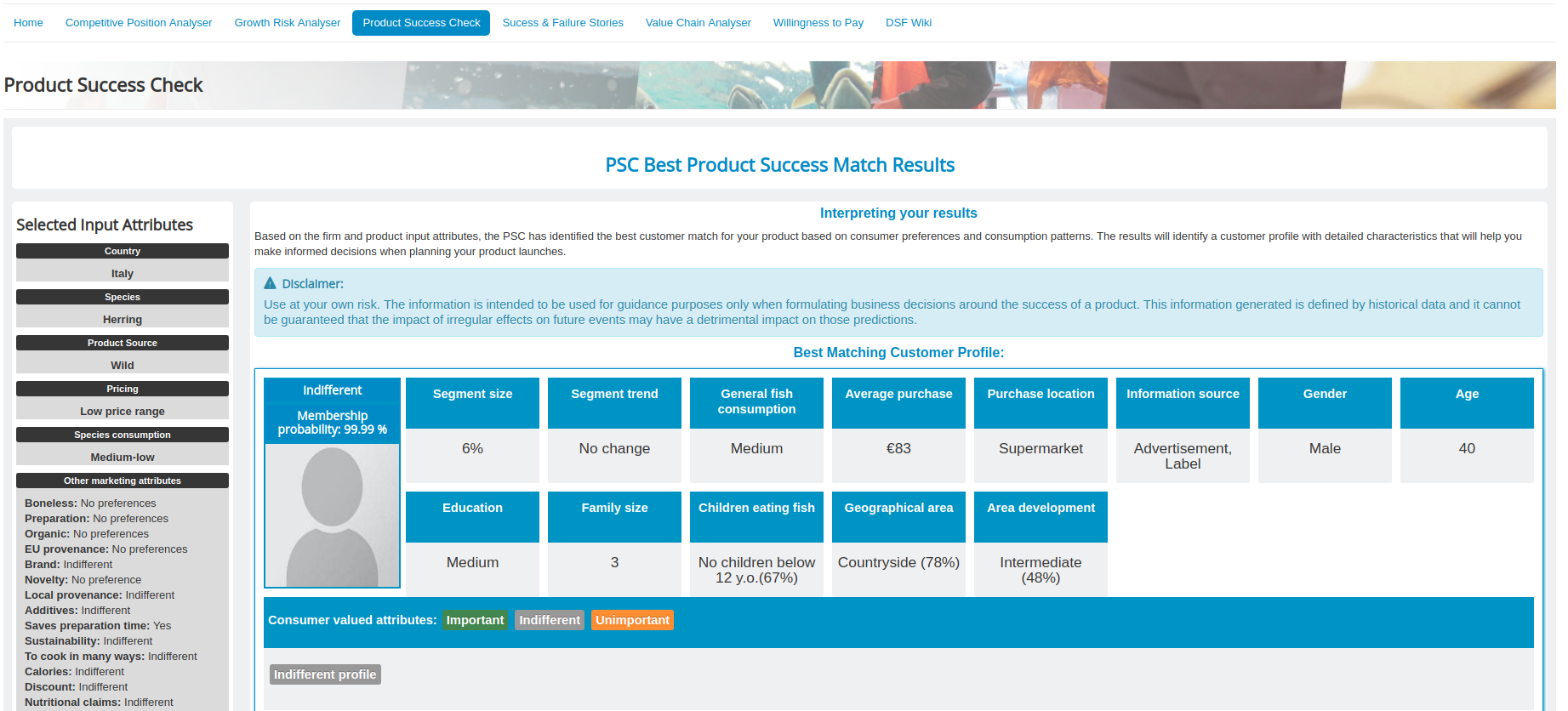

PSC results pageAfter a user click the button to perform the product success check, the results page will be displayed containing the description of the best matching consumer profile for the analysed product, as well as a graphical comparison of consumption probabilities for different product formats. The presentation formats selected in the previous page will be highlighted in the graph, and the selected attributes used for the regression will be displayed in the sidebar on the left.

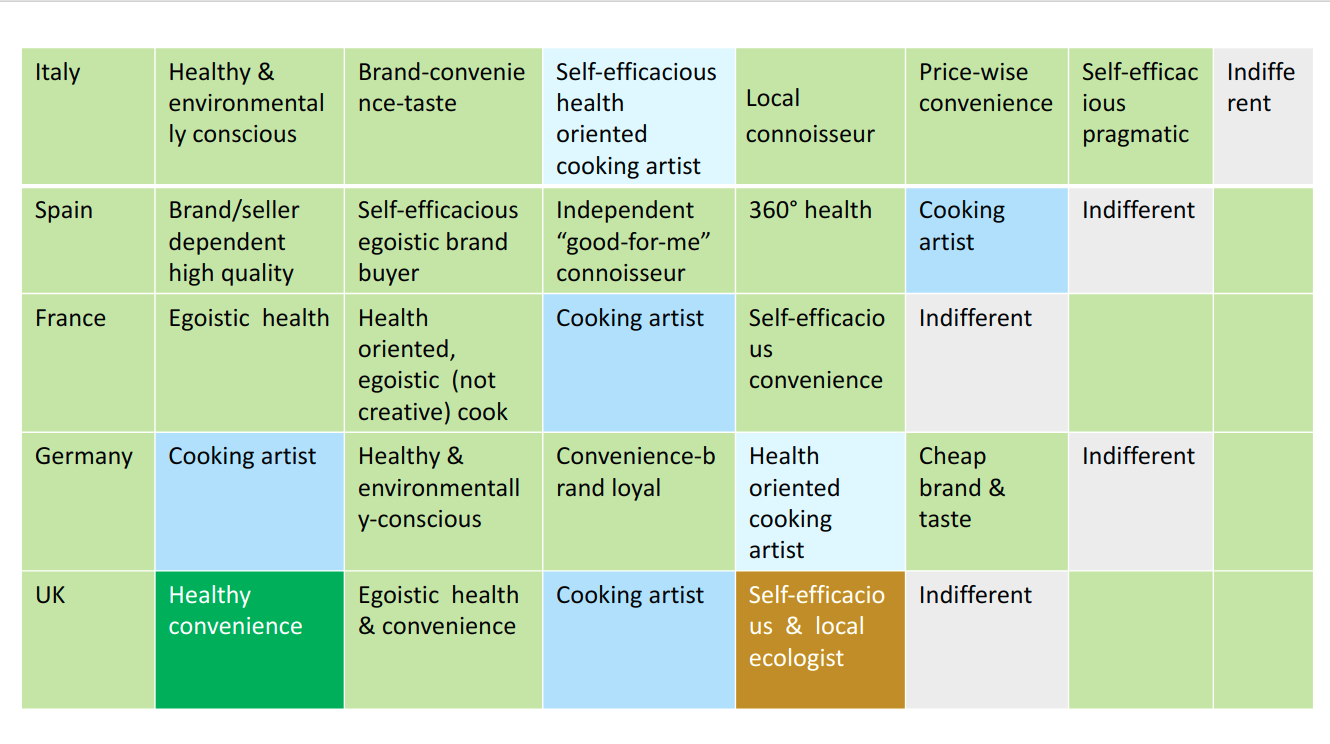

Segments description

The table here below presents a summary of the segments identified in the single countries (and in the “total” EU countries) under study. Some segments are cross-national or pan-European (light blue, light red), while others are specific to a few (grey cells)/only one country (dark green).Italy

The health & environmentally conscious consumer represents 13 % of the Italian consumers (trend: stable). Members of this segment are willing to pay (second highest expenditure for fish in Italy) for beneficial effects for both personal and environmental health. Predominantly women aged 50 + value items such as environmentally friendly, sustainability and natural ingredients, nutrients, easy-to digest characteristics highly. Appearance and traceability are also important to this segment, pointing to critical evaluation and check of quality/safety issues related to fish. They prefer wild fish, boneless and traditional recipes. Their favourite place of purchase is the supermarket/fishmonger which are also their sources of information. The segment’s usage rate is medium-high. Of note, consumers here like all fish species (although they consume sea bream and sea bass most) and buy a broad range of formats. The women and their small families (3 persons) reside in bigger urban centres, with children who are grown up but still live at home.

The brand-convenience-taste consumers reflect only a small but growing portion of the Italian market (7 %). This group of young consumers with small families declares to have a preferred brand and to favor taste over nutritional aspects. Highly important to them are availability of the fish, new formats, labels and omega 3. The consumers here also value fish products that take little time to prepare while nutrients or sustainability claims are of no importance to them. Consistent with a brand buyer is also the fact that these consumers are not self-efficacious– they rely instead on the familiarity and security that comes with a preferred brand and label (another aspect of “convenience”). In line with this profile is the supermarket as the only place of purchase, which is also, together with advertisements, the segment’s main source of information. People in this group live predominantly in rural areas of the country. The favourite species are salmon (ready-to-eat/to cook, fresh fillet), sea bream (fresh fillet) and cod (frozen fillet) with overall medium consumption and average expenditure.

The self-efficacious cooking artist represents 14 % of Italian consumers (trend: growing). Here we find the self-efficacious (all items that point to knowledge and evaluation of fish score high) relatively young male who likes to cook, is creative in meal preparation and looks for versatility. Consistent with the passion for cooking, saving time in meal preparation is unimportant to him. He looks for healthy products (with traceability) but also for a reasonable price-quality ratio. He and his partner (or small family) live in coastal/rural areas as well as in urban centres. The favourite place of purchase is the supermarket or the fishmonger, the source of information is the label or the advice from the fishmonger. Chooses predominantly sea bream, sea bass and cod in a wide range of formats (except ready to eat). Fish expenditure is average, in line with the fact that those who have more knowledge of fish can find more alternatives among available products.

The local connoisseur represents the biggest segment in Italy (24%/growing). This is the group of consumers who know everything about fish (high values across self-efficacy items), use its versatility and experiment with new formats or recipes. Relatively young women here (with small family) strongly emphasise the health-nutritional aspect and underline easy digestion. This group of consumers also favours local origin. They pay attention to environment and sustainability issues and indicate the preference for a (local) brand or seller. Emphasising value for money, they do not trade off quality for price (but would instead go for a cheaper species or stock the fish in order to be flexible). They prefer wild fish, are indifferent to bones, and are inclined to traditional preparation. Their consumption is medium-high (mainly sea bream, sea bass, less cod and salmon in a wide range of formats) with an expenditure that is the highest across all Italian segments. These consumers buy in the supermarket or at the fishmonger and do not indicate any sources of information.

Price-wise convenience consumers (14%/stable) represented in segment 5 are very price conscious, reflected also in their low expenditure on fish. People here are not knowledgeable about fish. They strongly underline health, easy-to-cook characteristics and texture. In line with this profile is their fish selection – they favour cod and salmon (fresh and frozen fillets but also canned, smoked, ready-to-cook/ready-to eat). Both genders aged 54 + are represented here, mainly living with one grown up child in rural and urban areas. Preferably they buy in supermarkets which are, together with advertisements, also the source of information.

The self-efficacious pragmatic fish consumers, a large (23%) and growing segment with high fish expenditure. They value the health benefits of fish, look for conservation and versatility. Preferences here bring together the health of both, individuals and the environment, added is a strong emphasis on value for money. Although this segment is knowledgeable about fish and its preparation, the profile seems to reflect a pragmatic instance of “having to eat and cook fish” without related pleasure of doing so. In fact, this segment has only two favourite species, namely salmon and cod, which they consume frequently, predominantly as fresh/frozen fillets. Women aged 45 + with small families, medium-high education and income represent the socio-demographic profile of this segment best.

Indifferent consumers are the smallest group of consumers (6%/stable), represented by relatively young male with small family living in rural or intermediate areas of Italy. Their favourite place of purchase is the supermarket. They consult the label or ads for fish information. Species include sea bream and salmon and their expenditure is among the lowest across the segments.

Spain

Segment 1 represents brand/seller “dependent” high quality consumers who are not self-efficacious (23%/growing). The preferred “brand“ here is either the shop/seller or the brand itself. Consumers do not feel on the safe side regarding fish evaluation and preparation and thus rely on the trusted seller/brand of whom they learn. They give importance to inclusive health (individual and environment) and have a broad quality understanding for which they are ready to pay. This segment shows high fish consumption and the highest expenditure for fish. Consistent with the fact that they like to cook but do not indicate corresponding competence they go for a very limited range of species. They buy in supermarkets or at the fishmonger and listen to the advice of the fishmonger or seller. Women aged 46 + with small children (who eat fish) and low-medium education but relatively high income best represent this group of consumers. Favourite species are sea bream (whole/fresh fillet) and cod (fresh/frozen fillet, dried).

Self-efficacious selfish brand buyer (23%/growing): also this group of consumers has a preferred brand/seller but it is, as compared to segment 1, self-efficacious. It is “egoistic” in terms of health orientation as only items which focus on individual health are important (while environmental attention is unimportant) to this segment. Men around 55 here take care of their family which lives in cities close to the coast. They are medium sea bass and salmon consumers who spend relatively little on fish.

The independent “good for me” connoisseur (9%, growing) values taste and nutrition equally. Members of this segment love fish (sensory appeal) and they value its benefits for health. They cross-check on labels and expect a guaranteed origin. In line with this, the segments favourite species is wild fresh sea bass which is consumed in high quantities. Women aged 48, living with family in cities at the coast are willing to spend for their selected premium sea bass which they preferably buy at the fishmonger or in the supermarket.

The consumers in the 4th and biggest (29 %, stable) segment in Spain are directed towards nutritional-digestive and inclusive health (360 degree-health). Consistent with this emphasis is the importance given to origin and traceability. Value for money is crucial to this segment, and they value conservation. Their medium-high fish consumption is reflected also in a relatively high fish expenditure mainly spent on fresh sea bream and salmon (fresh/smoked). Young women here take care of their families with young children.

(Salmon) Cooking artists (9%/stable), very young couples (24 +), like to cook and trust in their competence of fish (salmon) preparation, they are creative and experiment with new formats, and they emphasise versatility. None of the health related items is of importance. The young couples go mainly for wild salmon (medium –high consumption) in the supermarket. Salmon is the dominant species they buy in all formats. Consistent with the artist stance is also the (low) use of an exotic species such as herring. The main source of information is the seller.

The indifferent (7%/stable), with medium-low consumption of salmon and cod, spends little on fish. Typically consumers here are young male, small family size, low education level living in urban centers in the countryside.

France

The good for me health consumer represents 29 % of the French market (trend: stable) that expects mainly health benefits from fish consumption and looks for guarantees in terms of sustainability certifications and traceability. Predominantly consisting of male in their fifties, highly educated and with high income, this segment appreciates “easy-to-cook” products and emphasises value for money. It is characterised by low-medium consumption and low expenditure for sea bream (either fresh fillet or ready-to-eat). Shopping for two, predominantly in supermarkets, these men use the label or the seller for information.

The health oriented (selfish), (not creative) cook (23%/growing) is medium-high in fish consumption and the highest in expenditure. Women aged around 45 highly value the health benefits of fish, they like cooking and the variety and versatility that comes with many species and a wide range of formats (herring, cod and sea bream) in traditional preparations. They purchase in the supermarket for a small family and take information from the label and the seller.

The cooking artist represents around a quarter of fish consumers in France (trend: stable). This profile cuts across all ages, also the very young. They choose carefully, go for high quality for which they are ready to pay and they consult many information sources. Health is not on the agenda of this segment and they have no environmental concerns. They shop for sea bream at the supermarket or at the fishmonger. The couple prefers fresh, but they are flexible and willing to try different formats and recipes.

Self-efficacious convenience consumer to whom, beyond inclusive health, convenience is central (31%/stable). They give importance to each and every aspect and thus represents very demanding consumers. This consumer critically checks the expected quality: reads labels and values certificates and guarantees. Medium consumption of varied fish species and broad range of formats (reflecting convenience), and second highest expenditure on fish. Relatively young women and men are representing the class, living in the countryside/intermediate cities in small families.

The indifferent in France are the smallest group of consumers (7%/stable). The class is on a medium-low level in fish consumption and the lowest expenditure for trout, salmon and cod. Prefer mainly in fresh and frozen formats. The segment is predominantly young singles or couple, living in the countryside in smaller cities.

In all segments salmon and trout is consumed. The species mentioned above distinguish the segments from this overall baseline consumption.

Germany

The cooking artist (12%/stable) is loyal to a brand/seller and gives importance to local origin. Consumers in this segment share the characteristics that cut across-countries for the cooking artist: they like to cook/are capable of preparing fish, value versatility, are creative and ready to try new formats. Taste here clearly dominates nutritional aspects (only Omega 3 is of importance). Consumers in this segment are not price sensitive, a fact reflected also in the highest fish expenditure across German segments. They prefer fresh fish, medium usage rate, mainly salmon but also the more “exotic” sea bream (the only segment in Germany) and sea bass. The class includes both genders, they are young, live with a small family with smaller kids in cities in the countryside.

Healthy & environmentally-conscious consumers make up a third of the German market (growing). To consumers in this segment, a healthy diet and a natural product and the texture are central. Health here is inclusive of the environment, consumers value sustainability certification and put emphasis on a guaranteed origin. They are not self-efficacious and thus trust their “seller/brand”, but also consult the label and ask for guarantees. The group is ready to pay for the value they ask for, i.e. a healthy & environmentally safe diet, which is reflected in high fish expenditure. The class includes both genders aged over 54 involved in decisions and patterns of fish consumption (salmon, trout and sea bass; fresh and frozen); consistent with their health focus their consumption is medium high.

The convenience- brand loyal consumer (23%/growing), looks for value for money. Brands provide the benefits she asks for: nutrients, sustainability certification, traceability, label. Ready-to-eat is emphasised which together with fresh formats may satisfied her want for creativity. Predominantly relatively young female living in a two-person-household in cities in the countryside with lower fish expenditure and medium fish consumption represent this cluster best. The members of this segment shop in supermarkets where they get information in-store, from the seller or from the label.

The fourth segment comprises healthy cooking artists who like variety. Being a premium segment in terms of expenditure, this profile unites the cooking artist with a focus on health. Versatility is important, but experimentation is also reflected in a broad range of species and formats. The socio-demographic profile of women over 54, with medium high education, in 2 person-households, is very much in line with this segment.

Cheap brand and taste consumer (16%/stable): People in this segment have learned the claims of their preferred brand (but they are not knowledgeable about fish), omega 3 and tasty, they are price-conscious and, overall, seem to go for an easy buy without much involvement or major decision criteria. Fish here offers the best compromise between health and taste. No importance is given to origin and traceability. Male in their forties (couple) spend little for medium-low consumption.

The indifferent present around 7 % of the market, predominantly young and single. Medium consumption, relatively high expenditure and a broad range of species and formats.

Of note, herring is consumed in all segments. The species mentioned above distinguish the segments from this overall baseline consumption.

UK

Healthy convenience consumers (22 %, growing) have their focus on “easy” to cook, to stock, to use (versatile). Health is also central, with a strong focus on digestion and environmental concern and the request for traceability. The segment is characterised by medium consumption and highest expenditure on fish across the segments. Women, aged above 50 with medium-high education and a 2-person household describe the segment best. Members of this segment appreciate wild fish; their favourite species are sea bream, sea bass – fresh fillets, ready-to-eat, whole fish.

Selfish health & convenience consumers, the biggest segment (43 %, growing) are typically younger couples with medium – low income but relatively high expenditure on fish. They are informed and are consulting many information sources, do not trade off quality for price and are indifferent to brands, origin and traceability. The focus is on health, but also easy to cook, versatility, and conservation are important. Consume salmon and sea bass in medium quantity. This segment is similar to segment 1 in convenience but health is not inclusive and more focused on nutrients than on digestion and its information behaviour is more extensive.

Cooking artist (8 %/stable trend). Similar to her counterparts in the other countries, the British cooking artist likes to cook and to experiment with new formats. Taste is an important theme, while she is indifferent to health and environmental concerns; dietary issues are not important. British cooking artists are not really knowledgeable about fish. Women aged 44+ in small families with children eating fish do best describe the socio-demographic characteristics. Prefer wild, favourite species sea bream and cod. Given the low income she really likes and spends (over proportionally) for fish.

Self-efficacious & local ecologist (13 %/growing segment) are very young singles or 2-person households. They are knowledgeable and environmentally conscious. At the same time they give much importance to the local context. The segment members enjoy cooking and they trust in their meal preparation. Medium consumption of salmon, sea bream, sea bass, but with low expenditure.

The segment of indifferent (14 %, growing) is composed of young male, single or in a household of two, and low to medium education. Prefer salmon and cod, ready to eat, ready to cook. Medium consumers, low expenditure.

In all segments cod is consumed. The species mentioned above distinguish the segments from this overall baseline consumption.

Europe

We construct 11 European segments which are briefly discussed here below.

The salmon fan segment (9 %/growing), in line with the only species it consumes, values highest omega 3, availability, versatility and value for money. These consumers also clearly favor taste over nutritional aspects. Consumers here are women in their forties, living in households of two persons with medium – high salmon consumption of all formats and relatively high expenditure. In terms of relative composition, this segment is very prominent in the UK (29 %).

Segment two represents the self-efficacious inclusive health consumer, one of the largest EU segments (17 %, growing): knowledgeable people who appreciate the health-nutritional aspect of fish. Dietary considerations are not important (e.g. nr. of calories). Health includes the well being of the environment. People emphasise value for money, expect traceability and certification but are indifferent with regard to organic products. Male and female consumers aged around 50, with medium expenditure and fish consumption; favourite species are salmon, sea bream, cod with wide variety of formats. Germans make up 24 % of this segment.

Cooks with inclusive health focus (11%) characterise segment 3. They enjoy meal preparation (but are neither creative nor knowledgeable of fish) and emphasise omega 3 and “easy-to-digest” attributes. Their overall important theme is individual and environmental health, and, importantly, animal welfare, which is cross-checked with label and certifications. The segment is not price sensitive and is ready to pay for the expected value. Relatively young men here take care of small families who live in urban centres in the countryside. Low-medium consumption, but relatively high expenditure on fish. UK dominated with 27% of consumers in this segment (trend: stable).

Tasty and easy quality (8%). To this segment value for money is important as are “easy to cook” and quick preparation of meals. Availability and conservation is stressed, emphasising the time/convenience posture of the segment. Taste and texture are valued more than health aspects. No environmental concerns and also self-efficacy criteria are low/indifferent. Young male (early thirties) with medium-high education take care of small families. They prefer wild over farmed and spend much for taste and easy quality - high expenditure for medium-high fish consumption. Segment is mainly populated by French, Spanish and Italians (trend: increasing).

Segment 5 is the 360 degree- health oriented segment (11%), which gives much importance to natural fish products. Also “easy to digest” and nutrients are of utmost importance, as is the absence of smell and a guaranteed origin. It is the only segment where people also have a concern regarding negative effects of farming. Consistent with this preference they favour wild fish. The segment is characterised by medium-high fish consumption with corresponding high expenditure. Women in their 50s in 2-people households with medium education represent best the demographic profile of the segment. Italians dominate this segment (trend: increasing ).

Segment 6, one of the smallest in EU (5 %), is characterising the innovative brand buyer. Consumers here have a favourite brand to which they are also loyal. “Claim”-related items are important but not supported by corresponding factual knowledge. People here are also the only ones to underline new dietary preparations (e.g. gluten free products), they prefer products that take little time for preparation, and they emphasise conservation and versatility. Time, overall, is an important factor for this group. The known brand is a response to this: choosing the familiar brand saves time in terms of reflection/selection and it is a guarantee for satisfied expectations. Consumption of this segment is high with corresponding highest expenditure across all segments. British, Italian and French women around 45, with small families make up this segment (trend: increasing).

Indifferent: the majority of indifferent consumers is divided among UK (31 %) and France (27 %), followed by Spain and Germany (15 % and 14 %, respectively), with a stable trend. Only 12 % of the class is populated by Italian consumers. This segment is characterised by male and female aged 18-40, with low education and medium-low consumption. Expenditure, not surprisingly, is the lowest.

Healthy convenience (6 %). Segment 8 consumers look for easy to cook meals that take little time to prepare, appreciate conservation and general health/environmental benefits. Being demanding on all dimensions, they are ready to pay for the corresponding products. As confirmed by high fish expenditure, consumers do not trade off value for money. Here young dads with medium-high education take care of their bigger families’ health by balancing it with the need to have meals easily and quickly prepared (trend: stable). Only Italy is underrepresented (16 %) in this overall balanced segment.

This group –the local – natural brand/seller (5 %) - values “local” and natural highly. More than emphasising the presence of positive nutrients and elements, consumers here emphasise the absence of ingredients and substances. They are self-efficacious, trust a certain – local – brand or seller to whom they are loyal. They also stress availability. Fish consumption is medium – low, expenditure is at the lower level across segments. The socio-demographic show relatively young men and women in households of three holding a medium education level. German consumers account for 27 % of this small segment (trend: stable).

In this segment we find the cook with selfish health focus (8%) who likes taste and nutrition. Broader health, dietary or environmental concerns are not considered important. Consistent with enjoying the preparation and consumption of fish, this segment’s expenditure is medium-high with corresponding high expenditure. Relatively young Spanish women in small households without children best describe the consumers of this segment (trend: increasing).

Cooking artists (17 %, stable) are creative, like to experiment with new formats, like to cook and are self-efficacious. No environmental and health concerns. Women in their fifties in small households (2-3 members) with medium consumption and relatively low expenditure characterise this segment’s demographic profile. The majority of the class is made of Italians, while the minority comes from UK.