Difference between revisions of "CPA"

Jacandrade (talk | contribs) |

Jacandrade (talk | contribs) |

||

| Line 10: | Line 10: | ||

---- | ---- | ||

| − | The Competitive Position Analyser tool is the computerised version of the FACI survey and it is the implementation of the models described in this page. The concept of competitiveness can be traced back to early writing on economics in the 17th and 18th centuries, but has become ever more urgent in the last decades with rapid improvements in transport and communication and a higher level of globalisation. Although competitiveness may be measured by single indicators, such as productivity of labour, a deeper understanding of the competitive standing of firms and countries can be gained by employing multi-dimensional measurements. | + | The Competitive Position Analyser tool is the computerised version of the FACI survey and it is the implementation of the models described in this page. The concept of competitiveness can be traced back to early writing on economics in the 17th and 18th centuries, but has become ever more urgent in the last decades with rapid improvements in transport and communication and a higher level of globalisation. Although competitiveness may be measured by single indicators, such as productivity of labour, a deeper understanding of the competitive standing of firms and countries can be gained by employing multi-dimensional measurements. |

| − | <div id="cpi_structure"> [[File:Cpi structure.jpg|The structure of the Global Competitiveness Index. Source: WEF 2016.]]</div> | + | |

| + | The choice of methods depends on a variety of factors, including the perceived need for complexity, data availability and how the results are to be used. The Fisheries and Aquaculture Competitiveness Index (FACI) developed in this deliverable is modelled on the Fisheries Competitive Index (FCI) developed by the Directorate of Fresh Fish Prices in Iceland and the Norwegian College of Fishery Science at the University of Tromsø in 2004-2005. The FACI though expands on the FCI in two directions. First, by developing a national-level FACI that also includes aquaculture. Second, by designing a firm-level FACI that is intended to capture the views of operators of individual firms and is therefore less complex. The national-level FACI consists of 144 items, whereof 44 are taken from the WEF Global Competitiveness Index, 19 are based on data obtained from national, public sources and 81 are based on answers from a survey conducted among specialists in each country. . Whereas the information taken from the GCI analyses the overall competitiveness of the nation, the other sources will throw light on the competitiveness of the fisheries and aquaculture sectors. The firm-level FACI is based on a survey which in the case of firms engaged in the harvesting, processing or marketing of wild capture fish consists of 40 questions, and in the case of aquaculture firms consists of 45 questions. | ||

| + | |||

| + | The FACI was employed to analyse the competitiveness of three fisheries firms in Norway, one in Iceland and one in Newfoundland, and assess the competitive standing of Spain, Iceland, Norway and Vietnam. Newfoundland was also included in the national study, but the comparison is incomplete due to some gaps in the information collected. The firms in Newfoundland and Iceland were found to have a competitive edge over their Norwegian competitors, mostly due to their ability to fend of new entrants, flexible value-chains and high level of R&D development and innovation. At the national level, Iceland, Norway and Spain all ranked close . | ||

| + | |||

| + | == Methods == | ||

| + | ---- | ||

| + | |||

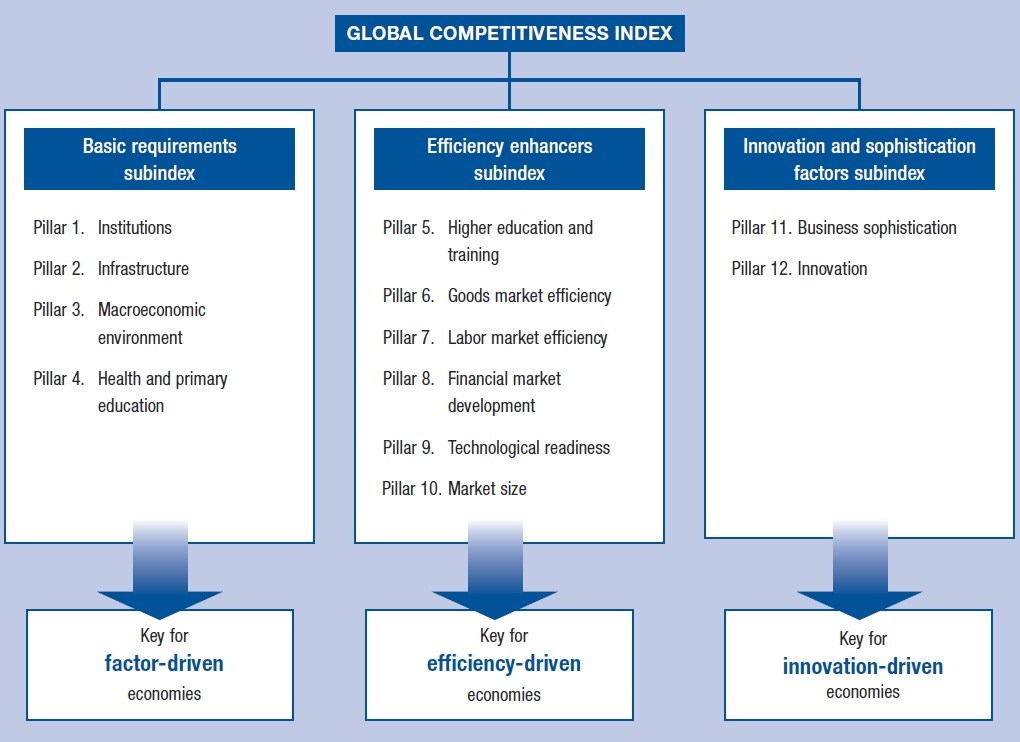

| + | Currently, the Global Competitiveness Index (GCI) is probably the most comprehensive index of its kind. The index defines competitiveness as the set of institutions, policies and factors that determine the level of productivity of a country. The most recent analysis covers 138 countries, with a combined output representing 98% of the world GDP. The index, which is compiled annually by the World Economic Forum, combines 114 indicators that capture concepts that matter for productivity and long-term prosperity. As shown in the [[#cpi_structure|figure ]] below, these indicators are grouped into 12 pillars: institutions, infrastructure, macroeconomic environment, health and primary education, higher education and training, goods market efficiency, labour market efficiency, financial market development, technological readiness, market size, business sophistication, and innovation. These pillars are in turn organised into three sub-indexes: basic requirements, efficiency enhancers, and innovation and sophistication factors. The three sub-indexes are given different weights in the calculation of the overall Index, depending on each economy’s stage of development, as proxied by its GDP per capita and the share of exports represented by raw materials. | ||

| + | <div id="cpi_structure">[[File:Cpi structure.jpg|The structure of the Global Competitiveness Index. Source: WEF 2016.]]</div> | ||

| + | |||

| + | === Fisheries and Aquaculture Competitiveness Index (FACI) === | ||

| + | |||

| + | As outlined above, competitiveness can be measured in a number of ways, using both simple and more complex analytical tools. The choice of methods depends on a variety of factors, including the perceived need for complexity, data availability and how the results are to be used. | ||

| + | |||

| + | he FACI must be flexible enough to meet the needs of the two different end-users; industry and policymakers. With this in mind it was decided to develop two different kinds of competitiveness indexes; a firm-level FACI and a national-level FACI. The firm-level FACI is only intended to capture the views of operators of individual firms and therefore less complex. It is based on a survey which in the case of firms engaged in the harvesting, processing or marketing of wild capture fish consists of 40 questions, and in the case of aquaculture firms consists of 45 questions. The firms are able to access the | ||

| + | [http://dss.primefish.eu/index.php/cpa firm-level FACI], complete the survey and then compare their answers to those provided by other operators. The degree of comparison will, of course, depend on the number of firms using the PrimeDSS, but provided the number of users is large enough, it would be possible to undertake comparison between firms in the same sectors both in the same country as well as between countries, as well as between different sectors. By thus benchmarking themselves against others, firms could gain a better understanding of their competitive standing. | ||

| + | |||

| + | The national-level FACI is modelled on the Fisheries Competitive Index (FCI) developed by the Directorate of Fresh Fish Prices in Iceland and the Norwegian College of Fishery Science at the University of Tromsø in 2004-2005 (Verðlagsstofa skiptaverðs, 2005). The FCI consists of 139 questions and observations which are split between six sub-indexes that make it possible to calculate scores both for the FCI as a whole as well as for individual sub-indexes. This further expands the use of the FCI. The index was applied to the Icelandic and Norwegian fish industries. The national-level FACI consists of 144 items, whereof 44 are taken from the WEF Global Competitiveness Index, 19 are based on data obtained from national, public sources and 81 are based on answers from a survey conducted among specialists in each country. Whereas the information taken from the GCI analyses the overall competitiveness of the nation, the other sources will throw light on the competitiveness of the fisheries and aquaculture sectors. The national-level FACI will therefore yield a comprehensive measure of competitiveness which takes both into account general conditions in the country as well as those that deal specifically with the sectors of interest. | ||

| + | |||

== Models == | == Models == | ||

Revision as of 17:10, 4 February 2018

Contents

Competitive Position Analyser

Introduction

The Competitive Position Analyser tool is the computerised version of the FACI survey and it is the implementation of the models described in this page. The concept of competitiveness can be traced back to early writing on economics in the 17th and 18th centuries, but has become ever more urgent in the last decades with rapid improvements in transport and communication and a higher level of globalisation. Although competitiveness may be measured by single indicators, such as productivity of labour, a deeper understanding of the competitive standing of firms and countries can be gained by employing multi-dimensional measurements.

The choice of methods depends on a variety of factors, including the perceived need for complexity, data availability and how the results are to be used. The Fisheries and Aquaculture Competitiveness Index (FACI) developed in this deliverable is modelled on the Fisheries Competitive Index (FCI) developed by the Directorate of Fresh Fish Prices in Iceland and the Norwegian College of Fishery Science at the University of Tromsø in 2004-2005. The FACI though expands on the FCI in two directions. First, by developing a national-level FACI that also includes aquaculture. Second, by designing a firm-level FACI that is intended to capture the views of operators of individual firms and is therefore less complex. The national-level FACI consists of 144 items, whereof 44 are taken from the WEF Global Competitiveness Index, 19 are based on data obtained from national, public sources and 81 are based on answers from a survey conducted among specialists in each country. . Whereas the information taken from the GCI analyses the overall competitiveness of the nation, the other sources will throw light on the competitiveness of the fisheries and aquaculture sectors. The firm-level FACI is based on a survey which in the case of firms engaged in the harvesting, processing or marketing of wild capture fish consists of 40 questions, and in the case of aquaculture firms consists of 45 questions.

The FACI was employed to analyse the competitiveness of three fisheries firms in Norway, one in Iceland and one in Newfoundland, and assess the competitive standing of Spain, Iceland, Norway and Vietnam. Newfoundland was also included in the national study, but the comparison is incomplete due to some gaps in the information collected. The firms in Newfoundland and Iceland were found to have a competitive edge over their Norwegian competitors, mostly due to their ability to fend of new entrants, flexible value-chains and high level of R&D development and innovation. At the national level, Iceland, Norway and Spain all ranked close .

Methods

Currently, the Global Competitiveness Index (GCI) is probably the most comprehensive index of its kind. The index defines competitiveness as the set of institutions, policies and factors that determine the level of productivity of a country. The most recent analysis covers 138 countries, with a combined output representing 98% of the world GDP. The index, which is compiled annually by the World Economic Forum, combines 114 indicators that capture concepts that matter for productivity and long-term prosperity. As shown in the figure below, these indicators are grouped into 12 pillars: institutions, infrastructure, macroeconomic environment, health and primary education, higher education and training, goods market efficiency, labour market efficiency, financial market development, technological readiness, market size, business sophistication, and innovation. These pillars are in turn organised into three sub-indexes: basic requirements, efficiency enhancers, and innovation and sophistication factors. The three sub-indexes are given different weights in the calculation of the overall Index, depending on each economy’s stage of development, as proxied by its GDP per capita and the share of exports represented by raw materials.

Fisheries and Aquaculture Competitiveness Index (FACI)

As outlined above, competitiveness can be measured in a number of ways, using both simple and more complex analytical tools. The choice of methods depends on a variety of factors, including the perceived need for complexity, data availability and how the results are to be used.

he FACI must be flexible enough to meet the needs of the two different end-users; industry and policymakers. With this in mind it was decided to develop two different kinds of competitiveness indexes; a firm-level FACI and a national-level FACI. The firm-level FACI is only intended to capture the views of operators of individual firms and therefore less complex. It is based on a survey which in the case of firms engaged in the harvesting, processing or marketing of wild capture fish consists of 40 questions, and in the case of aquaculture firms consists of 45 questions. The firms are able to access the firm-level FACI, complete the survey and then compare their answers to those provided by other operators. The degree of comparison will, of course, depend on the number of firms using the PrimeDSS, but provided the number of users is large enough, it would be possible to undertake comparison between firms in the same sectors both in the same country as well as between countries, as well as between different sectors. By thus benchmarking themselves against others, firms could gain a better understanding of their competitive standing.

The national-level FACI is modelled on the Fisheries Competitive Index (FCI) developed by the Directorate of Fresh Fish Prices in Iceland and the Norwegian College of Fishery Science at the University of Tromsø in 2004-2005 (Verðlagsstofa skiptaverðs, 2005). The FCI consists of 139 questions and observations which are split between six sub-indexes that make it possible to calculate scores both for the FCI as a whole as well as for individual sub-indexes. This further expands the use of the FCI. The index was applied to the Icelandic and Norwegian fish industries. The national-level FACI consists of 144 items, whereof 44 are taken from the WEF Global Competitiveness Index, 19 are based on data obtained from national, public sources and 81 are based on answers from a survey conducted among specialists in each country. Whereas the information taken from the GCI analyses the overall competitiveness of the nation, the other sources will throw light on the competitiveness of the fisheries and aquaculture sectors. The national-level FACI will therefore yield a comprehensive measure of competitiveness which takes both into account general conditions in the country as well as those that deal specifically with the sectors of interest.